User Reviews

More

User comment

3

CommentsWrite a review

2024-01-09 18:10

2024-01-09 18:10 2023-03-13 14:50

2023-03-13 14:50

Score

5-10 years

5-10 yearsSuspicious Regulatory License

White label MT4

Global Business

High potential risk

Influence

Add brokers

Comparison

Expose

Exposure

Score

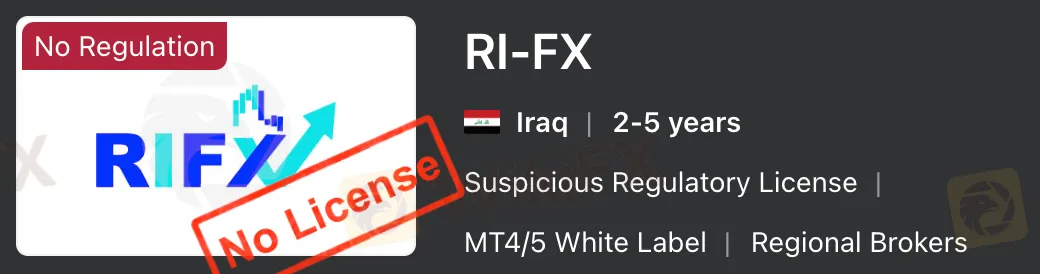

Regulatory Index0.00

Business Index7.03

Risk Management Index0.00

Software Index8.52

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

Company Name

RI-FX Capital Corporation

Company Abbreviation

RI-FX

Platform registered country and region

Iraq

Company website

X

YouTube

Company summary

Pyramid scheme complaint

Expose

| RI-FX | Basic Information |

| Company Name | RI-FX |

| Founded | 2021 |

| Headquarters | Iraq |

| Regulations | Not regulated |

| Tradable Assets | Futures, Options on Futures, Commodities, Forex, EFPs, CFDs, Indices, Other Foreign Currency-Denominated Instruments |

| Account Types | Elite, Astral, Stellar, Titans |

| Minimum Deposit | $50 |

| Maximum Leverage | Up to 1:400 |

| Spreads | Varies by account type |

| Commission | Varies by account type; $6 per lot for Zero Account |

| Deposit Methods | Electronic methods (VISA/MasterCard not accepted) |

| Trading Platforms | MetaTrader 4, cTrader |

| Customer Support | Phone, Email, Live Chat, Physical Address |

| Education Resources | Blog, RIFX Academy |

| Bonus Offerings | None |

RI-FX is a relatively new player in the online trading industry, offering a wide range of financial instruments across various asset classes. The platform is tailored to both novice and experienced traders, providing account types that cater to different levels of trading expertise. RI-FX's trading environment is supported by advanced platforms like MetaTrader 4 and cTrader, which are renowned for their user-friendly interfaces and comprehensive analytical tools.

One of RI-FX's notable features is its diverse array of tradable assets, including futures, forex, commodities, and indices. This variety allows traders to diversify their portfolios and explore different markets. RI-FX also emphasizes educational resources, including a blog and the RIFX Academy, to support traders' development and knowledge.

However, RI-FX's unregulated status is a significant concern. The lack of regulatory oversight means that there's an increased risk regarding the safety and security of client funds and overall transparency in business practices. This factor makes it crucial for potential traders to exercise caution and conduct thorough research before engaging with the platform.

RI-FX is not regulated by any recognized financial regulatory authority. As an unregulated broker, it operates without oversight from regulatory bodies that are responsible for ensuring compliance with industry standards and protecting the interests of traders. This lack of regulation raises concerns about the safety and security of funds, as well as the transparency of the broker's business practices.

RI-FX presents a varied trading environment with an assortment of instruments and account types, attempting to cater to the diverse needs of traders. The broker offers spreads across different accounts, and traders can choose between MetaTrader 4 and cTrader platforms. However, the absence of regulation introduces substantial uncertainties regarding the safety of funds and operational transparency. The broker's promotion of no commissions on some account types may attract traders, but the overall lack of regulatory oversight raises significant red flags, requiring cautious consideration. The summarized table below outlines the main aspects of RI-FX without employing positive language:

| Pros | Cons |

|

|

|

|

|

|

|

|

|

|

RI-FX offers a diverse array of trading instruments to cater to a broad range of investment preferences. The available instruments include:

1. Futures Contracts: Traders on RI-FX can engage in futures contracts, allowing them to buy or sell assets at predetermined prices on specified future dates. This instrument provides a structured way to speculate on the future price movements of various assets.

2. Options on Futures Contracts: RI-FX provides options on futures contracts, offering traders the right, but not the obligation, to buy or sell the underlying asset at a predetermined price. Options add flexibility to trading strategies by allowing investors to hedge or leverage their positions.

