User Reviews

More

User comment

0

CommentsWrite a review

No comment yet

Score

5-10 years

5-10 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Influence

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index7.35

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

Danger

| Aspect | Information |

| Registered Country | United Kingdom |

| Company Name | Investments |

| Regulation | Conducted without regulation |

| Minimum Deposit | $250 - $5,000 |

| Maximum Leverage | Up to 1:1000 |

| Tradable Assets | Forex, CFDs, Stocks, Commodities |

| Account Types | Mini, Standard, Bronze, Silver, Gold, Platinum, Black, VIP |

| Customer Support | Phone, Email |

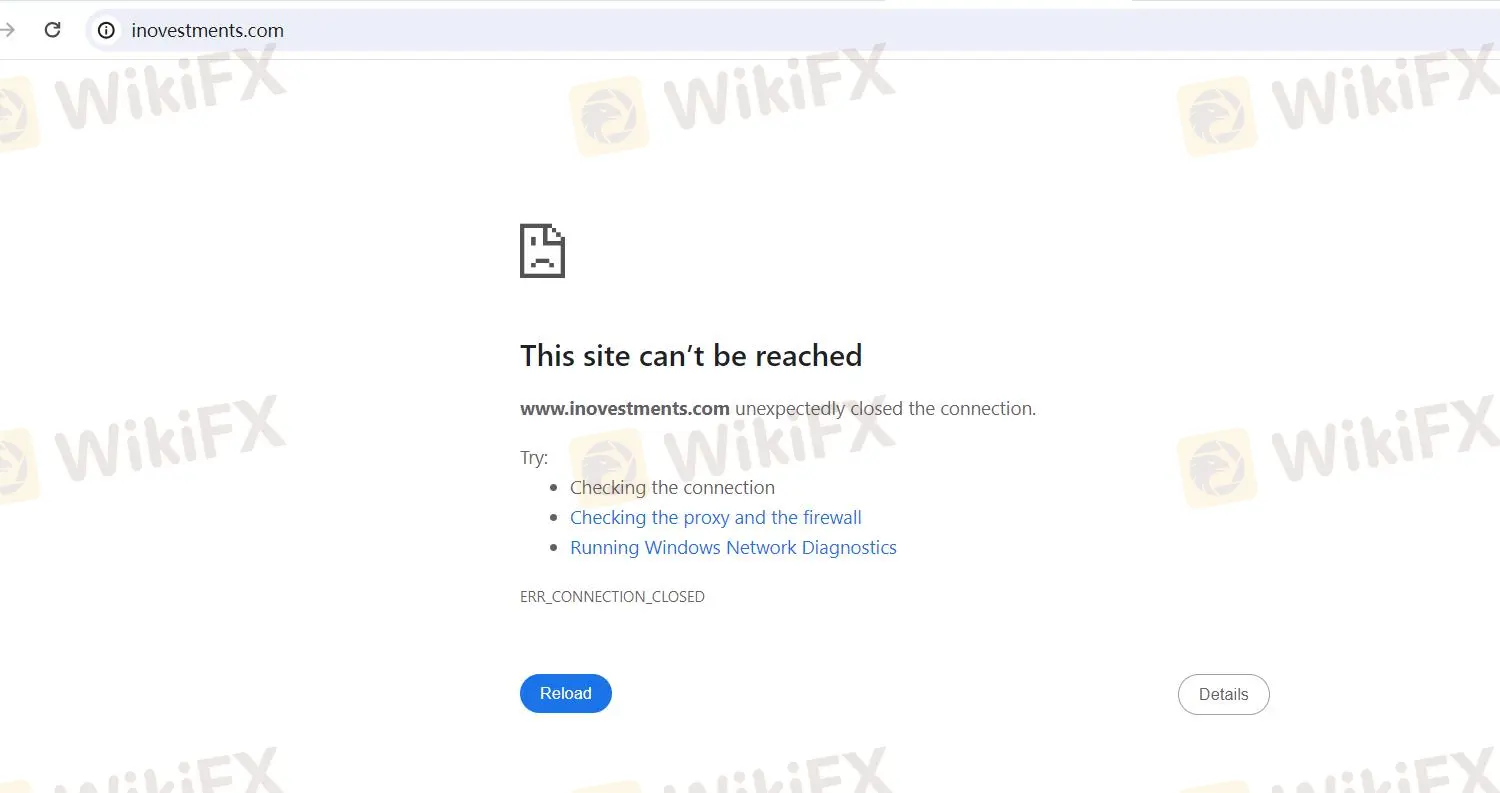

| Website Status | Down |

Investments, based in the United Kingdom, offers a range of account types catering to various investor levels, from entry-level Mini Accounts to exclusive VIP Accounts. While the company provides access to a diverse array of tradable assets, including Forex, CFDs, stocks, and commodities, it operates without regulatory oversight, which may raise concerns for some investors. With a minimum deposit requirement ranging from $250 to $5,000 and maximum leverage of up to 1:1000, Investments aims to accommodate a wide range of traders. However, it's important to note that the website is currently down, which could impact accessibility and raise questions about reliability. Investors can reach out to Investments for support via phone or email.

Investments conducted without regulation as a broker can expose investors to significant risks, including potential fraud and lack of investor protection. Regulatory oversight is crucial in ensuring fair and transparent practices within the investment industry, safeguarding the interests of investors and maintaining market integrity. Therefore, engaging with regulated brokers provides investors with a layer of security and confidence in their investment activities.

Investments offers a comprehensive range of trading products and account types, providing investors with diverse opportunities to participate in the financial markets. However, the absence of specific pros and cons listed suggests that while Investment may offer attractive features, it's essential for investors to conduct thorough research and due diligence to evaluate its suitability for their investment goals and risk tolerance.

| Pros | Cons |

|

|

|

|

|

|

|

Investments offers the following trading products:

Forex (Foreign Exchange):

Provides opportunities to profit from fluctuations in exchange rates.

Investors speculate on the relative strength or weakness of one currency against another.

Involves trading currency pairs such as EUR/USD, GBP/USD, etc.

CFDs (Contracts for Difference):

Provides flexibility, leverage, and the ability to profit from both rising and falling markets.

Includes indices, commodities, and individual stocks.

Allow investors to speculate on price movements of various financial instruments without owning the underlying asset.

Stocks:

