User Reviews

More

User comment

105

CommentsWrite a review

2026-02-25 12:10

2026-02-25 12:10

2026-01-16 11:59

2026-01-16 11:59

Score

2-5 years

2-5 yearsRegulated in Indonesia

Forex Trading License (EP)

MT4 Full License

Global Business

High potential risk

Benchmark

Influence

Add brokers

Comparison

Quantity 20

Exposure

Score

Regulatory Index6.40

Business Index6.85

Risk Management Index0.00

Software Index9.41

License Index6.44

Single Core

1G

40G

More

Company Name

KVB Prime Limited

Company Abbreviation

KVB

Platform registered country and region

Comoros

Company website

X

YouTube

Company summary

Pyramid scheme complaint

Expose

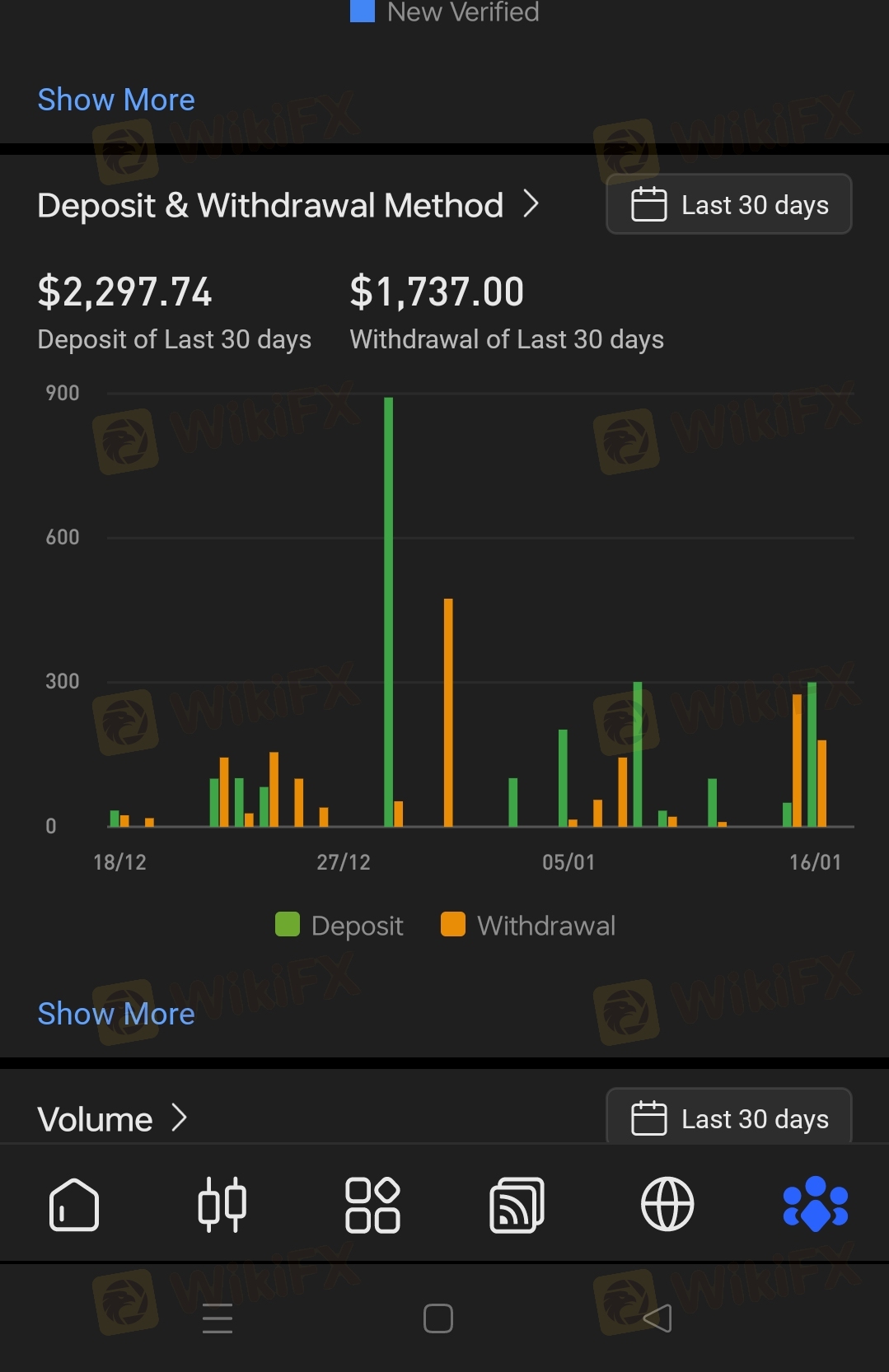

Everyone, stay away from KVB Markets. They're a scam and manipulating accounts. I deposited 15,000 to follow the advice of a respected expert, and my account grew to 40,000. Then they interfered with my trading, placing seven large hedging trades that wiped out my account. Now I can't even complain to their email. I'm truly heartbroken, everyone. Don't trust them, or you'll suffer like I did. I also hope that investors will be more vigilant and not be fooled by KVB's false propaganda.

