User Reviews

More

User comment

2

CommentsWrite a review

2023-02-23 11:39

2023-02-23 11:39

2023-02-14 16:02

2023-02-14 16:02

Score

Influence

Add brokers

Comparison

Quantity 1

Exposure

Score

Regulatory Index0.00

Business Index7.37

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

Company Name

Nación Bursátil

Company Abbreviation

Nación Bursátil

Platform registered country and region

Argentina

Company website

Company summary

Pyramid scheme complaint

Expose

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

| Nación Bursátil Review Summary in 6 Points | |

| Founded | 1996 |

| Registered Country/Region | Argentina |

| Regulation | Not regulated |

| Products & Services | CEDEARs ETFs, Negotiable Obligations, Deferred Checks, Bonuses, Actions, Financial Trusts, Mutual Funds, Passes and Bonds, Financial Derivates, Futures, CEDEARs, Guaranteed Promissory Notes, ELECTRONIC CREDIT INVOICE |

| Trading Platforms | Homebroker |

| Customer Support | Phone, Address, Email, Contact us form |

Nación Bursátil is a global financial company based in Argentina. It provides traders with access to products and services including CEDEARs ETFs, Negotiable Obligations, Deferred Checks, Bonuses, Actions, Financial Trusts, Mutual Funds, Passes and Bonds, Financial Derivates, Futures, CEDEARs, Guaranteed Promissory Notes, ELECTRONIC CREDIT INVOICE. It is currently not regulated by any recognized financial authorities which may raise concerns when trading.

In the following article, we will analyze the characteristics of this financial company from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the company's characteristics at a glance.

| Pros | Cons |

| •Wide range of financial products and services | • Commissions and trading related fees charged |

| • Many years' industry experience | • Not regulated |

| • Limited info on deposit/withdrawal |

When considering the safety of a financial service company like Nación Bursátil or any other platform, it's important to conduct thorough research and consider various factors. Here are some steps you can take to assess the credibility and safety of a financial service company:

Regulatory sight: It is currently not regulated by any major financial authorities, which means that there is no guarantee that it is a safe platform to trade with.

User feedback: A report of fraud on WikiFX should be taken into consideration as potential red flags. It is recommended to conduct thorough research and due diligence before engaging with any financial company or investment platform.

Security measures: Nación Bursátil adheres to relevant regulatory requirements and industry best practices to maintain a high level of security. Compliance ensures that client investments are handled within the framework of established rules and regulations.

Ultimately, the decision of whether or not to trade with Nación Bursátil is a personal one. You should weigh the risks and benefits carefully before making a decision.

Nación Bursátil offers a wide array of products and services to its clients, catering to various investment and financial needs. Their offerings include:

CEDEARs (Certificados de Depósito Argentinos): These are certificates representing shares of foreign companies that trade on the Argentine stock exchange.

ETFs (Exchange-Traded Funds): ETFs are investment funds traded on stock exchanges, representing a diversified portfolio of assets.

Negotiable Obligations: Also known as bonds, these are debt securities issued by corporations or governments to raise capital.

Deferred Checks: Checks that are postdated to a future date for payment.

Bonuses: Financial instruments representing debt securities with fixed interest rates and maturity dates.

Actions: Referring to shares or stocks representing ownership in a company.

Financial Trusts: Investment vehicles that hold and manage assets on behalf of beneficiaries.

Mutual Funds: Investment funds that pool money from multiple investors to invest in a diversified portfolio.

Passes and Bonds: Securities issued by the government or corporations to raise funds with specific maturity dates and interest rates.

Financial Derivatives: Financial contracts with values based on underlying assets or benchmarks.

Futures: Financial contracts obliging the buyer to purchase an asset or the seller to sell an asset at a predetermined price and date.

Guaranteed Promissory Notes: Notes with an added layer of security provided by a third-party guarantee.

ELECTRONIC CREDIT INVOICE: Digital invoices used for electronic transactions and record-keeping.

With this diverse range of financial products and services, traders get accesses to investment opportunities, risk management tools, and access to capital markets.

