User Reviews

More

User comment

6

CommentsWrite a review

2023-02-28 10:54

2023-02-28 10:54 2022-12-13 10:57

2022-12-13 10:57

Score

Scam Brokers

Scam Brokers5-10 years

Suspicious Regulatory License

Suspicious Scope of Business

High potential risk

Influence

Add brokers

Comparison

Quantity 89

Exposure

Score

Regulatory Index0.00

Business Index7.57

Risk Management Index0.00

Software Index4.00

License Index0.00

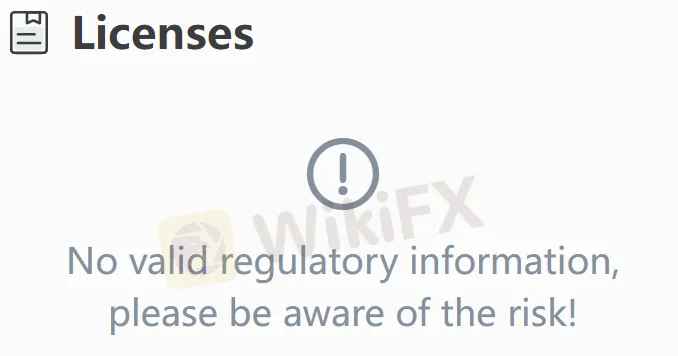

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

Danger

More

Company Name

Guardian Capital AG

Company Abbreviation

GCG ASIA

Platform registered country and region

Switzerland

Company website

Company summary

Pyramid scheme complaint

Expose

After scamming me of $500, GCG ASIA absconded.

A lot of scams here. Keep asking u to invest. You need to pay for your upgrade if u wanna withdraw funds!

Can't withdraw funds since October 20. Besides, our withdrawals are transferred back to other wallets in the account, infriging investors' rights.

1.GCG ASIA was opened at the end of December, 2018. And 111 gave no access to withdrawal since April, 2019. 2.Fuhao Qiu was arrested by Cambodian police in May, 2019. The so-called president Zheng cheated a lot of money by consignment business 3.GCG ASIA promised that the withdrawal problem can be solved after depositing $500 to register GIB digital bank before it absconded. In fact, the users still can’t withdraw and swindle members out of $500 instead. 4.111 was renamed GIB and pocked half of its members’ money, releasing the half money within three years. 5.90% profits of members were stolen by GCG ASIA 6.Now GCG ASIA still ballyhoos its fraud programs. The way GCG ASIA cheated can rank top 500 in the world!

I was cheated by the scammer and lost my money.

I was cheated into investing over 50,000 RMB, which could not be withdrawn. What can I do to get my money back?

Chen Wei, GCG’s behind-the-scenes boss, the others are all on the platform. Chen Wei was filed and pursued because of the Wanwei coin fraud. This person has long organized a fraud platform in Malaysia to defraud Chinese investors.

1.111 was opened at the end of December, 2018. And GCG ASIA gave no access to withdrawal since April, 2019. 2.Fuhao Qiu was arrested by Cambodian police in May, 2019. The so-called president Zheng cheated a lot of money by consignment business 3.GCG ASIA promised that the withdrawal problem can be solved after depositing $500 to register GIB digital bank before it absconded. In fact, the users still can’t withdraw and swindle members out of $500 instead. 4.GCG ASIA was renamed GIB and pocked half of its members’ money, releasing the half money within three years. 5.90% profits of members were stolen by GCG ASIA 6.Now 111 still ballyhoos its fraud programs. The way GCG ASIA cheated can rank top 500 in the world!

Is GCG ASIA existing now? Can’t withdraw in digital bank, either.

It is simply a fraud. The rich Qiu has absconded with clients’ money. The unleash of the fund needs 3 years. It is a rip-off.

GCG ASIA claimed to solve the withdrawal problem as long as the digital bank was established. But now it has absconded. It still has 3 years to go before the withdrawal is available. I just want to take my fund back. But I am required to add fund.

