User Reviews

More

User comment

4

CommentsWrite a review

2024-01-18 18:05

2024-01-18 18:05

2023-02-28 14:08

2023-02-28 14:08

Score

Score

Regulatory Index4.11

Business Index6.71

Risk Management Index0.00

Software Index4.00

License Index1.25

Single Core

1G

40G

More

Company Name

Alpha Trade PTY LTD

Company Abbreviation

ALPHA TRADE

Platform registered country and region

Australia

Company website

X

Company summary

Pyramid scheme complaint

Expose

| Aspect | Information |

| Company Name | Alpha Trade |

| Registered Country/Area | Australia |

| Founded Year | Regulatory compliance risks |

| Regulation | Regulated by Australian authorities |

| Market Instruments | Forex, Commodities, Digital Assets |

| Spreads | Starting from 0.2 |

| Trading Platforms | N/A |

| Customer Support | Phone at +61 290 373 900 or email at cs@alphatrade.com.au |

Alpha Trade, established in Australia in 2020, offers a range of trading assets including Forex, commodities, and digital assets. Its competitive advantages lie in offering low spreads, responsive customer support, accessible mobile trading, and a transparent fee structure.

However, users may encounter challenges navigating the complex website, limited educational resources, and risks about regulatory compliance. As of its founding year in 2020, Alpha Trade operates under Australian regulations, providing traders with a regulated trading environment.

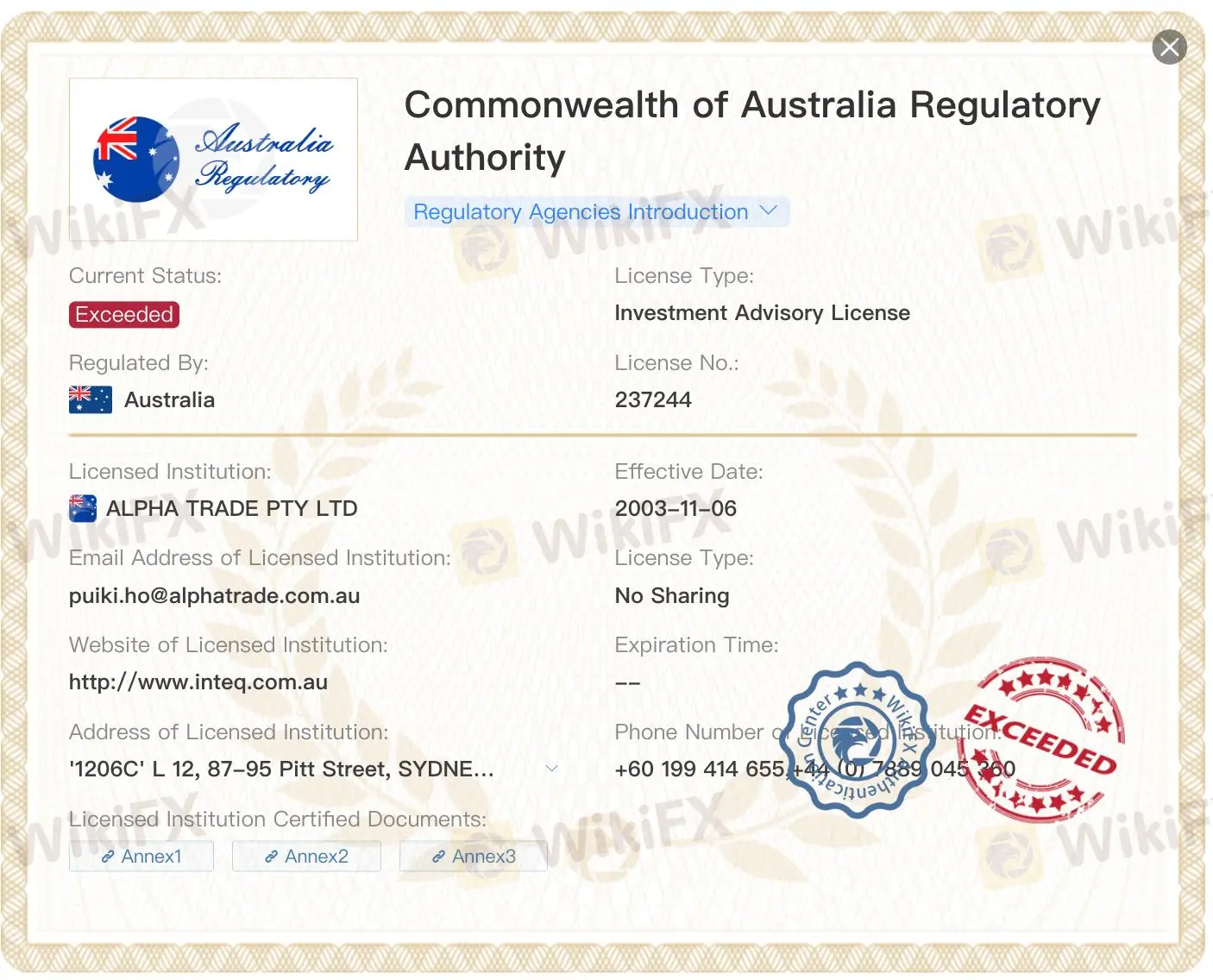

Alpha Trade's regulation status significantly influences traders on the platform.

