User Reviews

More

User comment

3

CommentsWrite a review

2024-02-07 16:29

2024-02-07 16:29 2023-02-28 17:46

2023-02-28 17:46

Score

5-10 years

5-10 yearsRegulated in United Kingdom

Investment Advisory License

Suspicious Scope of Business

Suspicious Overrun

Medium potential risk

Influence

Add brokers

Comparison

Expose

Exposure

Score

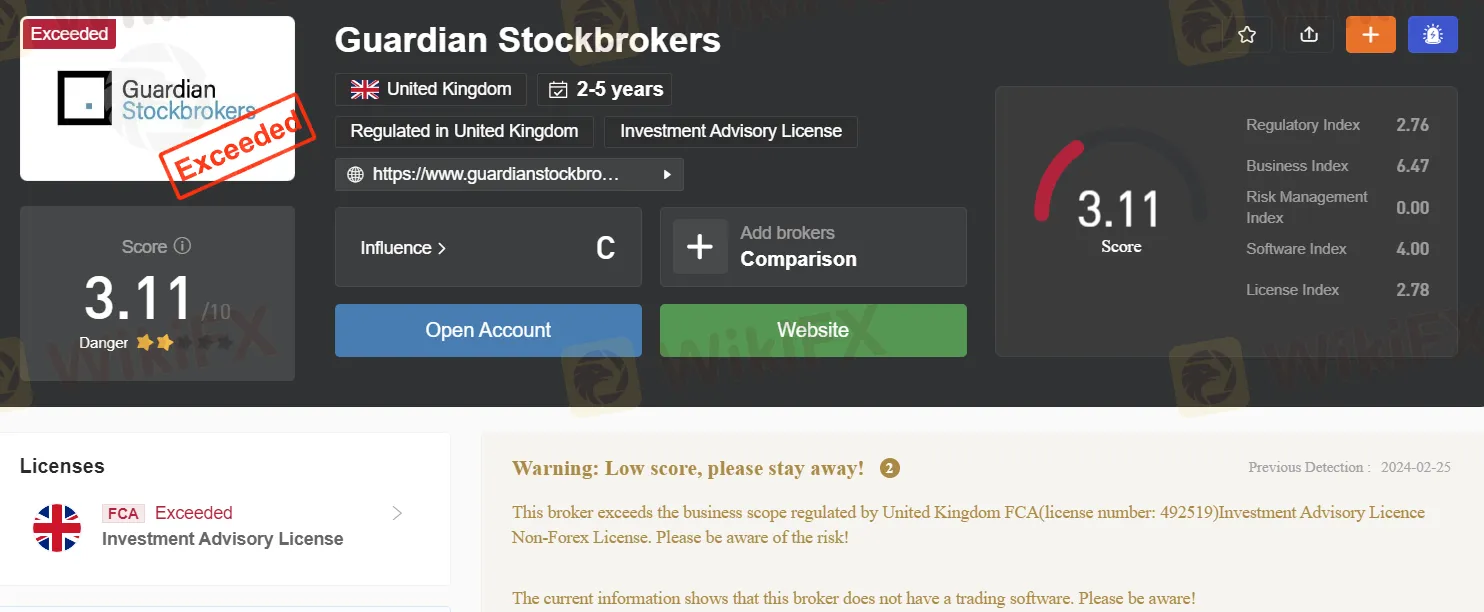

Regulatory Index2.78

Business Index7.08

Risk Management Index0.00

Software Index4.00

License Index2.78

Single Core

1G

40G

More

Company Name

Guardian Stockbrokers Limited

Company Abbreviation

Guardian Stockbrokers

Platform registered country and region

United Kingdom

Company website

X

Company summary

Pyramid scheme complaint

Expose

| Aspect | Information |

| Registered Country/Area | United Kingdom |

| Founded Year | 2019 |

| Company Name | Guardian Stockbrokers |

| Regulation | Regulated by the UK's Financial Conduct Authority (FCA), license number 492519 but exceeded |

| Services | Spread betting, CFDs across Forex, indices, shares, commodities, bonds, sectors, and interest rates |

| Trading Platforms | Web Platform, Trading App, MetaTrader 4, ProRealTime |

| Account Types | Demo Account, Live Account |

| Customer Support | Phone: 020 7638 6996, Email: newaccounts@guardianstockbrokers.com |

Guardian Stockbrokers, established in 2019 and based in the United Kingdom, is a financial services provider regulated by the UK's Financial Conduct Authority (FCA) under license number 492519, though it has been noted to operate beyond its authorized scope. The company offers a range of trading services, including spread betting and CFDs across various markets such as Forex, indices, shares, commodities, bonds, sectors, and interest rates. They provide their clients with a selection of trading platforms, including a Web Platform, Trading App, MetaTrader 4, and ProRealTime, catering to both beginners and advanced traders. Guardian Stockbrokers supports its customers with a demo account for practice trades and a live account for real trading. Customer support is accessible via phone and email, ensuring clients have the necessary assistance.

