User Reviews

More

User comment

3

CommentsWrite a review

2022-11-27 09:56

2022-11-27 09:56

2022-11-24 10:01

2022-11-24 10:01

Score

5-10 years

5-10 yearsRegulated in Vanuatu

Retail Forex License

Suspicious Scope of Business

Australia Common Business Registration Revoked

Suspicious Overrun

Medium potential risk

Offshore Regulated

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index3.05

Business Index7.46

Risk Management Index7.38

Software Index4.00

License Index3.05

Single Core

1G

40G

More

Company Name

Market Equity Inc

Company Abbreviation

Market Equity

Platform registered country and region

Vanuatu

Company website

X

YouTube

Company summary

Pyramid scheme complaint

Expose

| Aspect | Information |

| Company Name | Market Equity |

| Registered Country/Area | Vanuatu |

| Years | 5-10 years |

| Regulation | Regulated by VFSC |

| Market Instruments | Commodities, Forex, Futures, Indicators, Shares, Contract Specifications, SWAPs Rate, Futures Expiry, Holidays, CFD's, and Market Equity Card |

| Account Types | ECN Account, Money Back Account, and Scalping Account |

| Minimum Deposit | $100 |

| Maximum Leverage | 1: 500 |

| Spreads | From 0.0 |

| Trading Platforms | MT5 platform |

| Demo Account | Yes |

| Customer Support | Phone: +44 1 444 36 4444, Email: cs@marketequityinc.com, and Ticket |

| Deposit & Withdrawal | VISA, MasterCard, Union Pay, K-net, Skrill, Neteller, SticPay and fasapay. |

| Educational Resources | Learning Videos, Glossary, Technical Analysis, and Articles |

Market Equity, with 5-10 years of experience, is a registered company in Vanuatu regulated by VFSC.

It offers market instruments, including Forex, Commodities, and CFDs, with account options like ECN, Money Back, and Scalping. A minimum deposit of $100 and a maximum leverage of 1:500 provide accessibility.

The MT5 platform, with spreads starting from 0.0, is user-friendly. Traders can practice with a demo account. Customer support via phone, email, and a ticket system is available.

Deposits and withdrawals are facilitated through various methods like VISA, MasterCard, and Skrill. Educational resources include learning videos and articles to support traders' understanding of the market.

Market Equity is regulated by the Vanuatu Financial Services Commission (VFSC), holding an offshore regulatory status. The company operates under a retail forex license, with License No: 40221. Market Equity Inc. is the licensed institution, and the regulatory status has been effective since April 4, 2020.

This regulatory oversight ensures that Market Equity complies with the standards and requirements set by the VFSC, providing a level of confidence and accountability for traders using their services.

| Pros | Cons |

| Comprehensive Market Instruments | Offshore Regulatory Status |

| High Maximum Leverage | Inadequate Platform Diversity |

| Competitive Spreads | Overwhelming Inclusion of SWAPs and Expiry Rates |

| Multi-Channel Customer Support | Single Currency Support |

| Regulated by VFSC | / |

Pros:

Comprehensive Market Instruments: Market Equity offers a wide range of market instruments, including Commodities, Forex, Futures, Shares, and more, providing traders with options to suit their preferences.

High Maximum Leverage: The platform's high maximum leverage of 1:500 allows traders to amplify their positions, potentially increasing profits.

Competitive Spreads: Market Equity provides competitive spreads starting from 0.0, contributing to a favourable trading environment for users aiming for cost-effective trading.

Multi-Channel Customer Support: The platform offers various customer support channels, including phone, email, and a ticket system, ensuring that traders can access assistance through their preferred communication method.

Regulated by VFSC: Market Equity is regulated by the Vanuatu Financial Services Commission (VFSC), providing a level of oversight and accountability to ensure fair and transparent trading practices.

Cons:

Offshore Regulatory Status: Being regulated offshore may pose a conundrum for traders who value regulatory environments with more stringent oversight.

Inadequate Platform Diversity: The platform exclusively utilizes the MT5 trading platform. While MT5 is a popular and robust platform, some traders may prefer access to multiple trading platforms for a more customized trading experience.

Overwhelming Inclusion of SWAPs and Expiry Rates: While providing information on SWAPs and expiry rates can be beneficial, some traders may find it overwhelming or unnecessary for their trading strategy. A more streamlined approach to presenting this data could improve user experience.

Single Currency Support: Market Equity's limitation to support only the USD for payments may be a drawback for traders who prefer or predominantly use other currencies.

Commodities: Market Equity provides access to a variety of commodities, allowing traders to engage in the buying and selling of physical goods such as gold, silver, oil, and agricultural products.

Forex: The platform facilitates Forex trading, enabling users to participate in the foreign exchange market and trade currency pairs, taking advantage of fluctuations in exchange rates.