ความผิดพลาดของ KVB ทำลายเงินต้น 78,000 บาทของผม บ้าจริง! ทุกวันผมเทรด USD/THB ตอนตีสาม แต่ความผิดพลาดของ KVB ดูเหมือนจะส่งผลเสียต่อผมตลอด ผมตั้งจุดตัดขาดทุนไว้ที่ 36.10 แต่ตลาดกลับตกลงมาแค่ 36.15 แต่ระบบกลับเทรดที่ 36.42 ความผิดพลาดของ Slippage 27 จุด ส่งผลให้ขาดทุน 5,400 บาท ที่แย่กว่านั้นคือวันศุกร์ ผมตั้งจุด Take Profit ไว้ที่ 41.20 สำหรับ EUR/THB และราคาพุ่งขึ้นไปที่ 41.25 แต่ระบบบังคับให้ผมปิดสถานะที่ 41.08 ความผิดพลาดของ Slippage 17 จุด ทำให้เงินในบัญชีผมหายไป ภายในหนึ่งเดือน เทรดไป 30 ครั้ง 21 ครั้งหลุด เฉลี่ย 23 จุดต่อครั้ง ขาดทุนรวม 78,000 บาท ไร้ยางอายจริงๆ! KVB ไม่มีแม้แต่ทะเบียนบ้าน แต่กลับเช่าออฟฟิศเล็กๆ บนถนนสุขุมวิท แล้วมาหลอกพ่อค้าแม่ค้าในตลาดกลางคืนอย่างเรา การกระทำของ KVB นี่มันจงใจนะ อย่าให้ใครโดนหลอกอีก!

Everyone, be warned. KVB used the lie of "SC regulation" to trick me into depositing RM120,000, and now my account is frozen and I can't withdraw a single cent! Their salesperson used printed "SC registration screenshots" to sell me their account, claiming it was "safe and secure." I fell for it and deposited money into the EUR/MYR market. After only making a profit of RM16,000, my account was locked due to "abnormal trading patterns." Customer service said I needed to pay a 20% "risk margin" to unlock my account. I scraped together RM34,000 and paid it, but I still couldn't access my account. Others who were scammed like me have had as much as RM250,000 frozen. This unlicensed platform should be shut down by the Bank of Japan (BNM). Losing your entire principal due to inability to complete your mission is a clear attempt to legally plunder customer funds.