Firstly, the platform has exceeded its Investment Advisory License regulated by the Commonwealth of Australia Regulatory Authority under license number 237244. This license type typically entails providing investment advice, implying a certain level of expertise and oversight. Traders may perceive this breach as a sign of regulatory non-compliance, potentially eroding trust and confidence in the platform's integrity and reliability.

Additionally, the platform has also exceeded its Common Business Registration license, regulated by the same authority under license number 055 971 232. This license typically pertains to general business operations, indicating a departure from the intended scope of financial services. Traders may interpret this violation as a lack of adherence to regulatory standards, raising risks about the platform's transparency and accountability.

| Pros | Cons |

| Competitive spreads as low as 0.2% | Complex website interface |

| Responsive customer support | Lack of educational resources |

| Accessible mobile trading | Regulatory compliance concerns |

| Transparent fee structure | Limited research tools |

Pros:

Competitive spreads as low as 0.2%: Alpha Trade offers competitive spreads, starting as low as 0.2% for certain assets. Competitive spreads benefit traders by reducing the cost of trading, allowing them to retain more of their profits.

Responsive customer support: Alpha Trade provides responsive customer support, ensuring that traders can quickly receive assistance with their inquiries or issues. Responsive support enhances the overall trading experience by addressing risks promptly.

Accessible mobile trading: Alpha Trade offers accessible mobile trading capabilities, enabling traders to manage their portfolios and execute trades conveniently from their mobile devices. Mobile trading provides flexibility and allows traders to stay connected to the markets even while on the go.

Transparent fee structure: Alpha Trade maintains a transparent fee structure, allowing traders to easily understand the costs associated with their trades. A transparent fee structure builds trust and confidence among traders, as they can make informed decisions regarding their trading activities.

Cons:

Complex website interface: The official website of Alpha Trade is complex to navigate, potentially causing frustration for traders trying to access information or utilize platform features. A complex website interface can hinder user experience and make it difficult for traders to find relevant resources.

Lack of educational resources: Alpha Trade lacks comprehensive educational resources, which may limit the ability of traders, especially beginners, to learn about trading strategies, market analysis, and risk management. Adequate educational resources are essential for empowering traders with the knowledge needed to make informed decisions.

Regulatory compliance risks: Traders may have risks about Alpha Trade's regulatory compliance, which could affect their trust in the platform. Regulatory compliance ensures that brokers operate within legal boundaries and adhere to industry standards, protecting the interests of traders and ensuring fair market practices.

Limited research tools: Alpha Trade provides limited research tools, which may hinder traders' ability to conduct in-depth market analysis and make informed trading decisions. Comprehensive research tools, such as technical analysis indicators and market news, are essential for traders to stay informed about market trends and potential opportunities.

Alpha Trade provides access to a wide array of assets, including FOREX, COMMODITIES, and DIGITAL ASSETS, each tailored to meet the needs of traders seeking various investment opportunities.

FOREX

Trading currency pairs involves predicting how one currency will change in value relative to another. Alpha Trade offers Forex traders some of the narrowest spreads available globally. The platform continually assesses pricing to enhance depth, speed, and cost efficiency.

COMMODITIES

Commodity markets attract speculators due to fluctuations in supply and demand. Alpha Trade provides a straightforward method to gain exposure to popular commodities like energy and metals. Commodities can be traded individually or in pairs using CFDs, eliminating the need to own the underlying product.

DIGITAL ASSETS

Cryptocurrency CFDs are favored by traders who prefer avoiding the complexities of securely purchasing and storing cryptocurrencies. Alpha Trade allows traders to open leveraged long or short positions with minimal capital, profiting from price differences between opening and closing positions. Leverage amplifies exposure to cryptocurrency markets, enhancing potential gains or losses.

