User Reviews

More

User comment

0

CommentsWrite a review

No comment yet

Score

2-5 years

2-5 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index6.08

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

| Key Information | Details |

| Company Name | Huixin Global Markets |

| Years of Establishment | Within 1 year |

| Headquarters | United Kingdom |

| Office Locations | N/A |

| Regulation | Unregulated |

| Tradable Assets | Foreign exchange, precious metals (gold, silver), oil, and stock index |

| Minimum Deposit | $100 USD |

| Leverage | Up to 1:400 |

| Deposit/Withdrawal Methods | Bank Transfer |

| Trading Platforms | MT4 |

| Customer Support Options |

HX is an unregulated financial brokerage based in the United Kingdom that has operated for less than 1 year. The company deals with foreign exchange, precious metals (gold, silver), oil, and stock index trading, utilizing the MT4 platform. While being unregulated, it facilitates trading with a minimum deposit requirement of US$100 and offers leverage of up to 1:400. Deposit and withdrawal methods are conducted primarily through bank transfers. The company's customer support is accessible via email.

HX operates without the oversight of any regulatory authority, positioning itself as an unregulated entity. This choice to function without regulatory involvement results in a situation where HX's activities are not subject to the customary oversight, standards, and mandates that regulated counterparts adhere to. This lack of regulatory involvement extends to industry-specific guidelines, mandated financial reporting, and the enforcement of consumer safeguards, aspects that are typically found in the realm of regulated brokerage firms.

HX presents traders with the opportunity to engage in trading across multiple markets, including foreign exchange, precious metals, oil, and stock indices, while also providing access to the MT4 trading platform. The broker offers leverage up to 1:400, potentially amplifying trading positions. With a relatively low minimum deposit requirement of US$1,000, the barrier to entry for traders is accessible. HX supports deposit and withdrawal transactions through bank transfers, allowing for straightforward financial interactions. Additionally, the customer support channel via email provides a direct means of communication for inquiries.

HX's unregulated status raises concerns about the lack of oversight and adherence to industry standards. The absence of detailed information regarding educational content and bonus offerings limits transparency and potential value for traders seeking additional resources. Furthermore, the lack of account types means that there is not a variety of account setting preferences for traders with differing financial backgrounds and risk tolerances. Lastly, HX only offered customer support through email, which may lead to slower response times and limited real-time assistance for users in need of immediate help or inquiries.

| Pros | Cons |

| Various assets | Unregulated |

| Low deposit | Lack of account types |

| MT4 platform | Singular Customer Support Option |

HX provides a range of market instruments, encompassing forex trading, commodities trading, and indices trading. However, it's important to note that the company's website does not provide specific examples or detailed information regarding these offered market instruments. This lack of specific examples on the company website might negatively impact the credibility of the broker, as potential traders could find it challenging to assess the depth and scope of these offerings.

Forex: HX provides access to the forex trading market, enabling traders to engage in currency trading. This market instrument involves the exchange of one currency for another based on prevailing exchange rates.

Commodities: Traders using HX have the opportunity to trade commodities, including tangible assets like gold and silver. Commodities trading can be influenced by factors such as supply, demand, and geopolitical events.

Indices: HX offers trading in stock indices, allowing traders to speculate on the performance of a group of stocks representing a specific market or sector.

The following is a table that compares HX to competing brokerages:

| Broker | Market Instruments |

| HX | Forex, Commodities, Indices |

| FXPro | Forex, Commodities, Indices, Cryptocurrencies |

| IC Markets | Forex, Commodities, Indices, Cryptocurrencies |

| FBS | Forex, Indices, Cryptocurrencies |

| Exness | Forex, Commodities, Indices, Cryptocurrencies, Options |

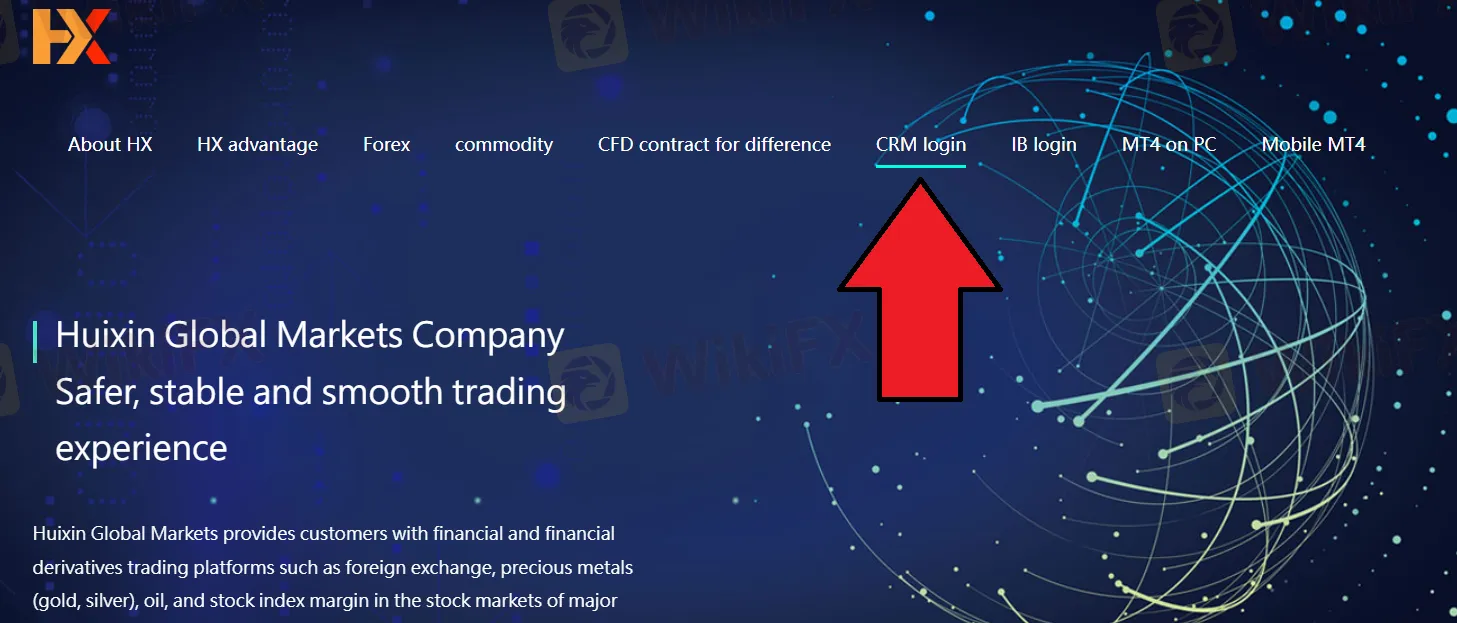

To open an account, the user needs to first navigate to HX's official website and find the “CRM login” button located at the top navigation bar.

