User Reviews

More

User comment

3

CommentsWrite a review

2024-04-11 18:33

2024-04-11 18:33

2024-01-15 17:32

2024-01-15 17:32

Score

2-5 years

2-5 yearsSuspicious Regulatory License

cTrader

Suspicious Scope of Business

Suspicious Overrun

High potential risk

Influence

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index5.73

Risk Management Index0.00

Software Index7.02

License Index0.00

Single Core

1G

40G

More

Company Name

Demeterer Europe Ltd

Company Abbreviation

Swissco

Platform registered country and region

Cyprus

Company website

Company summary

Pyramid scheme complaint

Expose

| Swissco Review Summary | |

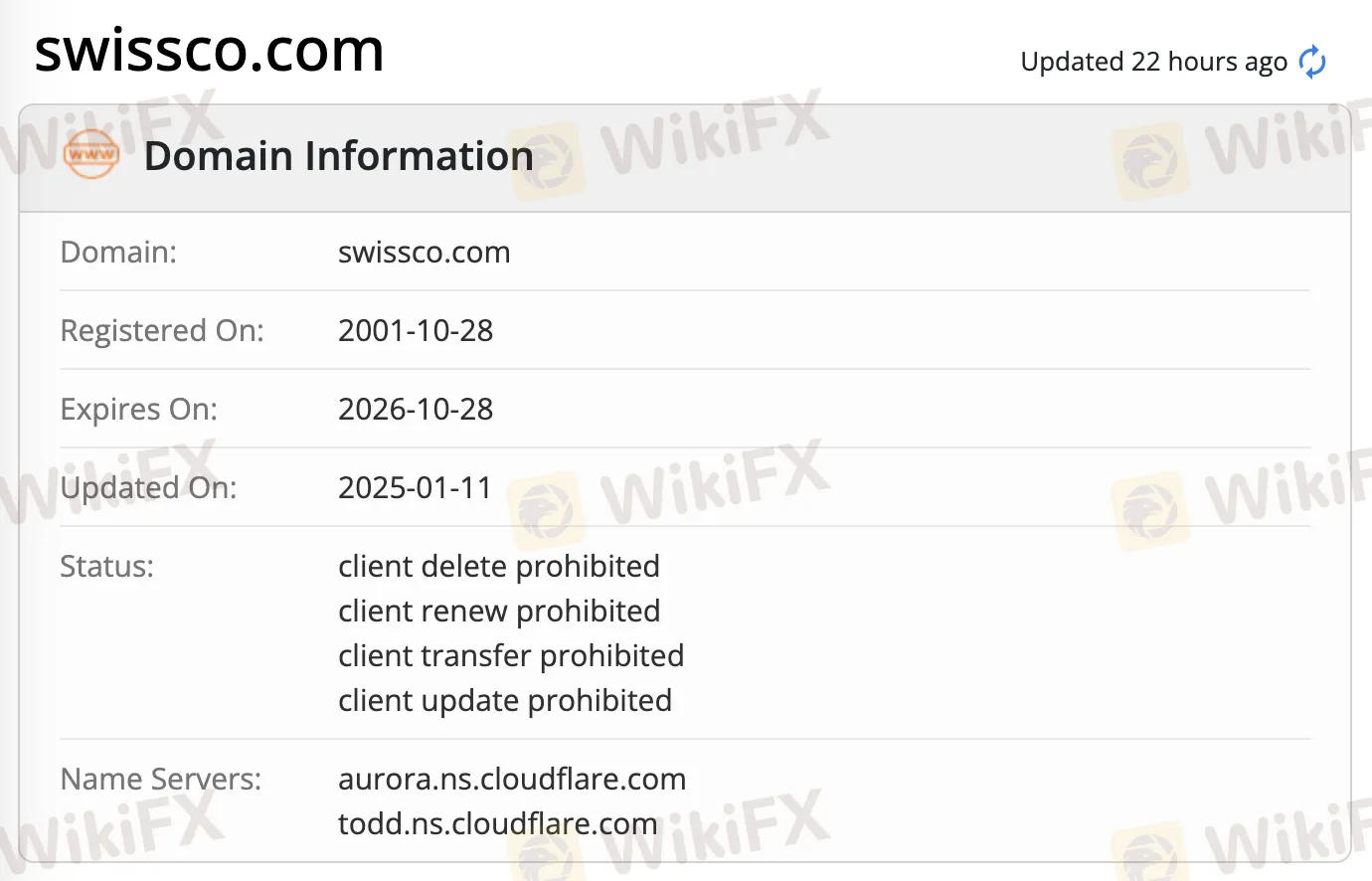

| Founded | 2001 |

| Registered Country/Region | Cyprus |

| Regulation | FSCA (Suspicious clone) |

| Market Instruments | Stocks, indices, commodities, forex, ctyptos |

| Demo Account | ✅ |

| Leverage | / |

| Spread | / |

| Trading Platform | WebTrader/cTrader/Mobile Trading |

| Minimum Deposit | / |

| Customer Support | Live chat, contact form |

| Email: support@swissco.com | |

| Regional Restrictions | US |

Swissco is a suspicious clone broker, offering trading on stocks, indices, commodities, forex and ctyptos with demo accounts on WebTrader/CTrader/Mobile Trading platforms.