Futures: Market Equity offers futures trading, allowing traders to speculate on the future value of financial instruments such as commodities, indices, or currencies.

Indicators: Traders can utilize various technical indicators provided by Market Equity to analyze market trends and make informed trading decisions.

Shares: The platform allows trading in shares, enabling users to invest in individual stocks of publicly traded companies.

Contract Specifications: Market Equity provides detailed contract specifications, outlining the terms and conditions of trading various financial instruments, helping traders make well-informed decisions.

SWAPs Rate: Users can engage in SWAP transactions, with Market Equity providing information on SWAP rates, allowing traders to manage their positions overnight.

Futures Expiry: Market Equity keeps traders informed about futures expiry dates, helping them manage their positions effectively.

Holidays: The platform considers market holidays, ensuring traders are aware of non-trading days and can plan their activities accordingly.

CFDs (Contracts for Difference): Market Equity facilitates CFD trading, allowing users to speculate on the price movements of various financial instruments without owning the underlying assets.

Market Equity Card: Traders can benefit from the Market Equity Card, a unique feature that likely serves as a personalized tool for managing transactions, accessing special features, or enhancing the overall trading experience on the platform.

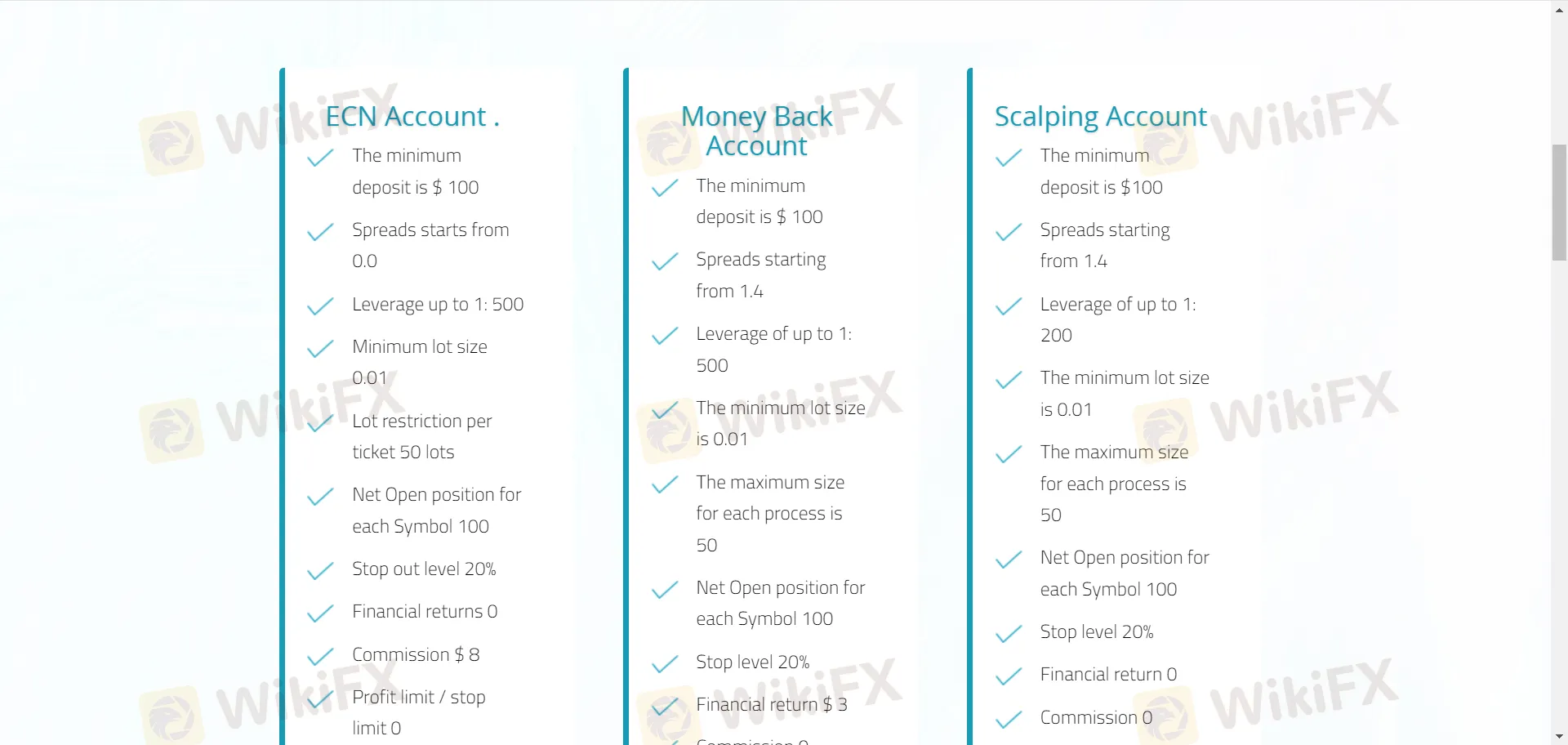

Market Equity offers three account types tailored to different trading styles:

ECN Account: Ideal for experienced traders seeking tight spreads (from 0 pips) and leverage up to 1:500. It charges a commission of $8 per trade and allows hedging and expert advisors.

