User Reviews

More

User comment

3

CommentsWrite a review

2024-01-31 19:34

2024-01-31 19:34

2023-03-22 17:53

2023-03-22 17:53

Score

2-5 years

2-5 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index6.66

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

Company Name

Coin Exchange Fx

Company Abbreviation

Coin Exchange Fx

Platform registered country and region

Canada

Company website

Company summary

Pyramid scheme complaint

Expose

| Aspect | Information |

| Company Name | Coin Exchange Fx |

| Registered Country/Area | Canada |

| Founded Year | 2019 |

| Regulation | Unregulated |

| Minimum Deposit | $5,000 |

| Maximum Leverage | Up to 1:500 |

| Spreads | Starting from 0.5 pips |

| Trading Platforms | MetaTrader 4 (MT4) and MetaTrader 5 (MT5) |

| Tradable Assets | Forex, Cryptos, Stocks |

| Account Types | Platinum, Gold, Silver and Basic account |

| Customer Support | Phone: +1 (618) 710-6254, Email: support@coinexchangefx.online |

| Deposit & Withdrawal | Bank transfer, credit card, debit card, and e-wallets |

| Educational Resources | Limited resources |

Coin Exchange Fx, founded in Canada in 2019, offers a wide range of trading assets, including Forex, Cryptos, and Stocks. Operating without regulatory oversight, it presents inherent risks for traders and investors. The absence of regulatory supervision raises concerns about adherence to industry standards and investor protection, making it vital for users to exercise caution when engaging with unregulated platforms. Unregulated entities may lack transparency, accountability, and legal safeguards, making it challenging to seek redress in case of disputes or malpractices. However, the platform provides various pros, such as market diversity, versatile account types, high leverage, cost-effective trading, and a user-friendly MetaTrader platform. On the downside, Coin Exchange Fx lacks comprehensive educational resources, and the minimum deposit requirement varies widely based on account types, potentially limiting accessibility for some traders. Traders should carefully consider these factors before engaging with Coin Exchange Fx.

Coin Exchange Fx operates without regulatory oversight, which poses inherent risks for traders and investors. Without regulatory supervision, there is no assurance of adherence to established industry standards or investor protection. Traders should be cautious when engaging with unregulated platforms, as they may lack transparency, accountability, and legal safeguards. In the event of disputes or malpractices, the absence of regulatory authority can make it challenging to seek redress or recover funds. It is advisable to consider the potential risks and exercise caution when dealing with unregulated entities like Coin Exchange Fx.

| Pros | Cons |

| Diverse Trading Assets | Lack of Regulation |

| Multiple Account Types | Limited Education Resources |

| High Leverage | Minimum Deposit Requirements |

| Tight Spreads | |

| MT4 and MT5 Platform |

Pros:

Market Instruments: Coin Exchange Fx offers a diverse range of trading assets, including Forex, Cryptos, and Stocks. The Forex market's high liquidity and significant daily turnover of approximately $5.1 trillion can provide ample trading opportunities.

Account Types: The platform provides a variety of account types with different leverage options and competitive starting spreads, making it accessible to a wide range of investors with varying risk tolerance and capital availability.

Leverage: Coin Exchange Fx offers high leverage of up to 1:500, allowing traders to control larger positions with a smaller initial deposit.

Spreads & Commissions: The platform offers tight spreads and low commissions on trading pairs, making it cost-effective for traders.

Trading Platform: Coin Exchange Fx utilizes the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms known for their user-friendly interface, extensive features, and customization options.

Cons:

Lack of Regulation: Coin Exchange Fx operates without regulatory oversight, raising concerns about adherence to industry standards and investor protection. Unregulated platforms may lack transparency and accountability, potentially posing risks to traders.

Educational Resources: The platform lacks comprehensive educational resources, such as tutorials and webinars, limiting opportunities for traders to enhance their knowledge and trading skills.

Minimum Deposit: The minimum deposit requirement varies significantly depending on the selected account type, ranging from $5,000 for the Basic account to $50,000 for the Platinum account, potentially limiting accessibility for some traders.

