User Reviews

More

User comment

49

CommentsWrite a review

2026-02-18 15:02

2026-02-18 15:02

2025-12-16 04:30

2025-12-16 04:30

Score

5-10 years

5-10 yearsRegulated in Australia

Market Making License (MM)

MT4 Full License

Global Business

High potential risk

Offshore Regulated

Influence

Add brokers

Comparison

Quantity 22

Exposure

Score

Regulatory Index9.08

Business Index7.81

Risk Management Index0.00

Software Index9.81

License Index9.09

Single Core

1G

40G

Danger

More

Company Name

Capital Com Online Investments Ltd

Company Abbreviation

capital.com

Platform registered country and region

Bahamas

Company website

X

447897000276

Company summary

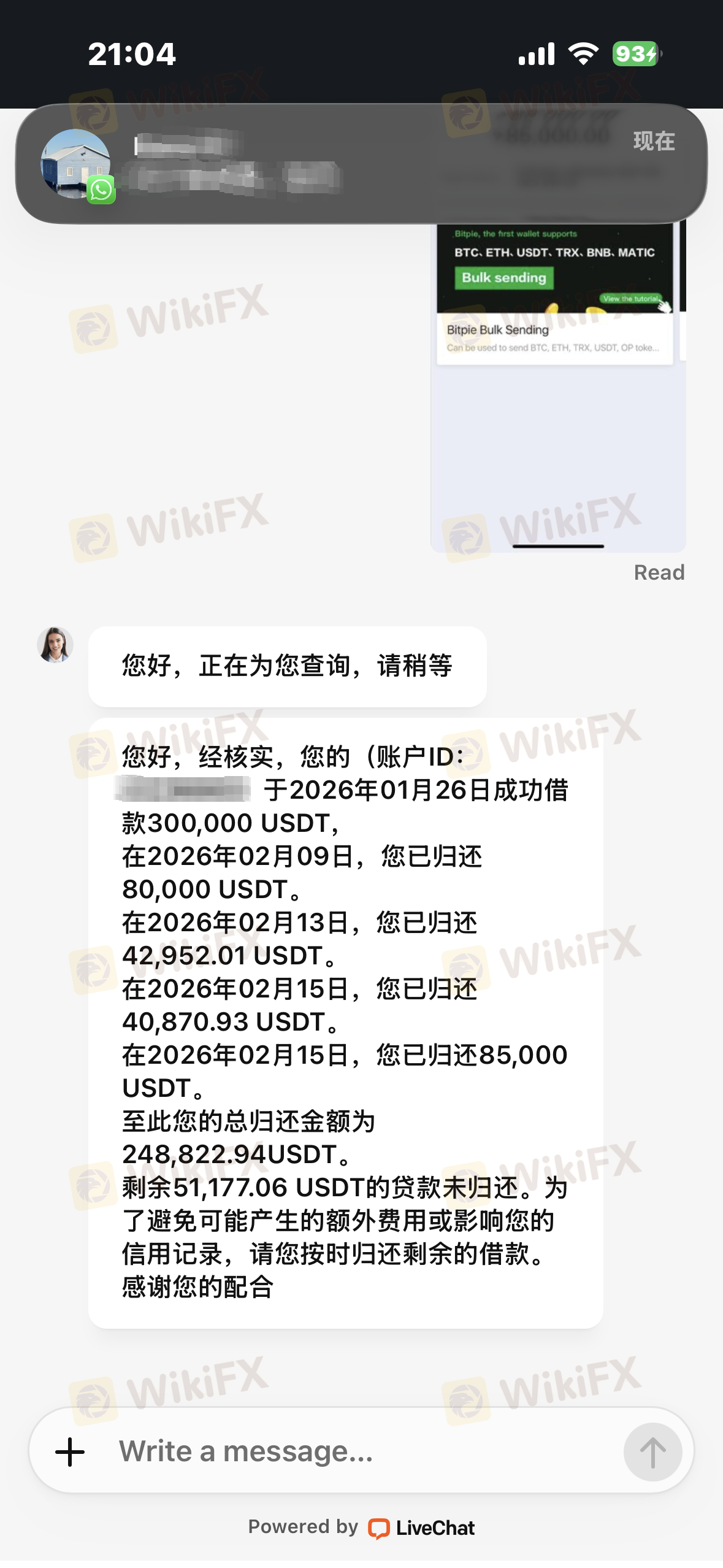

Pyramid scheme complaint

Expose

Do not invest here

fraudulent broker capital.com loss all money will report to all

I made a withdrawal of 350 dollars about 3 weeks ago, so far I still haven't received anything!

I can't withdraw money Inc I am trying to add new - old bank account (the same which I deposited from, but there was an informations reset), and I am still getting communicate "name_on_account is invalid". What's wrong?

Why can’t I withdraw my USDT ?

My application of withdrawal has been refused. Unable to withdraw

I deposited $1,000 in capital.com and traded, the platform closed my account, my withdrawal was not processed, and my deposit was not refunded to me

You want me to be satisfied with your platform. I didn't get the solution. Every time I get the same email Same message from the withdrawal transaction date Date 19/1/66 The way you said that the money will come in today, still haven't received the amount of 60 $ as before, this is your solution. After a week it told me to wait another week should I wait until the year 3000 or not? I hope this fix is fixed soon. I will continue to give satisfactory ratings.

Why can't I withdraw my money?

I deposited bu the verification delayed for a long time. Beware of it.

I am writing to express my significant frustration and disappointment regarding a withdrawal from my account that has been pending for an excessive amount of time (15 days).

I deposited coins into Binance under my real name, and now I’ve applied for a withdrawal, but they still haven’t approved it. I’ve already submitted my ID, passport, and all other documents for verification, so what more do I need to prove? I’ll just file for mediation through WikiFX. This is honestly the first time in my life I’ve ever experienced such worry and difficulty with a platform when it comes to withdrawals. Even after I provided every possible proof of my identity, they kept delaying the withdrawal for various reasons, and I still haven’t received my funds — around $6,262.

