User Reviews

More

User comment

1

CommentsWrite a review

2023-03-03 18:36

2023-03-03 18:36

Score

2-5 years

2-5 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index6.57

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

| SenderFX | Basic Information |

| Company Name | SenderFX |

| Founded | 2022 |

| Headquarters | Iraq |

| Regulations | Unregulated |

| Tradable Assets | Indices, Futures, Bonds, Forex |

| Account Types | Standard Account |

| Minimum Deposit | Not specified |

| Maximum Leverage | 1:300 |

| Spreads | Not specified |

| Commission | Not specified |

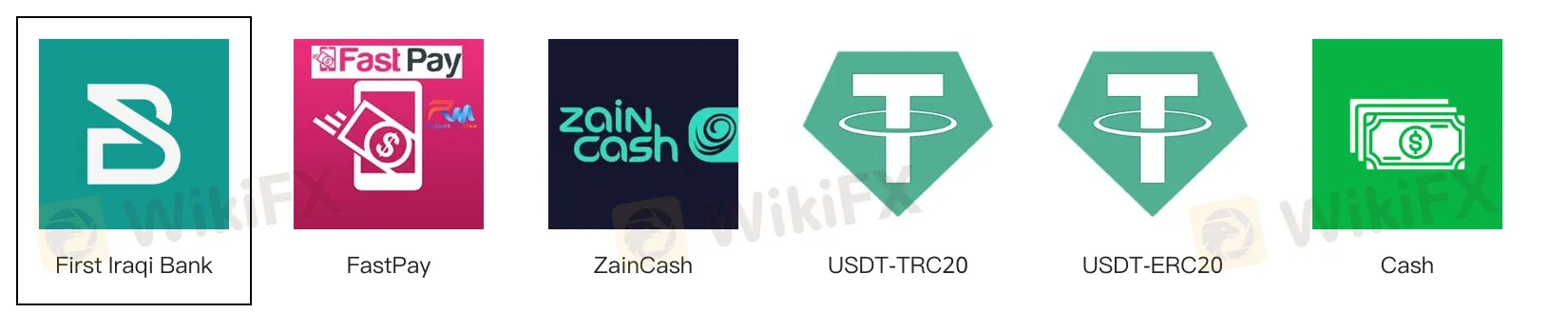

| Deposit Methods | First Iraqi Bank, FastPay, ZainCash, USDT-TRC20, USDT-ERC20, Cash |

| Trading Platforms | MT5, Android, iOS, Web Terminal |

| Customer Support | Email, Phone, Live Chat |

| Education Resources | Video Tutorials |

| Bonus Offerings | None |

SenderFX is a brokerage firm that offers a wide range of trading instruments, including indices, futures, bonds, and forex. Founded in 2022 and headquartered in Iraq, SenderFX aims to provide traders with access to global financial markets and diverse investment opportunities. The company offers a standard trading account with flexible leverage options ranging from 1:2 to 1:300, allowing traders to tailor their positions according to their risk appetite.

While SenderFX provides the popular MetaTrader 5 platform for trading, the lack of regulatory oversight is a significant concern. Traders should be aware of the potential risks associated with trading with an unregulated broker, including the absence of fund protection and limited avenues for dispute resolution.

In terms of educational resources, SenderFX offers video tutorials that cover various aspects of trading and financial markets. These resources are designed to cater to traders of all experience levels, providing valuable insights and knowledge to enhance trading skills.

Overall, SenderFX presents traders with a range of tradable assets, flexible leverage options, and educational resources. However, it is important for traders to carefully consider the risks associated with an unregulated broker before engaging in trading activities with SenderFX.

SenderFX is not regulated by any recognized financial authority. This means that the broker operates without the oversight and supervision that regulation provides. Trading with an unregulated broker like SenderFX exposes traders to significant risks, as there are no guarantees regarding the safety of funds, fair trading practices, or proper handling of client complaints. Regulated brokers, on the other hand, are subject to strict regulations and are required to adhere to certain standards and guidelines to protect the interests of their clients. It is generally advisable to choose a regulated broker to ensure a higher level of security and accountability in the trading process.