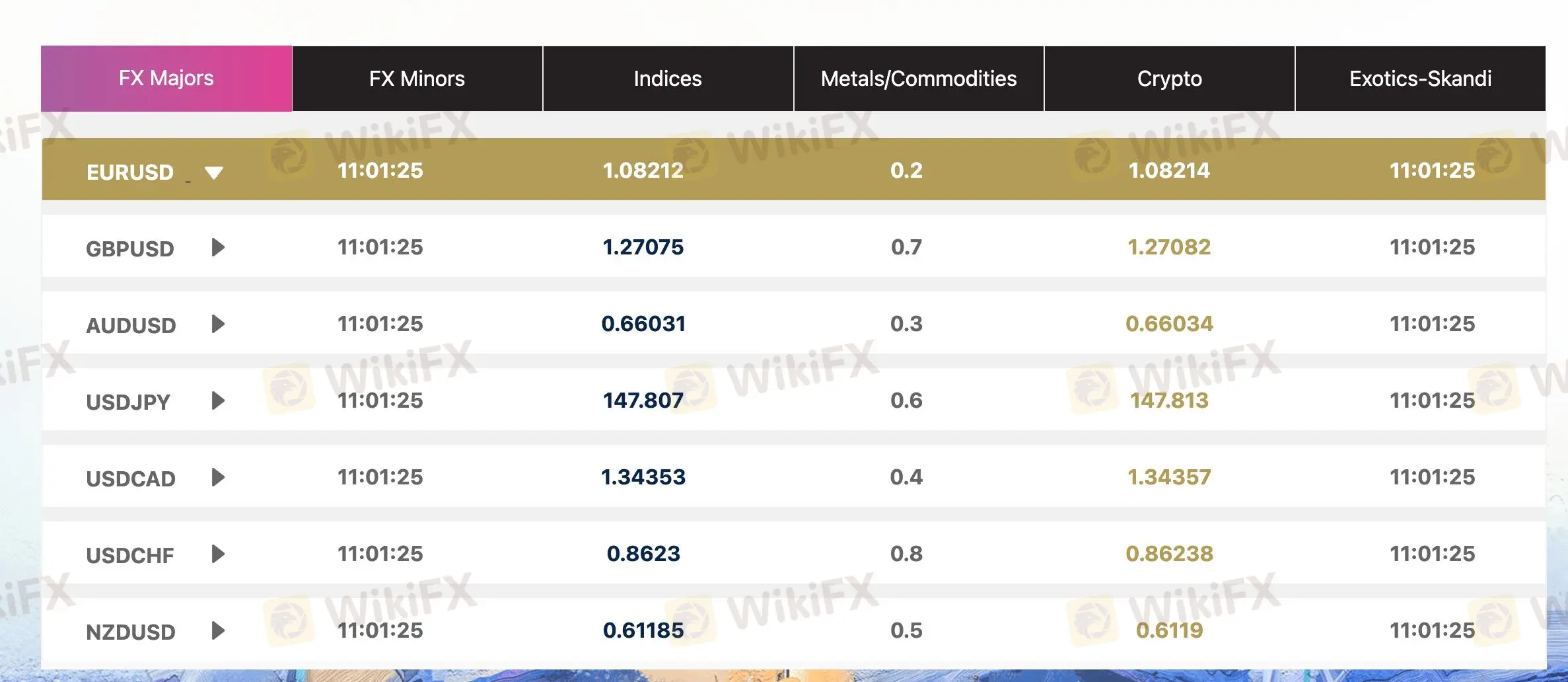

At Alpha Trade, spreads and commissions are structured to provide competitive pricing for traders across various asset classes.

For FX majors, the spread typically ranges from 0.2% to 0.8%, ensuring narrow differentials between bid and ask prices for currency pairs. This narrow spread enhances cost efficiency for traders engaging in foreign exchange transactions.

When trading indices, traders can expect spreads ranging from 0.5% to 6%, reflecting the volatility and liquidity of these instruments.

Similarly, metals trading entails spreads ranging from 0.5% to 14%, accommodating the wide range of metals available for trading, each with its own supply-demand dynamics.

Alpha Trade offers comprehensive customer support services to assist traders with inquiries and issues.

Traders can reach the support team via phone at +61 290 373 900 or through email at cs@alphatrade.com.au.

Additionally, updates and announcements are provided on their Twitter account at https://twitter.com/alphatradeau.

The support team is responsive and strives to address customer risks promptly, ensuring a positive trading experience. Whether traders require assistance with account-related queries, technical issues, or general information, Alpha Trade's customer support team is available to provide assistance and guidance.

Alpha Trade issues risk alerts to inform traders about potential risks associated with engaging with the platform.

The recent detection on March 22, 2024, reveals risking findings. The broker exceeds the business scope regulated by the Australian Securities and Investments Commission (ASIC) under license number 237244, which is designated for Investment Advisory Licence Non-Forex activities, as well as license number 055 971 232, intended for Administration of Industry and Commerce-Register Non-Forex activities.

Moreover, it has been noted that the broker lacks trading software, posing further risks to traders. These alerts serve as a cautionary measure, urging individuals to exercise caution and stay vigilant when considering involvement with Alpha Trade.

In conclusion, Alpha Trade offers competitive advantages such as low spreads, responsive customer support, and accessible mobile trading.

However, the platform faces challenges such as a complex website interface, limited educational resources, and potential regulatory compliance risks. While its transparent fee structure and range of market instruments are appealing, traders should carefully consider the platform's limitations, such as the lack of comprehensive educational materials and complex website interface.

Q: What assets can I trade on Alpha Trade?

A: Alpha Trade offers trading opportunities in Forex, commodities, and digital assets.

Q: How can I contact customer support at Alpha Trade?

A: You can reach Alpha Trade's customer support via phone, email, or their Twitter account.

More

User comment

4

CommentsWrite a review

2024-01-18 18:05

2024-01-18 18:05

2023-02-28 14:08

2023-02-28 14:08