User Reviews

More

User comment

3

CommentsWrite a review

2024-07-19 17:06

2024-07-19 17:06

2024-06-27 11:40

2024-06-27 11:40

Score

5-10 years

5-10 yearsRegulated in Hong Kong

Dealing in futures contracts

Suspicious Scope of Business

Suspicious Overrun

Medium potential risk

Add brokers

Comparison

Quantity 1

Exposure

Score

Regulatory Index7.77

Business Index7.72

Risk Management Index7.63

Software Index7.00

License Index7.77

Single Core

1G

40G

More

Company Name

PREMIER Q SECURITIES LTD

Company Abbreviation

PRIME CDEX

Platform registered country and region

Hong Kong

Company website

Company summary

Pyramid scheme complaint

Expose

| Aspect | Information |

| Company Name | PRIME CDEX |

| Registered Country/Area | China Hong Kong |

| Years | 2004 |

| Regulation | Regulated by SFC |

| Market Instruments | Sercurities, Stocks, and Futures |

| Customer Support | Phone: customer service +852 2111 2666, customer order +852 3839 0129/3898 0108 and Email: cs@premierqhk.com |

| Deposit & Withdrawal | Online and offline deposit |

| Educational Resources | Industry News, Financial Calendar, and 7*24 News |

PRIME CDEX, headquartered in China Hong Kong, has been serving traders since its establishment in 2004. Regulated by the Securities and Futures Commission (SFC).

It offers a range of market instruments including securities, stocks, and futures. Traders can reach out via phone for general inquiries or order-related queries. Additionally, an email option is available for further assistance. Traders can choose between online and offline methods.

PRIME CDEX, a financial institution operating in Hong Kong, falls under the regulatory oversight of the Securities and Futures Commission (SFC). The regulatory status of PRIME CDEX varies based on the specific license type and its current validity.

Dealing in Futures Contracts (License No. AHA296): PRIME CDEX holds a valid license for dealing in futures contracts, regulated by the Securities and Futures Commission of Hong Kong. This license type indicates that PRIME CDEX is authorized to engage in futures trading activities in compliance with the regulations set forth by the SFC.

Dealing in Securities (License No. AAU948 - Expired): Although PRIME CDEX previously held a license for dealing in securities, the current status of this license is expired. While it indicates past authorization to engage in securities trading activities, traders should note that the license is no longer active, potentially affecting the scope of services provided by PRIME CDEX in this regard.

Asset Management (License No. BGX384 - Expired): Similarly, PRIME CDEX previously obtained a license for asset management activities regulated by the SFC. However, the current status of this license is also expired. This signifies that PRIME CDEX's authorization to provide asset management services is no longer valid under this license.

| Pros | Cons |

| Regulated Environment | Limited Information |

| Different Market Instruments | Exceeded licenses |

| Comprehensive Customer Support | / |

| Flexible Deposit and Withdrawal | / |

To open an account with PRIME CDEX, you have two convenient methods to choose from:

Method 1: Open an account online via APP

Step 1: Download the “乾立亨APP” from your app store.

Step 2: Open an account online in just 3 minutes through the following steps: Follow the instructions on the app to select either the domestic or overseas account opening method.

Method 2: Open an account by mailing information offline

Step 1: Prepare the required documents:

Step 2: Download Adobe Acrobat Reader from the provided link.

Step 3: Download, read, and sign the necessary forms:

Step 4: Mail the signed account opening form and required documents to:

Room 808, 8th Floor, Central Plaza, 18 Harbor Road, Wan Chai, Hong Kong (Customer Service Department)