Coin Exchange Fx offers a range of trading assets, including Forex, Cryptos, and Stocks.

In the Forex market, it provides opportunities to trade various currency pairs. The foreign exchange market is known for its high liquidity and significant daily turnover, amounting to approximately $5.1 trillion. Investors can engage in currency trading with the potential for profit but should be aware of the associated risks.

Coin Exchange Fx also offers Cryptos as a trading asset. Traders can participate in the cryptocurrency market with the support of experienced brokers. The platform promotes the potential to make money in both rising and falling markets. While the emphasis on connecting with veteran brokers and learning from professionals is mentioned, the credibility and transparency of these brokers should be carefully evaluated.

In addition to Forex and Cryptos, Coin Exchange Fx provides opportunities for trading in Stocks. This includes a diverse range of assets, from established industries to emerging new-age sectors. While it promotes trading with confidence, investors should conduct their research and due diligence when considering stock trading, as market risks can vary significantly based on the chosen assets.

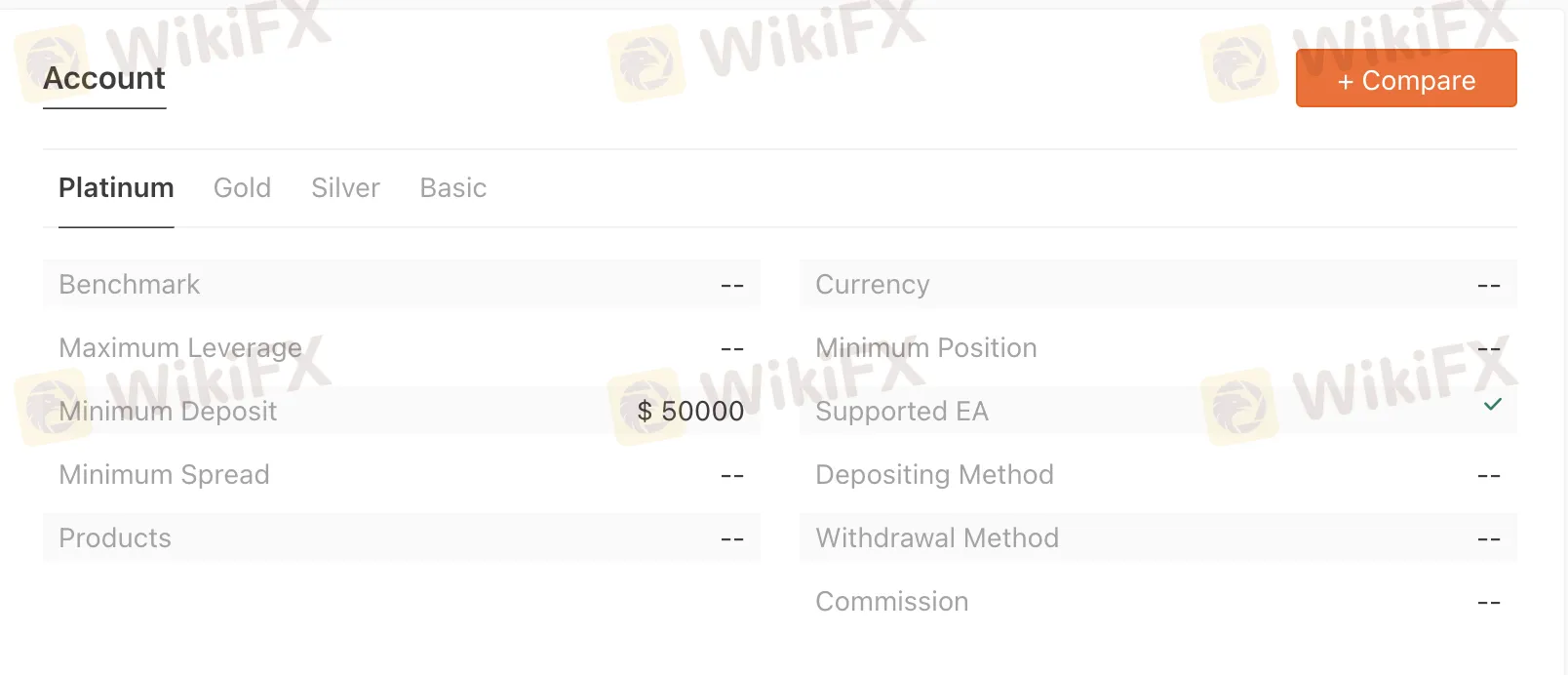

Coin Exchange Fx offers a variety of account types to cater to different trading needs.

The Platinum account provides a high leverage of 1:500, while Gold offers 1:400, Silver offers 1:300, and Basic offers 1:200 leverage.

All account types have competitive starting spreads, beginning at 0.5 pips, ensuring cost-effective trading. Additionally, these accounts come with minimal commissions, as low as 0.

Traders can select their preferred account based on their risk tolerance and capital availability, with minimum deposits ranging from $5,000 for Basic to $50,000 for the Platinum account, offering flexibility to a diverse range of investors.

| Aspects | Platinum | Gold | Silver | Basic |

| Leverage | 1:500 | 1:400 | 1:300 | 1:200 |

| Spread | Starting from 0.5 pips | Starting from 0.5 pips | Starting from 0.5 pips | Starting from 0.5 pips |

| Commission | As low as 0 | As low as 0 | As low as 0 | As low as 0 |

| Minimum Deposit | $50,000 | $30,000 | $10,000 | $5,000 |

| Demo Account | Yes | Yes | Yes | Yes |

| Trading Tool | MT4, MT5 | MT4, MT5 | MT4, MT5 | MT4, MT5 |