I'm a trader from Indonesia, and I'm disappointed with KVB's trading environment. The malicious slippage caused me to lose my account due to a major market fluctuation. I had already placed a short position in the EUR/USD market with a stop-loss at 1.1050. However, as soon as the data came out, the price skyrocketed. Normally, my stop-loss would have been triggered around 1.1048, but KVB's transaction price directly hit 1.1067, effectively shutting me out. In all my years of trading, I've never encountered such outrageous slippage on a reputable platform during the non-farm payroll period. Furthermore, KVB's spreads are typically higher than other platforms, with EUR/USD spreads generally ranging from 1.8 to 2.2 pips, while other platforms typically range from 1.2 to 1.5. The quotes are often low when I'm going long, and high when I'm going short. My trading history has resulted in additional losses exceeding $2,300 per month due to this.

I was scammed by this platform's spreads, which were often 8 times the normal level. I was trading EUR/USD with KVB. The spread was usually stable at 1.8-2.2 pips, but between May 10th and 15th, it suddenly widened to 14-17 pips, 8 times the normal level. On May 12th, I traded one lot of EUR/USD, and the spread alone cost me $150 (about RM675), while the same position normally costs only $20 (about RM90). Within 5 days, I paid an extra RM2,860 in fees due to the unusual spreads. KVB does not have a local Malaysian forex license. They're truly deceptive, using random advertising to deceive people.

In the afternoon (Asian session) Malaysian time, your EURUSD spreads consistently stayed above 2.8 pips. Meanwhile, other major platforms were running spreads below 1.5. Shameless! They're operating without a license and freezing accounts. Who's responsible if I can't withdraw RM50,000? KVB doesn't even have a BNM license in Malaysia, yet they're so brazen about soliciting customers! I deposited RM50,000, and my account was suddenly frozen, citing "compliance review." Their slippage during trading was the worst of anyone else's. My stop-loss on USD/JPY was set at 138.5, but it only closed at 139.8. A 130-point slippage resulted in a loss of RM23,000. KVB is not licensed to trade forex in Malaysia. Freezing accounts is purely a scam.

Your Malay customer, claiming to be a "central bank policy analyst," contacted me via WeChat, boasting about having "inside Bank Negara" access and advance knowledge of interest rate policy trends. I foolishly believed your lies and followed your guidance to invest heavily. The so-called "policy signals" you provided were completely fabricated! I later discovered that you specifically released false information during periods of low liquidity, making it impossible for clients to close their positions in time! After my margin call, your Malay customer service representative even claimed "market interpretation errors" and shamelessly promoted their "policy insider service," claiming that for an annual fee of RM20,000, you could obtain "real policy information." This scam, which fabricates policy signals, then lures clients into trading, and then extorts them, is truly outrageous!