3. Commodities and Forward Contracts: The platform facilitates trading in commodities, representing valuable physical goods, as well as forward contracts that involve agreements to buy or sell assets at future dates.

4. Foreign Exchange Transactions: Traders can actively participate in the foreign exchange market on RI-FX, engaging in currency trading to capitalize on exchange rate fluctuations.

5. Exchange for Physicals (EFPs): RI-FX supports EFPs, enabling traders to swap a futures position for the underlying physical asset. This instrument provides strategic alternatives for managing positions.

6. Contracts for Differences (CFDs): CFDs on RI-FX allow traders to speculate on the price movements of various financial instruments without owning the underlying assets. This instrument provides flexibility and leveraged trading opportunities.

7. Indices: Traders can access indices on RI-FX, allowing them to invest in the performance of a group of assets rather than individual securities. Indices provide a diversified approach to market exposure.

Other Foreign Currency-Denominated Financial Instruments: RI-FX accommodates any other foreign currency-denominated financial instruments, expanding the scope of available trading options.

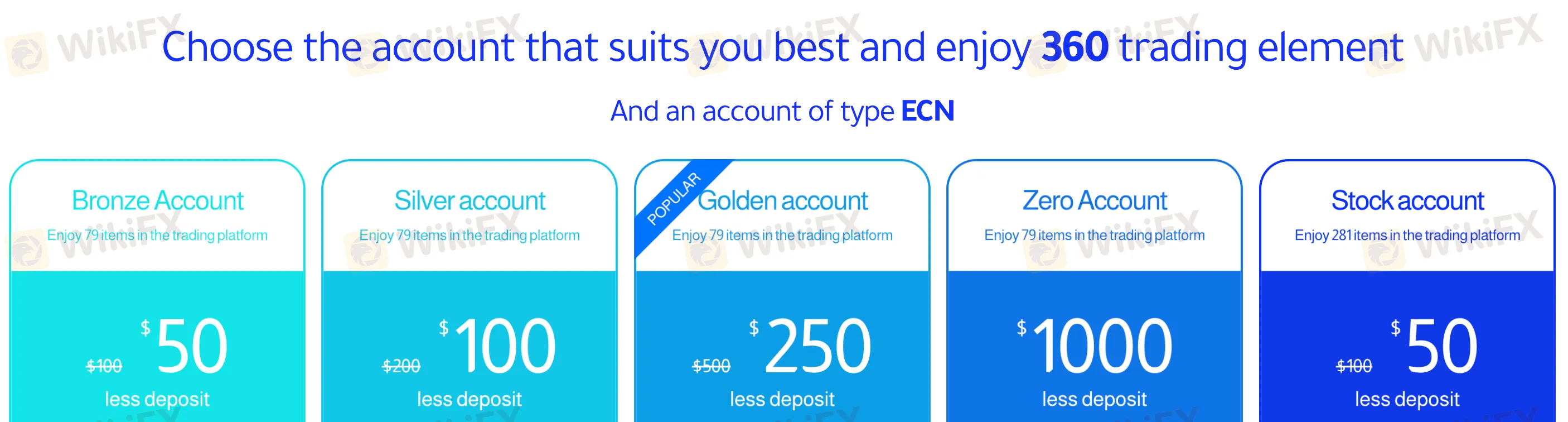

RI-FX caters to a diverse audience of traders by offering a comprehensive range of account types, each crafted to meet specific trading needs and preferences. Let's delve into the details of each account option:

1. Bronze Account:

Designed with novice traders in mind, the Bronze Account requires an initial deposit of $50. As part of a reduced deposit promotion, traders can avail themselves of a $50 discount. With spreads starting from 1.7 pips and leverage up to 1:400, this account provides a balanced introduction to trading. It offers instant execution, an Islamic account that is SWAP-free, and allows hedging and scalping. Additionally, there are no commissions on forex trades.

2. Silver Account:

Tailored for those seeking competitive conditions, the Silver Account necessitates an initial deposit of $100, with a reduced deposit promotion of $100. Featuring spreads starting from 1.6 pips and leverage up to 1:400, this account maintains the advantages of instant execution, a SWAP-free Islamic account, and the freedom for hedging and scalping. Similar to the Bronze Account, there are no commissions on forex trades.

3. Golden Account:

Intermediate-level traders can opt for the Golden Account, requiring an initial deposit of $250, with a reduced deposit promotion of $250. Boasting spreads starting from 1.5 pips and leverage up to 1:400, this account offers a compelling balance of cost and performance. It includes instant execution, a SWAP-free Islamic account, and the flexibility for hedging and scalping. Commissions on forex trades remain absent.

4. Zero Account (Popular):

A preferred choice for experienced traders, the Zero Account comes with a reduced deposit promotion of $1000. Offering competitive spreads starting from 0.8 pips and leverage up to 1:400, this account provides instant execution and a SWAP-free Islamic account. Unlike the previous accounts, there is a commission of $6 per 1 lot for currencies and metals. Hedging and scalping are permitted.

