User Reviews

More

User comment

0

CommentsWrite a review

No comment yet

Score

5-10 years

5-10 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index7.35

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

| Broker Name | Investment Shark & Asset Management |

| Founded in | 2014 |

| Registered in | Nigeria |

| Regulated by | Not regulated |

| Market Instruments | Equities, Indices, Commodities, Currencies |

| Service Types | M&A, Financial Analysis, Advisory Services |

| Customer Support | ADMIN@ISAML.COM, +234 806 127 4194 |

Investment Shark & Asset Management, headquartered in Lagos, Nigeria, operates as a boutique investment bank founded in 2014 and registered in Nigeria. It operates as an unregulated boutique investment bank headquartered in Lagos, Nigeria. Investment Shark stands out with its expertise in capital market services, advisory solutions, and real estate management. The firm offers a diverse range of market instruments including equities, indices, commodities, and currencies. Service types encompass mergers and acquisitions (M&A), financial analysis, and advisory services, providing clients with customized products and comprehensive solutions. With a commitment to excellence, Investment Shark & Asset Management delivers professional customer support throughADMIN@ISAML.COMand +234 806 127 4194, ensuring clients receive tailored assistance for their investment needs.

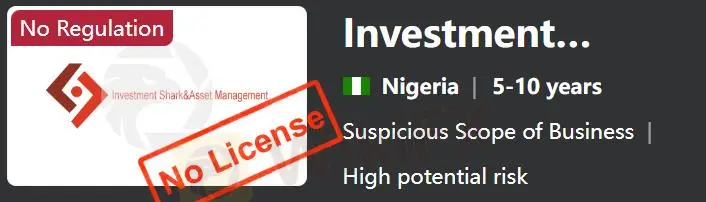

Investment Shark & Asset Management operates as an unregulated boutique investment bank headquartered in Lagos, Nigeria. As such, the firm does not fall under any regulatory oversight. While this lack of regulation provides flexibility, clients should consider the associated risks and conduct thorough due diligence before engaging in any financial transactions. Investment Shark focuses on delivering tailored investment solutions, capital market services, advisory expertise, and real estate management, leveraging its industry knowledge to meet client objectives effectively.

Investment Shark & Asset Management trade with many market instruments, including equities, indices, commodities, and currencies. These instruments provide investors with opportunities to participate in various sectors of the financial markets, from stock ownership and market benchmarking to commodity trading and foreign exchange investments. With Investment Shark's expertise in asset management and market analysis, clients can access a portfolio of instruments tailored to their investment objectives, risk tolerance, and market preferences, enhancing their ability to achieve optimal returns and portfolio diversification.

Investment Shark & Asset Management stands out for its tailored investment solutions and comprehensive advisory services, catering to the diverse needs of investors. It offers multiple service types, providing flexibility and options for clients. However, drawbacks include a lack of educational resources or transparency regarding company policies and procedures, which may hinder informed decision-making for investors. Operating without regulatory oversight also poses potential risks to traders, and the absence of specific leverage information adds to the complexity for potential clients.

| Pros | Cons |

| • Tailored investment solutions | • Operates without regulatory oversight, potentially exposing traders to risks |

| • Offers multiple service types | • Lack of educational resources or transparency regarding company policies and procedures |

| • Comprehensive advisory services | • Lack of specific leverage information |

Investment Shark is a premier investment banking firm specializing in corporate finance, equity and debt capital markets, private equity, and strategic consulting services. Leveraging deep industry expertise, Investment Shark provides tailored solutions for mergers and acquisitions, financial analysis, and advisory services to help clients optimize their capital structure and achieve strategic growth objectives. On the other hand, Asset Management Service Types offered by Investment Shark encompass a range of investment strategies, including portfolio management, risk assessment, and asset allocation across various asset classes such as equities, fixed income, real estate, and alternative investments. These services are designed to maximize returns and manage risk effectively for institutional and individual investors.

Investment Shark & Asset Management Customer Support is committed to providing responsive and comprehensive assistance to clients. With a dedicated email address atADMIN@ISAML.COMand a contact number at +234 806 127 4194, clients can reach out for inquiries, account assistance, technical support, and general queries. The support team is well-versed in investment banking, corporate finance, asset management, and related fields, ensuring that clients receive professional and tailored support to meet their needs efficiently and effectively.

Investment Shark & Asset Management stands out as a boutique investment bank offering tailored investment solutions, comprehensive advisory services, and a diverse range of market instruments including equities, indices, commodities, and currencies. With a strategic location in Lagos, Nigeria, the firm leverages industry expertise to meet client objectives effectively. However, challenges such as a lack of educational resources and operating without regulatory oversight require clients to be cautious when trading.

What types of investment products does Investment Shark & Asset Management offer?

Investment Shark offers a diverse range of investment products including equities, indices, commodities, and currencies, tailored to meet the unique needs of clients.

How can I contact Investment Shark & Asset Management for customer support?

You can reach Investment Shark's customer support team via email at ADMIN@ISAML.COM or by calling +234 806 127 4194 for assistance with inquiries, account management, and general queries.

Is Investment Shark & Asset Management regulated?

No, Investment Shark operates as an unregulated boutique investment bank. Clients should conduct thorough due diligence and risk assessment before engaging in financial transactions with the firm.

What types of advisory services does Investment Shark & Asset Management provide?

Investment Shark offers comprehensive advisory services including mergers and acquisitions (M&A), financial analysis, and strategic consulting, helping clients make informed investment decisions and achieve their financial goals.

Trading online carries inherent risks, including the potential loss of your entire investment. It's essential to recognize that online trading may not be suitable for everyone, and individuals should carefully consider their risk tolerance before participating. Additionally, please be aware that the details provided in this review are subject to change as companies update their services and policies. Therefore, it's advisable to verify the most up-to-date information directly with the company before making any trading decisions. Ultimately, the responsibility for utilizing the information in this review lies solely with the reader.

More

User comment

0

CommentsWrite a review

No comment yet

start to write first comment