The GIB digital bank is all fake. Withdrawals open only 5 months have been opened in the past two years. Around the month, the others are not withdrawing money for various reasons, and the principal cannot be withdrawn at all! Those who make money are the bosses, such as Xiaokai, Huang Jianqiu (Principal Huang). At present, the two leaders have successfully cashed out! At the end of the year, all the upper-levels are preparing to divide money to prevent investors from withdrawing. At present, all the withdrawal channels are closed. If you want to withdraw, you must invest more money. It is raised at about 10% per month, and then it is raised in January and February to find a reason to withdraw. If you want to withdraw cash, you must invest again!

Unable to withdraw. It's said all the funds were transferred to GIB digital bank. Scam!

GCG ASIA asked members to invest $500 to register digital bank. Now there are many problems with the digital bank. You can't withdraw.

I deposited in April, 2019 and I can’t withdraw. It’s said that something happened to the boss! I met another leader in September, 2020 and asked me to open an account of digital banking to withdraw! I deposited 50,000! He told me that if I paid $1,500 for an account of digital banking I can withdraw all the money and my account balance was over 600,000 now. It feels fake!

The pyramid scheme by GCG, the former name of GIB, is revealed as follows: 1.GCG, which started its operation at the end of December 2018, began to block investor withdrawals on a large scale from April 2019. 2. Mr. Qiu, head of GCG, was arrested by the Cambodian police in May 2019. Later, a so-called GCG general manager Mr. Zheng launched 5-5 or 6-4 orders, inflicting heavy losses on a large number of members! 3. Before absconding, GCG promised members that the withdrawal problem will be fixed if they invest US$500 to register for the GIB Digital Bank. However, the investors were still unable to withdraw money. The registration fee later increased to US$1,000. 4. GCG rebranded itself to GIB (Global Investment Bank) after it scammed 50% of GCG members’ deposits and plotted to scam the rest in the next three years. 5. Moreover, 90% of the profits in GCG members’ accounts in the past year or so were swindled with the remaining 10% left to continue their scam. 6. Currently, GIB continues to publicize its fraudulent money-raising scheme in the hope of joining the Fortune Global 500 companies!