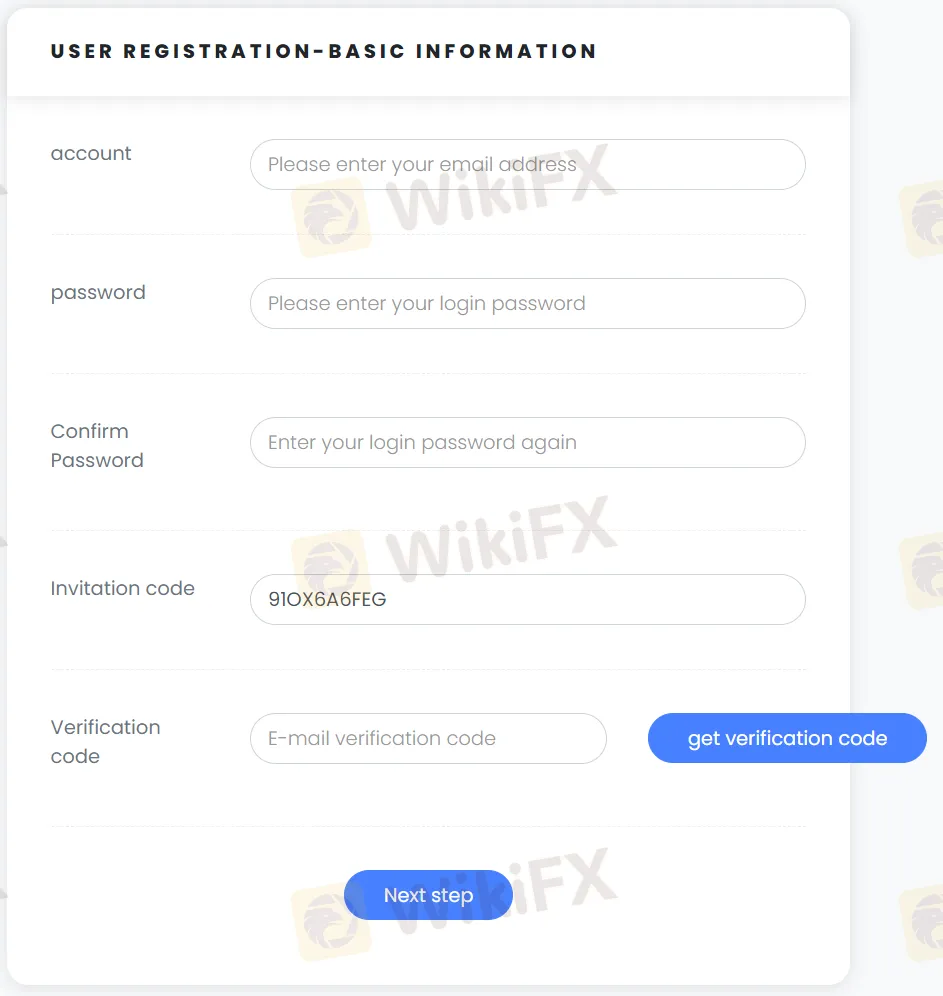

From this button, the user will be forward to the user registration-basic information page, where the user will be prompted to fill-in basic account information like the account's email address and password.

Once this is completed, the email used will recieve a verification code that will need to be used on the same page in order to continue to the next step.

After pressing the “Next Step” button, the user will be forwarded to the personal information page, where the user will fill out information like name, address, and date of birth.

Finally, once this information is submitted the account creation process will be completed and the user can begin configuring financial settings.

The minimum deposit requirement for HX stands at US$100 for Indicies trading and US$1,000 for forex, which positions it as a broker with a relatively higher entry barrier compared to some other brokers in the industry. This minimum deposit amount is a crucial consideration for potential traders, as it reflects the initial investment needed to open an account with the company. It's important to take into account that both US$100 and US$1,000 minimum deposit may influence the accessibility of the broker's services for traders with varying budget sizes, potentially limiting the appeal to those seeking lower initial investment options.

HX offers a maximum leverage ratio of up to 1:400. Leverage in trading allows traders to control larger positions with a relatively smaller amount of capital. It's important to note that while higher leverage can amplify potential profits, it also increases the risk of significant losses.

The limited information on leverages provided by HX, without specifying leverage ratios for different asset classes, may raise concerns about transparency and clarity for potential traders. Competing brokers often offer detailed leverage information, allowing traders to make more informed decisions based on their risk appetite. The absence of such detailed leverage data on HX's website could potentially impact the company's credibility, as traders may seek comprehensive and transparent information to evaluate the risk associated with their trades.

For a comparative overview, the following table shows the maximum leverage ratios for the mentioned market instruments of HX in comparison to other brokerages:

| Broker | Forex | Commodities | Indices |

| HX | 1:400 | 1:400 | 1:400 |

| IC Markets | 1:500 | 1:500 | 1:200 |

| FBS | 1:3000 | 1:1000 | 1:1000 |

| Exness | 1:2000 | 1:200 | 1:2000 |

While the official website does not mention extensive information lot sizes, it does mention that HX allows a minimum transaction quantity of 0.01 lots, which implies that users have the flexibility to engage in relatively smaller trades. This feature can be advantageous for traders who prefer to manage their risk by executing smaller positions, especially when dealing with volatile markets. It provides accessibility to traders with limited capital, allowing them to participate in the markets without committing to larger trade sizes.