| Customer Support | 24/7 Email, live chat, phone | 24/7 Email, live chat, phone | 24/7 Email, live chat, phone | 24/7 Email, live chat, phone |

Opening an account with Coin Exchange Fx involves several straightforward steps. Here's a breakdown of the process in six steps:

Registration:

Visit the official Coin Exchange Fx website. Click on the “Sign Up” or “Register” button to initiate the registration process.

Fill out the required personal information, including your full name, email address, phone number, and preferred password.

Account Verification:

After completing the registration, you'll receive a verification email or SMS containing a verification link or code.

Login:

Use the registered email address and password to log in to your newly created account.

Account Information:

Once logged in, you'll need to provide additional account information, including your country of residence, date of birth, and sometimes identity verification documents (such as a government-issued ID).

Account Funding:

To start trading, you'll need to deposit funds into your account. Coin Exchange Fx typically offers various deposit methods, including bank transfers, credit/debit cards, and e-wallets.

Start Trading:

With your account funded, you can now explore the platform, select your preferred trading assets, and execute your trades. You can access trading tools and make use of the features offered through their chosen trading platform, such as MetaTrader 4 (MT4) or MetaTrader 5 (MT5).

Coin Exchange Fx offers leverage up to 1:500. This means that you can control a position worth up to 500 times your initial deposit. Leverage can be a powerful tool, but it can also be risky.

Coin Exchange Fx offers tight spreads and low commissions on all its trading pairs. The spreads vary depending on the currency pair and the market volatility. However, the spreads are generally lower than other exchanges.

The following table shows the average spreads for some of the most popular currency pairs:

| Currency Pair | Spread |

| BTC/USD | 0.5 pips |

| ETH/USD | 0.7 pips |

| LTC/USD | 1.0 pips |

| BCH/USD | 1.2 pips |

| XRP/USD | 1.5 pips |

Coin Exchange Fx also charges no commission on all trades.

Coin Exchange Fx uses the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms. These are two of the most popular trading platforms in the world, and they are known for their user-friendly interface and powerful features.

