User Reviews

More

User comment

0

CommentsWrite a review

No comment yet

Score

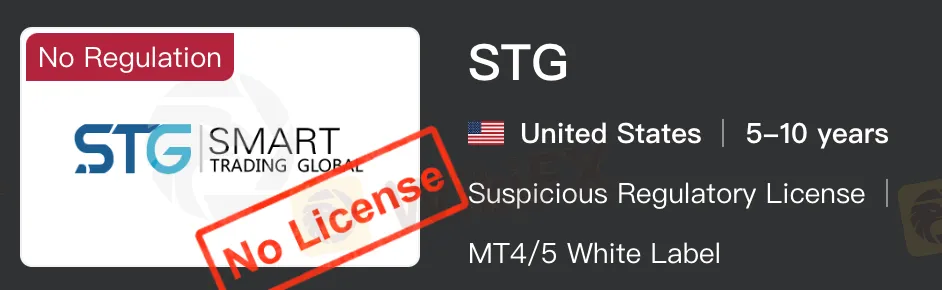

5-10 years

5-10 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index7.27

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

| STG | Basic Information |

| Company Name | STG |

| Founded | 2023 |

| Headquarters | United States |

| Regulations | Unregulated |

| Products and Services | Equities, Fixed Income, Forex, Commodities, Cryptocurrencies, ETFs |

| Trading Platforms | Sterling, Tekion, Das, MT5, Dynamics Trading |

| Deposit & Withdraw Methods | Prepaid card system |

| Customer Support | Email: info@stgmarkets.com |

| Education Resources | Latest news, events, publications |

STG, established in 2023 and based in the United States, presents itself as an unregulated brokerage offering a wide array of financial products and services, including equities, fixed income, forex, commodities, cryptocurrencies, and ETFs. Despite its broad portfolio and access to various trading platforms like Sterling, Tekion, Das, MT5, and its proprietary Dynamics Trading, STG's lack of regulatory oversight raises important considerations for potential clients regarding security and transparency. Aimed at providing institutional pricing and enhanced trading support, STG endeavors to address these concerns with innovative payment solutions, dedicated customer support, and a wealth of educational resources, catering to the needs of a diverse investor base seeking to navigate the complexities of global markets.

STG, identified as a brokerage service, currently operates without valid regulation from any recognized financial oversight body. This lack of regulatory status means that STG does not adhere to the stringent rules and protections that govern regulated financial entities, which are designed to ensure fair trading practices, transparency, and security of client funds. Potential clients should be aware that engaging with an unregulated broker such as STG carries inherent risks including, but not limited to, less accountability in the event of disputes, the possibility of inadequate financial security, and potentially less transparency in operational practices.

STG offers a diversified portfolio of trading options that cater to a broad spectrum of investors, boasting an array of financial instruments including equities, forex, commodities, and cryptocurrencies, coupled with access to several sophisticated trading platforms like Sterling, Tekion, and MT5. This is complemented by an innovative payment system through a prepaid card, robust customer support, and a rich repository of educational materials aimed at enriching clients' trading knowledge. However, STG's significant drawback lies in its unregulated status, raising concerns about the safety of client funds and the transparency of its operations. This juxtaposition places prospective clients at a crossroads of leveraging STG's advanced trading infrastructure against the backdrop of potential risks associated with unregulated entities.

| Pros | Cons |

|

|

|

|

|

|

STG offers institutional pricing on a suite of financial products for diverse investors, including equities, fixed income, forex, commodities, cryptocurrencies, and ETFs, along with direct trading team support.

Here is a comparison table of trading instruments offered by different brokers:

| Broker | STG | RoboForex | Exness | AMarkets |

| Forex | Yes | Yes | Yes | Yes |

| Metalls | Yes | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes | No |

| CFD | No | Yes | Yes | Yes |

| indexes | Yes | Yes | Yes | Yes |

| Stock | No | Yes | Yes | Yes |

| ETF | Yes | Yes | No | No |

| Options | No | No | No | No |

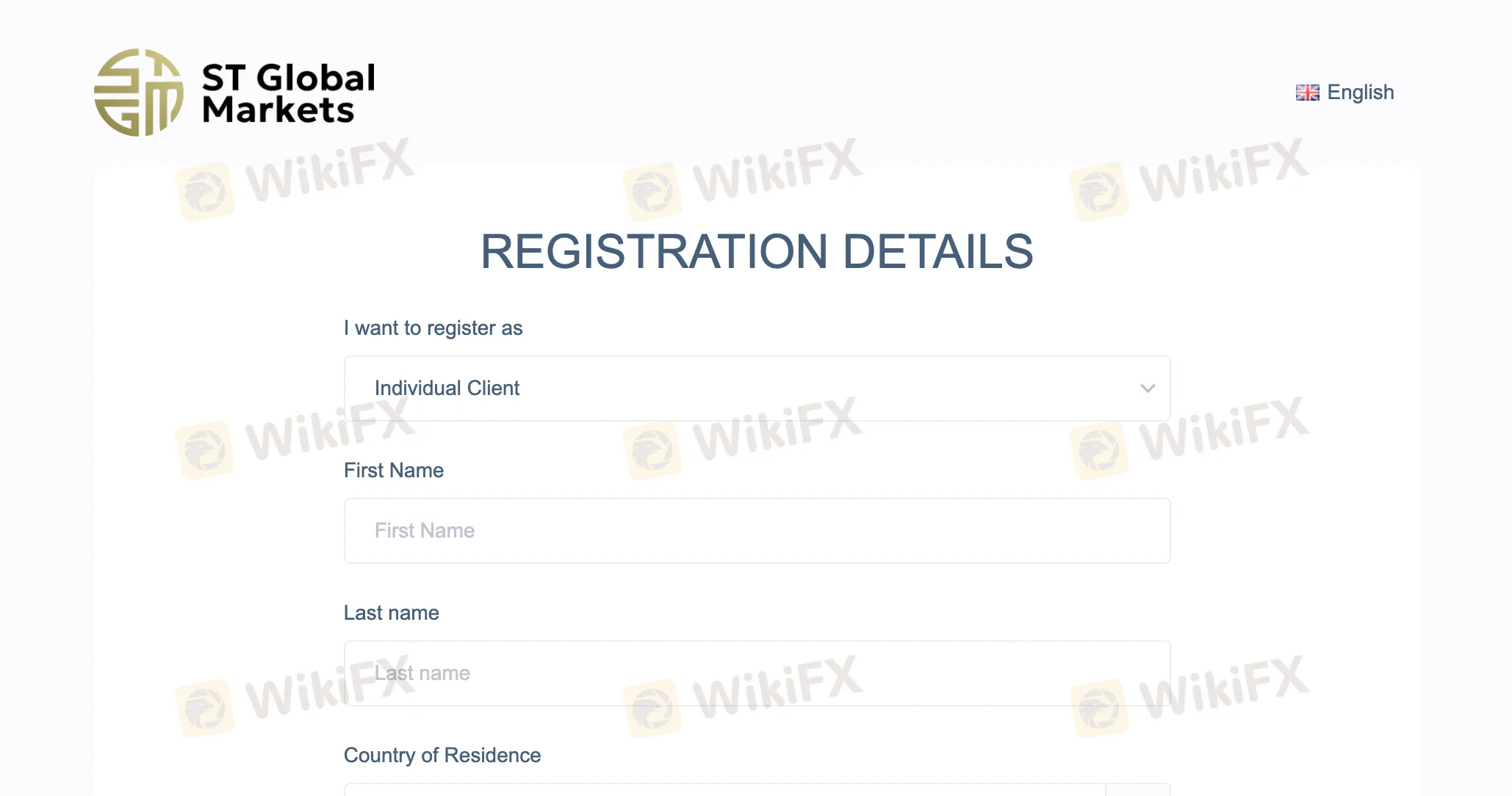

To open an account with STG, follow these steps.

Visit the STG website. Look for the “Register” button on the homepage and click on it.

Sign up on websites registration page.

Receive your personal account login from an automated email

Log in

Proceed to deposit funds to your account

Download the platform and start trading

STG offers an innovative payment solution through a prepaid card system, with the flexibility to manage and spend funds easily across various transactions like online shopping, in-store purchases, and ATM withdrawals.

STG provides a selection of trading platforms such as Sterling, Tekion, Das, MT5, and its custom-built platform, Dynamics Trading, supported by a dedicated team to assist clients in choosing the platform best suited for their trading needs.

STG provides customer support from their office at GlobalOne House, No. 83 East Bay Street, Nassau, The Bahamas, and can be contacted via email at info@stgmarkets.com.

STG offers educational resources through the latest news, events, and publications, keeping clients informed and educated on market trends and trading strategies.

STG positions itself as a potentially attractive option for investors seeking varied financial products and innovative trading solutions. Its commitment to offering institutional pricing and direct trading team support underscores its ambition to cater to both novice and experienced investors. However, the lack of regulatory oversight remains a significant drawback, raising concerns about the transparency and security of client investments. As such, while STG offers compelling services and support, prospective clients must carefully weigh these advantages against the inherent risks associated with trading through an unregulated broker.

Q: How can I start trading with STG?

A: Register on the STG website, follow the sign-up process, deposit funds, and you can begin trading.

Q: What products can I trade with STG?

A: STG offers trading in forex, metals, cryptocurrencies, indices, and ETFs, among other products.

Q: Is STG regulated?

A: No, STG currently operates without formal regulation from financial oversight bodies.

Q: What platforms does STG offer for trading?

A: STG provides various platforms including Sterling, Tekion, Das, MT5, and Dynamics Trading.

Q: How can I contact STG for support?

A: STG can be contacted via email at info@stgmarkets.com for customer support inquiries.

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies. In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

More

User comment

0

CommentsWrite a review

No comment yet

start to write first comment