5. Stock Account:

Tailored for those interested in stock trading, the Stock Account requires an initial deposit of $50, with a reduced deposit promotion of $50. Featuring spreads starting from 0.7 pips, this account provides instant execution, a SWAP-free Islamic account, and allows hedging and scalping. Notably, traders gain access to a wide array of tradable items, totaling 281 in the trading platform.

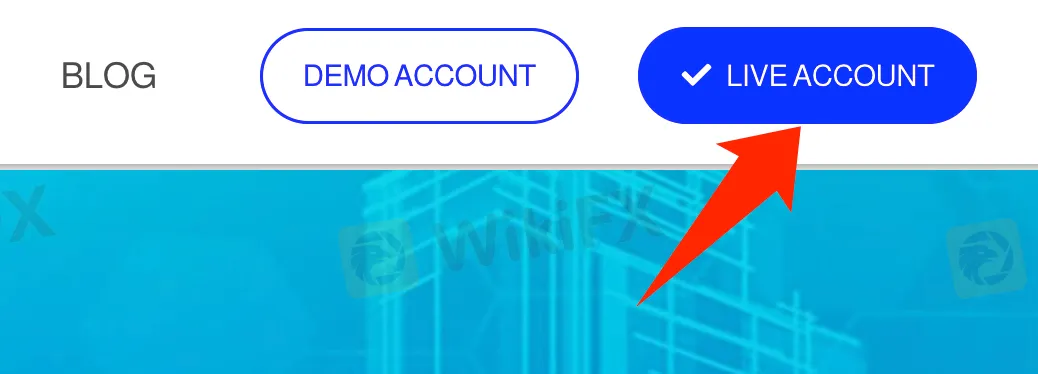

To open an account with RI-FX, follow these steps.

Visit the RI-FX website. Look for the “LIVE ACCOUNT” button on the homepage and click on it.

Sign up on websites registration page.

Receive your personal account login from an automated email

Log in

Proceed to deposit funds to your account

Download the platform and start trading

The leverage offered by RI-FX reaches up to 1:400, allowing traders to control larger positions with a relatively smaller amount of capital. This amplification of trading power can enhance both potential profits and losses, making it crucial for traders to carefully consider and manage their leverage usage.

While higher leverage can magnify profits, it also heightens the risk of significant losses. Traders should exercise caution and employ risk management practices, such as setting stop-loss orders and diversifying their portfolios, to mitigate the potential adverse effects of high leverage.

Here is a comparison table of maximum leverage offered by different brokers:

| Broker | RI-FX | FxPro | VantageFX | RoboForex |

| Maximum Leverage | 1:400 | 1:200 | 1:500 | 1:2000 |

RI-FX offers a competitive pricing structure with varying spreads and commissions depending on the chosen account type. The spreads, which represent the difference between the bid and ask prices, play a significant role in the overall cost of trading.

For the Bronze, Silver, and Golden accounts, traders can benefit from spreads starting from 1.7, 1.6, and 1.5, respectively. These spreads are competitive and can contribute to cost-effective trading, especially for those engaging in regular trading activities.

The Zero Account, a popular choice among traders, offers even tighter spreads, starting from 0.8. While this account type features a commission of $6 per 1 lot, the combination of low spreads and a commission-based model can be advantageous for traders who prioritize reduced trading costs.

RI-FX's Stock account, tailored for those interested in stock trading, provides spreads starting from 0.7. The focus on lower spreads across various account types reflects RI-FX's commitment to offering favorable trading conditions for a diverse range of financial instruments.

Traders should carefully consider their preferred trading style, frequency, and the associated costs when choosing an account type based on spreads and commissions. Additionally, RI-FX's transparent fee structure allows traders to make informed decisions aligned with their individual trading preferences.

RI-FX provides a straightforward and user-friendly process for depositing funds into trading accounts. Traders can transfer funds using various electronic methods suitable for their preferences. The process involves submitting a request from the customer's home page, and once approved, the deposit is made, ensuring a seamless and efficient transaction.

It's important to note that, as of now, RI-FX does not accept deposits via VISA or MasterCard. However, the platform offers alternative electronic methods for depositing funds, providing users with options that align with their needs and preferences.

When it comes to withdrawing profits or funds from the trading account, RI-FX supports several methods to facilitate the process. Traders can choose from options such as Zain Cash, Asia Hawala, cash withdrawals, and transfers at exchange offices, along with Shopini Express. This variety of withdrawal methods aims to provide flexibility and convenience for users to access their profits.

The minimum deposit amount required for the initial deposit is $50, and for subsequent deposits, the minimum is $30. This structure allows users to start trading with a reasonable initial investment and provides flexibility for additional deposits.

