User Reviews

More

User comment

17

CommentsWrite a review

2025-04-05 23:38

2025-04-05 23:38

2024-08-26 15:42

2024-08-26 15:42

Score

5-10 years

5-10 yearsRegulated in Mauritius

Securities Trading License (EP)

MT5 Full License

Regional Brokers

High potential risk

Offshore Regulated

Influence

Add brokers

Comparison

Quantity 5

Exposure

Score

Regulatory Index4.62

Business Index7.02

Risk Management Index0.00

Software Index7.73

License Index0.00

Single Core

1G

40G

More

Company Name

Zarvista Capital Markets Ltd

Company Abbreviation

ZarVista

Platform registered country and region

Comoros

Company website

Company summary

Pyramid scheme complaint

Expose

| Aspect | Information |

| Company Name | ZarVista |

| Founded year | 2019 |

| Regulation | MISA |

| Market Instruments | CurrenciesMetalsIndiciesCommoditiesCryptocurrency |

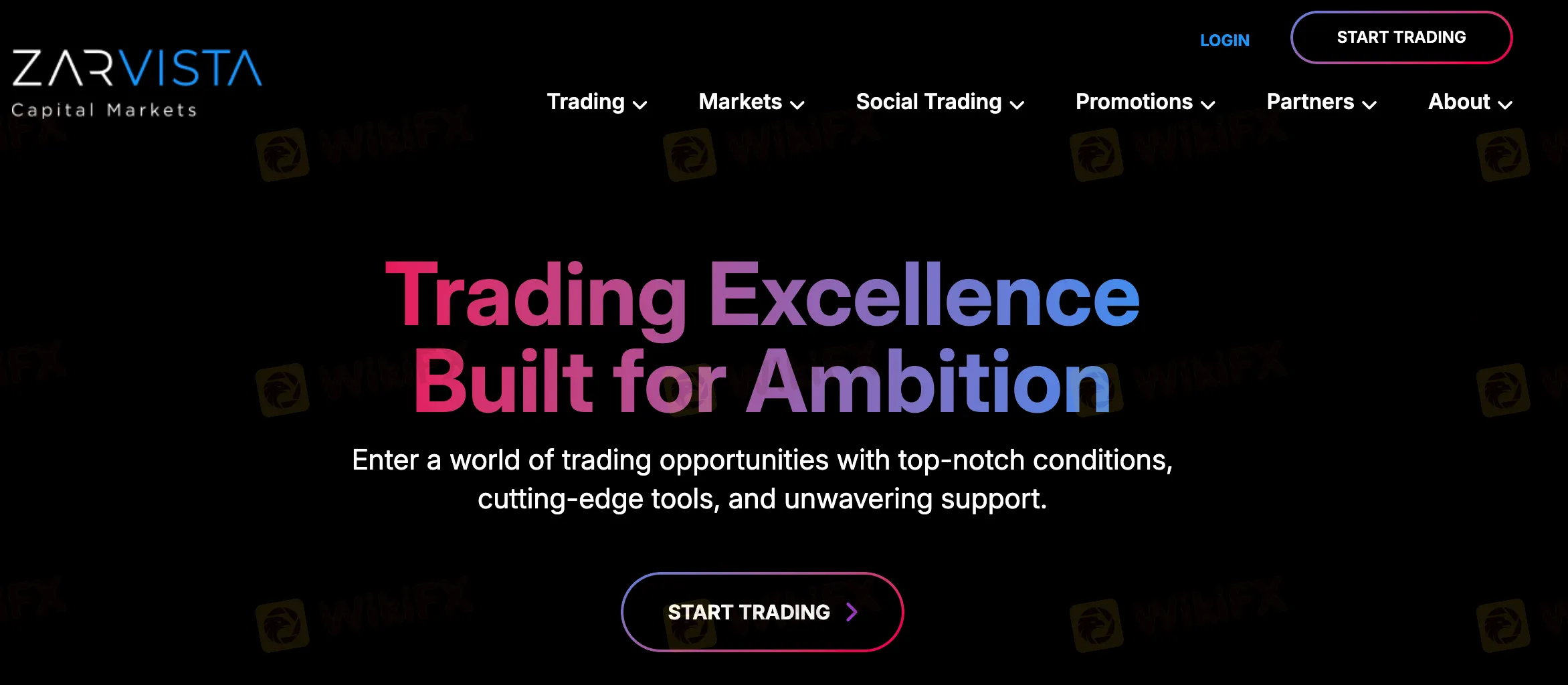

| Account Types | STARTERBUSINESSPROFESSIONALVIP |

| Minimum Deposit | $50 |

| Maximum Leverage | Up to 1:500 |

| Spreads | From 0 pips |

| Trading Platforms | MetaTrader 5 |

| Customer Support | Live chat, email |

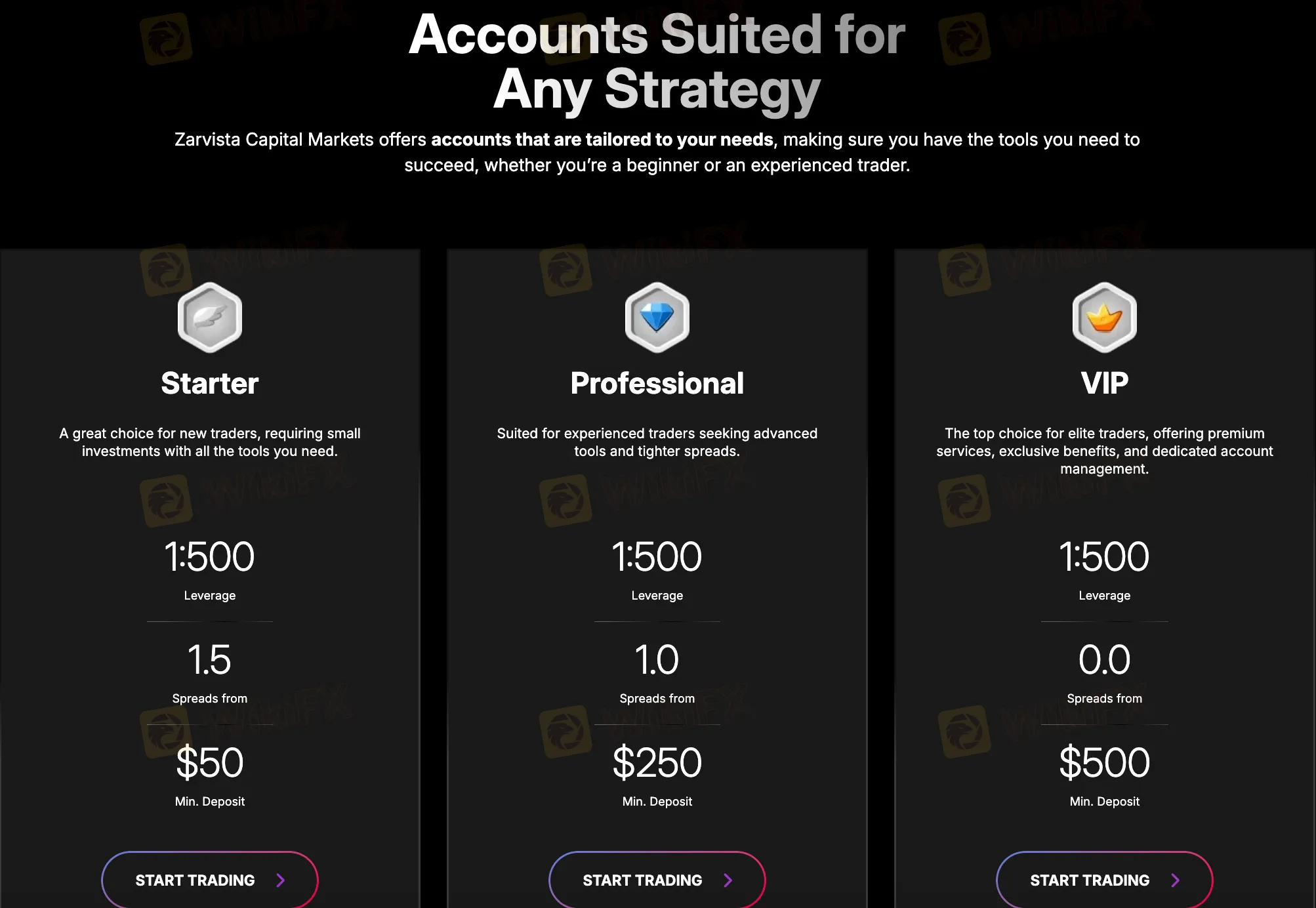

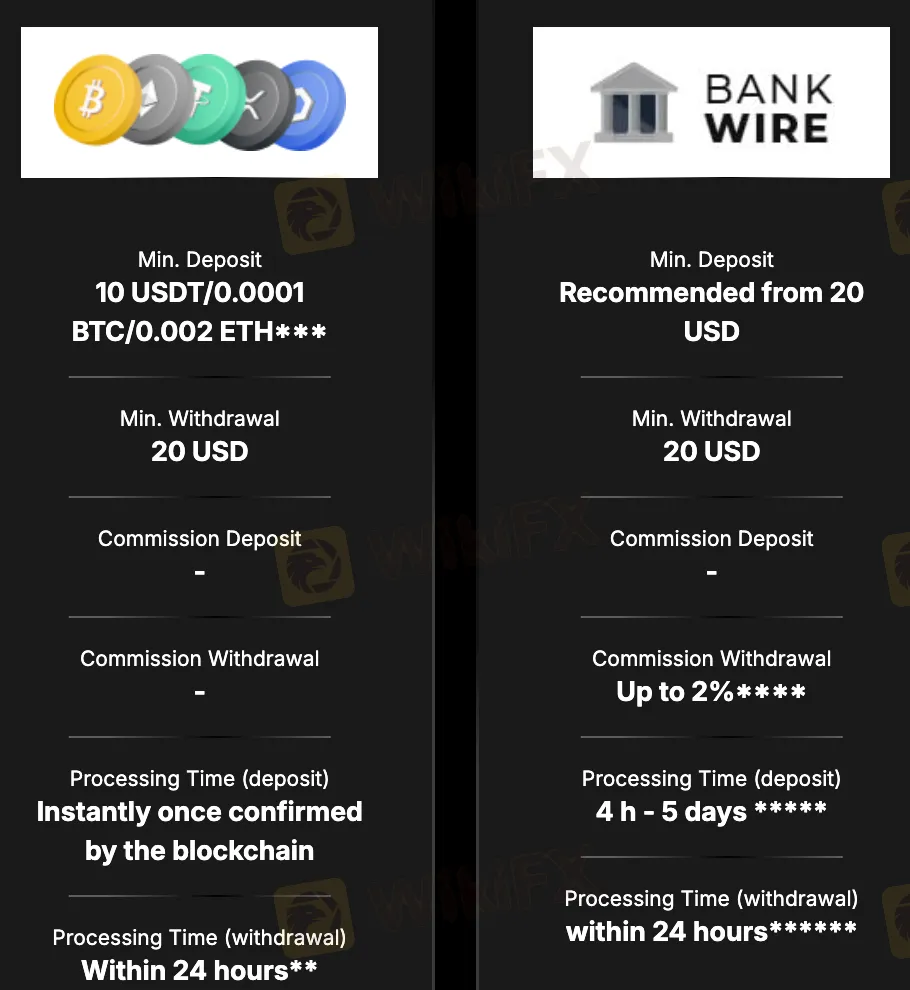

| Deposit & Withdrawal | BANK WIRE, bitcoin, ethereum, Skrill, NETELLER, ERC-20, USDT |