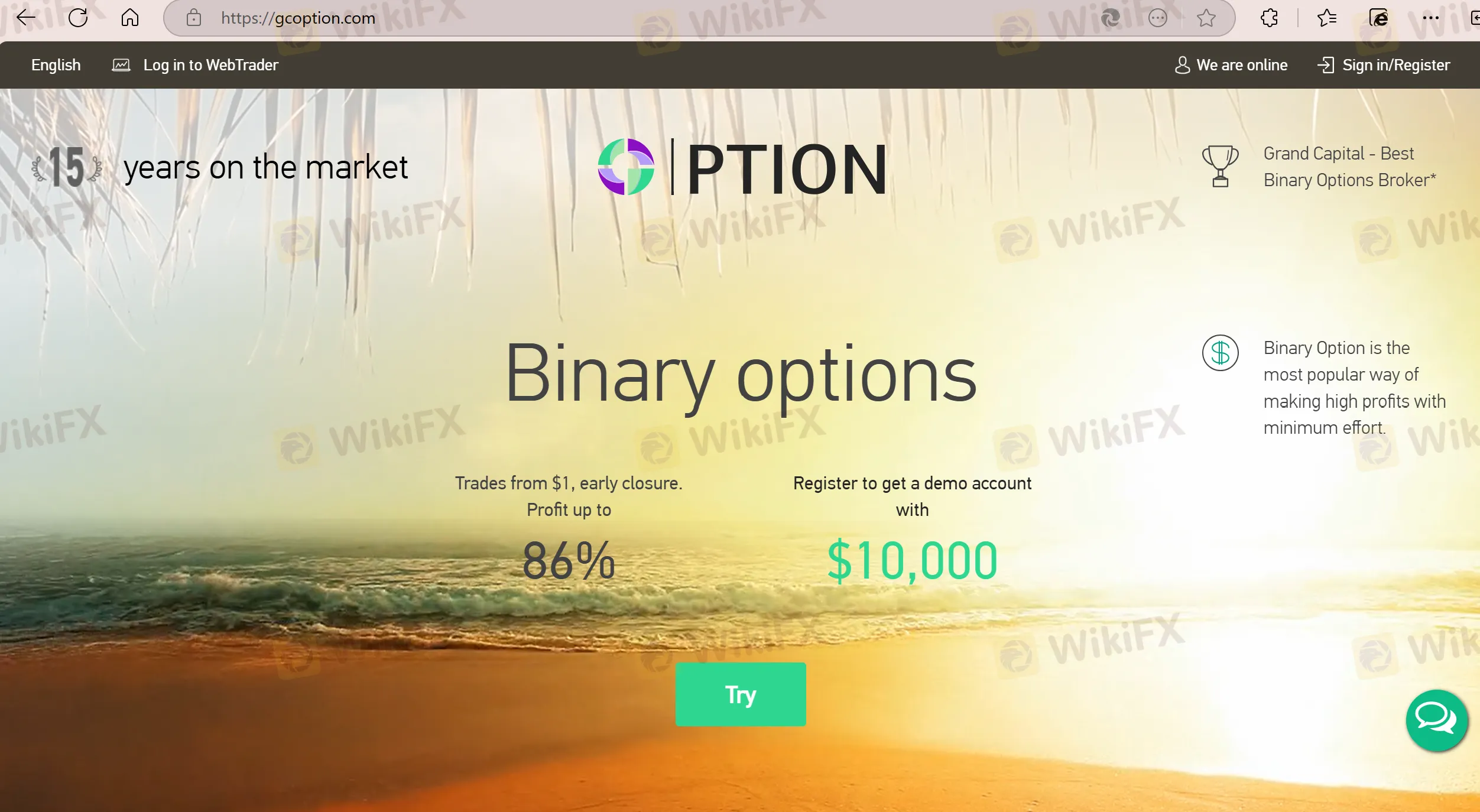

| GC OptionReview Summary | |

| Founded | 2019 |

| Registered Country/Region | Saint Vincent and the Grenadines |

| Regulation | No regulation |

| Market Instruments | Currency pairs, stocks, indices, metals |

| Demo Account | ✅ |

| Leverage | / |

| Spread | / |

| Trading Platform | MT4, WebTrader Pro, WebTrader Classic |

| Minimum Deposit | $10 |

| Promotion | ✅ |

| Customer Support | 24/7 multilingual support |

| Live chat | |

| Email: support@grandcapital.net [Mon–Fri 6:00 AM–6:00 PM (GMT)] | |

| Social media: Instagram, YouTube, Twitter, Facebook | |

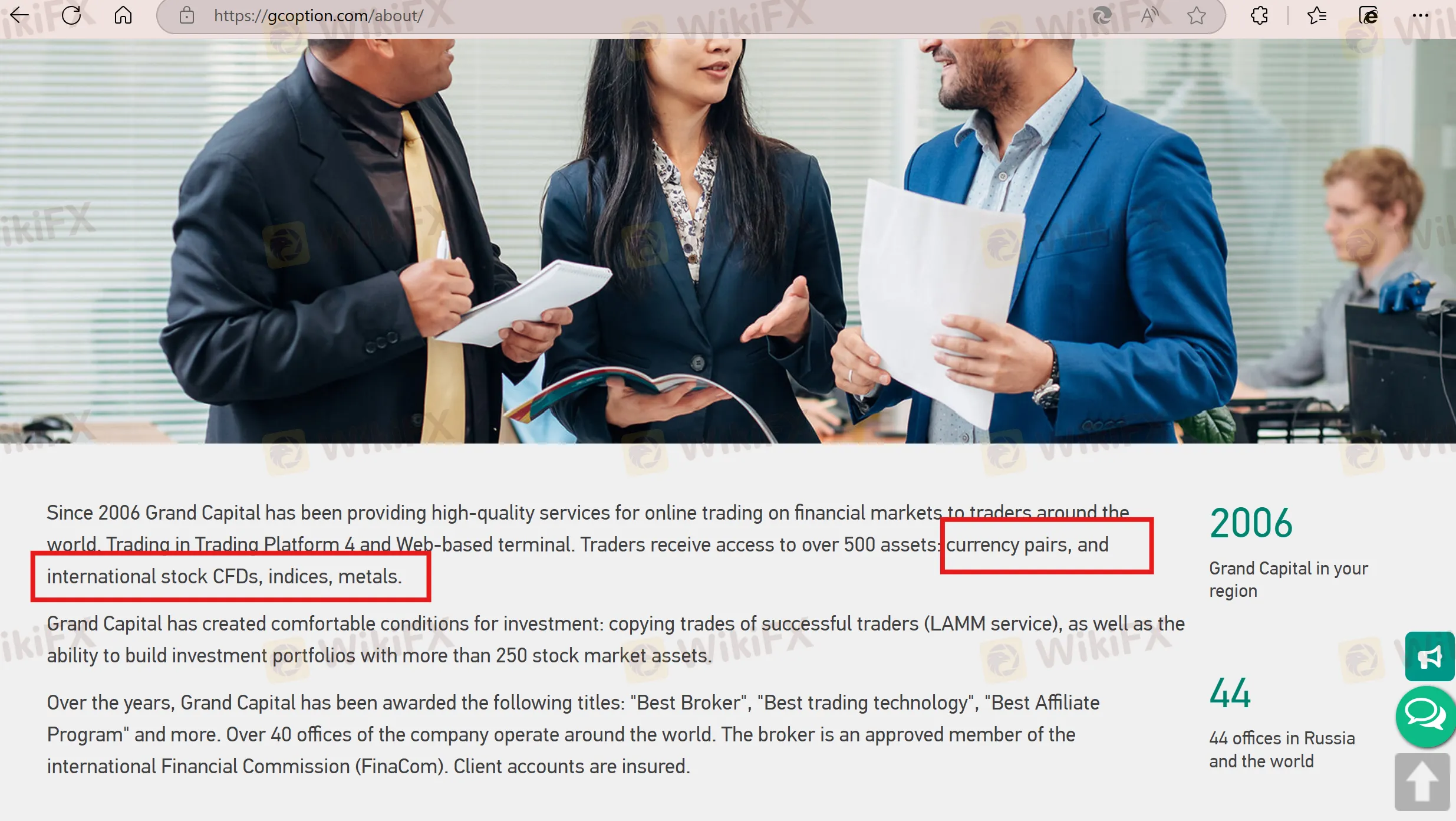

GC Option was registered in 2019 in Saint Vincent and the Grenadines, offering trading services related to currency pairs, stocks, indices, and metals. It provides three types of accounts, with a minimum deposit of $10. Besides, demo accounts and promotions are also provided. However, this company is not regulated, and it does not reveal details of leverage ratio and spread.

| Pros | Cons |

| Demo accounts offered | Lack of regulation |

| Low minimum deposit | Lack of transparency |

| MT4 supported | Limited payment options |

| Multiple channels for customer support | |

| Promotions offered |

No, GC Option is not regulated by financial regulatory authorities in Saint Vincent and the Grenadines, which means the company lacks regulation from its registration site. Therefore, potential risks cannot be ignored.

GC Option provides several types of products, including currency pairs, stocks, indices, and metals.