Can’t withdraw even with no margin/ positive cash?

My withdrawal took more than 3 weeks. No one solved my question. Beware.

I made a deposit transaction on Capital.com, but after I initiated a withdrawal request, Capital.com locked my account and prevented me from logging in. I have not processed my withdrawal yet

withdraw money But still did not receive the amount of money that was withdrawn, asked the customer service system, got the same answer, waited as before, inquired at the bank that received the international money transfer, there would be no information about the transaction of money waiting for international transfers. nothing confirmed It's like cheating. When a problem arises, let the AI system answer only the same words. The beneficiary bank came here because it is a scam of this platform. When someone transfers to play, it's very convenient, but whoever is fooled to transfer here, don't get profit or withdraw money, it will share with the director's system. Lots of money to make us bored and don't want to do it by ourselves because there is no system to try to accept customers. The implication is that capital is a scam platform, don't be fooled into playing. Wasting free money and wasting many opportunities

| Quick capital.com Review Summary | |

| Founded | 2016 |

| Registered Country/Region | Cyprus |

| Regulation | ASIC, CYSEC, FCA, SCA, SCB |

| Market Instruments | 3,000+ CFDs, shares, forex, indices, commodites, cryptocurrencies, ESG |

| Demo Account | ✅ |

| Min Deposit | 10 USD/EUR/GBP |

| Leverage | Up to 1:300 (professional) |

| EUR/USD Spread | 0.6 pips |

| Trading Platforms | Mobile Apps, Desktop, TradingView, MT4 |

| Deposit & Withdrawal Fee | ❌ |

| Inactivity Fee | 10 USD or equivalent for inactive for more than 1 year |

| Customer Support | 24/7 multilingual, live chat, phone, email, social media, Help Center |

capital.com is a CFD (Contracts for Difference) broker registered in Cyprus and well regulated by a number of regulators. The broker offers access to 3,000 CFDs, including shares, forex, indices, commodites, cryptocurrencies, and ESG via the MT4 and other trading platforms. The platform offers a variety of trading tools and educational resources to help traders improve their skills and knowledge.

capital.com offers a user-friendly and comprehensive trading experience with a wide range of markets and instruments, competitive spreads, and a variety of trading platforms. The platform also provides extensive educational resources and trading tools. Additionally, capital.com has no deposit or withdrawal fees, and there are multiple payment methods available. However, overnight funding and guaranteed stop premiums can add to the cost of trading, and some traders may prefer more trading platforms and account types.

| Pros | Cons |

| • Offers a wide range of trading instruments | • Negative reviews and complaints |

| • Demo accounts available | • No MetaTrader 5 |

| • User-friendly and intuitive trading platforms | • Limited research tools |

| • Multiple account types and funding methods | • Overnight funding charges and guaranteed stop premiums |

| • No deposit and withdrawal fees | • Limited info on accounts and deposits & withdrawals |

| • Offers negative balance protection and guaranteed stop-loss | |

| • No funding fees, commission, or inactivity fees |

Yes, it is regulated by several popular regulatory authorities.

| Regulator | Jurisdiction | Status | License Type | License Number |

| Australia Securities & Investment Commission (ASIC) | Australia | Regulated | Market Maker (MM) | 513393 |

| Cyprus Securities and Exchange Commission (CySEC) | Cyprus | Regulated | Market Maker (MM) | 319/17 |

| Financial Conduct Authority (FCA) | United Kingdom | Regulated | Straight Through Processing (STP) | 793714 |

| Securities and Commodities Authority (SCA) | United Arab Emirates | Regulated | Retail Forex License | 20200000176 |

| Securities Commission of The Bahamas (SCB) | Bahamas | Offshore Regulated | Retail Forex License | SIA-F245 |