Guardian Stockbrokers is operating beyond the authorized business scope regulated by the United Kingdom's Financial Conduct Authority (FCA) under license number 492519, specifically their Investment Advisory License Non-Forex. Engaging with such a broker may expose investors to significant risks due to potential regulatory non-compliance. Caution is advised when dealing with entities operating outside their licensed parameters.

Guardian Stockbrokers offers a mix of advantages and drawbacks for traders. On the plus side, they provide a wide range of market instruments, including Forex, indices, shares, commodities, and more, which allows traders to diversify their investment strategies. Additionally, their platform variety caters to all levels of traders, from beginners to professionals, with options like a user-friendly web platform, a convenient trading app, and advanced platforms like MetaTrader 4 and ProRealTime. They also offer both demo and live accounts, enabling traders to practice strategies or dive into real trading. However, there are significant cons, including their operation beyond the scope authorized by the FCA, which may expose investors to regulatory risks. Also, the trading costs, including spreads, commissions, and overnight funding fees, can impact profitability.

In short, Guardian Stockbrokers has a wide range of trading options and tools but comes with regulatory and cost-related concerns.

|

|

|

|

|

|

|

|

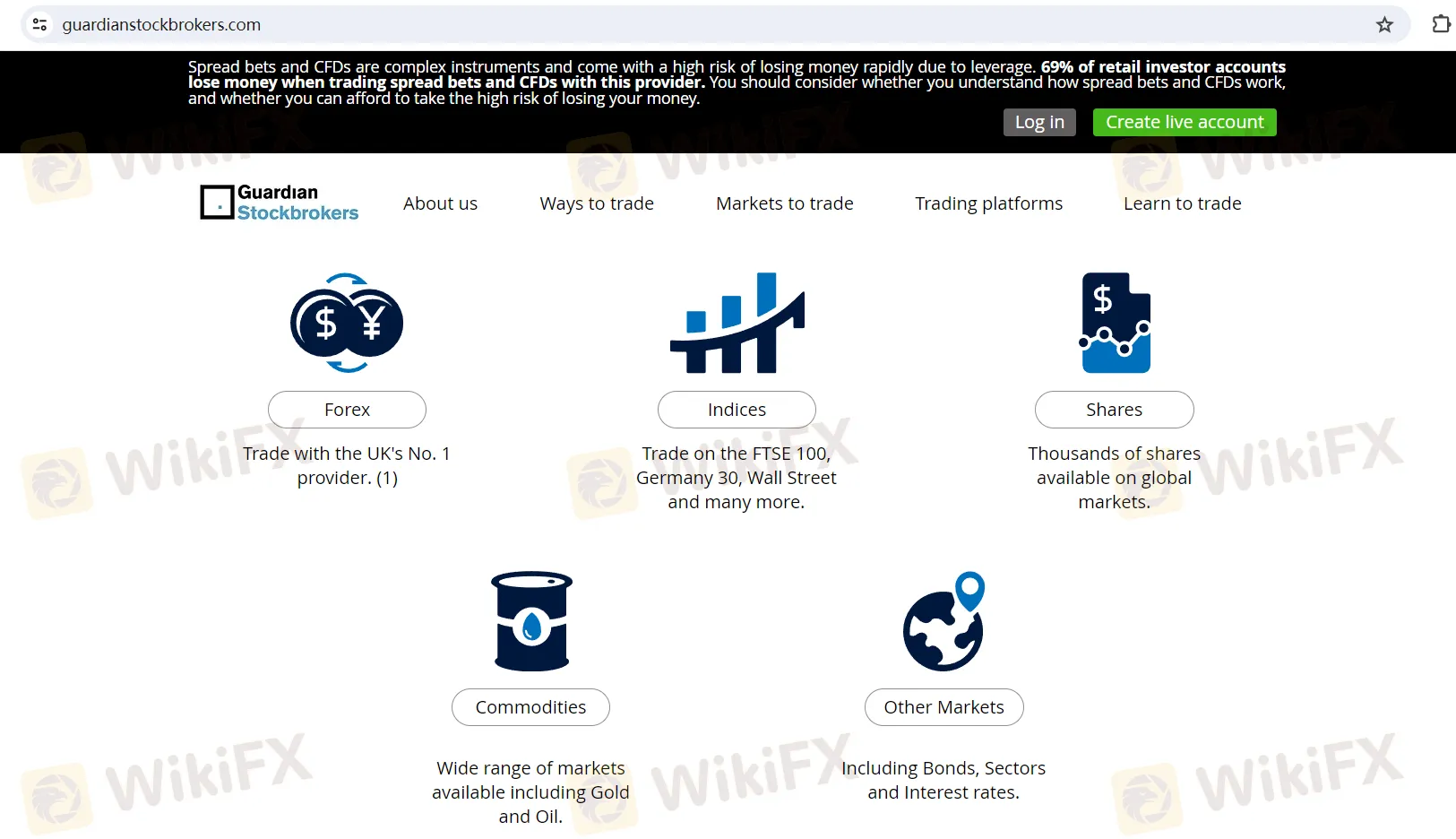

Guardian Stockbrokers provides access to a diverse array of market instruments:

Forex: Trade with the UK's No. 1 provider.

Indices: Access markets like FTSE 100, Germany 30, and Wall Street.

Shares: Choose from thousands of shares across global markets.

Commodities: Trade in markets including Gold and Oil.

Other Markets: Explore Bonds, Sectors, and Interest rates for additional trading opportunities.

These offerings enable investors to engage in Spread bets and CFDs across a wide range of assets, allowing them to benefit from various market conditions and investment strategies.

Guardian Stockbrokers offers two types of accounts:

Demo Account: Practice trading with virtual funds to learn the platform and test strategies without risking real money.

Live Account: Trade with real money in the financial markets, accessing all available instruments and executing trades in real-time.

