User Reviews

More

User comment

3

CommentsWrite a review

2024-02-07 15:33

2024-02-07 15:33

2022-12-01 13:44

2022-12-01 13:44

Score

2-5 years

2-5 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Add brokers

Comparison

Quantity 1

Exposure

Score

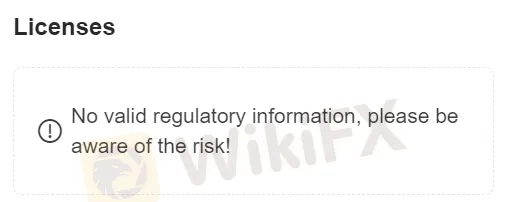

Regulatory Index0.00

Business Index6.73

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

Company Name

Solitix Fx

Company Abbreviation

Solitix Fx

Platform registered country and region

South Africa

Company website

Company summary

Pyramid scheme complaint

Expose

Note: Solitix FX's official site - https://solitixfx.com/ is currently not functional. Therefore, we could only gather relevant information from the Internet to present a rough picture of this broker.

| Solitix FX Review Summary | |

| Registered Country/Region | South Africa |

| Regulation | No Regulation |

| Market Instruments | Forex, Crypto, Indices, Shares |

| Demo Account | N/A |

| Leverage | Maximum 1:500 |

| Spread | 0.8 Floating |

| Commission | Charged For Only ECN Account: Minimum $10 |

| Trading Platform | MT4 |

| Minimum Deposit | $0 |

| Customer Support | Email: info@solitixfx.com, Tel: +27 11 759 4185, |

| Company Address | 4th floor, The FIRS, Near MAS Financial Services, Biermann Ave, Cradock Ave Cross Road, Rosebank, Tetris, Johannesburg, 2196, South Africa |

Solitix FX is a brokerage firm based in South Africa that operates without regulatory oversight. Their official website is inactive, raising concerns about the legitimacy and reliability of their services. The office of Solitix FX is located on the 4th floor, The FIRS, Near MAS Financial Services, Biermann Ave, Cradock Ave Cross Road, Rosebank, Tetris, Johannesburg, 2196, South Africa.

| Pros | Cons |

|

|

|

|

|

|

|

No Minimum Deposit: Solitix FX offers the advantage of not requiring a minimum deposit to open an account, making it accessible to traders of all levels, especially those who start with limited capital.

Tight Spreads: The brokerage provides tight spreads (from 1.2 pips for a standard account), which can be beneficial for traders looking to minimize trading costs.

High Leverage: Solitix FX offers a high leverage of 1:500, allowing traders to control larger positions with a smaller amount of capital.

MT4 Supported: Solitix FX supports the widely acclaimed MT4 trading platform, known for its user-friendly interface, advanced charting tools, and compatibility with Expert Advisors (EAs) for automated trading strategies.

No Regulation: One significant drawback of Solitix FX is its lack of regulation, raising concerns about the safety and security of clients' funds.

Dead Website: The brokerage's website is inaccessible or inactive, which reflects poorly on the company's professionalism and can lead to doubts about its reliability.

Regulatory Sight: Solitix FX is currently functioning without any regulation, meaning it does not fall under the supervision of any financial regulatory bodies and does not possess any licenses to operate in the financial market. The absence of any such oversight raises concerns about the firms adherence to financial standards and regulations, increasing the risk for investors.

User Feedback: Users should check the reviews and feedback from other clients to gain a more comprehensive sight of the broker, or look for reviews on reputable websites and forums.

Security Measures: So far we haven't found any information about the security measures for this broker.

Solitix FX offers a diverse range of market instruments for traders, encompassing Forex, Cryptocurrency, Indices, and Shares. With access to these instruments, traders can engage in currency pairs trading, cryptocurrency speculation, index trading, and investments in shares of various companies. This broad selection allows different trading preferences and strategies, so clients can capitalize on opportunities across multiple financial markets.

Solitix FX offers different leverage ratios depending on the type of account, but both leverages are quite high.

Student Account and Standard Account: These account types provide a leverage of 1:500. This means that for every unit of currency in the trading account, the trader can control up to 500 units of currency in the forex market.

ECN Account and Bonus Account: These accounts offer a leverage of 1:300. With this leverage ratio, traders can control up to 300 units of currency in the forex market for every unit of currency in their trading account.

| Account Types | Student Account | Standard Account | ECN Account | Bonus Account |

| Leverage | 1:500 | 1:300 | ||

Solitix FX provides different account types with different spreads and charges different commissions. It does not charge any commission for Student Account, Standard Account, Bonus Account but for ECN Account, which is $10 minimum.

| Account Type | Spread | Commission |

| Student Account | 0.8 floating | 0 |

| Standard Account | 1.2 floating | |

| Bonus Account | 1.9 floating | |

| ECN Account | 0.2 floating | $10 minimum |

The MT4 trading platform provided by Solitix FX offers traders a user-friendly interface with advanced charting tools, real-time quotes, and support for multiple order types, facilitating informed trading decisions and flexible execution strategies. Its robust security features ensure the safety of transactions, while its high reliability and fast execution speeds enhance the trading experience. Additionally, MT4's support for algorithmic trading through Expert Advisors and its availability on mobile devices enables traders to access their accounts and execute trades conveniently, making it a preferred choice for traders seeking a comprehensive and versatile trading platform.

Solitix FX provides comprehensive customer support through various channels to assist traders with their inquiries and concerns. Traders can reach out to the support team via email at info@solitixfx.comor by phone at +27 11 759 4185. The support team is available to address a wide range of queries, including account-related issues, technical assistance, and general inquiries about the trading services offered by Solitix FX. Additionally, the company's physical address is located on the 4th floor of The FIRS, near MAS Financial Services, Biermann Ave, Cradock Ave Cross Road, Rosebank, Tetris, Johannesburg, 2196, South Africa。

In summary, while Solitix FX offers competitive spreads, leverages and several advantageous trading conditions, its lack of regulation and inaccessible website raise significant concerns. We do not recommend users to trade with this broker.

Q: What is the minimum deposit of Solitix FX?

A: There is no minimum deposit required.

Q: What is the maximum leverage provided by Solitix FX?

A: The maximum leverage provided is 1:500 for Student Account and Standard Account.

Q: Does Solitix FX support MT4/5?

A: Yes, it does support MT4.

Q: Is there any commission charged by Solitix FX?

A: Yes, there is a commission of at least $10 for ECN Account.

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

The Financial Sector Conduct Authority (FSCA) warns the public about Solitix FX (Pty) Ltd and Mr Kevin Banks, urging caution in engaging with these entities for financial services-related activities due to their unlicensed status.

WikiFX

WikiFX

According to experts at the Bureau for Economic Research, South Africa is likely to witness another interest rate hike next week, albeit it may be greater than originally expected (BER).

WikiFX

WikiFX

"In order to curb forex scams, Nigerians must start viewing forex trading as a talent, not a get-rich-quick scheme." People must be patient in order to see their investments increase." These are the remarks of Emmanuel Okwara Jnr., Equiti's Nigerian country manager. The worldwide FX market is the world's largest financial market, with an estimated daily trading volume of around $7 trillion.

WikiFX

WikiFX

The establishment of South Africa's first real-time currency bank account addresses the dual issues of lower transaction fees and 24/7 visibility and access.

WikiFX

WikiFX

More

User comment

3

CommentsWrite a review

2024-02-07 15:33

2024-02-07 15:33

2022-12-01 13:44

2022-12-01 13:44