User Reviews

More

User comment

2

CommentsWrite a review

2023-02-17 16:38

2023-02-17 16:38

Score

5-10 years

5-10 yearsSuspicious Regulatory License

High potential risk

Influence

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index7.75

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

Company Name

TemplerFX

Company Abbreviation

TEMPLER

Platform registered country and region

Saint Vincent and the Grenadines

Company website

X

Company summary

Pyramid scheme complaint

Expose

| TemplerFX Review Summary | |

| Founded | 2005 |

| Registered Country/Region | Saint Vincent and the Grenadines |

| Regulation | Unregulated |

| Market Instruments | Forex, energies, precious metals, shares CFDs, and cash indices |

| Demo Account | ✅ |

| Leverage | Up to 1:2000 |

| Spread | From 0.1 pips |

| Trading Platform | MT4, Templer FX Trader |

| Minimum Deposit | $1 |

| Customer Support | Phone: +44 20 33557076 / +44 02 071128046 |

| Email: info@templerfx.com | |

| Facebook, Twitter | |

| Address: Suite 305, Griffith Corporate Centre Beachmont P.O.Box 1510, Kingstown, SVG | |

| Regional Restrictions | US, UK, EU, Canada, Turkey, Israel, and Japan |

Registered in St. Vincent and the Grenadines in 2005, TemplerFX is an online forex broker that provides its clients with a series of common forex instruments. It provides different account types with varying features and minimum deposit requirements through MT4 and Templer FX Trader trading platforms. However, TemplerFX was not a regulated broker and there are many residents have no access to trade with them.

| Pros | Cons |

| Wide range of trading instruments | Unregulated status |

| Multiple account types catering to different trading styles | Regional restrictions |

| Flexible leverage ratios | |

| Support for various payment methods |

TemplerFX is not a regulated broker. The absence of regulatory oversight raises concerns about the credibility and transparency of the broker's operations.

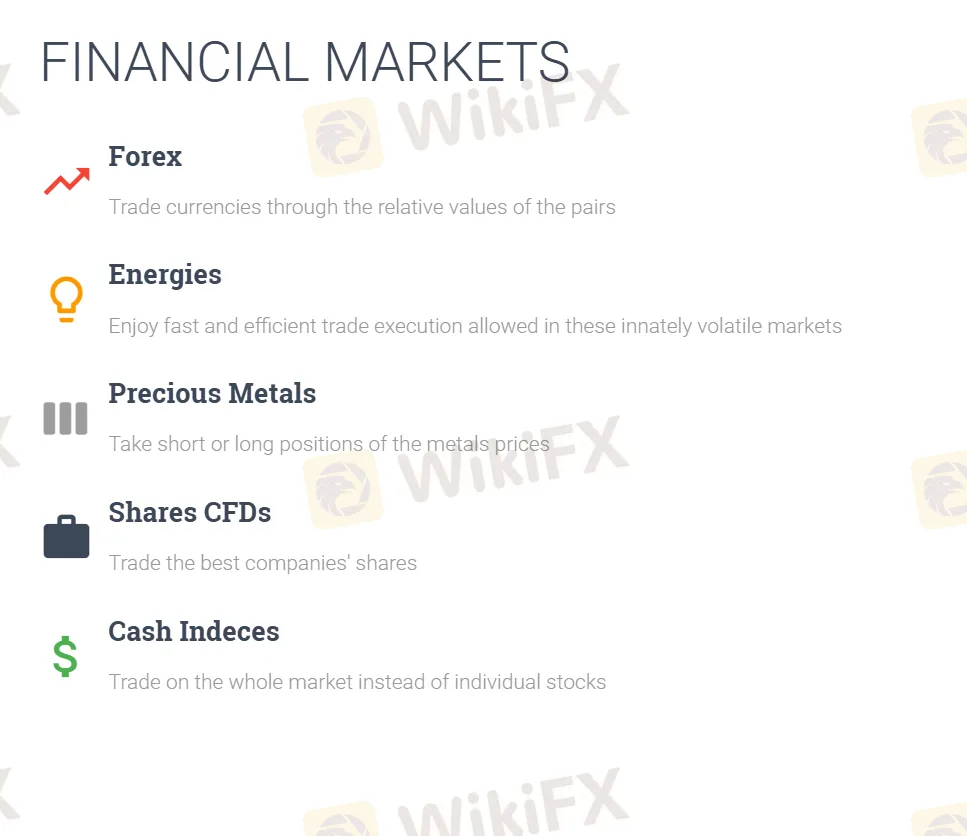

TemplerFX offers forex, energies, precious metals, shares CFDs, and cash indices.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Energies | ✔ |