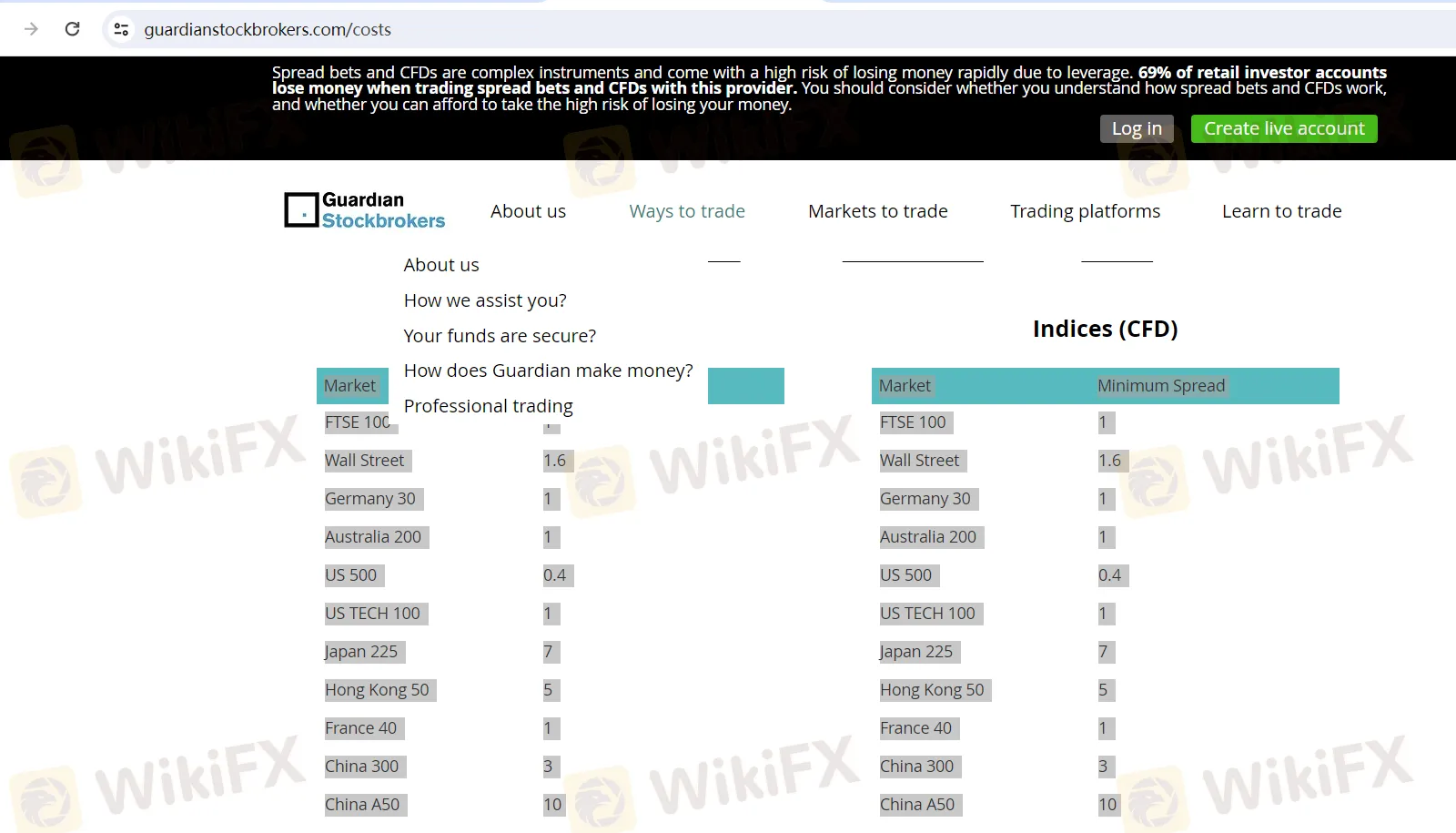

Guardian Stockbrokers impose various costs on their clients' trades, which can vary depending on the type of financial instrument and the nature of the trade. Here's a summary of the costs based on the information provided:

Spreads

Indices and Major Forex (Spot): The spread is the difference between the buy and sell price. This cost applies to both Spread Bets and CFDs, with the minimum spread varying by market. For instance, the FTSE 100 has a minimum spread of 1, while the US 500 has a lower spread of 0.4.

Commodities and Metals: These also have standard spreads, like Oil (Brent and US Crude) at 2.8 and Gold at 0.3.

Softs: Items like London Cocoa and NY Cocoa have spreads of 3 and 4, respectively.

Commissions

Shares CFDs: Trading Share CFDs incurs a commission instead of a spread. For UK Major shares, the commission is 0.10% with a minimum charge of £10 for online trades and £15 for phone trades. US Major shares have a commission of 2 cents per share with minimum charges of $15 (online) and $25 (phone). Euro Major shares also carry a 0.10% commission with respective minimum charges of 10€ (online) and 25€ (phone).

Overnight Funding

This fee applies if you hold a Daily Spread bet or cash CFD position overnight (after 22:00 UK time). The charge covers the funding cost of maintaining your position overnight.

Guardian Stockbrokers' trading costs are multifaceted, incorporating spreads, commissions, and overnight funding charges. These costs can impact the overall profitability of trades, especially for positions held overnight or trades involving shares where commissions and minimum charges apply. Traders should consider these costs when planning their trading strategies and managing their portfolios.