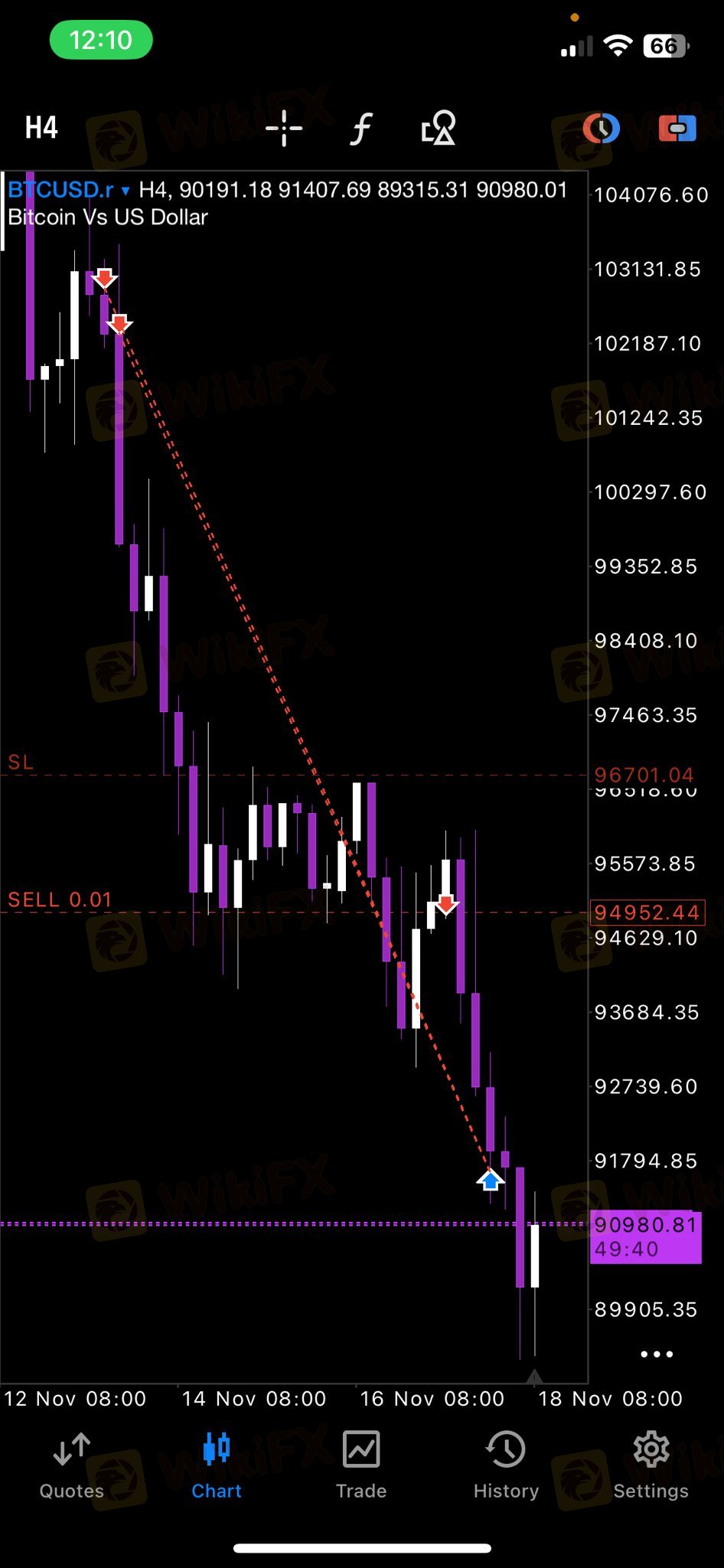

Capital.com offers 3,000+ market instruments for CFD trading, including shares, forex, indices, commodites, cryptocurrencies, and ESG.

The Forex category includes major, minor and exotic currency pairs.

The Indices category covers global indices such as the US 500, UK 100, and Germany 30. In the Commodities category, traders can trade on precious metals such as gold and silver, energy products such as oil and gas, and agricultural products such as wheat and corn.

The Shares category offers CFD trading on popular global companies such as Apple, Amazon, and Google.

Capital.com also offers CFD trading on a variety of cryptocurrencies such as Bitcoin, Ethereum, and Ripple, as well as ESG (Environmental, Social and Governance) trading, which focuses on socially responsible investments.

| Trading Assets | Supported |

| CFDs | ✔ |

| Shares | ✔ |

| Forex | ✔ |

| Indices | ✔ |

| Commodities | ✔ |

| Cryptocurrencies | ✔ |

| ESG | ✔ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

Demo Account: Up to 100,000 virtual dollars and you can use your demo account for trading as long as you wish.

Live Account: capital.com does not provide much real account information. Generally, Forex brokers offer several different levels of real accounts with different trading conditions (leverage, spreads, commissions, etc.) depending on the minimum deposit amount. Due to the law prohibiting interest in the Islamic region, some brokers also offer Islamic accounts without overnight interest charges.

The maximum leverage offered by capital.com is up to 1:300 for professional traders. It is important to keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can both work in your favour and against you.

Capital.com offers variable spreads on its various trading instruments, which means the spreads can widen or narrow based on market conditions. The spreads for each instrument are transparently displayed on the website and can be easily monitored in real-time using the platform's trading tools.

As for commissions, capital.com does not charge any commissions for its CFD trading services. Instead, it makes money by incorporating a small markup on the spread, which is known as the “buy-sell spread.” This allows traders to have greater visibility and transparency into their trading costs.