MT4 and MT5 offer a wide range of features, including:

A variety of charting tools and technical indicators

Multiple order types, including stop orders and limit orders

The ability to backtest and optimize trading strategies

A built-in news feed and economic calendar

Mobile apps for iOS and Android

Coin Exchange Fx has customized the MT4 and MT5 platforms to include its own features, such as:

A variety of cryptocurrencies

Leverage up to 1:500

Tight spreads and low commissions

24/7 customer support

Coin Exchange Fx offers a variety of payment methods, including bank transfer, credit card, debit card, and e-wallets. The minimum deposit amount varies depending on the payment method.

| Aspects | Platinum | Gold | Silver | Basic |

| Minimum Deposit | $50,000 | $30,000 | $10,000 | $5,000 |

The minimum deposit required for trading with Coin Exchange Fx varies based on the selected account type, with Platinum demanding a $50,000 minimum deposit, Gold requiring $30,000, Silver necessitating $10,000, and Basic starting with a more accessible $5,000.

Payment processing times also differ based on the method chosen. Bank transfers typically take 3-5 business days for funds to be credited. In contrast, credit and debit card transactions are processed instantly, as are payments made through e-wallets, ensuring efficient and convenient financial transactions for traders.

Coin Exchange Fx provides comprehensive customer support through multiple channels.

You can reach their customer support team at +1 (618) 710-6254 for direct assistance.

For inquiries and assistance via email, you can contact them at support@coinexchangefx.online.

Additionally, the official website, https://www.coinexchangefx.online/, serves as a valuable resource for information and potential support.

Their multi-channel approach ensures that traders and clients have access to timely assistance and information, enhancing the overall user experience.

Coin Exchange Fx lacks substantial educational resources for traders and investors. This absence of educational materials, such as tutorials, webinars, or educational articles, can hinder the ability of users to acquire knowledge and improve their trading skills. As a result, individuals looking for guidance or seeking to enhance their understanding of financial markets may need to explore external educational sources to supplement their trading experience. It is essential for traders to consider their own educational needs and evaluate whether the limited educational support provided by Coin Exchange Fx aligns with their requirements for informed and successful trading.

In conclusion, Coin Exchange Fx offers a diverse range of trading assets and competitive account options. However, its operation without regulatory oversight poses inherent risks for traders and investors. The absence of regulatory authority raises concerns regarding industry standards and investor protection, requiring users to exercise vigilance when dealing with unregulated platforms. While the platform provides benefits like market diversity, high leverage, and cost-effective trading, it lacks comprehensive educational resources and has varying minimum deposit requirements. Potential users should weigh the advantages and disadvantages carefully and consider their risk tolerance and educational needs before engaging with Coin Exchange Fx.

Q: How can I fund my Coin Exchange Fx account?

A: You can fund your account using various methods, including bank transfers, credit/debit cards, and e-wallets. Simply log in, navigate to the deposit section, select your preferred method, and follow the provided instructions.

Q: What are the minimum deposit requirements for different account types?

A: Minimum deposit requirements vary based on your selected account type, ranging from $5,000 for the Basic account to $50,000 for the Platinum account.

Q: Is Coin Exchange Fx regulated?

A: No, Coin Exchange Fx operates without regulatory oversight. Traders should be aware of the potential risks associated with trading on unregulated platforms.

Q: What trading platforms does Coin Exchange Fx offer?

A: Coin Exchange Fx uses MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms, both known for their user-friendly interfaces and powerful features.

Q: Does Coin Exchange Fx provide educational resources for traders?

A: Coin Exchange Fx offers limited educational resources. While you can access the trading platforms, tutorials, webinars, or educational articles are not prominently featured.

Q: How can I contact Coin Exchange Fx's customer support?

A: You can reach Coin Exchange Fx's customer support through various channels, including phone at +1 (618) 710-6254, email at support@coinexchangefx.online, and through their official website, https://www.coinexchangefx.online/.

More

User comment

3

CommentsWrite a review

2024-01-31 19:34

2024-01-31 19:34

2023-03-22 17:53

2023-03-22 17:53