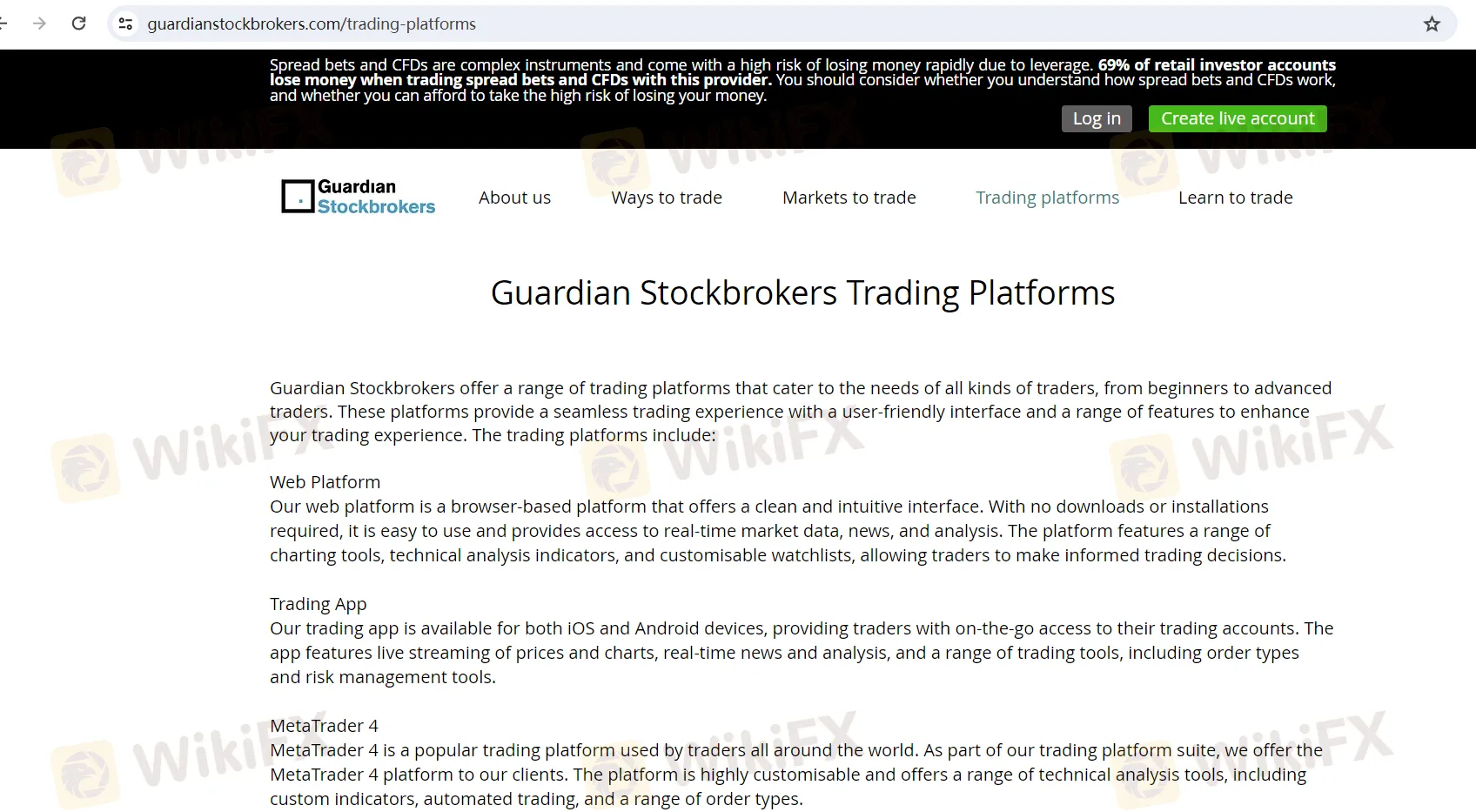

Guardian Stockbrokers offers four main trading platforms, each designed to cater to different trader needs:

Web Platform: This is an easy-to-use, browser-based platform that doesn't require any downloads. It offers real-time market data, news, analysis, charting tools, and customizable watchlists to help make informed decisions.

Trading App: Available for iOS and Android, this app allows trading on the move with access to live price streaming, charts, news, and includes various trading and risk management tools.

MetaTrader 4 (MT4): A globally popular platform known for its customization, technical analysis tools, automated trading (via Expert Advisors), and various order types.

ProRealTime: An advanced, web-based platform focusing on detailed charting and technical analysis. It offers real-time data, backtesting, and trading signals for informed trading decisions.

Each platform provides unique features to suit different trading styles, from simple and intuitive interfaces for beginners to advanced tools for seasoned traders.

Guardian Stockbrokers provides customer support through a phone line (020 7638 6996) and email (newaccounts@guardianstockbrokers.com). This ensures clients can easily get help with their accounts or any questions they have, showing the company's commitment to good service.

A1: Yes, Guardian Stockbrokers offers services to clients globally, but you should check whether your country is supported and comply with your local laws regarding trading and investments.