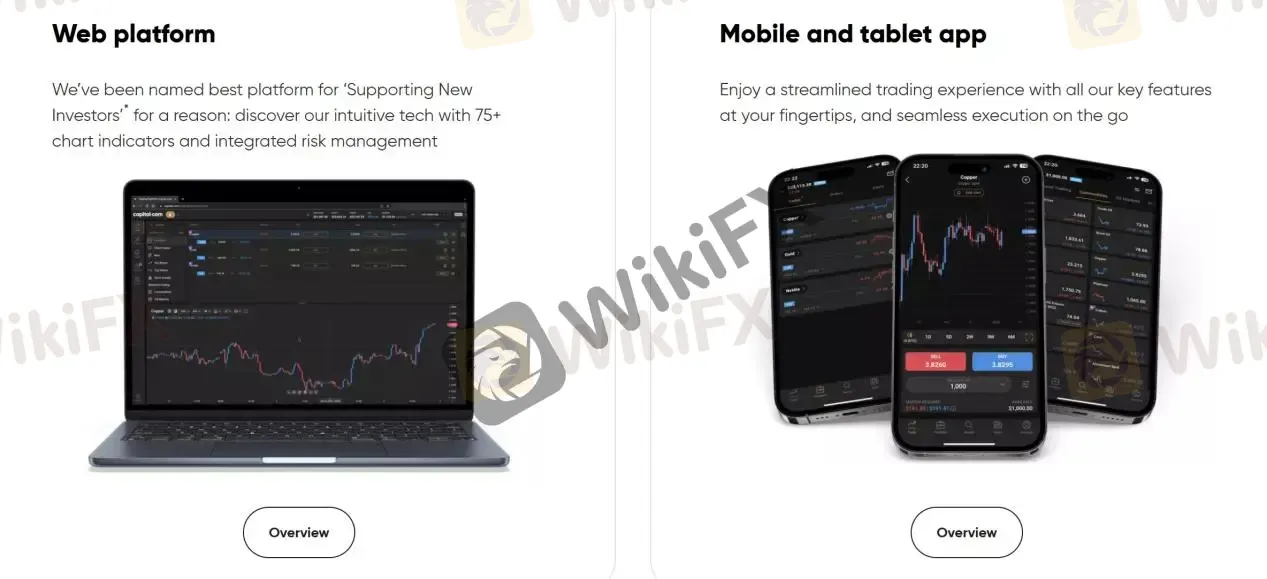

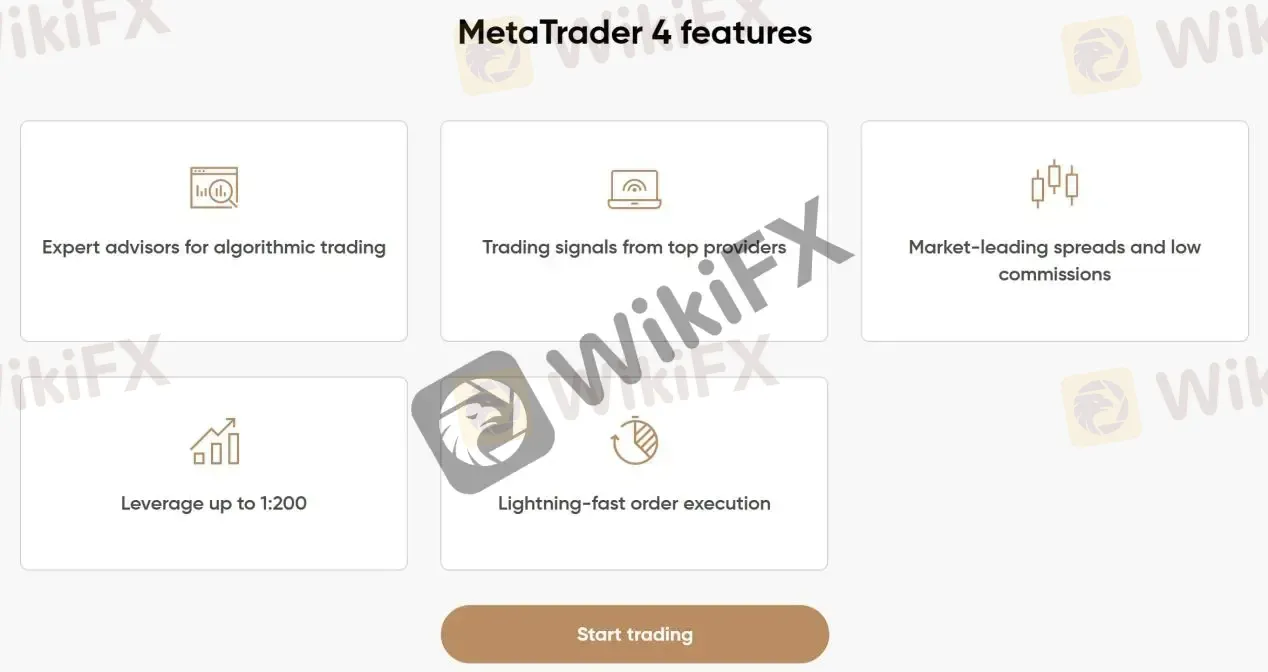

Capital.com offers a variety of trading platforms to cater to the needs of different traders. The platforms include Mobile Apps, Desktop, TradingView, and MT4.