| Educational Resources | Glossary |

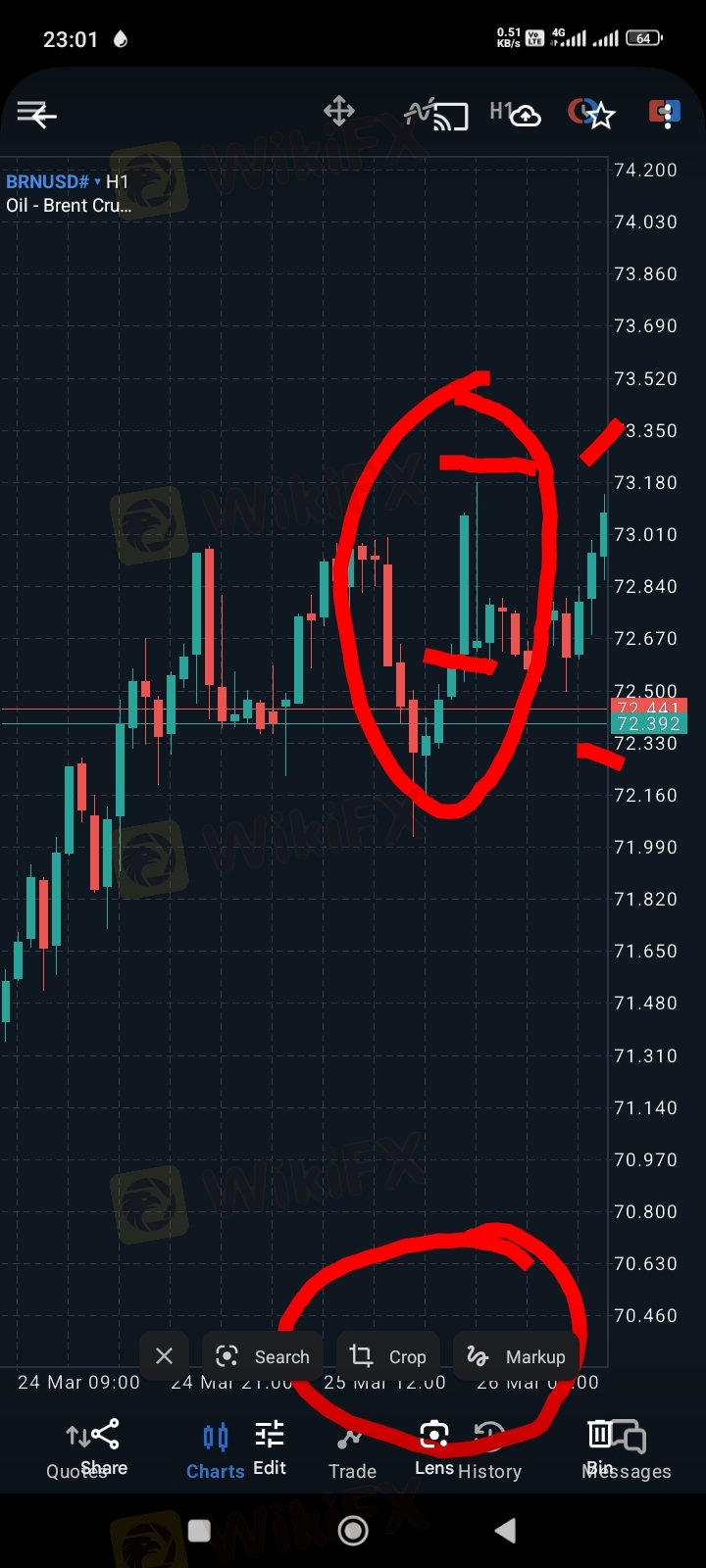

ZarVista, established in 2019, a Comoros-based forex broker, offers four account types with varying spreads and commissions, starting from 1.7 pips and no commissions for the Starter account to 0 pips and $5 per lot commission for the VIP account.

ZarVista is regulated in Comoros by the Mwali International Services Authority (MISA) under license no. T2023293.

ZarVista offers a wide range of trading products to suit the needs of all traders, including:

ZarVista offers four main account types to suit traders of different experience levels and risk appetites:

Starter Account: Designed for beginners, the Starter Account offers zero-commission trading, leverage up to 1:500, starting spreads as low as 1.7 pips, and no overnight swap fees.