Offers exposure to individual companies across various sectors for portfolio diversification.

Investors can profit from stock price movements, dividends, and capital appreciation.

Involves buying and selling shares of publicly traded companies.

Commodities:

Investors can speculate on price movements driven by factors like supply and demand dynamics, geopolitical events, and economic indicators.

Encompasses raw materials and resources such as precious metals (gold, silver), energy products (crude oil, natural gas), and agricultural products (wheat, corn).

Investment provides a comprehensive suite of trading products, allowing investors to diversify their portfolios and pursue various trading strategies across different financial markets.

Investments offers a range of account types tailored to meet the diverse needs and preferences of investors at different levels, from entry-level Mini Accounts to exclusive VIP Accounts reserved for elite investors.

MINI ACCOUNT

The Mini Account is tailored for those starting their investment journey with modest capital. With leverage up to 1:100, it provides the opportunity to amplify trading potential while managing risk. With a minimum deposit ranging from $250 to $5,000, it accommodates various budget sizes, making it accessible to a wide range of investors. This account specializes in Forex trading, offering a focused approach to currency markets. While specific details on spreads, positions, supported EAs, and deposit/withdrawal methods are not provided, the Mini Account serves as an entry point for individuals seeking exposure to the dynamic world of currency trading.

STANDARD ACCOUNT

The Standard Account caters to investors ready to take their trading to the next level. Offering leverage up to 1:200, it allows for greater flexibility in trading strategies while maintaining risk management. With a minimum deposit ranging from $5,000 to $25,000, this account targets investors with a more substantial capital base. It expands beyond Forex into CFDs and stocks, broadening the range of investment opportunities. While specifics on spreads, positions, supported EAs, and deposit/withdrawal methods are not provided, the Standard Account is designed for investors seeking diversification and increased market exposure.

BRONZE ACCOUNT

The Bronze Account is designed for investors with a higher risk appetite and a desire for expanded market access. With leverage up to 1:350, it offers enhanced trading power to capitalize on market opportunities. Requiring a minimum deposit between $25,000 to $50,000, this account is tailored for more experienced traders with a sizable capital base. It encompasses Forex, CFDs, stocks, and commodities, providing a comprehensive investment portfolio.

SILVER ACCOUNT

The Silver Account caters to seasoned investors looking for increased leverage and advanced trading capabilities. With leverage up to 1:500, it offers substantial trading power to capitalize on market movements. Requiring a minimum deposit ranging from $50,000 to $100,000, this account targets investors with significant capital resources.