| Trading Platform | Supported | Available Devices | Suitable for |

| Mobile Apps | ✔ | Mobile | / |

| Desktop trading | ✔ | Desktop | / |

| MetaTrader 4 | ✔ | Dekstop, Mobile, Web | Beginners |

| TradingView | ✔ | Dekstop, Mobile, Web | / |

| MetaTrader 5 | ❌ | / | Experienced traders |

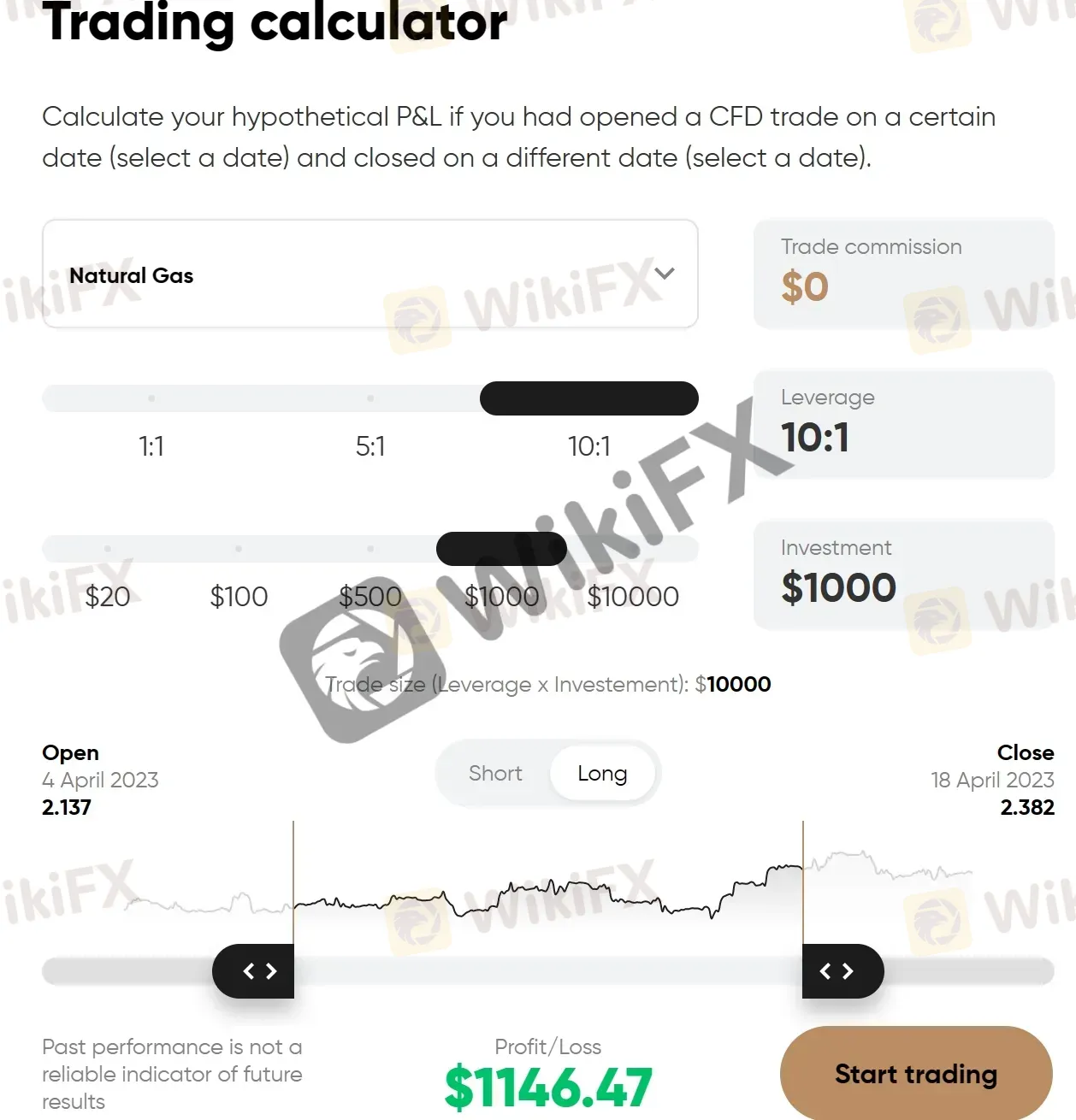

Capital.com offers a range of trading tools to help its clients make informed trading decisions. The trading calculator is one such tool that allows traders to calculate the potential profits and losses of a trade before placing it. Other tools include an economic calendar, market news, and an education section with a range of guides and tutorials for traders of all levels.

Capital.com offers a variety of payment methods for both deposits and withdrawals, including Apple Pay, VISA, MasterCard, wire transfer, PCI, worldpay, RBS, and Trustly. One of the main advantages of Capital.com's deposit and withdrawal system is that there are no fees associated with either process. This means that traders can deposit and withdraw funds as frequently as needed without incurring any additional costs.

capital.com minimum depoit vs other brokers

| capital.com | Most Other | |

| Minimum Deposit | 10 USD/EUR/GBP | $100 |

Capital.com's fee structure is designed to be transparent and competitive. The broker charges spreads on its trading instruments, which vary depending on market conditions and liquidity. More details can be found in the table below:

| Opening/Closing an account | ❌ |

| Demo account | ❌ |

| Inactivity fee | 10 USD or equivalent |

| Deposit & withdrawal fee | ❌ |

| Overnight fee | The fee will either be paid or received, depending on whether you are long or short. |

| Currency conversion | ❌ |

| Guaranteed stops | The GSL fee varies depending on the market you are trading, the positions open price and the quantity. |

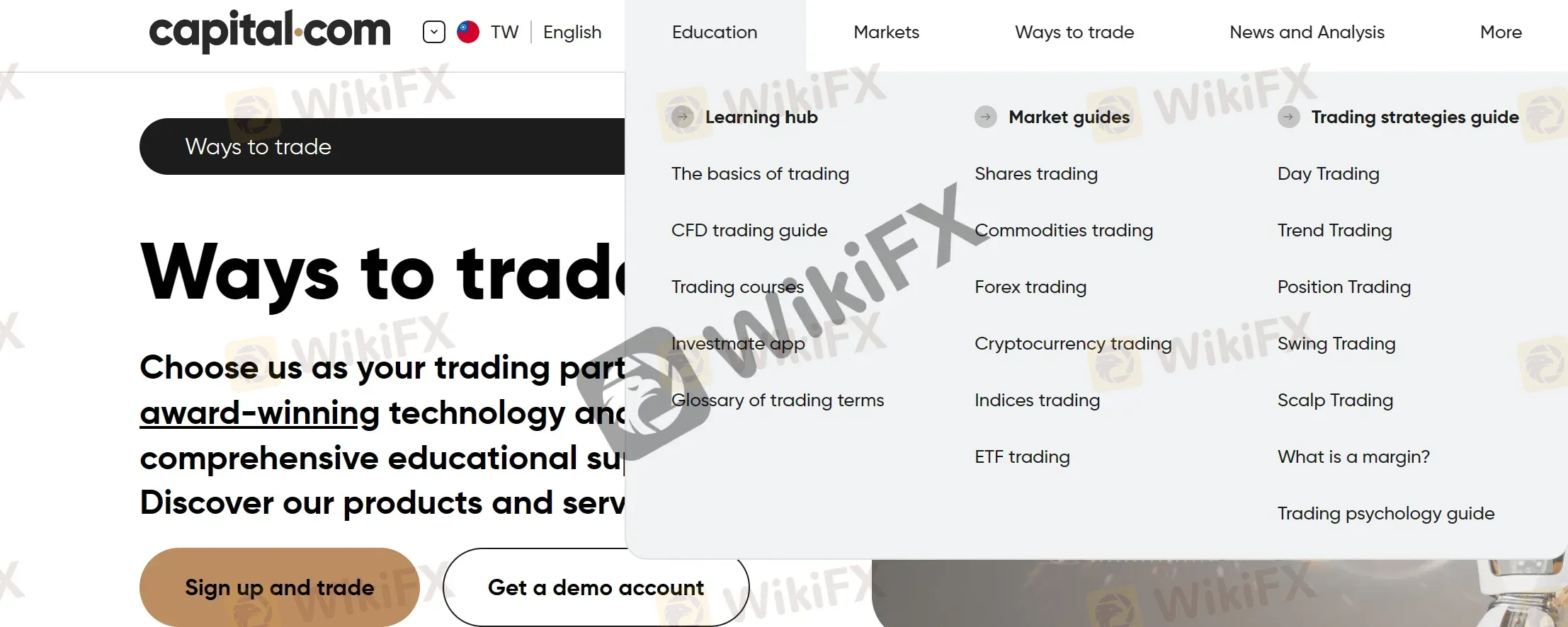

Capital.com provides a comprehensive educational section on their website, called the “Learning Hub”, where traders can find various materials to improve their trading skills and knowledge. They offer a wide range of educational resources, including articles, videos, webinars, and courses on various trading topics, such as technical analysis, risk management, and market psychology.