| Tradable Instruments | Supported |

| Currency Pairs | ✔ |

| Indices | ✔ |

| Stocks | ✔ |

| Metals | ✔ |

| Cryptos | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

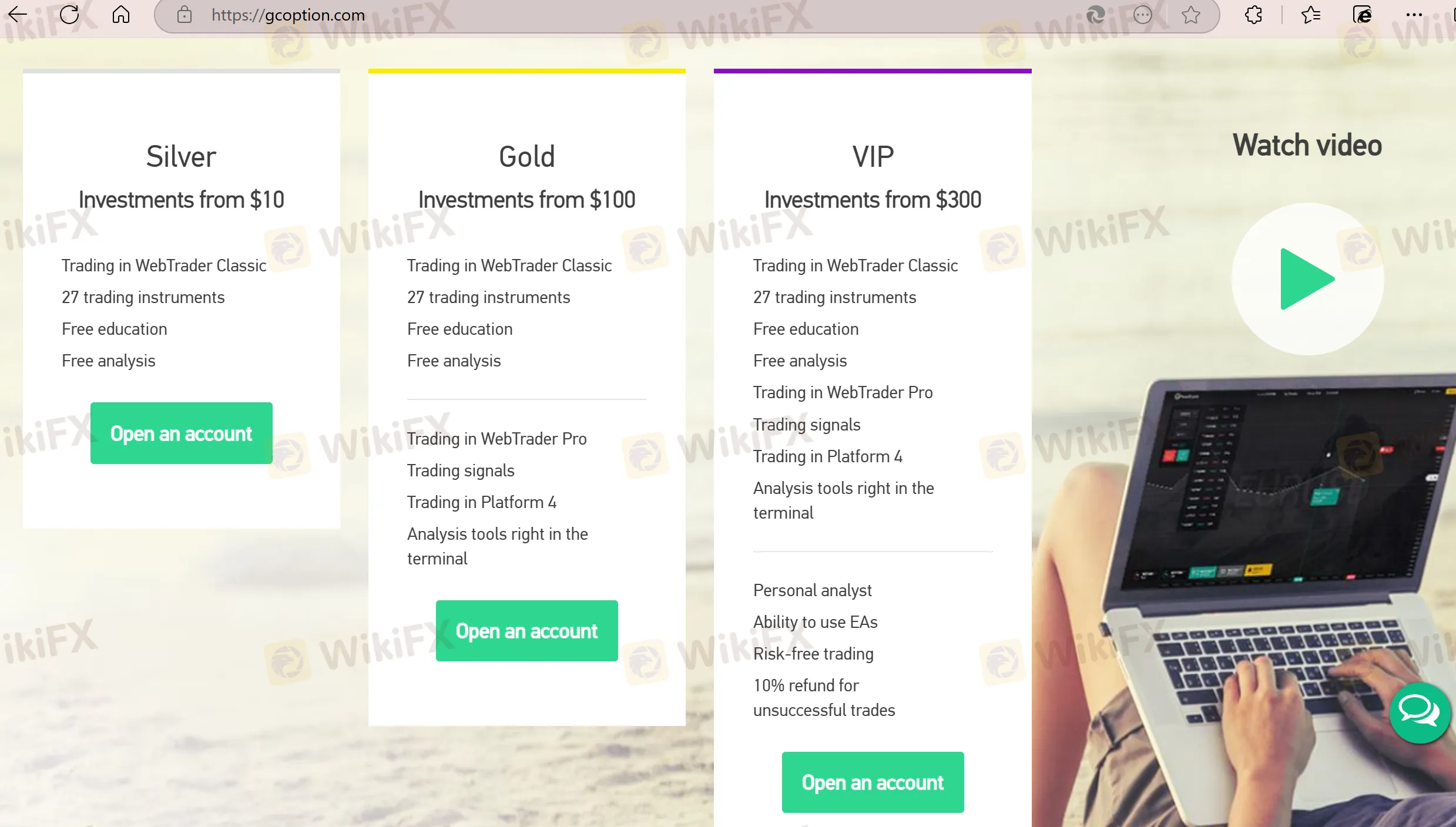

GC Option offers three types of accounts: Silver, Gold, and VIP Account. Besides, a demo account is also available. However, the leverage ratio, spread, and commission fees of each account are not clear.

| Account Type | Minimum Deposit |

| Silver | $10 |

| Gold | $100 |

| VIP | $300 |

GC Option uses WebTrader Pro, WebTrader Classic, and MT4 as its trading platforms. MT4 is a commonly used platform, which is suitable for beginners. However, it should be noted that web traders may have potential risks, and careful considerations are recommended.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT4 | ✔ | PC, web, mobile, mac | Beginners |