SenderFX offers a diverse range of tradable assets, including indices, futures, bonds, and forex, providing ample opportunities for traders to diversify their portfolios. The flexible leverage options of up to 1:300 offer traders the choice to adjust their trading positions according to their risk appetite. The availability of the popular MetaTrader 5 platform on multiple devices ensures a seamless and feature-rich trading experience. Additionally, the educational resources in the form of video tutorials cater to traders of all experience levels, enhancing their knowledge and skills in financial markets. However, a significant drawback is the lack of regulatory oversight, which exposes traders to potential risks concerning fund safety, fair trading practices, and dispute resolution. The absence of specific information on spreads and commissions creates uncertainty for traders regarding their overall trading costs. Furthermore, the website does not provide clear details on the minimum deposit requirement, causing inconvenience for potential clients seeking to start trading with the broker.

| Pros | Cons |

| Diverse range of tradable assets | Lack of regulatory oversight |

| Flexible leverage options | Uncertainty regarding spreads and commissions |

| Availability of MetaTrader 5 | Lack of specific information on minimum deposit |

| Educational video resources | |

| Multiple customer support options |

SenderFX offers a diverse range of trading instruments to meet the needs of different investors. Traders can choose from indices, futures, bonds, and forex to diversify their portfolios and capitalize on different market opportunities.

1. Indices: Traders can access various stock market indices, such as the S&P 500, US 100, Dow 30, Nikkei 225, and DAX Index. These indices represent the performance of specific stock markets and provide opportunities for investors to speculate on the overall market movements.

2. Futures: SenderFX provides access to futures contracts on assets like the S&P 500, Euro, Gold, Crude Oil, Natural Gas, and Corn. Futures trading allows traders to speculate on the future price movements of these assets, providing potential opportunities for hedging and speculation.

3. Bonds: Investors can trade Eurodollar, T-Bond, Ultra T-Bond, Euro Bund, Euro BTP, and Euro BOBL bonds. Bonds are debt securities issued by governments and corporations, offering a more stable investment option with regular interest payments.

4. Forex: The forex market offers currency pairs like EUR/USD, GBP/USD, USD/JPY, USD/CHF, AUD/USD, and USD/CAD. Forex trading involves buying and selling currencies, allowing traders to take advantage of exchange rate fluctuations.

Here is a comparison table of trading instruments offered by different brokers:

| Broker | SenderFX | OANDA | Forex.com | Webull |

| Forex | Yes | Yes | Yes | Yes |

| Indexes | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | No |

| Crypto | Yes | Yes | Yes | Yes |

| CFD | No | No | Yes | No |

| Commodities | Yes | Yes | Yes | No |

| Silver | No | Yes | Yes | No |

| Oil | Yes | No | Yes | No |

| Futures | Yes | No | Yes | No |

| Options | No | No | Yes | Yes |

| ETFs | No | No | No | Yes |

| Bonds | Yes | Yes | No | No |

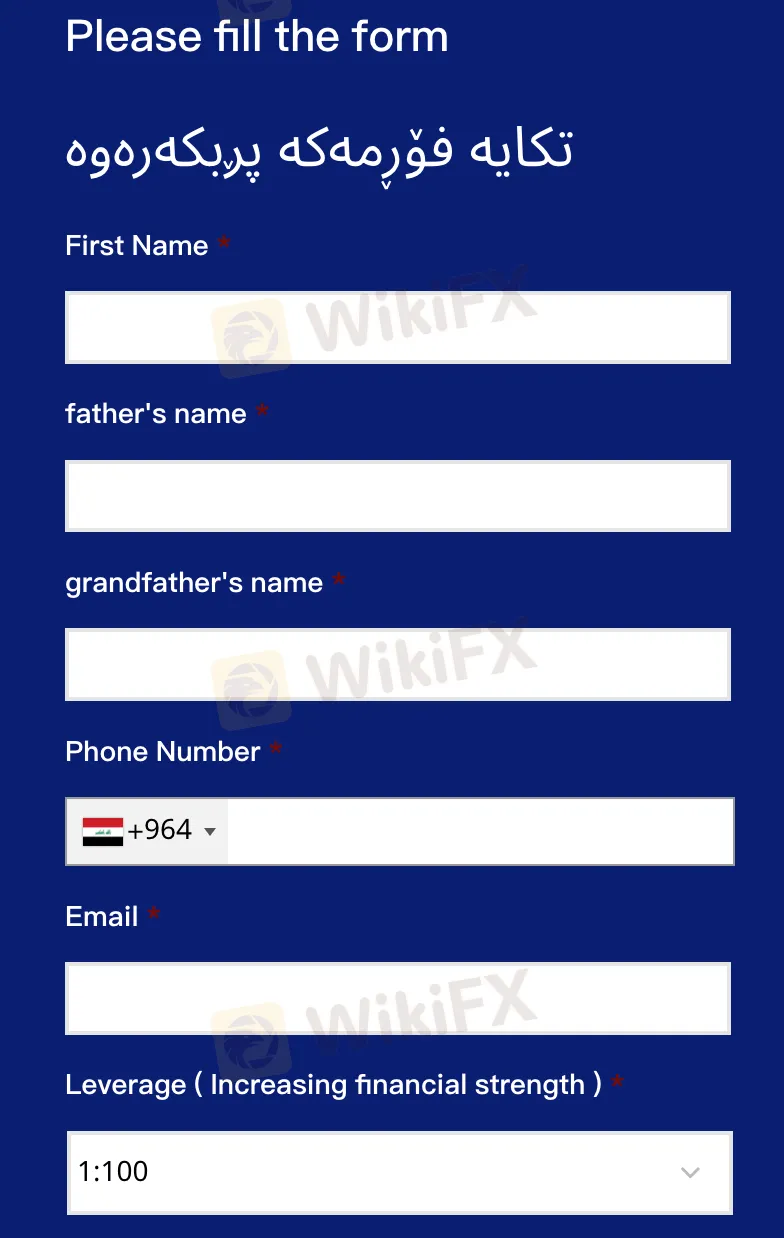

SenderFX offers a standard account type for its clients.However, it's important to note that trading CFDs (Contracts for Difference) involves a high level of risk, and there is a possibility of losing money rapidly due to the leverage offered in the standard account, which is 1:100. The standard account is likely to provide access to a wide range of trading instruments and features, but it's crucial for traders to exercise prudent risk management and have a clear understanding of the market conditions and their individual risk tolerance before engaging in CFD trading. It's advisable for potential clients to thoroughly review and understand the terms and conditions of the standard account before proceeding with trading activities on SenderFX's platform.