| Precious Metals | ✔ |

| Cash Indices | ✔ |

| Shares CFDs | ✔ |

| Cryptos | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

| Mutual Funds | ❌ |

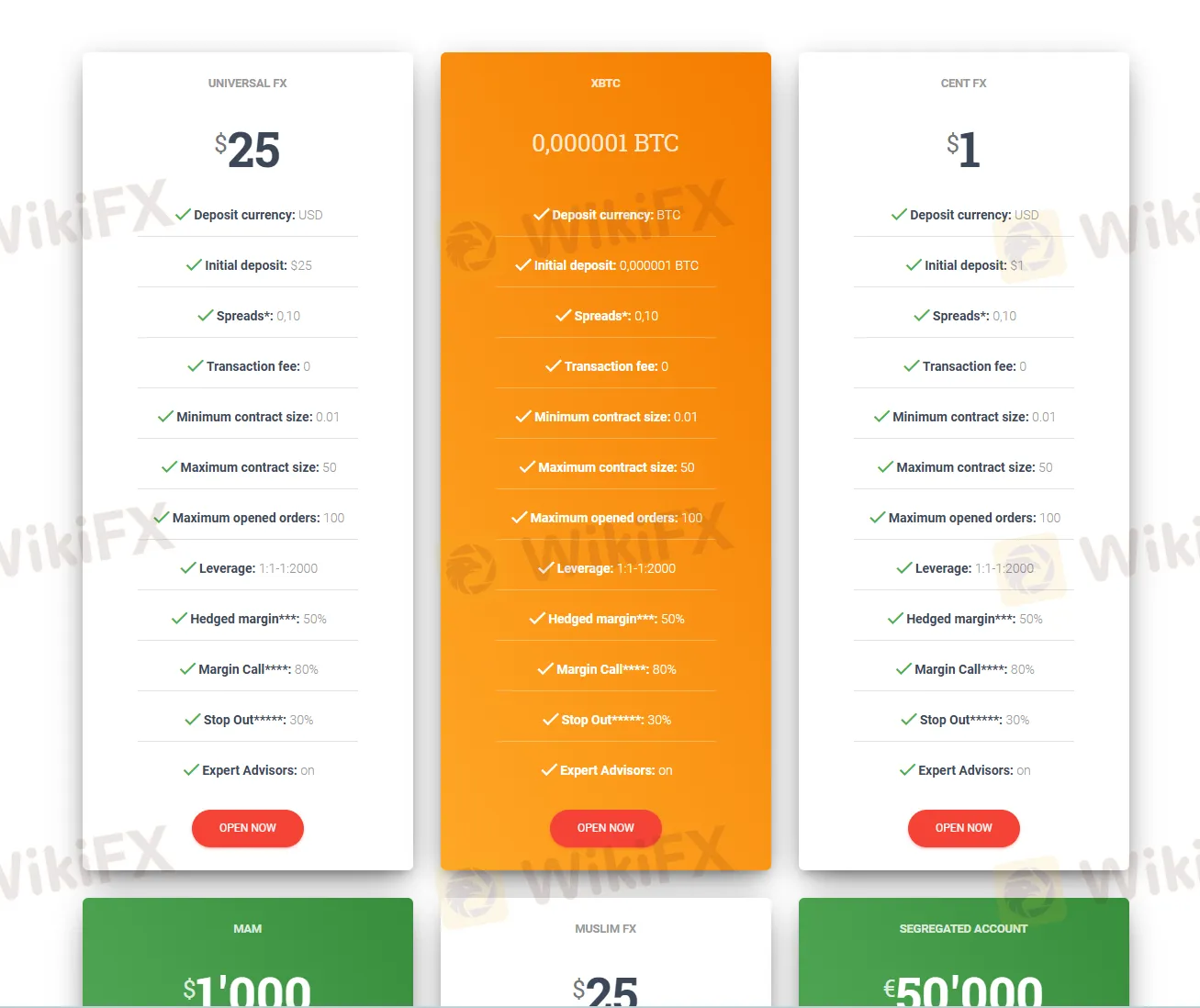

TemplerFX provides six types of accounts: Universal FX, XBTC, Cent FX, MAM, Muslim FX, and Segregated accounts. The minimum deposit requirements for these accounts are $25, 0.000001 BTC, $1, $1,000, $25, and €50,000 respectively.

| Account Type | Minimum Deposit |

| Cent FX | $1 |

| Universal FX | $25 |

| Muslim FX | $25 |

| XBTC | 0.000001 BTC |

| MAM | $1,000 |

| Segregated accounts | €50,000 |

TemplerFX offers flexible leverages for each account, ranging from 1:1 to 1:2000. High leverage also comes with a heightened level of risk. A small adverse price movement can lead to significant losses, potentially exceeding the traders initial deposit.

