User Reviews

More

User comment

3

CommentsWrite a review

2023-03-02 10:29

2023-03-02 10:29

2022-12-12 14:26

2022-12-12 14:26

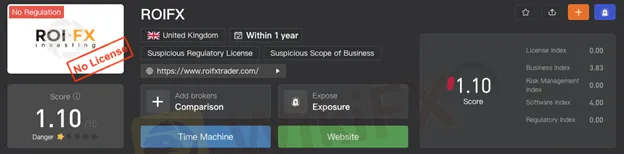

Score

2-5 years

2-5 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index6.51

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

Danger

More

Company Name

ROIFX LTD

Company Abbreviation

ROIFX

Platform registered country and region

United Kingdom

Company website

Company summary

Pyramid scheme complaint

Expose

| Basic | Information |

| Registered Countries | United Kingdom |

| Regulation | No License |

| Company Name | ROIFX LTD |

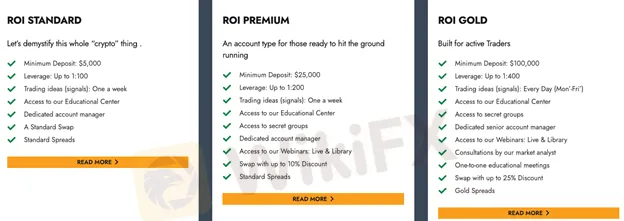

| Minimum Deposit | $5,000 |

| Maximum Leverage | 1:600 |

| Minimum Spread | N/A |

| Trading Platform | N/A |

| Trading Assets | Forex, Stocks, Commodities, Indices, Cryptocurrency, ETF |

| Payment Methods | Bank Transfer, VISA, MasterCard, Bitcoin |

| Customer Support | Email & Phone Support |

General Information

Registered in 2021, ROIFX is a United Kingdom-registered forex broker, giving their clients access to a vast global financial market, including Forex, Stocks, Commodities, Indices, Cryptocurrency. ROIFX offers five different types of trading accounts, with the minimum deposit to open an account starting at $5,000.

When it comes to regulatory licenses, ROIFX, in Saint Vincent and the Grenadines, is completely devoid. Take into account the potential danger.

Market Instruments

Six classes of trading assets are provided to clients who want to give a shot, including Forex, Stocks, Commodities, Indices, Cryptocurrency, ETF.

Account Types

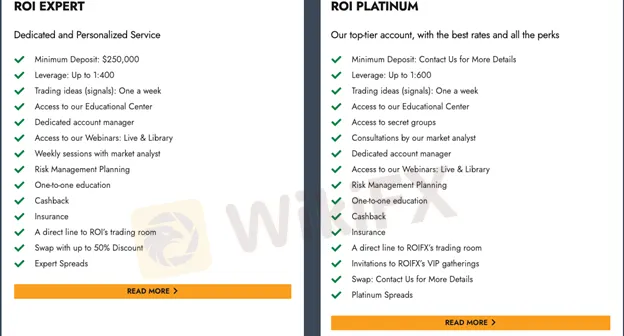

ROI Standard accounts, ROI Premium accounts, ROI Gold accounts, ROI Expert accounts, ROI Platinum accounts are available accounts for all clients. However, to trade with ROIFX costs much, as the minimum deposit to open a Standard account is as high as $5000.

Leverage

When it comes to leverage, ROIFX provides its customers with access to 1:600, which is far greater than the levels regarded appropriate by many regulators, with the maximum leverage for major currencies up to 1:30 in Europe and Australia, and 1:50 in the United States and Canada.

Since leverage can amplify both gains and losses, it can result in devastating losses for investors who lack experience. If you're just starting out in the trading world, it's best to stick with the lower size, no more than a 1:10.

Customer Support

If you have any inquiries or trading-related issues, you can reach this broker through the following contact channels:

Telephone: +447464128931

Email: support@roifxtrader.com

Company Address: 20-22 Wenlock Road, London, London, England, N1 7GU.

Or you can also follow this broker on Facebook, Instagram.

Risk Warning

Trading leveraged products such as forex, cryptocurrencies and derivatives may not be suitable for all investors as they carry a high degree of risk to your capital. Please ensure that your fully understand the risks involved, taking into account your investments objectives and level of experience.

The information presented in this article is intended solely for reference purposes.

Pros & Cons

| Pros | Cons |

| Multiple trading accounts available | No regulation |

| High minimum deposits | |

| Poor customer support | |

| Details of trading platform, spreads, commissions missing |

Frequently Asked Questions

What trading instruments can I trade with on ROIFX?

Trading instruments offered by ROIFX include Forex, Stocks, Commodities, Indices, Cryptocurrency, ETF.

What account types does Morgan Finance offer?

Five types of trading accounts are available, namely ROI Standard accounts, ROI Premium accounts, ROI Gold accounts, ROI Expert accounts, ROI Platinum accounts.

What is the minimum deposit required by ROIFX?

The minimum deposit required by ROIFX is $5,000.

The Financial Conduct Authority (FCA) has a list of businesses and persons it has identified as possibly operating without its authorization and oversight, or about whom it has concerns for other reasons. The list's purpose is to safeguard consumers and the integrity of the UK financial system by assisting them in avoiding doing business with these companies and persons. It is continuously updated, and customers are recommended to consult it before participating in any financial activities.

WikiFX

WikiFX

The British regulator FCA has issued an official warning against ROIFX on January 20th!!!

WikiFX

WikiFX

More

User comment

3

CommentsWrite a review

2023-03-02 10:29

2023-03-02 10:29

2022-12-12 14:26

2022-12-12 14:26