| Pros | Cons |

| Various trading instruments | Suspicious clone FSCA license |

| Demo accounts | No MT4/MT5 platforms |

| cTrader platform | US clients are not allowed |

| Commission fees charged |

Swissco is licensed by FSCA to offer services, but suspicious clone. Please be aware of the risk!

| Regulated Country | Regulator | Current Status | Regulated Entity | License Type | License No. |

| Financial Sector Conduct Authority (FSCA) | Suspicious Clone | DEMETERER (PTY) LTD | Financial Service Corporate | 50354 |

Swissco offers trading on stocks, indices, commodities, forex and ctyptos.

| Tradable Instruments | Supported |

| Stocks | ✔ |

| Indices | ✔ |

| Commodities | ✔ |

| Forex | ✔ |

| Cryptos | ✔ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

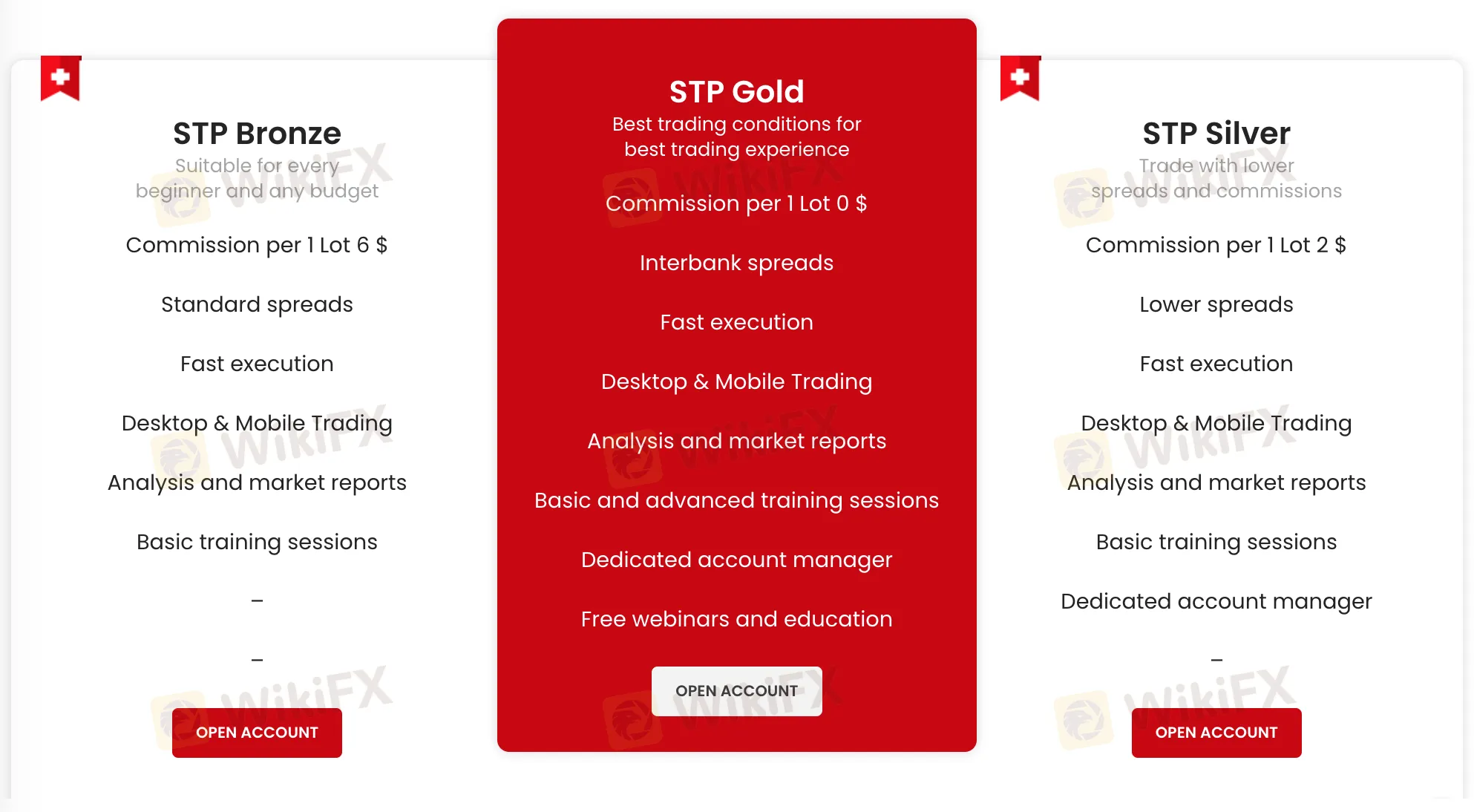

Here are three account types Swissco offers: STP Bronze, STP Gold, and STP Silver. But the minimum deposit requirements are not specified.

