User Reviews

More

User comment

0

CommentsWrite a review

No comment yet

Score

5-10 years

5-10 yearsSuspicious Regulatory License

Global Business

High potential risk

Influence

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index7.40

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

| AKBANK Review Summary | |

| Founded | 1948 |

| Registered Country/Region | Turkey |

| Regulation | No regulation |

| Financial Services | Expat Banking, Multinational Banking, Affluent Banking, Private Banking |

| Trading Platform | Akbank Mobile |

| Customer Support | Tel: 444 25 25 |

AKBANK, founded in Turkey in 1948, operates as an unregulated company offering a variety of specialized banking services, including Expat, Multinational, Affluent, and Private Banking. The company provides a mobile trading platform for investments and has a long-standing online presence, although specific fee details are not readily available.

| Pros | Cons |

| Long-established presence | Lack of regulation |

| Wide range of banking services | Lack of specific fee details |

| Limited channels for customer support |

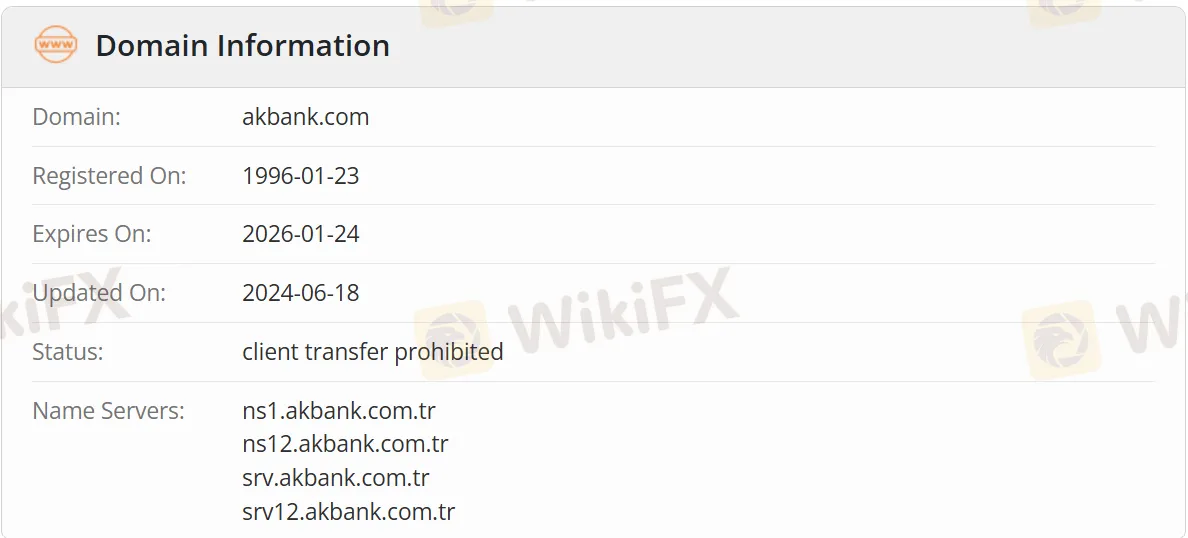

AKBANK is an unregulated broker. The WHOIS search shows the domain akbank.com was registered on January 23, 1996. Its present state is “client transfer prohibited,” which indicates the domain is locked and cannot be moved to another registrar. Please note the potential risks!

| Trading Platform | Supported | Available Devices | Suitable for |

| Akbank Mobile | ✔ | iOS, Android | Investors of all experience levels |

| MT4 | ❌ | / | Beginners |

| MT5 | ❌ | / | Experienced traders |

More

User comment

0

CommentsWrite a review

No comment yet

start to write first comment