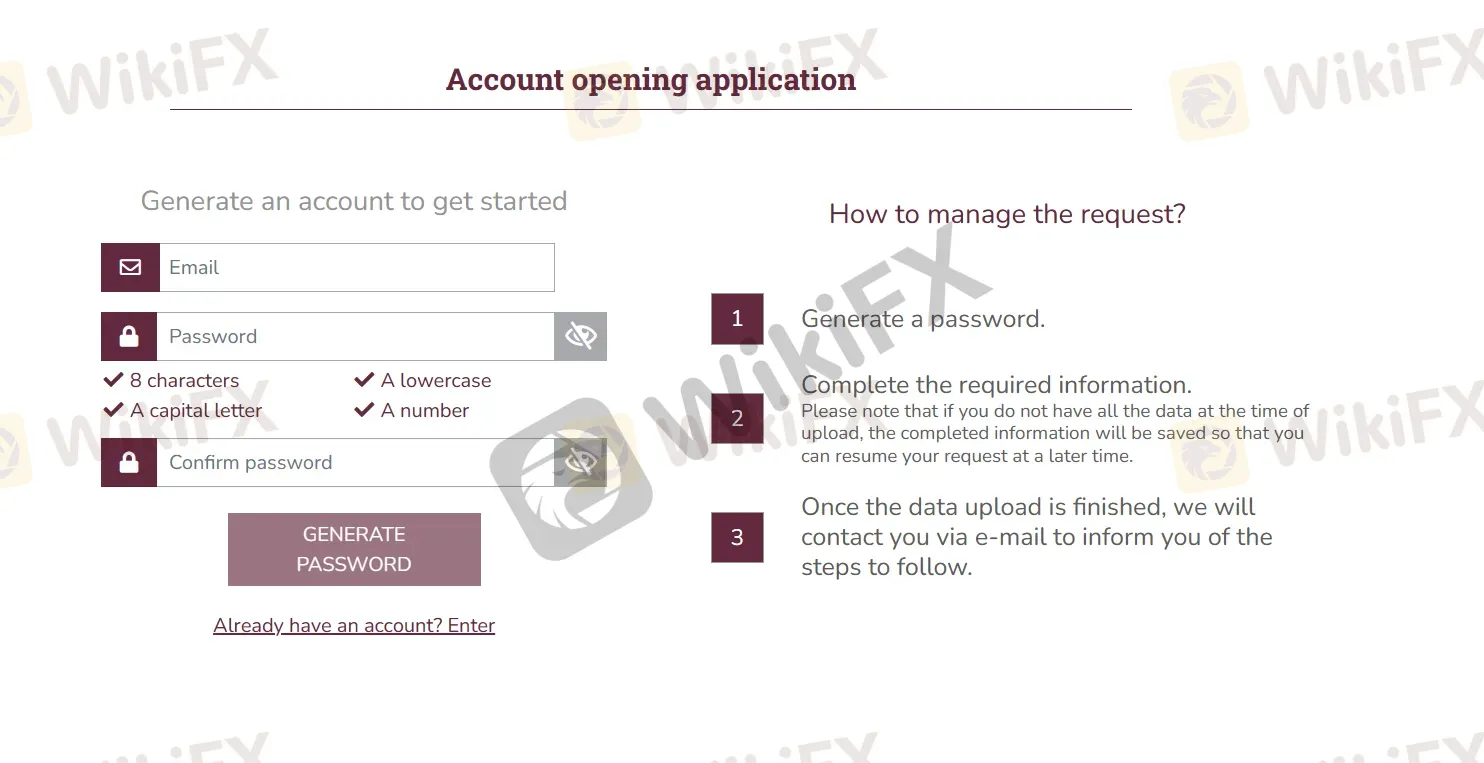

To begin the account registration process with Nación Bursátil, provide your email and generate a password to create your account credentials securely. You'll then be prompted to complete the required information. If you don't have all the necessary data at the time of upload, don't worry; the completed information will be saved, allowing you to resume your request at a later time.

Once you've finished uploading the data, Nación Bursátil will get in touch with you via email to inform you of the subsequent steps to follow, ensuring a seamless and personalized account setup process tailored to your needs and preferences.

However, requirement of a $65,000 (currency not specified) transfer when opening an account with Nación Bursátil is indeed notable. The company claims that this initial deposit is solely for the purpose of initiating the account opening process and will be fully credited to the client account. The deposited amount will be available for 100% use, giving traders the freedom to utilize it as they see fit in their trading activities. It is essential for potential traders to exercise due diligence and verify this information directly with Nación Bursátil to ensure accuracy and clarity.