| Account Type | Commissions |

| STP Bronze | $6/lot |

| STP Gold | ❌ |

| STP Silver | $2/lot |

More detailed info can be found via https://swissco.com/account-types-3/

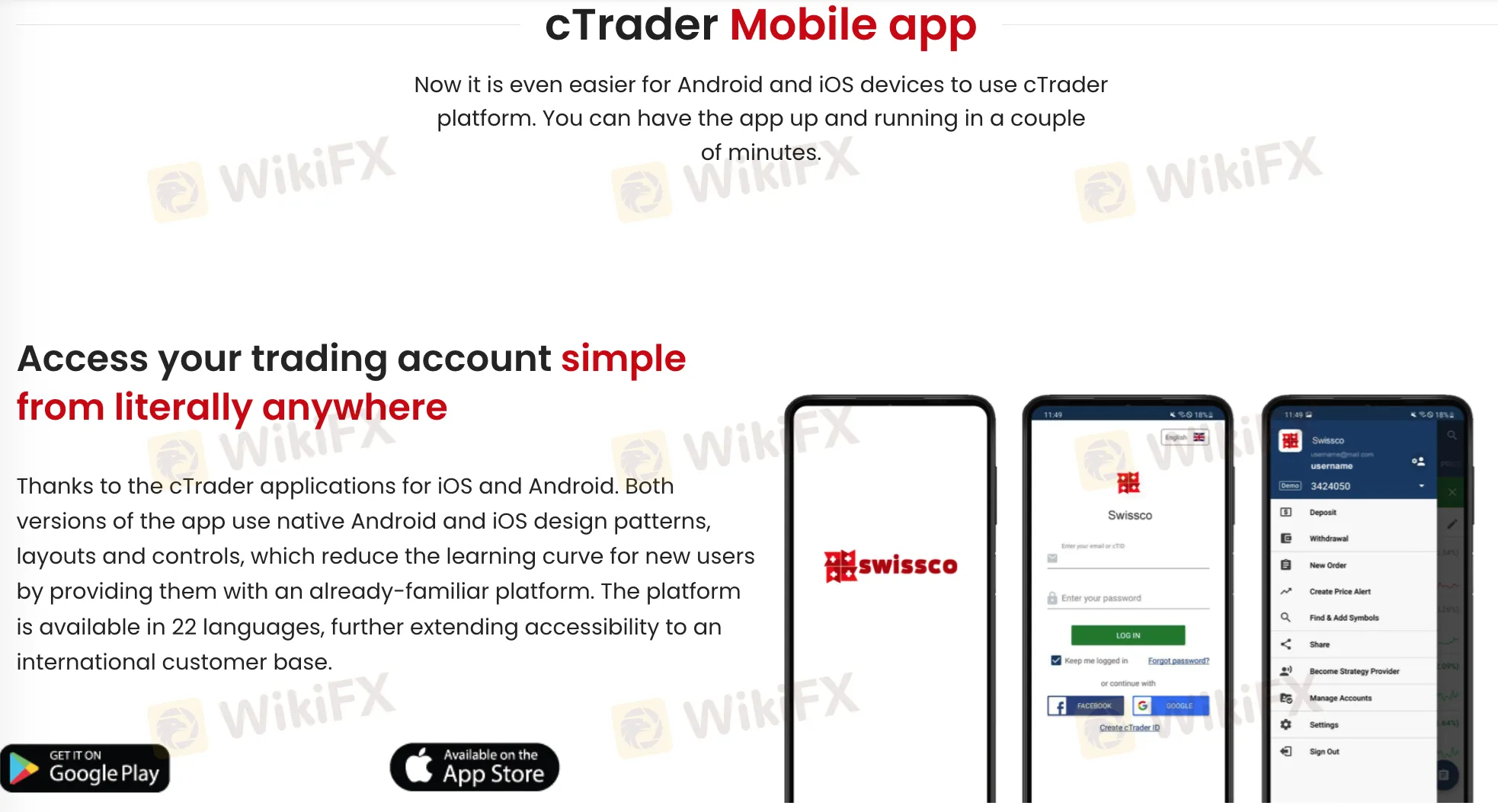

| Trading Platform | Supported | Available Devices | Suitable for |

| WebTrader | ✔ | iOS, Android | / |

| cTrader | ✔ | Desktop, mobile, iPad | / |

| Mobile Trading | ✔ | iOS, Android | / |

| MT4 | ❌ | / | Beginners |

| MT5 | ❌ | / | Experienced traders |

Swissco accepts payments via MasterCard, Maestro, VISA, Skrill, Neteller, Verisign, etc.

No minimum deposit or withdrawal amount defined and no fees or charges specified.

More

User comment

3

CommentsWrite a review

2024-04-11 18:33

2024-04-11 18:33

2024-01-15 17:32

2024-01-15 17:32