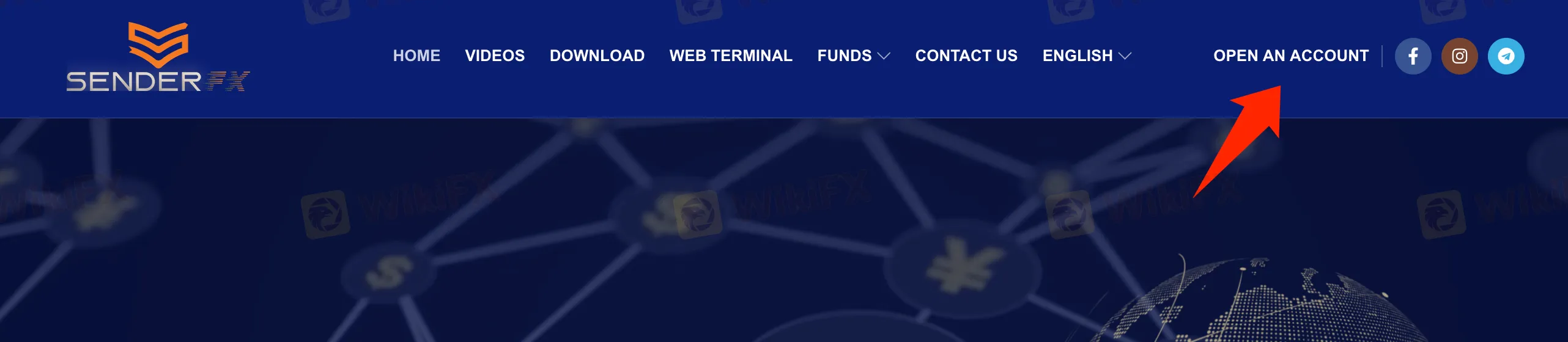

To open an account with SenderFX, follow these steps. However, it's essential to keep in mind that SenderFX is an unregulated broker. Trading with unregulated brokers carries inherent risks, including potential scams or fraudulent practices. As such, it is crucial to exercise extreme caution and conduct thorough research before deciding to trade with SenderFX. Potential traders should be aware of the risks involved and consider seeking advice from trusted sources before opening an account with an unregulated broker.

Visit the SenderFX website. Look for the “OPEN AN ACCOUNT” button on the homepage and click on it.

Sign up on websites registration page.

3.Receive your personal account login from an automated email

4.Log in

5.Proceed to deposit funds to your account

6.Download the platform and start trading

You can watch the video to learn more details about opening an account with SenderFX:

SenderFX offers a flexible leverage range for its clients, allowing them to choose the level of leverage that suits their trading preferences and risk appetite. The leverage offered by SenderFX ranges from 1:2 to 1:300. Leverage allows traders to control larger positions in the market with a relatively smaller amount of capital. For example, with a leverage of 1:100, a trader can control a position worth $10,000 with a deposit of only $100.

While leverage can amplify potential returns, it also increases the risk of losses, especially in volatile market conditions. Therefore, it's essential for traders to exercise prudent risk management and use leverage responsibly. Higher leverage levels provide traders with more trading power, but it's important to consider the potential downside and avoid over-leveraging, which can lead to significant losses.

SenderFX's flexible leverage options cater to both experienced traders who may seek higher leverage for more significant market exposure and conservative traders who prefer lower leverage to manage risk more effectively. By offering a range of leverage levels, SenderFX aims to accommodate a diverse range of traders and provide them with the tools they need to execute their trading strategies with confidence. As with any trading decision, it's crucial for clients to fully understand the implications of leverage and trade responsibly.

Here is a comparison table of maximum leverage offered by different brokers:

| Broker | SenderFX | IG | AvaTrade | IC Markets |

| Maximum Leverage | 1:300 | 1:200 | 1:400 | 1:500 |

SenderFX does not provide specific information about spreads and commissions on its website. As such, potential traders may need to contact the company directly or refer to the trading platform for accurate and up-to-date details on spreads and commissions. Spreads refer to the difference between the buying and selling price of a financial instrument, and commissions are additional fees charged by the broker for executing trades. These factors can significantly impact a trader's overall trading costs and should be carefully considered when choosing a broker. Due to the lack of available information on spreads and commissions, traders should exercise caution and conduct thorough research before deciding to trade with SenderFX to ensure they have a comprehensive understanding of the trading conditions and associated costs.

SenderFX offers a range of deposit and withdrawal methods to cater to the diverse needs of its clients. Some of the available methods include First Iraqi Bank, FastPay, ZainCash, USDT-TRC20, USDT-ERC20, and Cash. These options provide flexibility for traders to fund their accounts and withdraw their profits conveniently.

However, it is important to note that the website does not specify the minimum deposit amount required for each method. Traders interested in opening an account with SenderFX should contact the company directly or refer to the trading platform for detailed information on the minimum deposit and withdrawal requirements for each payment method.