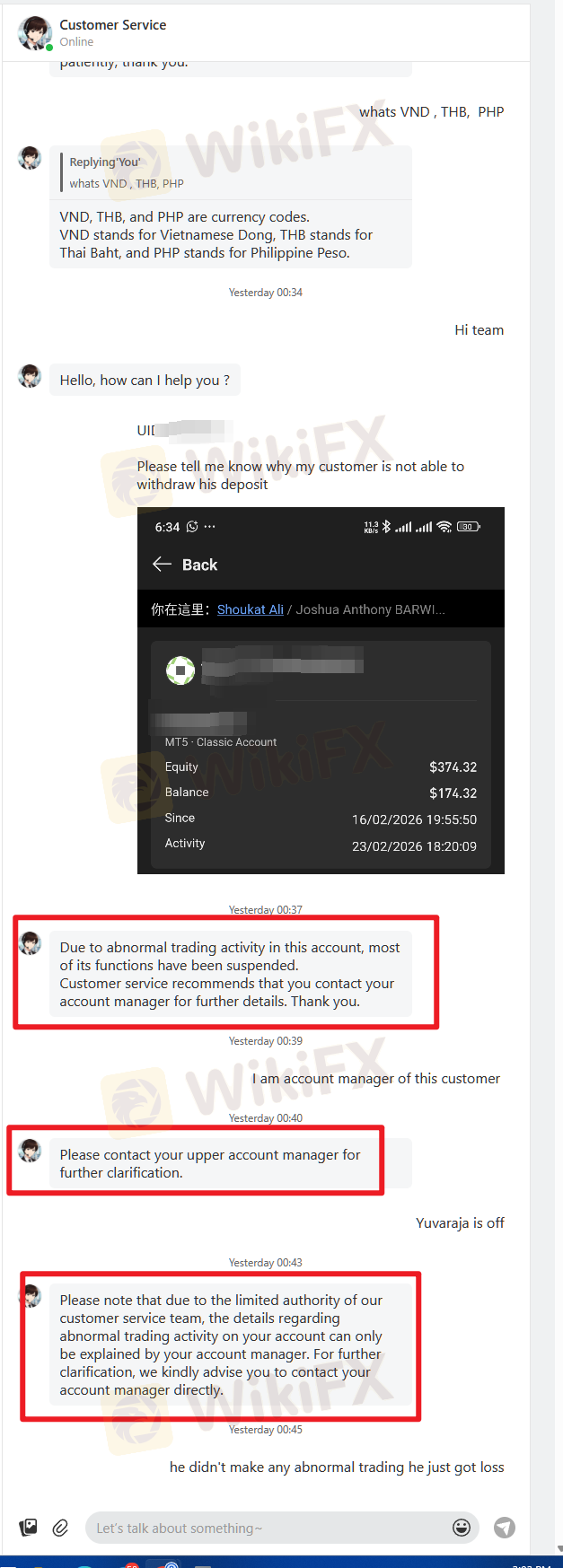

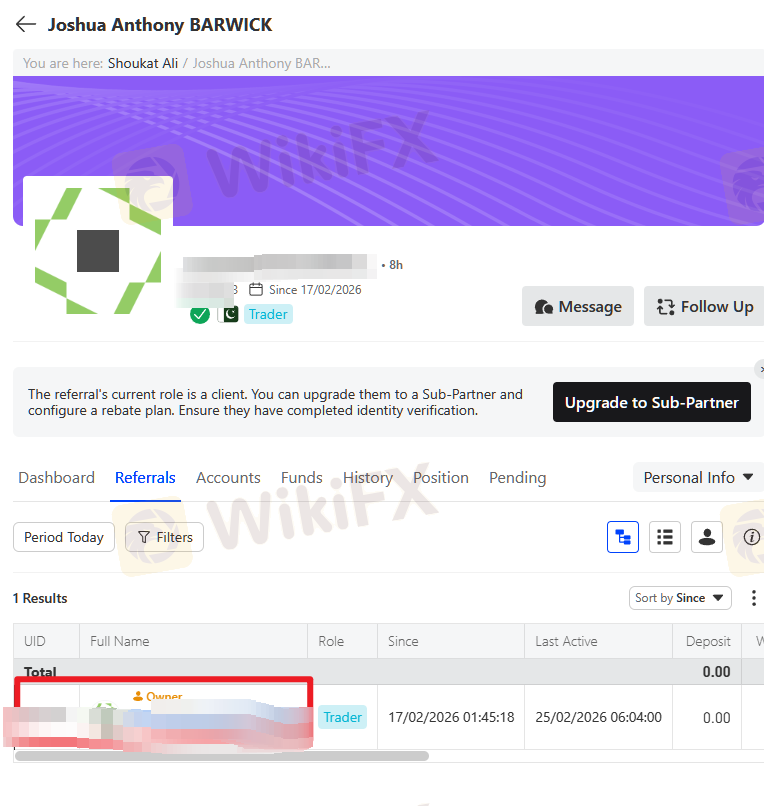

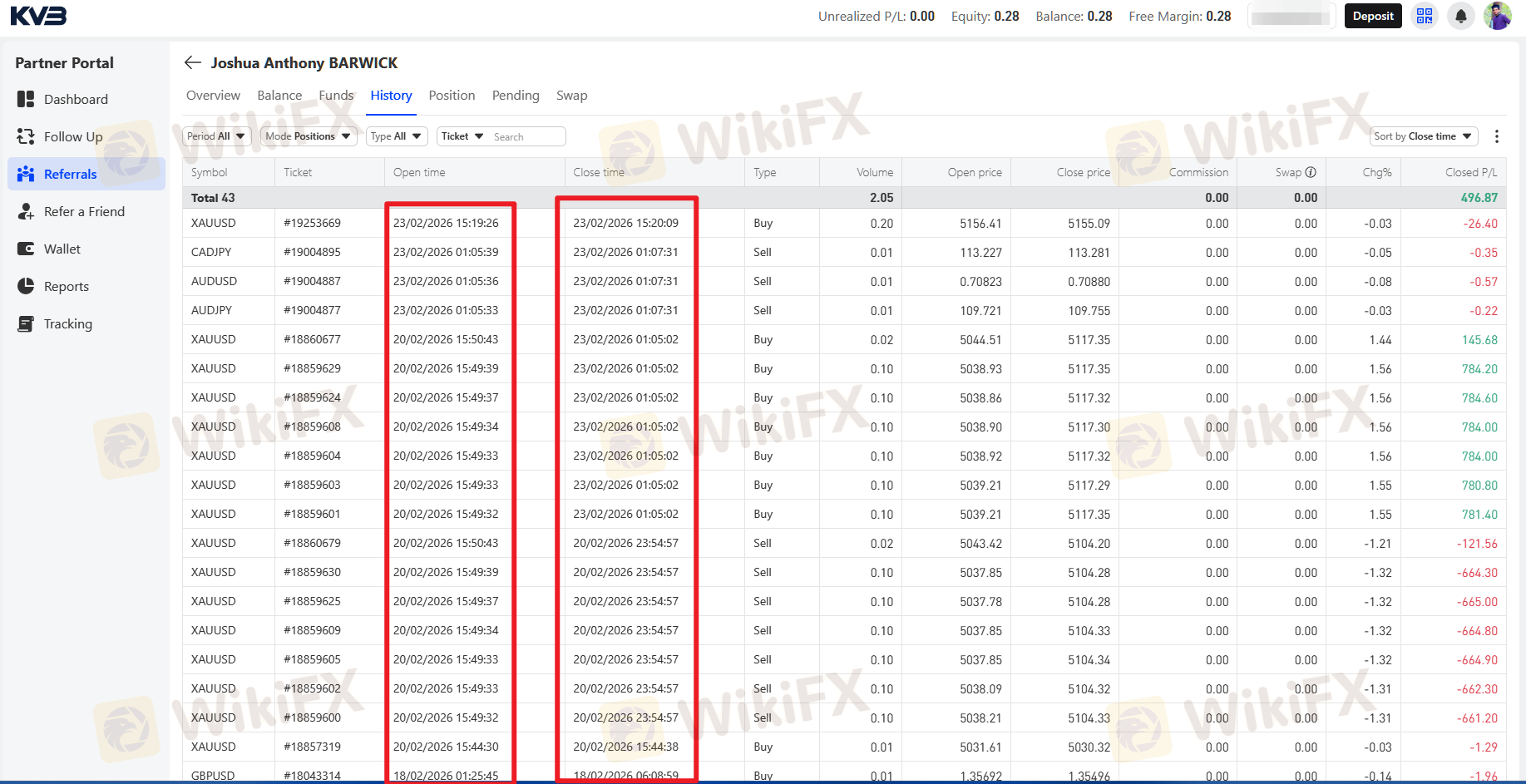

KVB, I was so blind to choose your platform! When I was trading forex, I strictly followed your data analysis, repeatedly checking its accuracy every time, yet I ended up losing money every time I placed an order! After careful comparison, I discovered that not only were your market data delayed, but you also deliberately manipulated key trading points, changing support levels lower and resistance levels higher, just to force our orders to stop losses early and profit from them! Now I want to stop my losses and withdraw my funds, but you're making it extremely difficult! I've submitted three withdrawal requests, and each time they were rejected with "data anomalies, requiring verification of transaction records." I asked to see the so-called "abnormal data records," but you couldn't produce them and just kept dragging your feet! I called my account manager, but he blocked me. I contacted online customer service, but they either played dead or gave a perfunctory response.