Additionally, they have a section dedicated to market guides, where traders can learn more about specific markets, and a section for trading strategies guides, where traders can find useful tips and strategies to enhance their trading performance.

| Service Time | 24/7 |

| Live chat | ✔ |

| Phone | +44 20 8089 7893 |

| support@capital.com | |

| Social Media | Facebook, Instagram, LinkedIn, YouTube, Twitter |

| Help Center | ✔ |

In conclusion, capital.com is a reputable online broker with a wide range of market instruments, low fees, and a variety of user-friendly trading platforms. The company offers free deposits and withdrawals with multiple payment methods, as well as educational resources to help traders of all levels. However, there are some negative reviews and complaints from their users. Overall, capital.com is a good choice for traders seeking a comprehensive and user-friendly trading experience.

| Q 1: | Is capital.com regulated? |

| A 1: | Yes. It is regulated by ASIC, CYSEC, FCA, SCA and SCB. |

| Q 2: | Does capital.com offer demo accounts? |

| A 2: | Yes. Demo accounts has up to 100,000 virtual dollars and you can use your demo account for trading as long as you wish. |

| Q 3: | Does capital.com offer the industry-standard MT4 & MT5? |

| A 3: | Yes. It supports Mobile Apps, Desktop Trading, MetaTrader 4, and TradingView. |

| Q 4: | Is capital.com a good broker for beginners? |

| A 4: | Yes. It is a good choice for beginners because it is regulated well and offers various trading instruments with competitive trading conditions on the leading MT4 platform. Also, it offers demo accounts that allow traders to practice trading without risking any real money. |

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 85.24% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

