User Reviews

More

User comment

0

CommentsWrite a review

No comment yet

Score

2-5 years

2-5 yearsRegulated in Indonesia

Forex Trading License (EP)

MT5 Full License

Regional Brokers

Influence

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index6.40

Business Index5.68

Risk Management Index9.36

Software Index8.57

License Index6.44

Single Core

1G

40G

| Straits Futures Indonesia Review Summary | |

| Founded | Not mentioned |

| Registered Country/Region | Indonesia |

| Regulation | Licensed by BAPPEBTI, |

| Market Instruments | Commodities, Futures, Options, Forex |

| Demo Account | ✅ |

| Trading Platform | Straits Direct, CQG Desktop, Straits Quick Trade |

| Customer Support | Physical Address: Amass Central Tower, Building 176, Street 63, Sangkat Boeung Keng Kang 1, Khan Boeung Keng Kang, Phnom Penh, Cambodia |

Straits Futures Indonesia (SFI) is an Indonesian commodity and futures trading platform. It's regulated by BAPPEBTI. Along with risk management choices for commodities producers and high-net-worth clients, the organisation offers tools and platforms that suit self-directed and broker-assisted trading.

| Pros | Cons |

| Licensed by BAPPEBTI | No fee structure information |

| Specialized commodity-focused services | No account types information |

| Provide 3 platforms |

| Category | Details |

| Regulatory Status | Regulated |

| License Type | Retail Forex License |

| Regulated By | Indonesia-BAPPEBTI |

| Licensed Institution | PT. Straits Futures Indonesia |

| License Number | 43/BAPPEBTI/09/2015 |

Straits Futures Indonesia offers many tradable assets, primarily focused on the commodity and futures markets.

| Tradable Instruments | Supported |

| Commodities | ✔ |

| Futures | ✔ |

| Options | ✔ |

| Forex | ✔ |

| Stocks | ❌ |

| Indices | ❌ |

| Cryptocurrencies | ❌ |

Straits Futures Indonesia doesn't mention the specific information of account types and fee structures.

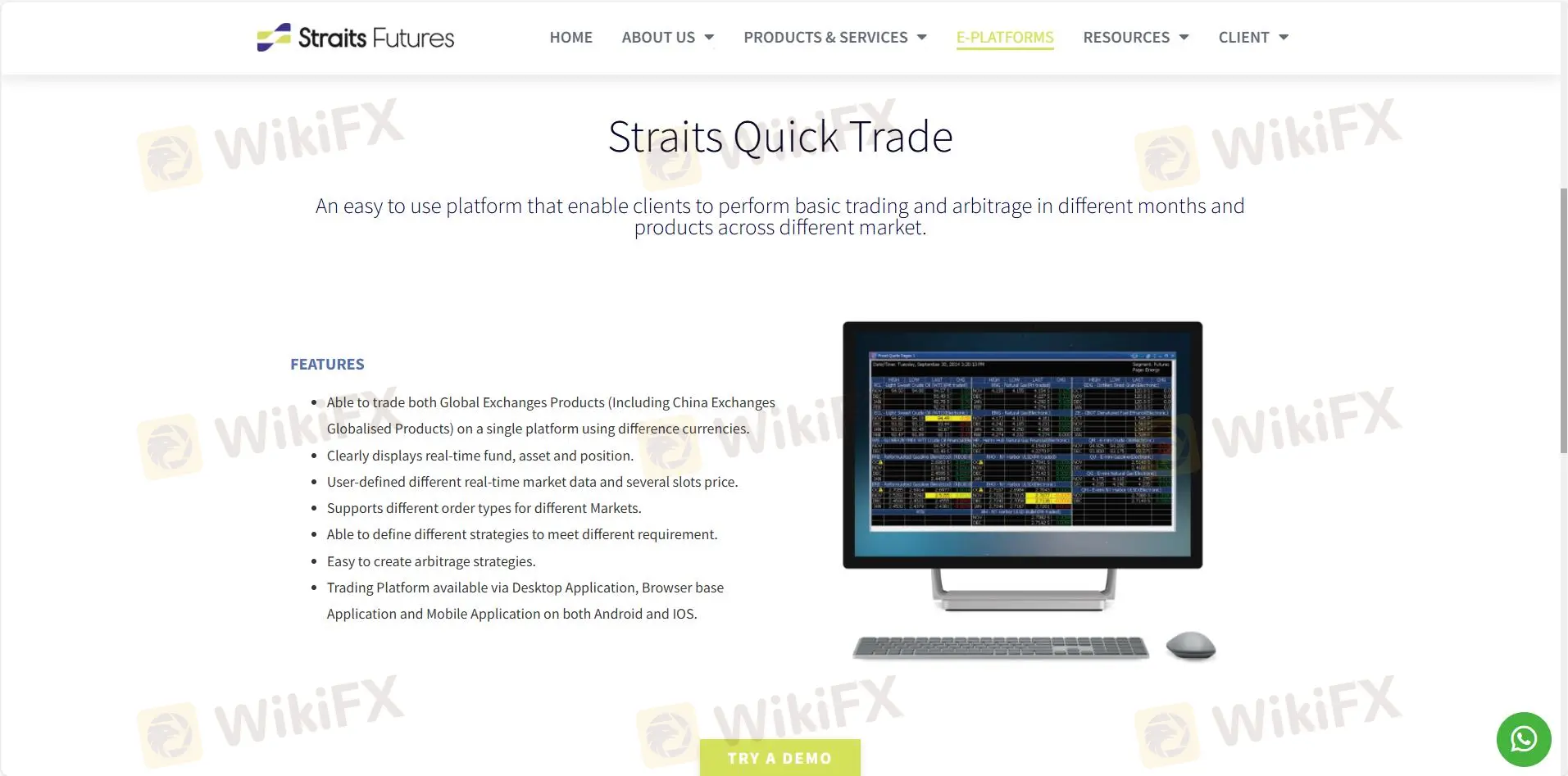

Straits Futures Indonesia offers 3 trading platforms to its users.

| Trading Platform | Supported | Available Devices | Suitable for |

| Straits Direct | ✔ | Desktop, Mobile | All levels |

| CQG Desktop | ✔ | Desktop | Experienced traders |

| Straits Quick Trade | ✔ | Desktop, Browser, Mobile | Traders seeking simplicity |

Straits Futures Indonesia does not mention deposit and withdrawal fees or minimum deposit requirements.

More

User comment

0

CommentsWrite a review

No comment yet

start to write first comment