User Reviews

More

User comment

2

CommentsWrite a review

2024-01-26 18:24

2024-01-26 18:24

2024-01-06 01:00

2024-01-06 01:00

Score

2-5 years

2-5 yearsRegulated in Hong Kong

Precious Metals Trading (AGN)

Suspicious Scope of Business

Medium potential risk

Influence

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index7.15

Business Index6.52

Risk Management Index7.38

Software Index6.43

License Index7.19

Single Core

1G

40G

More

Company Name

亨达金银投资有限公司

Company Abbreviation

Hantec Bullion Limited

Platform registered country and region

Hong Kong

Company website

85263358564

Company summary

Pyramid scheme complaint

Expose

| Hantec Bullion Review Summary | |

| Founded | 1990 |

| Registered Country/Region | Hong Kong |

| Regulation | CGSE regulated; suspicious ASIC, FCA, VFSC clone |

| Market Instruments | Precious metals: gold and silver |

| Demo Account | ✅ |

| Spread | / |

| Leverage | Up to 1:100 |

| Minimum Deposit | / |

| Trading Platform | MT4, Hantec e-Gold |

| Tel: (852) 2214 4288 | |

| Mainland toll-free: 4008 429 022 | |

| Fax: (852) 2214 4299 | |

| Email: cs@hantec.com, cs@hantecgroup.com | |

| Address: Unit 4609, 46 / F, Cosco Tower, 183 Queen's Road Central, Hong Kong | |

Hantec Bullion, one of the subsidiaries of the Hantac group, was established in 1990 and offers a range of precious metal products, including 99% gold, Hong Kong and RMB kilogram bars, as well as London gold and silver. It offers 24/5 support and a demo account to simulate market conditions for practicing.

Moreover, it does not charge deposit fees and commissions, significantly reducing trading costs for investors. Trades can be executed on the advanced MT4 platform and its proprietary Hantec e-Gold platform.

It also offers an analysis platform called “Trading Central” to offer research, forecast, commentaries and market trends from senior analyst for traders to seize market opportunities.

Furthermore, one assuring news if that the broker is decently regulated by CGSE (The Chinese Gold & Silver Exchange Society), proving a certain level of credibility and reliability.

| Pros | Cons |

| CGSE regulated | Limited transparency on trading conditions |

| MT4 platform | Trading margin required |

| Many years of industry experience | |

| Demo accounts | |

| No commissions |

Hantec Bullion is officially regulated by CGSE (The Chinese Gold & Silver Exchange Society), with a licenses numbering at 163, indicating legal compliance in the region.

Though its ASIC, FCA and VFSC licenses are suspected to be fake clones, but after investigation, the regulated entities are subsidiaries of the Hantec Group who has 19 offices around the globe, which means Hantec Bullion does not necessarily duplicate these licenses.

| Regulated Country | Regulator | Regulatory Status | Regulated Entity | License Type | License Number |

| CGSE | Regulated | 亨達金銀投資有限公司 | Type AA License | 163 |

| ASIC | Suspicious Clone | Hantec Markets (Australia) Pty Limited | Market Making (MM) | 326907 |

| FCA | Suspicious Clone | Hantec Markets Limited | Market Making (MM) | 502635 |

| VFSC | Suspicious Clone | Hantec Markets (V) Company Limited | Retail Forex License | 40318 |

Hantec Bullion focuses on precious metals trading mainly, with several asset classes included:

If you are enthusiastic in precious metals trading and want to trade with Hantec Bullion, learn and gain insights about the company's products before tapping into real trading activities.

| Tradable Instruments | Supported |

| Forex | ❌ |

| Commodities | ✔ |

| Indices | ❌ |

| Cryptocurrencies | ❌ |

| Shares | ❌ |

| ETFs | ❌ |

| Bonds | ❌ |

| Mutual Funds | ❌ |

Hantec Bullion provides a demo account that simulates real market conditions with virtual money distributing to trader's account for them to practice and test their trading strategies but no need to lose real money.

Live account is available for you to conduct actual trading when you are ready after gaining enough confidence and experience with demo account. The broker does not charge any commissions for actual trading, which benifits clients a lot by considerably reducing trading costs.

However, other vital trading conditions such as spread and minimum deposit requirements are not readily available, calling you to seek clarification from them directly.

Leverage, a trading tool that enables you to control larger positions with smaller capital, should always be used cautiously, with risk management indispensable for every investors.

With Hantec Bullion, leverage level is up to 1:100.

Hantec Bullion offers two trading platforms for trades execution: the popular MetaTrader4 and its proprietary Hantec e-Gold.