Additionally, traders should consider any potential fees or processing times associated with each payment method. The availability of deposit and withdrawal options may also vary depending on the client's location, so it is essential to check with the broker to ensure that the preferred method is available in the trader's region.

Overall, while SenderFX offers a variety of deposit and withdrawal methods, traders should seek clarity on the specific terms and conditions, including minimum deposit amounts and any associated fees, to make informed decisions about managing their funds effectively.

SenderFX provides its clients with multiple trading platform options to cater to their diverse needs. One of the primary platforms offered is MetaTrader 5 (MT5), a renowned and widely used trading platform in the industry. MT5 offers advanced charting tools, a wide range of technical indicators, and extensive market analysis features, empowering traders to make informed trading decisions. The platform allows users to execute trades seamlessly and efficiently, with access to real-time market data and the ability to create and implement their trading strategies.

Additionally, SenderFX offers dedicated mobile trading applications for both Android and iOS devices, allowing traders to stay connected to the markets and manage their trades on the go. The MT5 mobile apps provide full functionality and user-friendly interfaces, enabling clients to monitor their positions, receive real-time price alerts, and execute trades from their smartphones or tablets.

For those who prefer a web-based trading experience, SenderFX offers the Web Terminal. This platform allows traders to access their accounts and trade directly from a web browser without the need for any software downloads or installations. The Web Terminal provides a convenient and secure way to trade, regardless of the operating system or device being used.

SenderFX provides customer support to assist clients with their inquiries and concerns. They offer multiple channels of communication, including email and phone support. Clients can reach out to SenderFX's customer support team via the following contact details:

- Email: info@senderfx.com

- Phone: +9647501004008

- Phone: +9647508861230

Additionally, SenderFX offers a live chat feature, which allows clients to have real-time conversations with support representatives. This instant messaging service is a convenient way for clients to seek immediate assistance and get their questions answered promptly.

SenderFX provides educational resources in the form of informative videos that cover various aspects of trading and financial markets. These videos cater to traders of all experience levels, offering valuable insights into market analysis, trading strategies, risk management, and more. Whether you are a beginner seeking to understand the basics of trading or an experienced trader looking to refine your approach, these educational videos are designed to enhance your knowledge and skills.

In conclusion, SenderFX offers a diverse range of tradable assets, flexible leverage options, and educational resources through its MetaTrader 5 platform. Traders have access to global financial markets and the ability to diversify their portfolios with various instruments. However, the lack of regulatory oversight poses a significant disadvantage, as it raises concerns about fund protection and the absence of proper supervision. Potential traders should carefully consider the risks associated with trading with an unregulated broker and exercise caution when choosing SenderFX as their trading platform. While the company provides valuable educational resources, the absence of regulatory compliance remains a critical factor that traders should take into account when making their decisions.

Q: Is SenderFX a regulated broker?

A: No, SenderFX is not regulated by any recognized financial authority. It operates without oversight and supervision that regulation provides.

Q: What tradable assets are available on SenderFX?

A: SenderFX offers a diverse range of tradable assets, including indices, futures, bonds, and forex pairs.

Q: What is the maximum leverage offered by SenderFX?

A: SenderFX provides a flexible leverage range from 1:2 to 1:300, allowing traders to choose the level that suits their preferences and risk appetite.

Q: What deposit and withdrawal methods are available on SenderFX?

A: SenderFX offers a range of methods, including First Iraqi Bank, FastPay, ZainCash, USDT-TRC20, USDT-ERC20, and Cash.

Q: What trading platforms does SenderFX offer?

A: SenderFX provides MetaTrader 5 (MT5) as its primary trading platform, along with mobile apps for Android and iOS devices, and a Web Terminal for web-based trading.

More

User comment

1

CommentsWrite a review

2023-03-03 18:36

2023-03-03 18:36