| WebTrader Pro | ✔ | Web | / |

| WebTrader Classic | ✔ | Web | / |

| MT5 | ❌ | / | / |

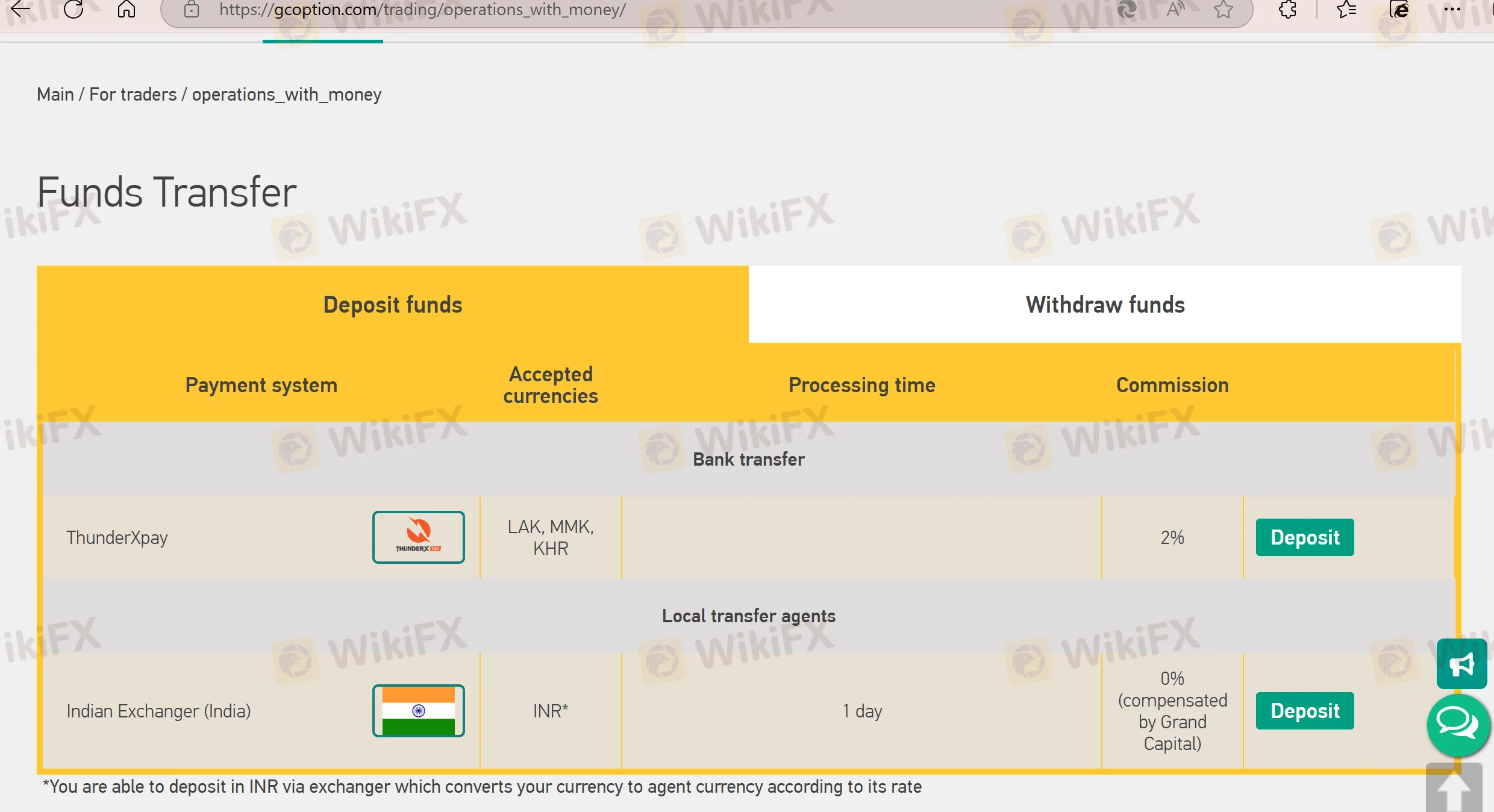

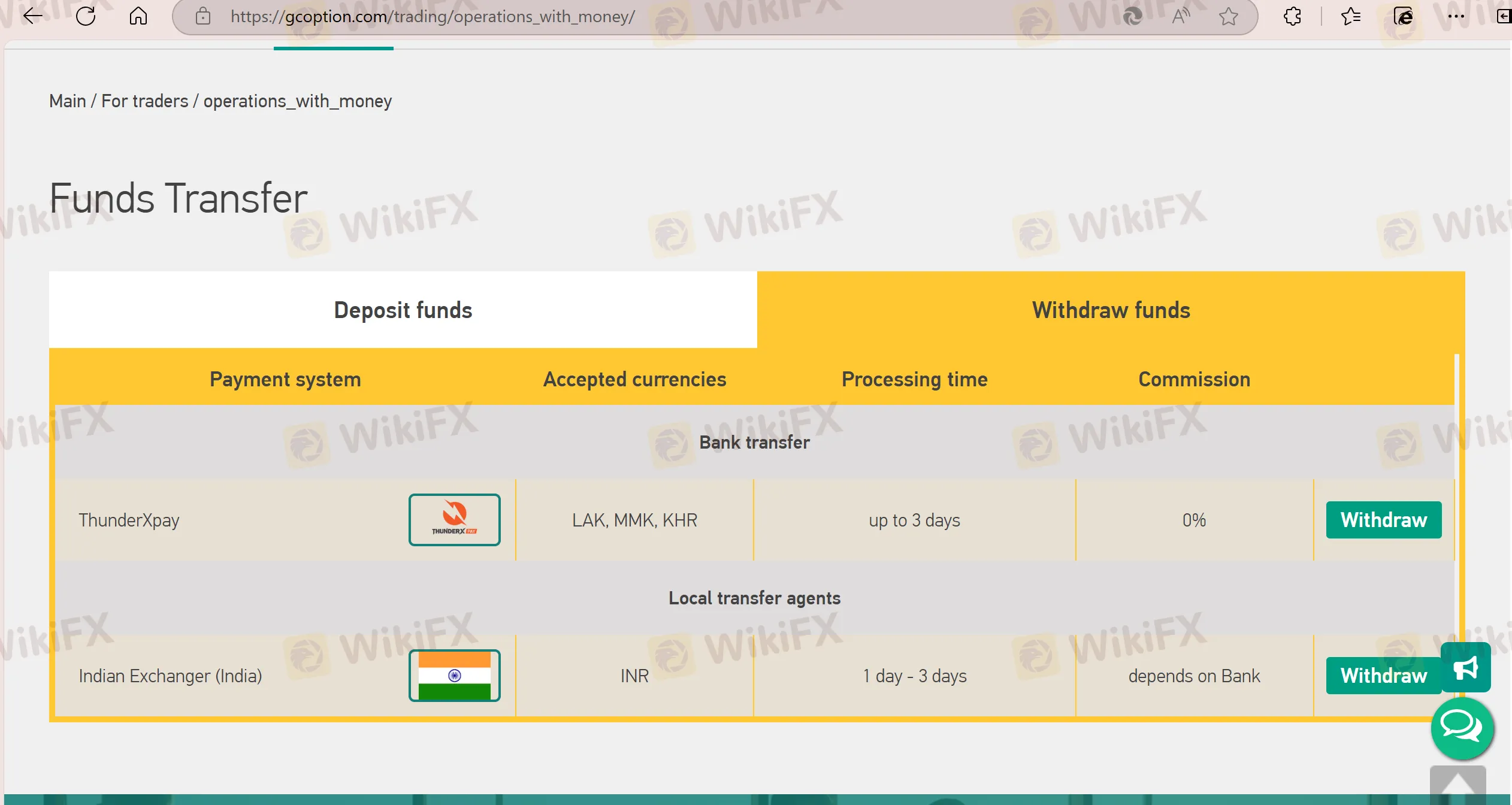

GC Option supports ThunderXpay and Indian Exchanger. The processing time and commission fees vary according to the types of payment options.

| Deposit Options | Accepted Currencies | Deposit Fees | Deposit Processing Time |

| ThunderXpay | LAK, MMK, KHR | 2% | / |

| Indian Exchanger | INR | ❌ | 1 day |

| Withdrawal Options | Accepted Currencies | Withdrawal Fees | Withdrawal Processing Time |

| ThunderXpay | LAK, MMK, KHR | ❌ | Up to 3 days |

| Indian Exchanger | INR | Depends on bank | 1 to 3 days |

GC Option has promoting activities which offer bonuses to traders.

The police arrested 10 individuals, including a man carrying the title "Datuk", for their suspected involvement in fraudulent forex investment schemes in five states on Saturday (Jan 1).

WikiFX

WikiFX

A Datuk is among 10 arrested for alleged links to a Forex investment scam involving losses of at least RM2.94mil.

WikiFX

WikiFX

More

User comment

6

CommentsWrite a review

2023-02-28 10:54

2023-02-28 10:54 2022-12-13 10:57

2022-12-13 10:57