Money Back Account: Suits value-oriented traders, offering spreads from 1.4 pips, leverage up to 1:500, and a $3 rebate per trade. However, scalping is not allowed.

Scalping Account: Designed for fast-paced trading with spreads from 1.4 pips and leverage up to 1:200. While it permits scalping and expert advisors, it lacks the commission-free structure and higher leverage of the other options.

All accounts share a $100 minimum deposit, no profit/stop limit restrictions, free swap, and the MT5 platform in USD currency.

| Feature | ECN Account | Money Back Account | Scalping Account |

| Minimum Deposit | $100 | $100 | $100 |

| Spreads (from) | 0 | 1.4 | 1.4 |

| Leverage | Up to 1:500 | Up to 1:500 | Up to 1:200 |

| Minimum Lot Size | 0.01 | 0.01 | 0.01 |

| Max Lot Size per Ticket | 50 | 50 | 50 |

| Max Open Positions per Symbol | 100 | 100 | 100 |

| Stop Out Level | 20% | 20% | 20% |

| Financial Returns | $0 | $3 | $0 |

| Commission | $8 | $0 | $0 |

| Profit/Stop Limit | No Limit | No Limit | No Limit |

| Hedging | Allowed | Allowed | No |

| Scalping | Yes | No | Yes |

| Expert Advisors | Yes | Yes | Yes |

| Swap Free | Yes | Yes | Yes |

| Trading Platform | MT5 | MT5 | MT5 |

| Account Currency | USD | USD | USD |

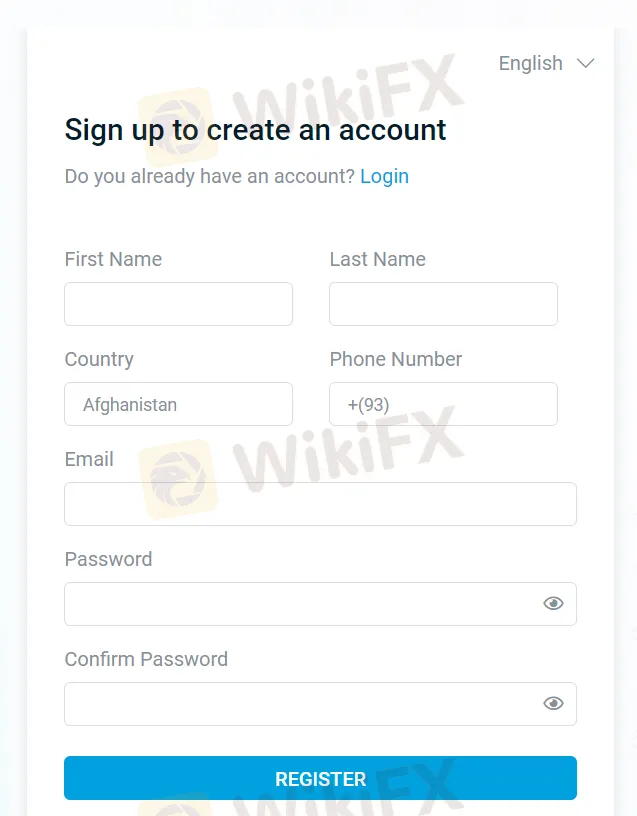

Opening an account with Market Equity is a straightforward process that can be completed online in a matter of minutes. Here's a breakdown of the steps involved:

Visit the Market Equity website and click “Open Live Account.”

Fill out the online application form: The form will request your personal information Be sure to have your identification documents (passport or ID card) and proof of address handy for uploading.

Fund your account: Market Equity offers various deposit methods, including bank transfers, credit/debit cards, and e-wallets. Choose your preferred method and follow the instructions to complete the deposit.

Verify your account: Once your account is funded, you'll need to verify your identity and address. This typically involves submitting scanned copies of your ID documents and proof of address.

Start trading: Once your account is verified, you're ready to explore the Market Equity trading platform and start making trades.

The Maximum Leverage of 1:500 offered by Market Equity is a notable feature that provides traders with enhanced flexibility and potential for maximizing their trading positions.

Leverage allows traders to control a larger position size with a relatively smaller amount of capital. In the case of 1:500 leverage, a trader can control a position size 500 times the amount of their initial investment.

