User Reviews

More

User comment

1

CommentsWrite a review

2024-02-29 14:41

2024-02-29 14:41

Score

5-10 years

5-10 yearsSuspicious Regulatory License

High potential risk

Influence

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index7.49

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

Company Name

Cobra Trading, Inc

Company Abbreviation

COBRA TRADING

Platform registered country and region

United States

Company website

X

YouTube

Company summary

Pyramid scheme complaint

Expose

| Cobra Review Summary | |

| Founded | 2003 |

| Registered Country/Region | United States |

| Regulation | NFA (Unverified) |

| Trading Products | Equities, Options |

| Demo Account | ✅ |

| Trading Platform | DAS Trader Pro, Sterling Trader Pro, TradingView |

| Minimum Deposit | $30,000 |

| Customer Support | Phone: 877-792-6272 |

| Email: info@cobratrading.com | |

| Address: 3008 E. Hebron Pkwy Building 400 Carrollton, TX 75010 | |

Founded in 2023, Cobra is an online broker founded in the United States, focusing on equities and options trading. The minimum deposit is as high as $30,000. Cobra provides multiple platform choices, including DAS Trader Pro, Sterling Trader Pro, and TradingView.

| Pros | Cons |

| Various trading products | Unverified regulation |

| Demo accounts available | High minimum deposit |

| Multiple platform choices | Limited payment methods |

No. Cobra currently only holds an unverified NFA license. Please be aware of the risk!

| Regulatory Status | Unverified |

| Regulated by | National Futures Association (NFA) |

| Licensed Institution | Cobra Trading, Inc |

| Licensed Type | Common Financial Service License |

| Licensed Number | 0402075 |

Cobra offers trading on equities and options.

| Trading Products | Supported |

| Equities | ✔ |

| Options | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Indices | ❌ |

| Cryptos | ❌ |

| Bonds | ❌ |

| ETFs | ❌ |

| Futures | ❌ |

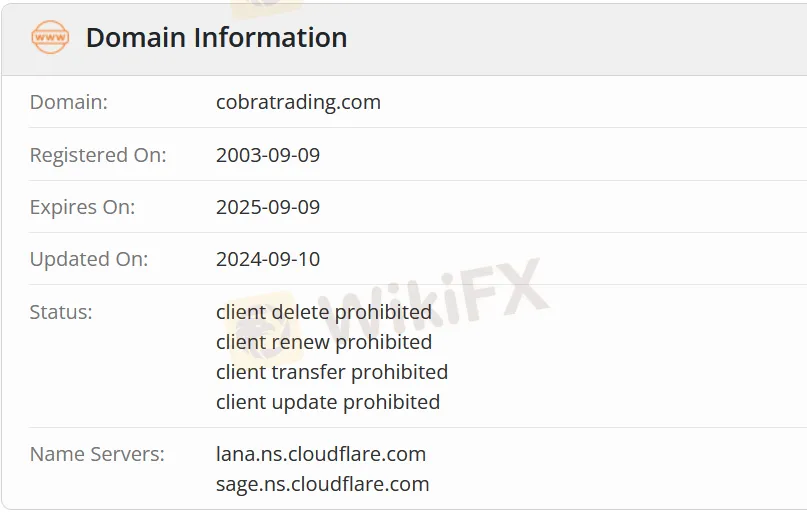

| Trading Products | Rates |

| Equities | From $0.0015 |

| Options | From $0.30 |

| Trading Platform | Supported | Available Devices |

| DAS Trader Pro | ✔ | Desktop |

| Sterling Trader Pro | ✔ | Desktop |

| TradingView | ✔ | Desktop |

Based on the limited information available on their website, we found that Cobra accepts payments via check, wire and ACH transfer.

More

User comment

1

CommentsWrite a review

2024-02-29 14:41

2024-02-29 14:41