HX offers bank transfer as a deposit and withdrawal method, with specific institutions including Citibank, UBS, JPMorgan Chase, Lmax, and CFH. This method provides traders with a direct and traditional way to fund their accounts or withdraw funds. It's essential to consider that the availability of these specific banking institutions can vary in terms of accessibility for users in different regions. Bank transfers are generally known for their reliability but may involve longer processing times compared to other deposit/withdrawal methods.

HX also employs OneZero as part of its deposit and withdrawal infrastructure, which comes with several benefits. OneZero is known for its efficient and reliable connectivity solutions in the financial industry. By leveraging OneZero's technology, HX can enhance transaction processing, ensuring that deposits and withdrawals are executed smoothly. The use of OneZero's platform may reduce latency and provide a more stable trading environment, contributing to a smoother experience for users when managing their funds. Additionally, it can enable HX to offer a higher level of transparency in financial transactions, fostering trust and confidence among its clientele.

Limiting deposit and withdrawal options to only bank transfers can be a disadvantage for traders seeking faster and more convenient transaction methods. Bank transfers typically involve longer processing times compared to electronic payment methods, potentially causing delays in accessing funds. Additionally, international bank transfers may incur higher fees, impacting the cost-effectiveness of transactions for users, particularly those in regions with limited access to the specified banking institutions.

HX exclusively utilizes the MT4 trading platform, providing traders with a widely recognized and established interface for executing their trades. This platform offers various tools and features for technical analysis and automated trading strategies.

Relying solely on the MT4 trading platform can be a disadvantage as it limits choice and flexibility for traders who may prefer alternative platforms. Some traders may find MT4's capabilities lacking in comparison to newer trading platforms, potentially missing out on advanced features. Additionally, being dependent on a single platform could hinder HX's ability to cater to a diverse range of trader preferences and needs.

5The following table compares the trading platforms offered by HX to those of other brokerages:

| Broker | Trading Platforms |

| HX | MT4 |

| FXTM | MT4, MT5 |

| Exness | MT4, MT5, Exness Web Terminal |

| Pepperstone | MT4, MT5, cTrader |

| FP Markets | MT4, MT5, IRESS, cTrader |

HX offers customer support through email, with the designated email address huixinservice@outlook.com provided for inquiries and assistance. This email support option allows users to communicate with the company directly and seek help or information.

Relying solely on email for customer support can be limiting as it may result in slower response times, potentially leaving users without immediate assistance in urgent situations and lacking the convenience of real-time support options like live chat or phone assistance. Additionally, some users may prefer alternative means of communication, and the absence of such options may impact their overall experience with the company.

In conclusion, HX is a brokerage which was established within the past year, and it operates without the oversight of any regulatory authority, placing it in an unregulated status. The company offers a selection of market instruments, providing traders with a range of options to explore. With a minimum deposit requirement of US$1,000 and leverage of up to 1:400, it caters to a specific segment of traders, but is limited in that there are no account options for diverse trading profiles. HX employs the MT4 trading platform, a widely recognized interface in the industry.

HX provides customer support exclusively through email which can be seen as a limiting factor for traders looking for a brokerage with developed communicational chanels. While the absence of regulatory oversight and the singular customer support option may raise some concerns, the company's trading offerings present an opportunity for traders willing to engage with an unregulated broker, taking into consideration the associated risks.

Q: What is the regulatory status of HX?

A: HX operates as an unregulated brokerage.

Q: What types of market instruments are offered by HX?

A: HX provides forex, commodities, and indices trading options.

Q: What is the minimum deposit requirement for HX?

A: The minimum deposit for HX is US$1,000.

Q: Which trading platform does HX use?

A: HX utilizes the MT4 trading platform.

Q: How can users contact HX for customer support?

A: Users can reach HX's customer support through email.

Q: What is the maximum leverage ratio offered by HX?

A: HX offers a maximum leverage ratio of up to 1:400.

More

User comment

0

CommentsWrite a review

No comment yet

start to write first comment