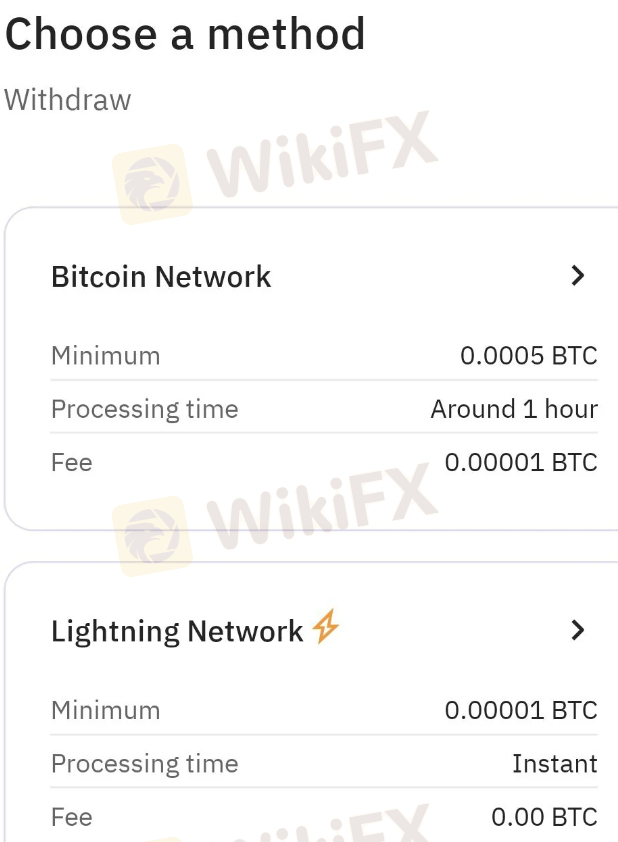

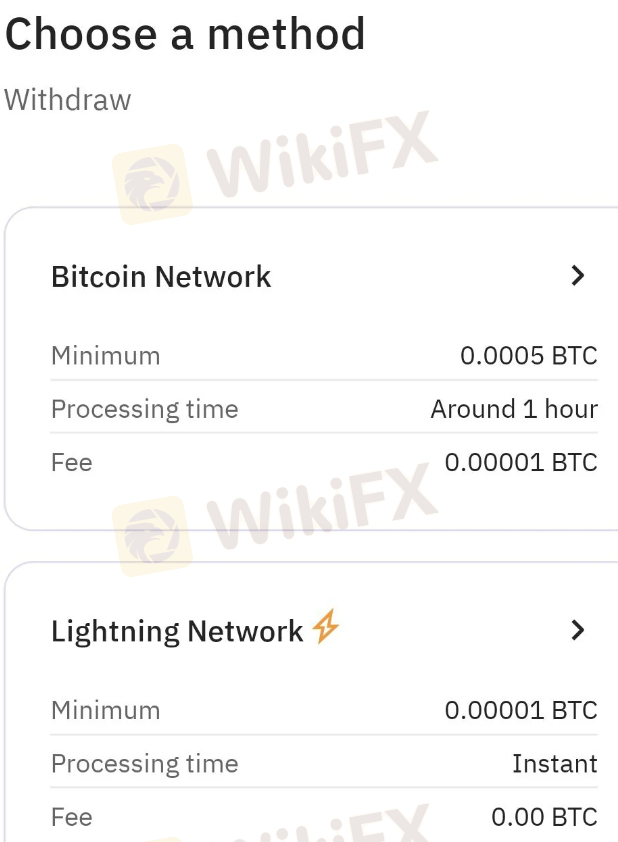

To deposit or withdraw funds with PRIME CDEX, you have two methods:

Method 1: Using the APP

Method 2: Offline Deposit with Customer Service Notification

Tips:

For customer support, PRIME CDEX offers various contact options:

Phone:

Email:

As part of its educational resources, PRIME CDEX provides valuable tools and information to help traders stay informed and make well-informed decisions. These resources include:

In summary, PRIME CDEX provides a regulated environment, giving traders a sense of security. The market instruments offer various investment opportunities, while comprehensive customer support ensures assistance is available. However, trading carries inherent risks, and returns aren't guaranteed.

Is PRIME CDEX regulated?

Yes, PRIME CDEX is regulated by the Securities and Futures Commission (SFC).

What market instruments does PRIME CDEX offer?

PRIME CDEX provides a range of market instruments including securities, stocks, and futures, offering traders various investment opportunities.

How can I contact customer support?

You can reach PRIME CDEX customer support by phone at +852 2111 2666 for general inquiries and +852 3839 0129/3898 0108 for customer orders. Alternatively, you can email them at cs@premierqhk.com.

What are the deposit and withdrawal options?

Traders can deposit funds through the app or offline transfer. Withdrawals can also be made through various channels.

More

User comment

3

CommentsWrite a review

2024-07-19 17:06

2024-07-19 17:06

2024-06-27 11:40

2024-06-27 11:40