I had a nightmare trading the USD/MYR currency pair with KVB. The platform advertised "spreads as low as 0 pips" on its ECN accounts, but when I opened a position, the actual spread suddenly soared from the usual 2.3 pips to 18 pips. My RM100,000 principal was instantly wiped out by RM5,400 in fees. Even worse, when the market hit my take-profit point of 4.7200, the platform slipped to 4.6950, forcing a liquidation. My original RM12,000 profit turned into a RM8,300 loss. By the end of June, my RM100,000 principal had lost RM32,000 due to slippage and unusual spreads. I absolutely do not recommend this platform. There are so many pitfalls.

This is the most shameless broker I've encountered in my years of trading. Accounts wiped out, customer service disconnected. KVB simply wiped out my $10,000 account! Last month, I went on a three-day business trip. When I logged in, my balance had gone from $10,820 to $0, and all my transaction history was gone. I called customer service 15 times, but no one answered. Now, even their customer service in Malaysia has deleted me. I complained to BNM, but the staff said, "KVB doesn't have a physical presence in Malaysia, so it's difficult to recover." A friend in Ipoh reported that his RM200,000 account was also wiped out. KVB claimed a "system bug caused data loss," but offered no compensation. KVB is a blatant scam. Malaysians, remember this broker and stay away.

The behavior of the KVB foreign exchange platform in the withdrawal process is no different from that of a robber. I traded on the platform and accumulated a profit. I submitted a withdrawal application, but it fell into oblivion and there was no response. I contacted customer service many times, but they either made excuses, saying that the system was under review and asked me to wait patiently, but this wait took weeks; or they simply ignored my messages and had no sincerity in solving the problem. They even made up ridiculous reasons such as my account was at risk and that additional information was required to continue delaying the withdrawal. I provided all the information as required, but there was still no progress. My funds were unreasonably withheld by the KVB platform and I cannot use a single cent. The illegal appropriation of investors' funds by the KVB platform has made more people see your ugly face.

During my time trading with KVB, I followed their advice, but ended up losing money every time. I spent real money, not to play disconnect and reconnect games! The stability of their trading platform (especially the MT4 server) is appalling! In the past two months, I've experienced no fewer than ten server outages, especially during critical times like the European market opening and Federal Reserve news releases. "No connection" would simply appear in the lower left corner of the screen, chart prices would stop updating, and all orders would be unexecuted and positions could not be closed! Can you imagine the despair of watching unrealized profits turn into losses, or even watch your account get wiped out, with no action to take? I'm using enterprise-grade dedicated fiber! Other platforms are working perfectly, but yours is the only one experiencing issues every day? They're putting their customers' hard-earned money at enormous technical risk, with absolutely no sense of responsibil

I must expose KVB. My US dollar funds were transferred to a jewelry company in Hong Kong and then returned to the platform through an offshore account. When I requested proof of the funds' movement, they refused to provide it and instead froze my account. The platform's overnight fees are ridiculously high. Holding one lot of gold costs $35 per day, five times the industry average. I calculated that overnight fees alone have cost me $18,700. KVB has been fined for "opaque fees" in the CFTC complaint file, yet they continue to operate unchecked. Now my $18,00 is stuck in my account, and customer service says "I must trade another 100 lots before I can withdraw my funds." This is clearly forced trading! It's a massive scam.