VIP Account: An ideal choice for traders seeking a balance of value and performance, the VIP Account offers zero-commission trading, leverage up to 1:500, tighter spreads (from 1.2 pips), and no overnight swap fees.

Business Account: The best choice for experienced traders, the Business Account offers the tightest spreads (from 0.7 pips) but charges a $6 commission per trade, leverage up to 1:500, and no overnight swap fees.

Professional Account: A premium choice for high-volume traders, the Professional Account offers raw spreads (from 0 pips) but charges a $5 commission per trade, leverage up to 1:500, and no overnight swap fees.

In addition to the account types listed above, ZaraFX also offers a number of other features, including:

ZarVista offers four account types with varying spreads and commissions:

ZarVista offers MetaTrader 5 (MT5), a powerful and highly respected trading platform that is favored by successful traders worldwide. With its comprehensive suite of features and advanced tools, MT5 can help you elevate your trading skills and achieve success in the financial markets.

Key Advantages of MT5 on ZarVista:

How MT5 Can Help You Succeed in Trading:

ZarVista puts you in control of your funds with their revolutionary payment system. Experience instant deposits and lightning-fast withdrawals 24/7, giving you more time to trade and less time waiting. They offer a wide range of secure and transparent payment options, including electronic methods, bank cards, bank transfers, and even Bitcoin, all with real-time tracking within your account.

ZarVista offers social trading, a unique feature that allows you to leverage the expertise of successful traders and potentially replicate their strategies in your own account.

Here's how it works:

Account Options:

Additional Benefits of ZarVista:

ZarVista is currently offering a 30% bonus on all new deposits. This means that if you deposit $100, you will receive an additional $30 in bonus funds. The bonus is withdrawable, but there are some terms and conditions that you will need to meet.

