User Reviews

More

User comment

0

CommentsWrite a review

No comment yet

Score

2-5 years

2-5 yearsRegulated in Indonesia

Forex Trading License (EP)

MT5 Full License

Regional Brokers

Influence

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index6.40

Business Index5.57

Risk Management Index9.34

Software Index7.73

License Index6.44

Single Core

1G

40G

More

Company Name

PT. ORBI TRADE BERJANGKA

Company Abbreviation

ORBI TRADE BERJANGKA

Platform registered country and region

Indonesia

Company website

+62812 8899 9917

Company summary

Pyramid scheme complaint

Expose

| PT. ORBI TRADE BERJANGKA Review Summary | |

| Founded | 2022 |

| Registered Country/Region | Indonesia |

| Regulation | BAPPEBTI |

| Market Instruments | Currencies, commodities, indices |

| Demo Account | ✅ |

| Leverage | / |

| Spread | / |

| Trading Platform | MT5, JAFeTS |

| Minimum Deposit | / |

| Customer Support | Contact form |

| Tel: +6221 2213 6400 | |

| Email: info@orbiberjangka.com | |

| Facebook, Instagram, YouTube, WhatsApp | |

| Address: Jl. Artery Klp. Gading No.E1/10, RT.5/RW.2, Pegangsaan Dua, Kec. Cpl. Gading, North Jkt City, Special Capital Region of Jakarta 14250 | |