One notable advantage for traders using RI-FX is the absence of commissions on both withdrawals and deposits. This fee-free approach enhances the transparency of transactions and ensures that users can manage their funds without incurring additional costs.

Here is a comparison table of minimum deposit required by different brokers:

| Broker | RI-FX | Exnova | Tickmill | GO Markets |

| Minimum Deposit | $50 | $10 | $100 | $200 USD |

RI-FX offers a choice of two prominent trading platforms, catering to the diverse preferences and needs of its users. The MetaTrader 4 platform, a widely recognized and popular choice among traders, provides a powerful and convenient trading experience. Traders can seamlessly execute trades from their desktop or on the go, utilizing the platform's robust features. MetaTrader 4 is available for Windows, offering a downloadable version, and also accessible through web browsers on various devices, including Android and iOS.

For those seeking an alternative trading platform, RI-FX provides access to cTrader, known for its integrated trading environment with numerous features and advantages. Traders can download the cTrader platform on Windows or access it through web browsers on various devices, including Android and iOS. This platform aims to offer a comprehensive and user-friendly interface for traders to execute trades and manage their portfolios efficiently.

RI-FX provides customer support through various channels, aiming to assist users in navigating the platform and addressing their inquiries effectively. Traders can reach out to the company headquarters using the phone number +971585948158. The headquarters is located in Iraq, specifically in Basra, Al Jonainah. This contact option allows users to connect with the support team for direct assistance and prompt responses to their queries.

For written communication, users can utilize the email address Support@ri-fx.com to send detailed messages or inquiries. Email communication provides a more formal and documented way for users to convey their questions, concerns, or requests to the customer support team.

RI-FX also offers a live chat feature on its platform, allowing users to engage in real-time conversations with support representatives. Live chat is a convenient option for users who prefer immediate responses and quick solutions to their concerns. This interactive channel enhances the overall customer support experience by providing direct and instant communication.

Additionally, users can leave a message on the RI-FX website by filling out the provided form. This allows users to submit their full name, email address, the subject of their inquiry, and a detailed message. The “Send Message” option provides an alternative means for users to communicate with the customer support team and receive assistance.

The availability of multiple contact options, including phone, email, live chat, and a message form, reflects RI-FX's commitment to offering accessible and diverse customer support channels, catering to the preferences and needs of its users.

RI-FX provides educational resources to support traders' ongoing learning and development. One of the key educational features is the blog, which contains the latest posts covering a range of topics relevant to trading and the financial markets. Users can access articles on various subjects, staying informed about market trends, strategies, and updates. Recent posts include information about the weekly competition for Ramadan 2021, the addition of PAMM services, and the opening of a new branch in Baghdad governorate.

The RIFX Academy is highlighted as a valuable educational resource, offering insights into how users can register and obtain certification. The academy likely provides structured courses or materials aimed at enhancing traders' knowledge and skills. Certification may be offered upon completion of specific courses, indicating a commitment to supporting traders at different skill levels.

While the provided information is brief, the blog and RIFX Academy appear to contribute to a learning environment for traders. The inclusion of diverse topics in the blog suggests a broad coverage of subjects relevant to the financial markets, catering to the educational needs of traders on the RI-FX platform.

In conclusion, RI-FX presents a trading platform with a range of instruments and account types, attempting to accommodate various trader preferences. However, substantial disadvantages cast shadows over potential advantages. The broker lacks regulatory oversight, raising concerns about the safety of funds and overall transparency. While the promotion of no commissions on certain accounts may be enticing, traders must carefully weigh the associated risks of dealing with an unregulated broker. The availability of MetaTrader 4 and cTrader platforms offers some flexibility, but the absence of regulatory backing remains a critical drawback, urging traders to exercise caution.

Q: Is RI-FX a regulated broker?

A: No, RI-FX operates without regulation, posing potential risks to traders due to the lack of oversight from financial regulatory authorities.

Q: What trading instruments are available on RI-FX?

A: RI-FX provides various trading instruments, including futures contracts, options on futures contracts, commodities, forward contracts, foreign exchange transactions, contracts for differences (CFDs), indices, and other foreign currency-denominated financial instruments.

Q: What is the minimum deposit required to open an account with RI-FX?

A: The minimum deposit for a live account with RI-FX is $50, allowing traders to start with a relatively small initial investment.

Q: How can I contact RI-FX customer support?

A: RI-FX offers customer support through various channels, including phone (contact number: +971585948158), email (Support@ri-fx.com), live chat on the platform, and a message form on the website.

Q: What trading platforms are available on RI-FX?

A: RI-FX provides access to MetaTrader 4 and cTrader platforms, giving traders options for their preferred trading interface.

More

User comment

3

CommentsWrite a review

2024-01-09 18:10

2024-01-09 18:10 2023-03-13 14:50

2023-03-13 14:50