The MT4 platform is widely recognized globally for its robust functions, built-in charting tools and techinical indicatiors and customized interface. Traders can configure settings of the platform according to their own preferences. It's downloaded from Windows, iOS and Android devices.

Besides, the company also developed its own platform called “Hantec e-Gold” which allows for trading on the go by mobile apps downloaded from iOS, Android and Windows devices. The platform claims full technical supports 24 hours a day.

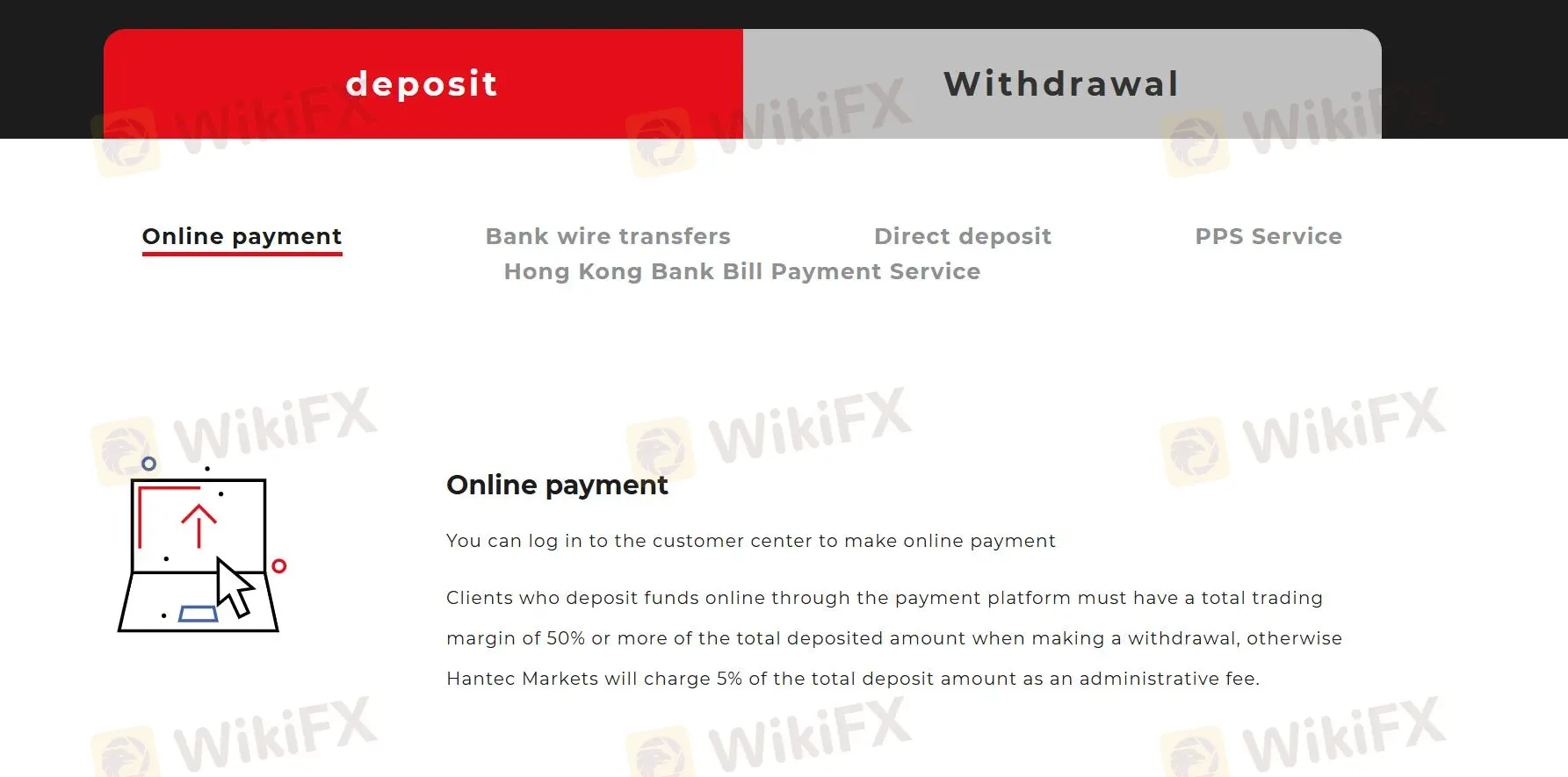

Hantec Bullion enables several funding methods, each with its own requirements and features.

More

User comment

2

CommentsWrite a review

2024-01-26 18:24

2024-01-26 18:24

2024-01-06 01:00

2024-01-06 01:00