Nación Bursátil offers its clients a user-friendly and accessible web-based trading platform named Homebroker, providing a convenient and seamless way to access financial markets and conduct trading activities. This web platform enables clients to trade a diverse range of financial instruments from the comfort of their web browser. Users can download the user manual from Nación Bursátils webpage for detailed instructions when the first time using the platform.

Orders can only be entered during market hours from 11 a.m. to 17 p.m through this platform but traders can view holdings and positions in the client account 24 hours a day.

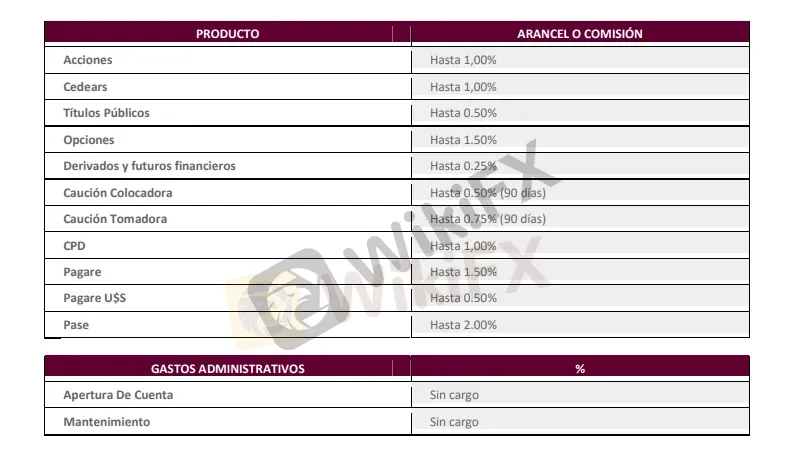

Nación Bursátil applies commissions and trading fees to its services, although the specific details of these charges vary according to different products and services. To obtain accurate and up-to-date information regarding commissions and related trading fees, clients are encouraged to visit the relevant page on Nación Bursátils website or directly consult with the company. By doing so, clients can obtain comprehensive details on the commission structure, any applicable fees, and any other trading costs associated with their specific investment activities.

https://nacionbursatil.com.ar/assets/pdf/aranceles.pdf

On our website, you can see that a report of fraud due to unable to withdraw. Traders are encouraged to carefully review the available information. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section, we would appreciate it and our team of experts will do everything possible to solve the problem for you.