TemplerFX offers different account types with varying pip spreads and transaction fee policies.

| Account Type | Spread | Transaction Fee |

| Universal FX | 0.1 pips | ❌ |

| XBTC | ||

| Cent FX | ||

| MAM | ||

| Segregated accounts | ||

| Muslim FX | 1 pip | $5/lot |

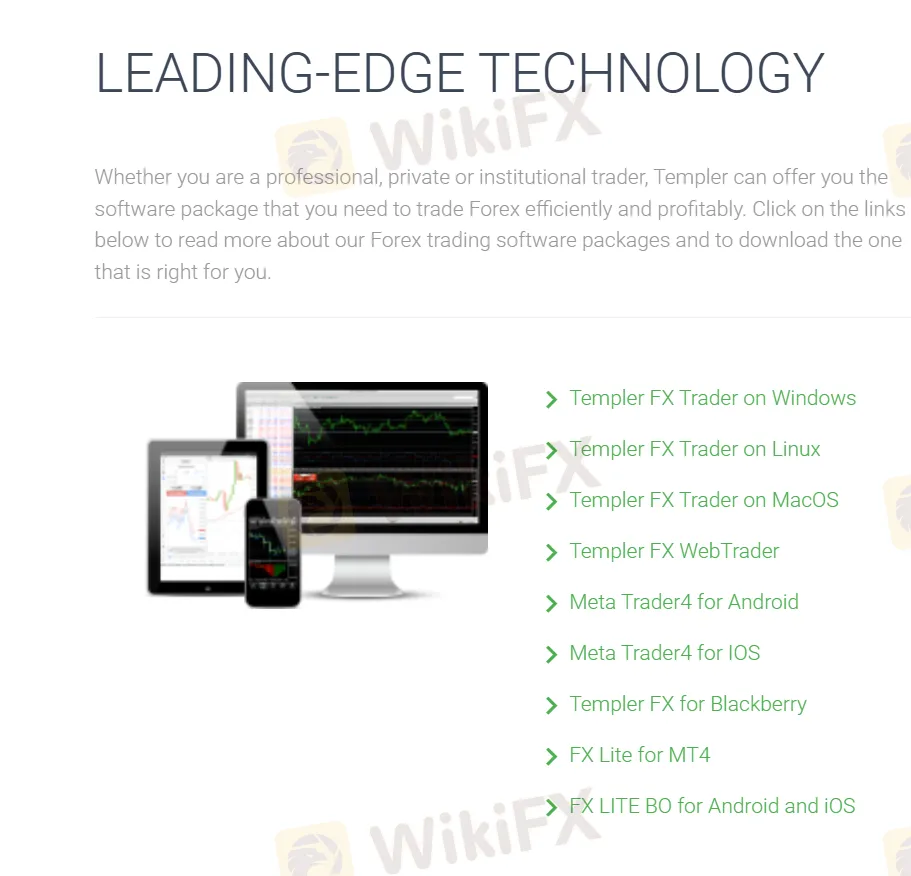

TemplerFX supports MT4 and Templer FX Trader.

For mobile users, there are MetaTrader 4 versions available for Android, iOS, and BlackBerry devices, each equipped with real - time trading features like order placement, stop - loss/take - profit setting, and access to trading history.

Desktop users can choose from options like Templer FX Trader on Linux (using Wine), MacOS (using Wine and PlayOnMac), and the Templer FX WebTrader, which is accessible via any modern browser on multiple operating systems without extra software installation.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT4 | ✔ | Web/ Android/ iOS | Beginners |

| MT5 | ❌ | / | Experienced traders |

TemplerFX offers many methods to make a deposit and withdrawal, including VISA, mastercard, wire transfer, skrill, CONTACT, LEADER, Perfect money, fasapay, OKPAY, and so on. You can learn more through clicking: https://templerfx.com/en/trading/trading_terms/deposit_withdraw.

Deposit Options

| Deposit option | Available currency | Minimum Deposit | Maximum Deposit | Deposit Fee | Deposit Processing time |

| VISA/ Mastercard | USD | 1 | 10,000 | 0 | Automatic, instantly |

| Wire Transfer | USD, EUR, CHF, GBP | 100 | - | Set by your bank | 1 hour |

| Skrill | USD | 10 | 10,000 | 0 | Automatic, instantly |

| Perfect Money | 1 | 1,000 | 1% | ||

| Fasapay | - | ❌ | |||

| OK PAY | - |

Withdrawal Options

| Withdrawal option | Available currency | Minimum Withdrawal | Maximum Withdrawal | Withdrawal Fee | Withdrawal Processing time |

| VISA/ Mastercard | USD | 15 | 1,000 | 2% + 5USD | 1 - 5 business days |

| Wire Transfer | 1,000 | - | 50 EUR | ||

| Skrill | 10 | up to a deposited sum | ❌ | Automatic, instantly | |

| Perfect Money | 1 | - | |||

| Fasapay | 500 | ||||

| OK PAY | 5 | 10,000 | 3% | up to 72 hrs |

More

User comment

2

CommentsWrite a review

2023-02-17 16:38

2023-02-17 16:38