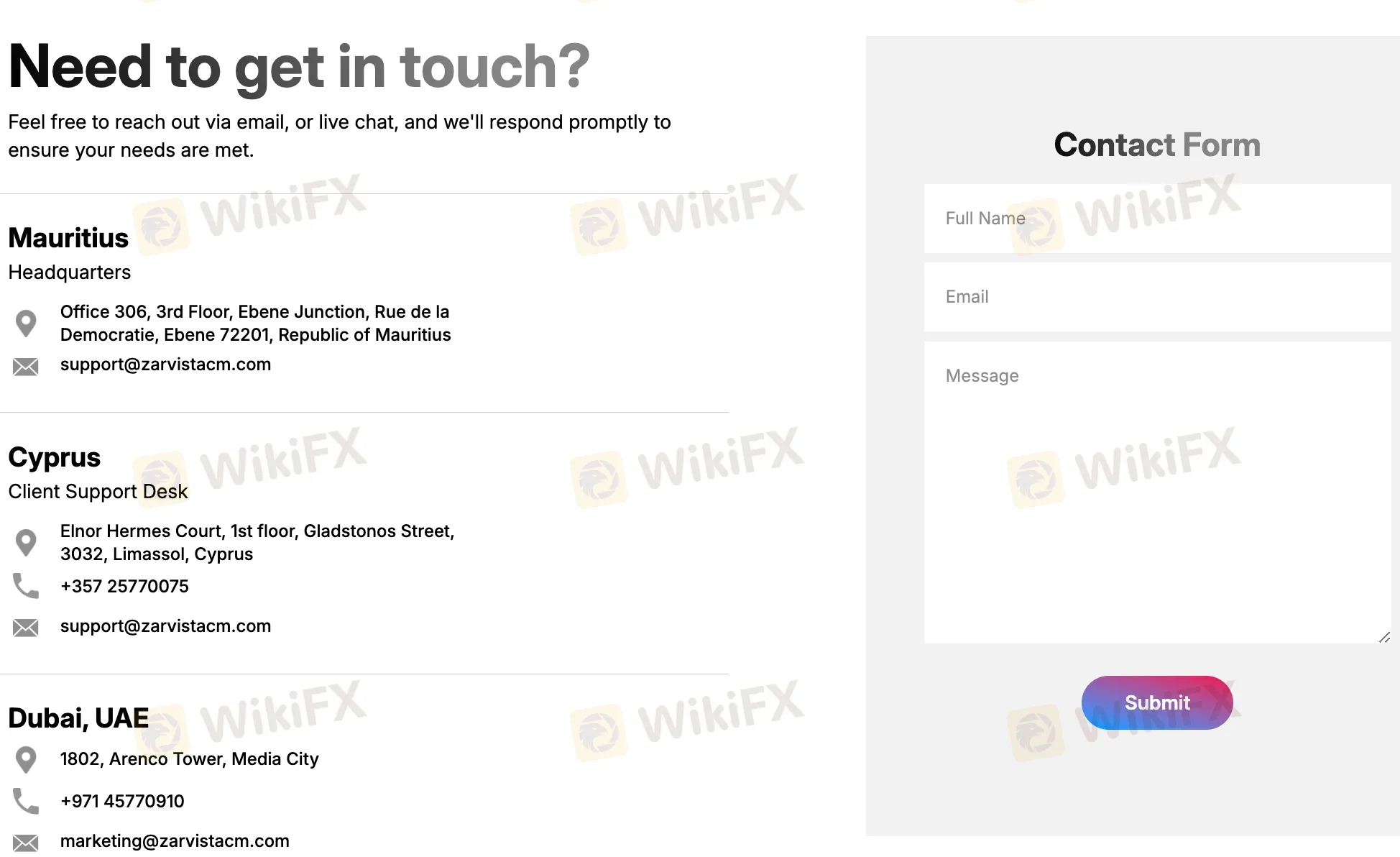

ZarVista offers two main methods for contacting them:

Email: Their primary method of contact seems to be via email at support@zarvistacm.com

For traders asking, "Is ZarVista legit?", the evidence points to a clear and strong conclusion: ZarVista operates as a high-risk broker. While it shows a modern interface and different account types, these features are overshadowed by major weaknesses in how it is regulated, a history of legal problems, and many user complaints. This article will break down these issues to give you a complete view of the risks involved. Our analysis shows that the chance of losing capital when dealing with ZarVista is very high. The combination of weak overseas licensing and documented problems creates a situation where trader funds are not properly protected.

WikiFX

WikiFX

This article gives you a complete, fair look at ZarVista (now called Zarvista Capital Markets as of September 2024). We'll examine what users say, check the company's legal status, and investigate the biggest problems users report. Our goal is to give you clear, factual information so you can make a smart decision based on evidence, not just marketing promises. We'll look at both the good services they offer and the serious issues you need to think about carefully.

WikiFX

WikiFX

For traders asking, "Is ZarVista legit?", the evidence points to a clear and strong conclusion: ZarVista operates as a high-risk broker. While it shows a modern interface and different account types, these features are overshadowed by major weaknesses in how it is regulated, a history of legal problems, and many user complaints. This article will break down these issues to give you a complete view of the risks involved. Our analysis shows that the chance of losing capital when dealing with ZarVista is very high. The combination of weak overseas licensing and documented problems creates a situation where trader funds are not properly protected.

WikiFX

WikiFX

ZarVista changed its name from ZaraFX in September 2024. It claims to be a worldwide broker offering various services. It offers the popular MetaTrader 5 (MT5) platform, high leverage of up to 1:500, and various account types tailored to different traders. However, when we look closer, we find many serious risks that anyone thinking about using it should know about. The main problem is how it's regulated - it operates in offshore locations that don't watch financial companies very closely. This gets worse when you add the many user complaints about problems getting their money out, plus a serious legal investigation by Indian authorities in 2025. This review will break down these problems and give you a clear picture of this broker. You need to do careful research, and we suggest you check any broker's current regulatory status and user reviews yourself. A tool like WikiFX can give you current information and important risk warnings.

WikiFX

WikiFX

More

User comment

17

CommentsWrite a review

2025-04-05 23:38

2025-04-05 23:38

2024-08-26 15:42

2024-08-26 15:42