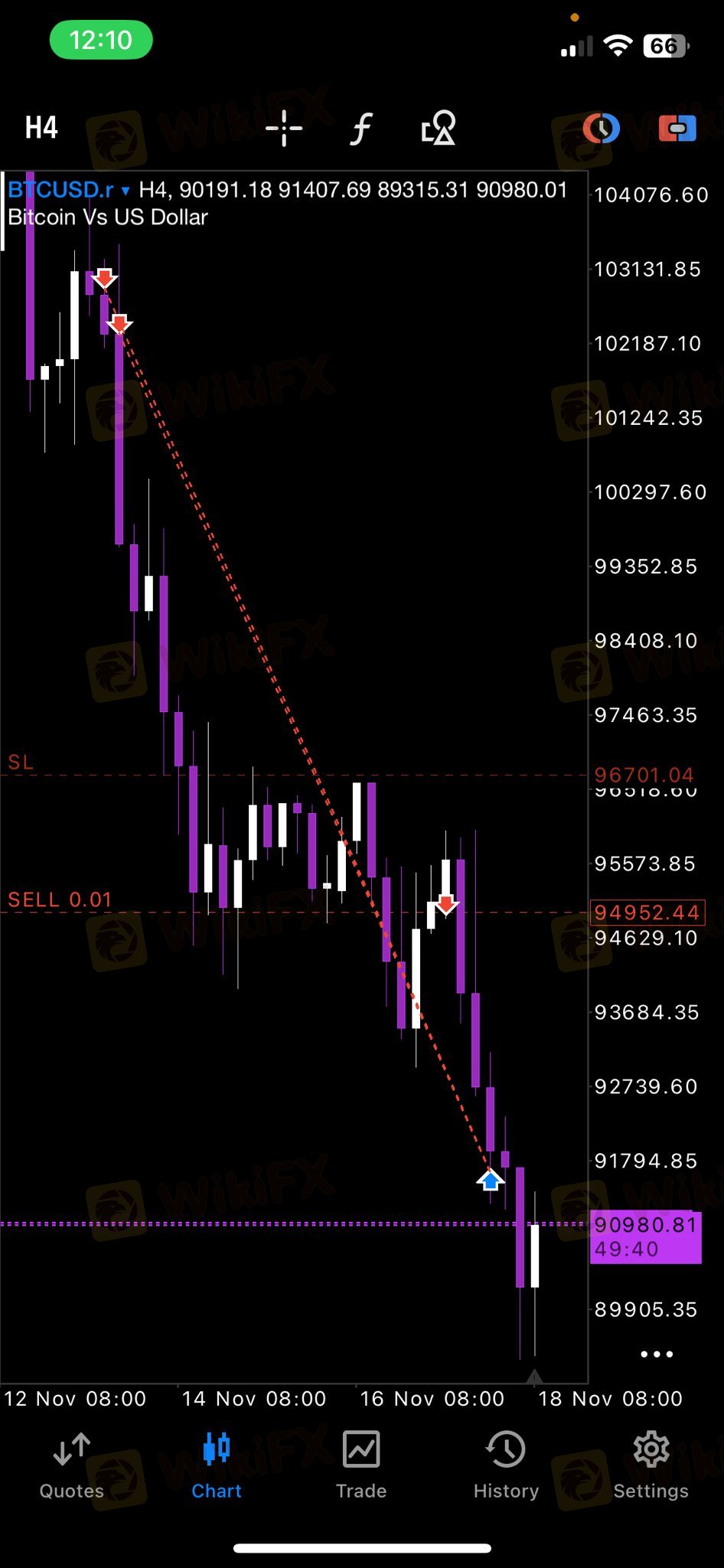

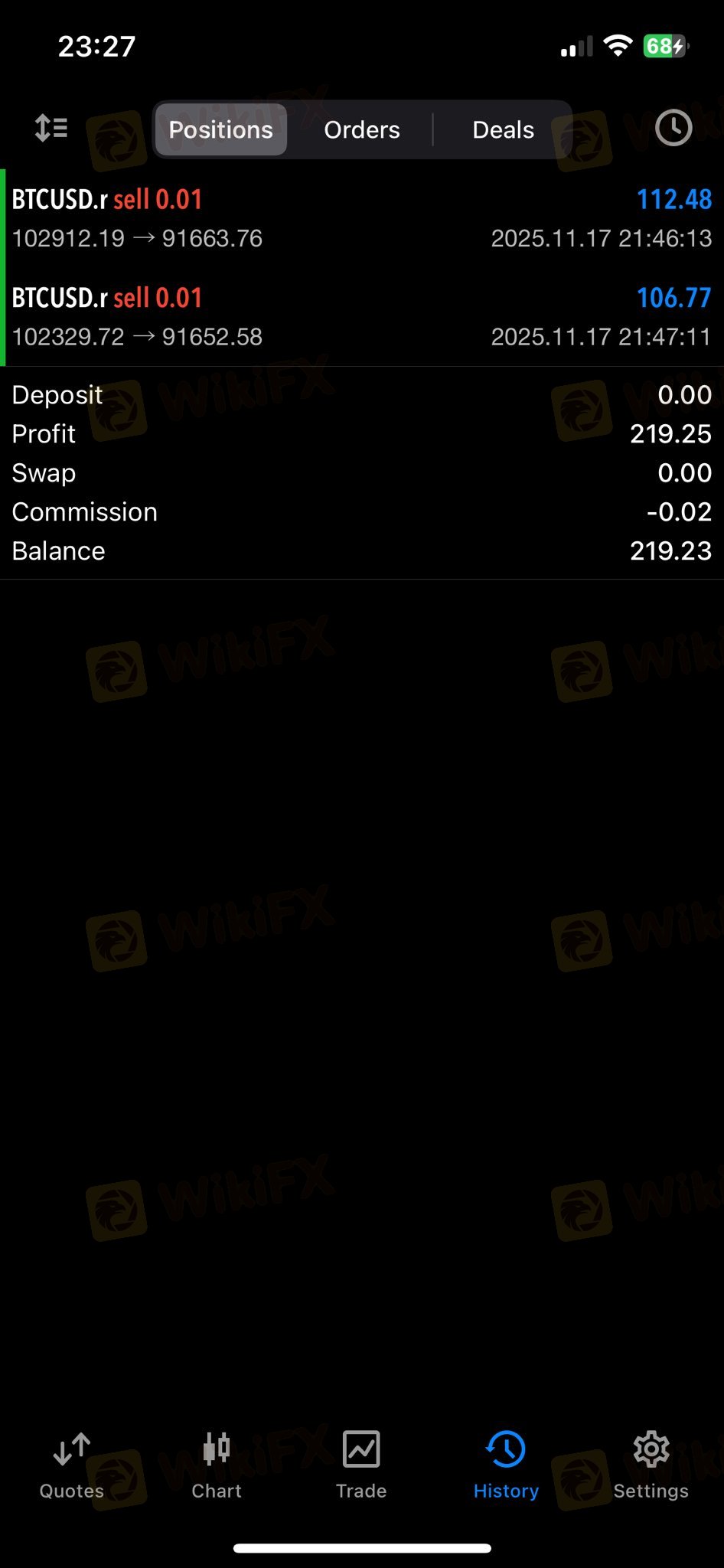

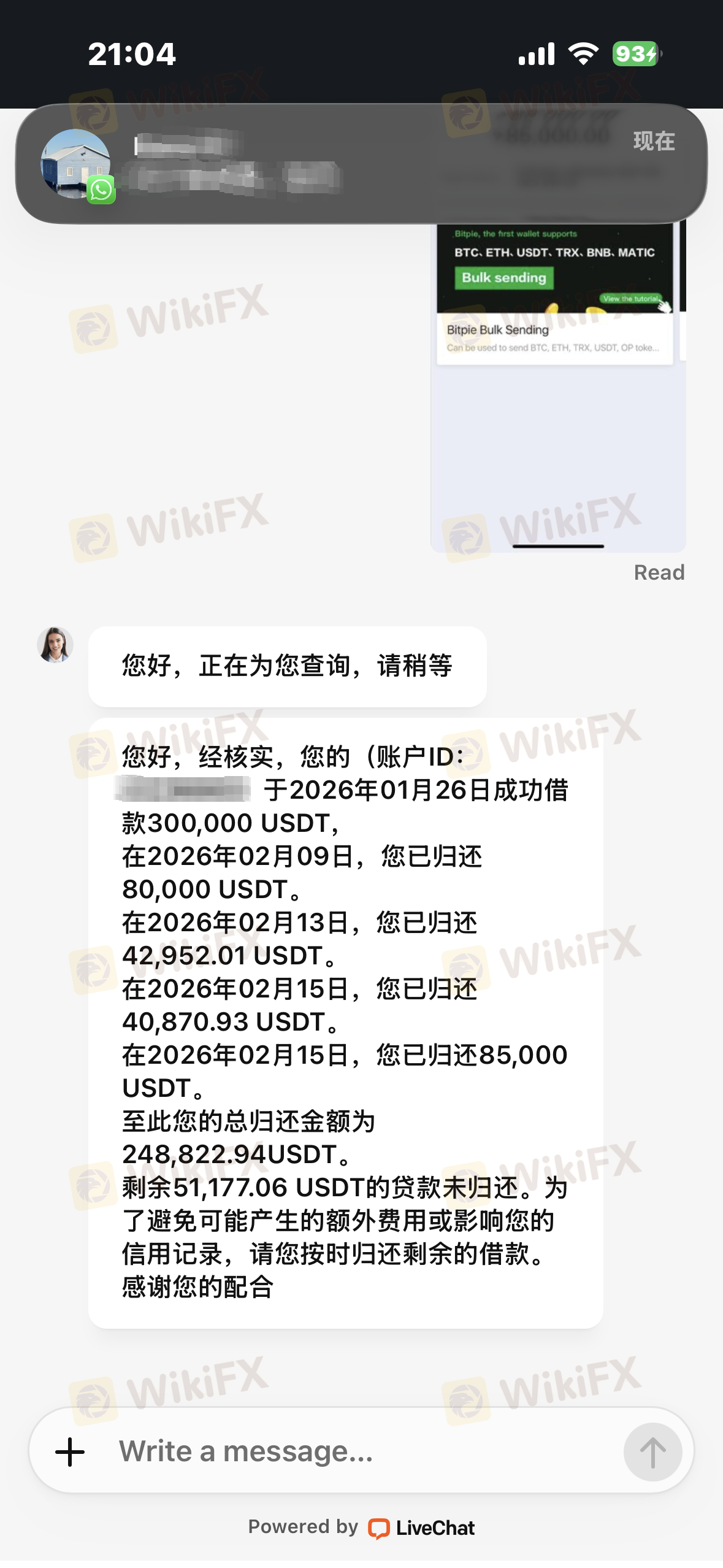

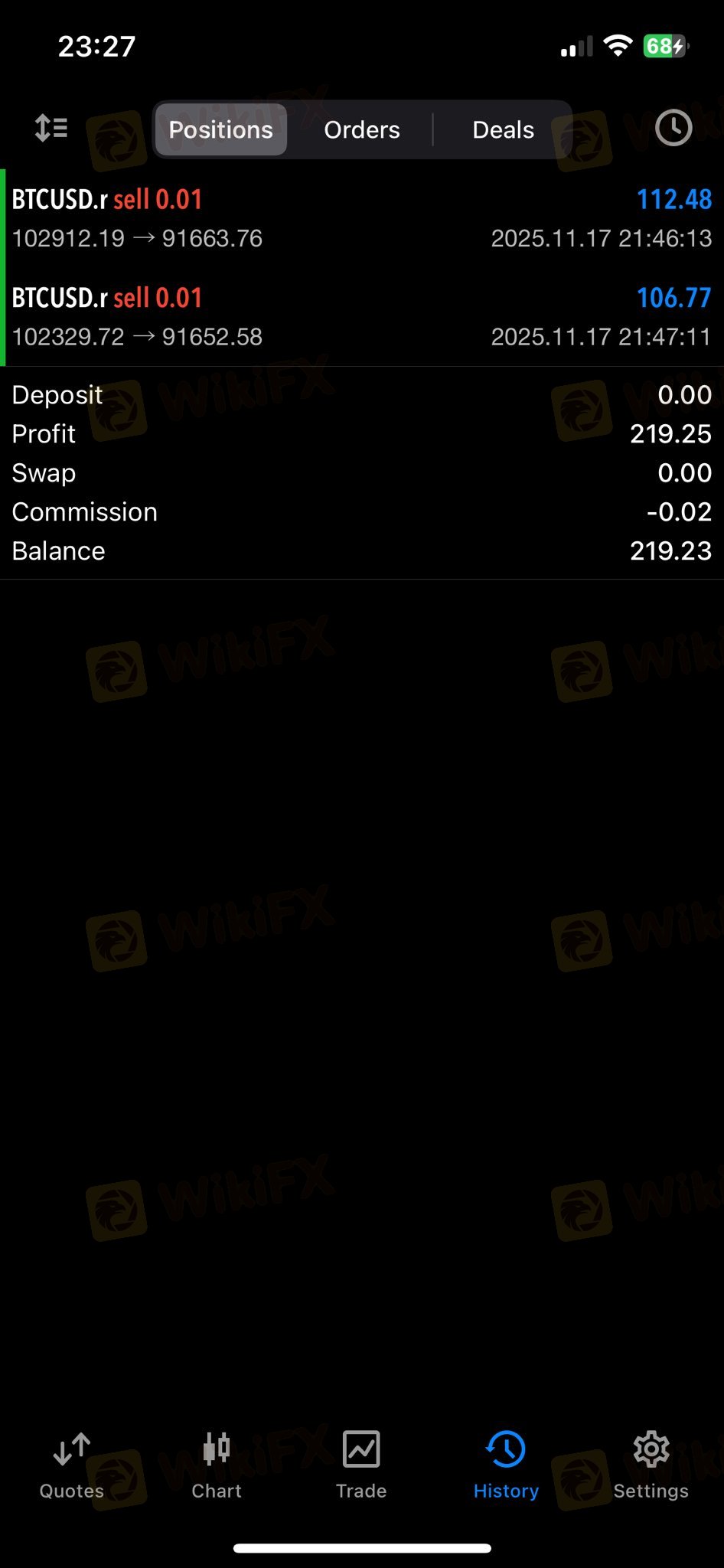

Recent investigations expose severe anomalies where Capital.com users report blocked withdrawals and demands for additional 'margin' payments to release funds. Despite holding valid licenses, the surge in access denials and a regulatory warning from Malaysia requires immediate caution.

WikiFX

WikiFX

Leading online trading platform Capital.com has announced a new platinum sponsorship agreement with Cypriot NASCAR Euro Series driver Vladimiros Tziortzis, strengthening its commitment to supporting local talent and international motorsport.

WikiFX

WikiFX

Capital.com holds a high WikiFX Score of 7.90 and bears regulation from top-tier authorities like the FCA and ASIC. However, recent 2025 user feedback highlights significant withdrawal issues and account freezes. This review analyzes its regulatory safety, trading platforms (MT4/MT5), and the contrast between its strong licensing and recent complaints.

WikiFX

WikiFX

Our investigation exposes a critical 'pay-to-withdraw' spiral where traders are forced to pay exorbitant 'margin' fees to access their own funds. Despite holding top-tier licenses, Capital.com displays severe red flags including revoked regulatory statuses and 32 urgent complaints alleging withdrawal blockades in the last three months.

WikiFX

WikiFX

More

User comment

49

CommentsWrite a review

2026-02-18 15:02

2026-02-18 15:02

2025-12-16 04:30

2025-12-16 04:30