GOLD ACCOUNT

The Gold Account is tailored for sophisticated investors seeking maximum leverage and unparalleled market access. With leverage up to 1:750, it provides exceptional trading power to execute advanced strategies. Requiring a minimum deposit ranging from $100,000 to $250,000, this account is designed for high-net-worth individuals and institutional investors. It offers access to all available instruments, enabling extensive diversification and strategic positioning.

PLATINUM ACCOUNT

The Platinum Account represents the pinnacle of trading excellence, tailored for elite investors with substantial capital resources. With leverage up to 1:1000, it offers unparalleled trading power and flexibility to execute complex strategies. Requiring a minimum deposit ranging from $250,000 to $500,000, this account is exclusively designed for high-net-worth individuals and institutional investors. It provides access to all available instruments, offering extensive diversification and strategic positioning across global markets.

BLACK ACCOUNT

The Black Account is the epitome of elite trading, tailored for ultra-high-net-worth individuals and institutional investors. With leverage up to 1:1000, it offers unparalleled trading power and flexibility to execute sophisticated strategies. Requiring a minimum deposit starting from $500,000 and beyond, this account is reserved for the most discerning investors seeking exclusive access to global markets. It provides access to all available instruments, enabling extensive diversification and strategic positioning at the highest level.

VIP ACCOUNT

The VIP Account represents the pinnacle of prestige and exclusivity, reserved for a select group of elite investors by invitation only. With leverage up to 1:1000, it offers unparalleled trading power and flexibility to execute complex strategies. The minimum deposit requirement is by invitation only, ensuring that only the most discerning investors gain access to this exclusive account.

Investment offers a maximum trading leverage of up to 1:1000, allowing investors to amplify their trading positions significantly compared to their initial investment. Leverage enables traders to control a larger position in the market with a relatively small amount of capital. With a leverage ratio of 1:1000, for example, traders can control $1000 in the market with only $1 of their own capital. While leverage magnifies potential profits, it also increases the potential risk, as losses are also amplified. Therefore, traders should exercise caution and employ risk management strategies when trading with high leverage to mitigate potential losses.

Investments' customer support is accessible through multiple channels, demonstrating a commitment to assisting clients promptly and effectively. With a phone line available at +442038077885, investors can directly communicate with support representatives for immediate assistance. Additionally, the company maintains an active presence on social media platforms like Twitter and Facebook, where clients can reach out for support or stay updated on company news and announcements. The availability of a dedicated customer service email address, support@inovestments.com, further facilitates communication for clients seeking assistance or clarification on various matters. Overall, Investment's customer support infrastructure aims to provide comprehensive assistance and guidance to clients, enhancing their trading experience and fostering trust and satisfaction within the client base.

Investments offers a wide range of account types catering to investors at various levels, from beginners to seasoned professionals, along with a diverse selection of trading products and high leverage options. While their customer support infrastructure seems robust, it's concerning that their website is currently down, raising questions about reliability. Therefore, potential investors should proceed with caution and conduct thorough due diligence before engaging with the platform.

Q1: What types of trading products does Investments offer?

A1: Investments offers Forex, CFDs, stocks, and commodities for trading.

Q2: What is the maximum leverage available with Investments?

A2: Investments offers a maximum trading leverage of up to 1:1000.

Q3: What is the minimum deposit required for a Mini Account with Investments?

A3: The minimum deposit for a Mini Account ranges from $250 to $5,000.

Q4: Who is the Black Account tailored for?

A4: The Black Account is tailored for ultra-high-net-worth individuals and institutional investors.

Q5: How can investors contact Investment's customer support?

A5: Investors can contact Investment's customer support via phone at +442038077885 or email at support@inovestments.com.

Online trading carries substantial risk, potentially leading to the total loss of invested funds. It may not be appropriate for all traders or investors. It's crucial to fully comprehend the associated risks before engaging in trading activities. Additionally, the content of this review is subject to change, reflecting updates in the company's services and policies. The review's creation date is also relevant, as information could have become outdated. Readers should confirm the latest information with the company prior to making any investment decisions. The responsibility for utilizing the information provided herein lies exclusively with the reader.

More

User comment

0

CommentsWrite a review

No comment yet

start to write first comment