User Reviews

More

User comment

3

CommentsWrite a review

2024-07-22 10:32

2024-07-22 10:32

2024-06-28 17:23

2024-06-28 17:23

Score

2-5 years

2-5 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Influence

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index5.44

Risk Management Index0.00

Software Index4.00

License Index0.00

Single Core

1G

40G

More

Company Name

Rich Smart Finance

Company Abbreviation

Rock Shield Capital Markets

Platform registered country and region

Australia

Company website

X

Company summary

Pyramid scheme complaint

Expose

| Rock Shield Capital MarketsReview Summary | |

| Founded | 2024 |

| Registered Country/Region | Australia |

| Regulation | Suspicious Clone |

| Market Instruments | ForexPrecious metals & CommoditiesIndicesCFDs |

| Demo Account | ✅ |

| Leverage | Up to 1:500 |

| Spread | 1 pip onwards (Standard Account) |

| Trading Platform | MT4 |

| Min Deposit | / |

| Customer Support | Email: info@rockshieldcm.com |

| Online Chat: 24/7 | |

| Social Media: Linkedin, Instagram, Twitter | |

| Physical Address: Level 1, 254 Rundle Street, Adelaide, Australia 5000 | |

Rock Shield Capital Markets, incorporated in Australia in 2023, is a broker that mainly offers Forex, Metals & Commodities, Indices, CFDs, supports traders to use MT4, and 2 accounts. At present, the regulatory status of this brokerage is judged to be a suspected clone.

| Pros | Cons |

| Support 0 commission | Suspicious Clone |

| Support for MT4 | Charge a swap fee |

| Support spread 0 pip onwards |

| Regulated Country/Region |  |

| Regulated Authority | ASIC |

| Regulated Entity | RICH SMART FINANCE PTY LTD |

| License Type | Straight Through Processing(STP) |

| License Number | 441277 |

| Current Status | Suspicious Clone |

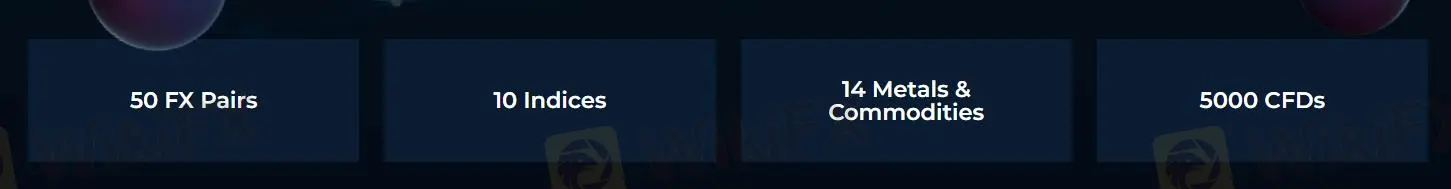

Rock Shield Capital Markets offers 50 forex pairs, 10 indices, 14 metals as well as commodities, and 5,000 CFDs.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Precious metals & Commodities | ✔ |

| Indices | ✔ |

| CFDs | ✔ |

| Stocks | ❌ |

| Bonds | ❌ |

| ETF | ❌ |

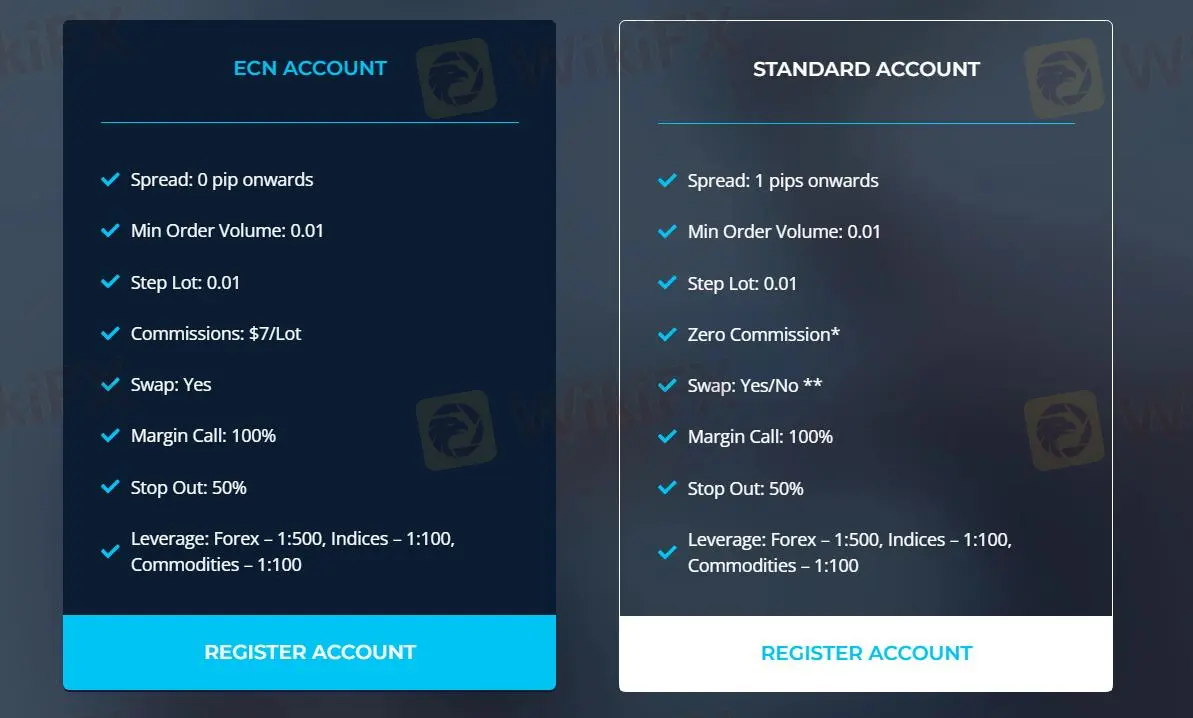

Rock Shield Capital Markets has two types of accounts: ECN Account and Standard Account. They have the same leverage, up to 1:500. The minimum transaction volume and the step lot are the same, both are 0.01.

| Account Types | ECN Account | Standard Account |

| Spread | 0 pip onwards | 1 pip onwards |

| Min Order Volume | 0.01 | 0.01 |

| Step Lot | 0.01 | 0.01 |

| Commissions | $7/Lot | Zero Commission |

| Swap | Yes | Yes/No |

| Margin Call | 100% | 100% |

| Stop Out | 50% | 50% |

| Leverage | Forex – 1:500, Indices – 1:100, Commodities – 1:100 | Forex – 1:500, Indices – 1:100, Commodities – 1:100 |

The spreads of the ECN Account and the Standard Account are 0 pip onwards and 1 pip onwards, respectively. The Commission is $7/Lot, Zero Commission. Both charge swap fees.

Rock Shield Capital Markets offers MT4 to traders, which can be used on mobile, web and desktop.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT4 | ✔ | Mobile, Web, Desktop | Beginner |

| MT5 | ❌ |

Rock Shield Capital Markets has 6 payment methods: BANK TRANSFER, HiPAY, Tether, VISA, FASTPAYS, mastercard.

More

User comment

3

CommentsWrite a review

2024-07-22 10:32

2024-07-22 10:32

2024-06-28 17:23

2024-06-28 17:23