A2: Yes, Guardian Stockbrokers may have minimum account requirements depending on the type of account you wish to open. It's best to contact them directly or check their website for the most current information.

A3: Guardian Stockbrokers offers multiple funding options, including bank transfers, credit/debit cards, and possibly other electronic payment methods. Detailed information on how to fund your account can be found on their website or by contacting customer support.

A4: Yes, Guardian Stockbrokers provides educational resources to help beginners understand trading and the markets. These may include webinars, tutorials, and articles on trading strategies and market analysis.

A5: As Guardian Stockbrokers is regulated by the Financial Conduct Authority (FCA) in the UK, they adhere to strict financial standards and client money protection rules. However, remember that all trading involves risk, and it's important to trade responsibly.

Online trading carries substantial risk, potentially leading to the total loss of invested funds. It may not be appropriate for all traders or investors. It's crucial to fully comprehend the associated risks before engaging in trading activities. Additionally, the content of this review is subject to change, reflecting updates in the company's services and policies. The review's creation date is also relevant, as information could have become outdated. Readers should confirm the latest information with the company prior to making any investment decisions. The responsibility for utilizing the information provided herein lies exclusively with the reader.

More

User comment

3

CommentsWrite a review

2024-02-07 16:29

2024-02-07 16:29 2023-02-28 17:46

2023-02-28 17:46