Market Equity provides the MetaTrader 5 (MT5) trading platform, offering a user-friendly and feature-packed experience. With MT5, traders can easily place buy/sell orders, view up to 100 charts simultaneously, and execute trades with just one click. The platform supports electronic trading for quick order execution and displays real-time market prices.

MT5 allows hedging, enabling traders to open multiple positions on the same instrument. It also includes advanced features for automated trading strategies. Users can stay updated with real-time buy/sell prices and leverage professional technical analysis through MQL5. The platform is accessible on both MAC and Windows operating systems for online trading and is compatible with mobile devices running on iOS and Android.

As offered by Market Equity, VISA and Mastercard both incur a 3% fee, with a minimum deposit of USD 100, exclusively in USD. K-net imposes a charge of 500 fils per transaction, requiring a minimum deposit of 20 KWD. SticPay and UnionPay each have a 3% and 2% fee, respectively, with a minimum deposit of USD 100 in USD. Skrill and Neteller vary in their fee structures, ranging between 4-5%, and both necessitate a minimum deposit of USD 100 in USD. Fasapay applies a 0.50% fee, and while the minimum deposit is unspecified, transactions are conducted exclusively in USD.

| Payment Method | Fee Structure | Minimum Deposit | Currency |

| VISA | 3% | $100 USD | USD |

| Mastercard | 3% | $100 USD | USD |

| K-net | 500 fils per transaction | 20 KWD | N/A |

| SticPay | 3% | $100 USD | USD |

| Skrill | 4-5% | $100 USD | USD |

| Neteller | 4-5% | $100 USD | USD |

| Fasapay | 0.50% | N/A | USD |

| UnionPay | 2% | $100 USD | USD |

Market Equity provides a comprehensive customer support system, offering multiple channels for assistance:

Phone: +44 1 444 36 4444 Traders can reach out to Market Equity's customer support team directly via phone. This immediate and direct communication channel allows for real-time assistance, making it suitable for urgent queries or concerns.

Email: cs@marketequityinc.comFor a more detailed or written inquiry, traders can utilize the email support provided by Market Equity. This allows users to communicate their questions or issues in a written format, receiving responses that may include more comprehensive information.

Ticket System: Market Equity employs a ticket system as another avenue for customer support. Traders can submit tickets outlining their concerns or inquiries, and the support team will respond accordingly. This system often ensures a systematic and organized approach to addressing customer queries.

Market Equity prioritizes trader education by offering a range of comprehensive resources:

Learning Videos: Market Equity provides learning videos, offering visual and interactive content to help traders understand various aspects of the financial markets. These videos cover topics such as trading strategies, market analysis, and platform tutorials, providing a dynamic learning experience.

Glossary: To assist traders in navigating financial jargon, Market Equity includes a glossary. This resource defines and explains key terms and concepts commonly used in the trading industry, ensuring that traders have a solid understanding of the terminology.

Technical Analysis: Market Equity equips traders with technical analysis tools, empowering them to evaluate price charts, identify patterns, and make informed decisions based on market trends. Technical analysis resources help traders develop analytical skills crucial for successful trading.

Articles: The platform features articles covering a wide range of topics related to trading, market trends, and financial strategies. These written resources provide in-depth insights, analysis, and commentary, contributing to traders' knowledge and helping them stay informed about market developments.

Market Equity comes with both positives and drawbacks. On the positive side, it offers a wide range of market instruments, and multi-channel customer support, and regulation by VFSC adds to a supportive trading environment.

However, there are concerns. The platform lacks diversity in trading platforms, and the inclusion of SWAPs and expiry rates may be overwhelming. Additionally, supporting only USD for payments might be limiting for traders using other currencies.

Traders should carefully consider these factors based on their preferences and needs before deciding if Market Equity aligns with their trading objectives.

Q: What are the documents required to open an individual account?

A: To open a live individual account, you will need to submit 2 copies of valid identification documents (national ID card, driving license or passport) and a copy of a valid proof of address showing your full name and address with an issue date of no more than 3 months.

Q: What types of documents does Market Equity require as proof of address?

A: In some cases, Market Equity asks for documents such as a utility bill, a local government address registration certificate or a bank statement issued in less than 6 months.

Q: How to be an Affiliate partner?

A: To be the Affiliate you only need to have a website or a social media account with a high number of followers.

Q: What is an Introducing Broker?

A: The Introducing Broker or the “IB” is an Agent who tries to get new clients to open accounts within Market Equity and get the commission in return.

Q: How long does it take for a withdrawal to be processed?

A: The timing of withdrawal process can take between one to two working days before the amount will be deposited into your bank account.

Q: Does your company provide the VPS server?

A: Yes, the VPS (Virtual private server) can be directly used through Meta quotes on your Meta Trader 5 platform.

More

User comment

3

CommentsWrite a review

2022-11-27 09:56

2022-11-27 09:56

2022-11-24 10:01

2022-11-24 10:01