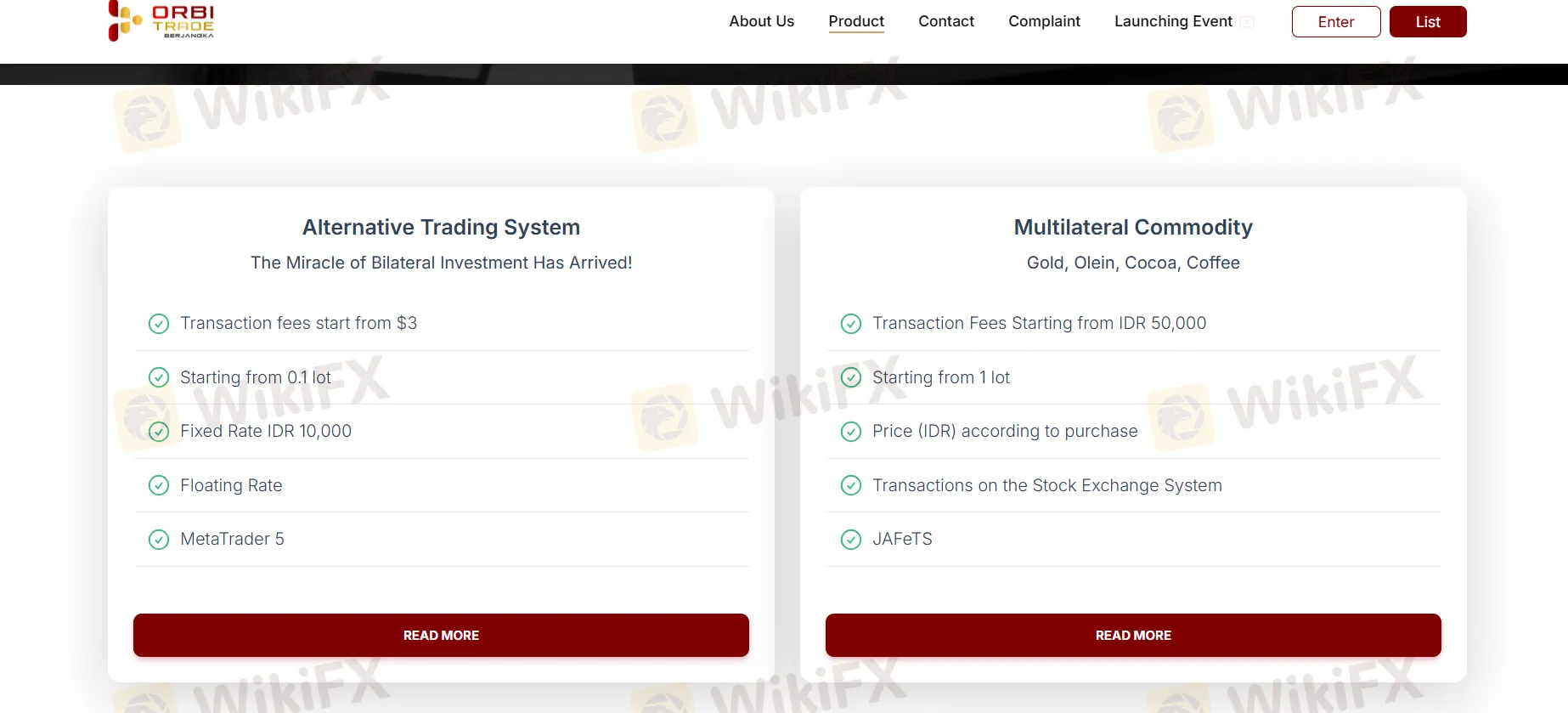

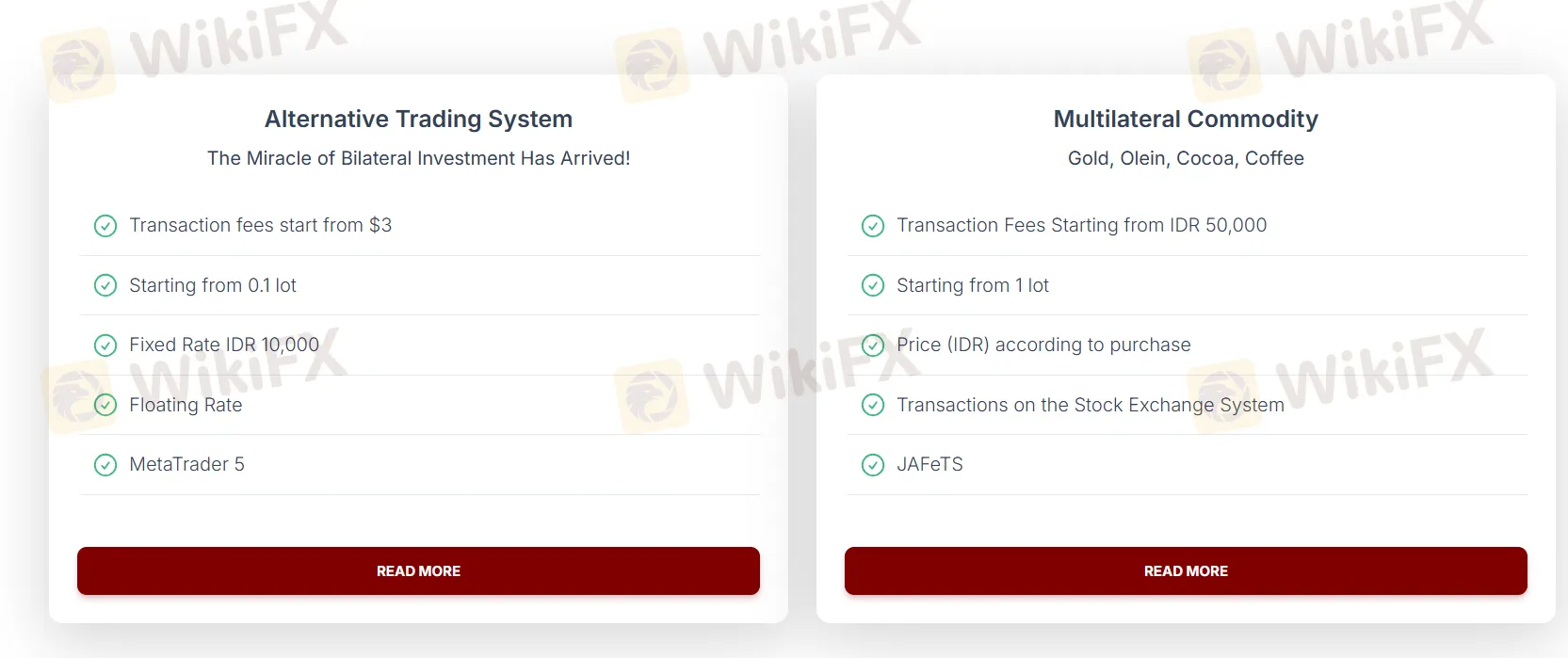

PT. ORBI TRADE BERJANGKA is a regulated broker, which was founded in Indonesia in 2022, offering trading on currencies, commodities and indices on the MT5 and JAFeTS trading platforms.

| Pros | Cons |

| Regulated by BAPPEBTI | Unclear fee structure |

| Demo accounts | Limited info on deposit and withdrawal |

| MT5 platform |

Yes. PT. ORBI TRADE BERJANGKA is licensed by BAPPEBTI to offer services. Its license number is 129/BAPPEBTI/SI/IX/2001. It also holds certifications from JFX.

| Regulated Country | Regulator | Current Status | Regulated Entity | License Type | License No. |

| Badan Pengawas Perdagangan Berjangka Komoditi Kementerian Perdagangan (BAPPEBTI) | Regulated | PT ORBI TRADE BERJANGKA | Retail Forex License | 129/BAPPEBTI/SI/IX/2001 |

PT. ORBI TRADE BERJANGKA provides a wide range of trading products such as currencies, 6 commodities (gold, silver, olein, coffee, cocoa and oil) and indices.

| Tradable Instruments | Supported |

| Currencies | ✔ |

| Commodities | ✔ |

| Indices | ✔ |

| Stocks | ❌ |

| Cryptos | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

| Trading Platform | Supported | Available Devices | Suitable for |

| JAFeTS | ✔ | Desktop, mobile, online web trader | / |

| MT5 | ✔ | Desktop, mobile, online web trader | Experienced traders |

| MT4 | ❌ | / | Beginners |

PT. ORBI TRADE BERJANGKA accepts payments via BCA. More detailed info on deposits and withdrawals are not disclosed.

More

User comment

0

CommentsWrite a review

No comment yet

start to write first comment