This was a devastating disaster, leading to my bankruptcy. For 90 consecutive days, KVB's MT4 server (number: KVB-Live04) experienced 37 disconnections, an average of 4.1 per week! During the European trading session, the disconnection frequency reached 82%. This resulted in a $12,800 loss on my crude oil position due to my inability to close it. Despite providing complete network logs (normal ping values and stable connections to other platforms), customer service refused compensation, citing "local network issues." I felt helpless because I had no guarantee of my funds. Everyone should be wary of a platform with fabricated data, poor customer service, and a lack of oversight.This entity only holds a weakly regulated license from CIMA (Cayman Islands Monetary Authority), and client funds are protected at zero cost!

KVB, you've gone too far! I applied for a withdrawal according to the normal process and submitted all the necessary documents. But you've been perfunctory and given all sorts of excuses, simply not letting me withdraw my funds. From the time I submitted my application until now, every time I contacted customer service, I've received meaningless replies, either saying it's under review, or that there's a system problem, or else they've just shifted the blame. No one has been able to truly resolve my issue. Looking at the data you provided, the spreads fluctuate wildly, seriously out of line with normal market conditions. I thought it was a one-off, but later discovered it seems to be a regular occurrence on your platform. Your actions are a complete scam for us investors! The funds I invested were the hard-earned savings of myself and my family, yet you're so brazenly trampling on our trust and preventing us from withdrawing our funds.

แพลตฟอร์ม KVB Forex เปรียบเสมือนหลุมดำที่กัดกินความมั่งคั่งของนักลงทุน! ผมเจอกับ Slippage อย่างรุนแรงขณะเทรด Forex บนแพลตฟอร์ม ยกตัวอย่างเช่น ในการเทรด EUR/JPY ตลาดมีความผันผวนของราคาอย่างต่อเนื่อง ผมจึงตัดสินใจวางคำสั่งซื้อขายที่ราคา 130.50 ตามกลยุทธ์ที่ผมวางไว้ อย่างไรก็ตาม ราคาที่ KVB รายงานนั้นสูงถึง 130.75 ซึ่งถือเป็น Slippage สูงถึง 25 จุด ซึ่งไม่ใช่ความผันผวนของตลาดตามปกติ แต่เป็นผลมาจากการปั่นราคาโดยเจตนาของแพลตฟอร์ม ผมสูญเสียเงินต้นไปจำนวนมาก เมื่อผมนำบันทึกการซื้อขายไปให้ฝ่ายบริการลูกค้าของแพลตฟอร์มเพื่อขอคำอธิบาย พวกเขากลับปัดข้อกังวลของผมออกไปด้วยข้ออ้างที่ฟังดูผิวเผิน เช่น "ความไม่แน่นอนของตลาด" โดยไม่สนใจข้อกังวลของผม การ Slippage ของ KVB เป็นการบ่อนทำลายหลักปฏิบัติการซื้อขายที่เป็นธรรมอย่างรุนแรง และทำให้นักลงทุนตกอยู่ในความเสี่ยงและเสี่ยงต่อการขาดทุนโดยไม่สมควร ฉันขอประณามพฤติกรรมที่ชั่วร้ายของแพลตฟอร์ม KVB อย่างรุนแรง และขอเรียกร้องให้นักลงทุนทุกคนตระหนักถึงหน้าตาที่แท้จริงของแพลตฟอร์มนี้ และอย่าหลงเชื่อการโฆษณาชวนเชื่อที่เป็นเท็จ เพื่อหลีกเลี่ยงการขาดทุนหนักเหมือนฉัน

| KVB Overview | |

| Item | Details |

| Established | 2023 |

| Registered Country/Region | United Kingdom |

| Regulation | BAPPEBTI (Retail Forex License) |

| Main Market Products | Forex, Commodities, Indices, Shares, Cryptocurrencies |

| Demo Account | ✅ |

| Leverage | Up to 1:1000 |

| Spread | From 1.2 pips |

| Trading Platforms | MetaTrader 4, MetaTrader 5, KVB App, ActsTrade |

| Minimum Deposit | $10 |

| Customer Support | Address: Hamchako, Mutsamudu, The Autonomous Island of Anjouan, Union of Comoros |

| Email: support@kvbplus.com, Live Chat | |

KVB is an online trading platform founded in 2023 and registered in the United Kingdom. It offers access to a wide variety of markets, including forex, commodities, indices, shares, and cryptocurrencies. To help you implement your trading strategies effortlessly, KVB provides robust platforms such as MetaTrader 4, MetaTrader 5, the KVB App, and ActsTrade.