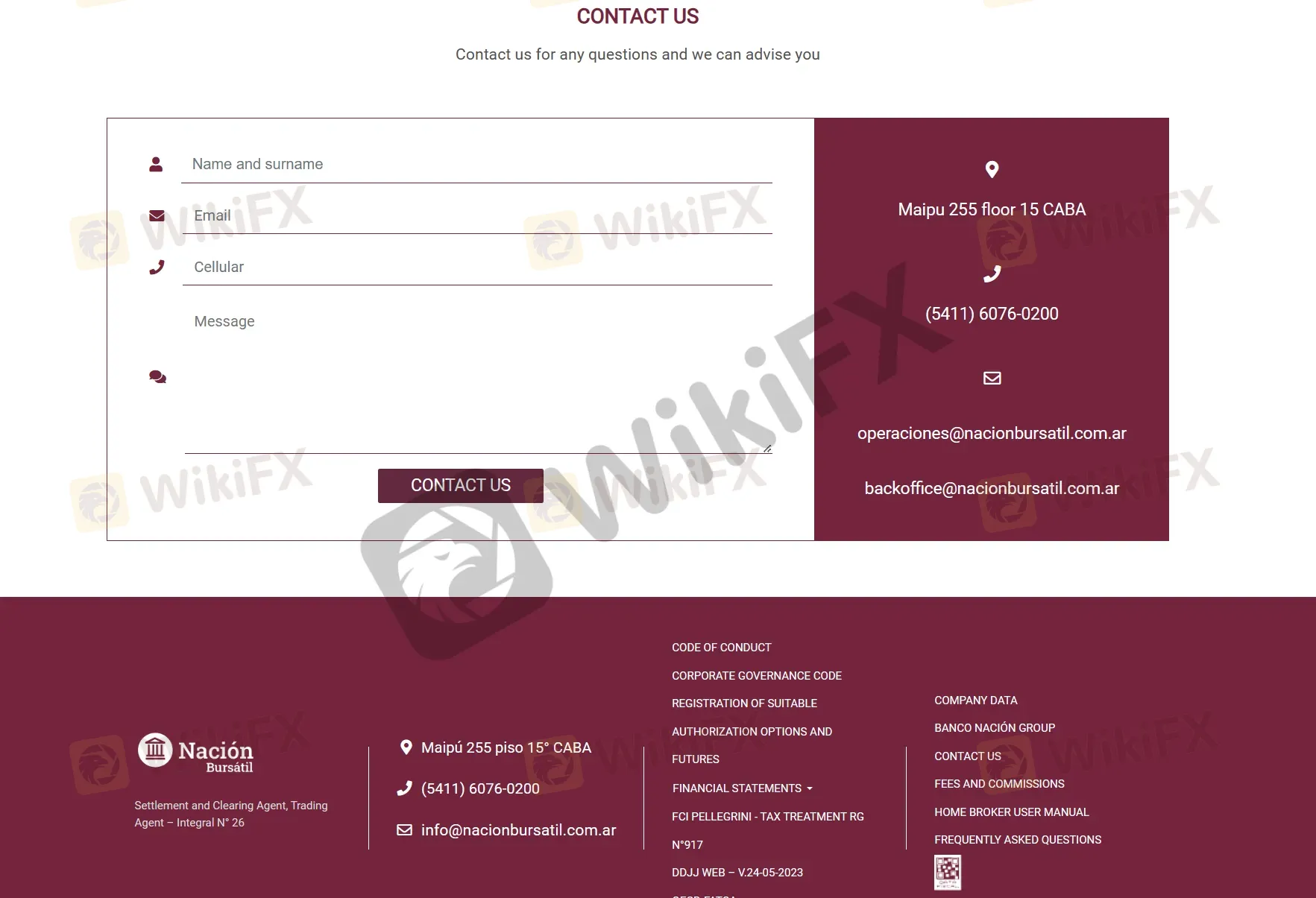

Nación Bursátil provides multiple customer service options to assist its clients. Customers can reach out to Nación Bursátil through various channels to address their queries and concerns as below:

Address: Settlement and Clearing Agent, Trading Agent – Integral N° 26

Tel: (5411) 6076-0200

Email: operaciones@nacionbursatil.com.ar; backoffice@nacionbursatil.com.ar; info@nacionbursatil.com.ar.

Besides of above, Nación Bursátil also offers a Contact Us form on their website. Customers can fill out this form with their queries, providing details about their specific needs or concerns.

According to available information, Nación Bursátil is a non-regulated Argentina -based financial service company. It provides traders with a comprehensive range of financial products and services including CEDEARs ETFs, Negotiable Obligations, Deferred Checks, Bonuses, Actions, Financial Trusts, Mutual Funds, Passes and Bonds, Financial Derivates, Futures, CEDEARs, Guaranteed Promissory Notes, ELECTRONIC CREDIT INVOICE. However, it is important to consider certain factors such as lack of regulations that may raise concerns, it is critical that potential clients exercise caution, conduct thorough research and seek up-to-date information directly from Nación Bursátil before making any investment decisions.

| Q 1: | Is Nación Bursátil regulated? |

| A 1: | No. It has been verified that this company currently has no valid regulation. |

| Q 2: | Is Nación Bursátil a good broker for beginners? |

| A2: | No. It is not a good choice for beginners. Not only because of its unregulated condition, but also because of a report of fraud on WikiFX. |

| Q 3: | Whats the products and services of Nación Bursátil? |

| A 3: | Nación Bursátil provides traders with a comprehensive range of financial products and services including CEDEARs ETFs, Negotiable Obligations, Deferred Checks, Bonuses, Actions, Financial Trusts, Mutual Funds, Passes and Bonds, Financial Derivates, Futures, CEDEARs, Guaranteed Promissory Notes, ELECTRONIC CREDIT INVOICE. |

More

User comment

2

CommentsWrite a review

2023-02-23 11:39

2023-02-23 11:39

2023-02-14 16:02

2023-02-14 16:02