| Regulatory Agency | Regulatory Status | License Number | Licensed Entity | License Type | Regulatory Jurisdiction | Negative Balance Protection |

| BAPPEBTI | Regulated | 1051/BAPPEBTI/SI/1/2007 | PT KVB FUTURES INDONESIA | Retail Forex License | Indonesia | Yes |

| Instrument | Availability |

| Forex | ✅ |

| Commodities | ✅ |

| Indices | ✅ |

| Shares | ✅ |

| Cryptocurrencies | ✅ |

| Options | ❌ |

| Funds | ❌ |

| ETFs | ❌ |

| Account Type | Minimum Deposit | Leverage | Spread | Commission | Other Features |

| Cent Account | $10 | 1:1000 | From 1.2 pips | None | Ideal for beginners |

| Classic Account | $30 | 1:1000 | From 1.2 pips | None | Standard account |

| Pro Account | $10 | 1:1000 | From 1.2 pips | None | Professional account |

| Plus Account | $10,000 | 1:1000 | From 0.0 pips | None | High-end account |

| Demo Account | None | 1:1000 | From 1.2 pips | None | Virtual funds |

KVB offers a range of account types to cater to different traders. The Cent Account is ideal for beginners with a low minimum deposit, while the Plus Account is tailored for professional traders, offering zero spreads but requiring a higher minimum deposit.

| Platform | Supported Devices | Suitable For |

| KVB App | iOS, Android | Mobile traders |

| KVB | Desktop | Desktop traders |

| ActsTrade | Windows, macOS | Desktop traders |

| MetaTrader 4 | Windows, macOS, Mobile | All traders |

| MetaTrader 5 | Windows, macOS, Mobile | Advanced traders |

| Payment Method | Deposit Time | Fees |

| Local Bank Transfer | Instant | Free |

| Cryptocurrency | Instant | Free |

| Payment Method | Withdrawal Time | Fees |

| Bank Transfer | Within 2 hours | Free |

| Cryptocurrency | Instant | Free |

| Minimum Deposit | Bonus Amount | Required Trading Volume |

| $500 | $100 | 20 lots |

| $1,000 | $200 | 40 lots |

| $2,000 | $400 | 80 lots |

| $5,000 | $1,000 | 200 lots |

| $10,000 | $2,000 | 400 lots |

Risk Disclaimer: Forex and CFD trading carry high risks. It can result in significant or total loss of your funds. This type of trading is not suitable for everyone. Make sure you understand the risks involved and trade with money you can afford to lose.

Ready to start trading with KVB? Register now and choose your preferred account type to access global markets and begin your trading journey!

Circle Stock extended its rally, rising about 15% on Monday and roughly 60% since its latest earnings report, as investor interest in stablecoins accelerates. The surge comes as USDC circulation jumpe

WikiFX

WikiFX

Asian shares declined at the start of the week as oil prices climbed amid escalating Middle East tensions. According to AP, investors grew cautious over potential disruptions in the Strait of Hormuz,

WikiFX

WikiFX

Oil prices surged as escalating Middle East tensions unsettled global markets, triggering a flight to safety. According to Bloomberg, concerns over potential supply disruptions—particularly around the

WikiFX

WikiFX

Escalating tensions involving Iran have triggered a sharp global market reaction, with equities falling and oil and safe-haven assets surging. According to Yahoo Finance, coordinated military strikes

WikiFX

WikiFX

More

User comment

105

CommentsWrite a review

2026-02-25 12:10

2026-02-25 12:10

2026-01-16 11:59

2026-01-16 11:59