User Reviews

More

User comment

0

CommentsWrite a review

No comment yet

Score

2-5 years

2-5 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index6.21

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

| Key Information | Details |

| Company Name | fpmarketsFX |

| Years of Establishment | Within 1 year |

| Headquarters | Australia |

| Office Locations | Exchange, House Level 5/10 Bridge St, Sydney NSW 2000, Australia |

| Regulation | Unregulated |

| Tradable Assets | Forex, Stocks, Commodities, Indices, Cryptocurrencies |

| Account Types | Entry, Silver, Gold, Platinum |

| Commission | 5 EUR/lot |

| Minimum Deposit | $250 |

| Leverage | Up to 1:200 |

| Spread | As low as 0.0 pips |

| Deposit/Withdrawal Methods | Not specified |

| Trading Platforms | Wave Mobile App |

| Customer Support Options | Phone |

FpmarketsFX is an unregulated trading entity in Australia, offering a spectrum of trading services encompassing forex, stocks, commodities, indices, and cryptocurrencies. The company presents a tiered account system accommodating diverse trading needs with varying deposit thresholds, spreads, and leverages.

Notably, the company's customer support is confined to a sole phone channel, a limitation that might deter those seeking comprehensive assistance. Furthermore, the absence of a website hampers access to critical information, including details about the touted Wave trading platform, along with deposit and withdrawal procedures.

FpmarketsFX operates without the oversight of any regulatory authority, rendering it unregulated in its trading activities. This absence of regulatory oversight implies that the company's operations are not subject to external monitoring or compliance with established financial standards. The broker functions without the formal framework that regulatory bodies typically provide, potentially resulting in an environment where investor protection measures and adherence to industry practices may not be guaranteed.

FpmarketsFX offers a range of tradable assets, spanning forex, stocks, commodities, indices, and cryptocurrencies. This variety allows traders to explore different markets within a single platform. The broker also presents multiple account types tailored to different deposit levels, accommodating various trading preferences. Additionally, the availability of leverage across different asset classes provides traders with potential opportunities to amplify their positions and manage risk accordingly.

The company's unregulated status raises concerns about transparency and investor protection. Moreover, the absence of a functional website restricts traders from accessing vital information, including the creation of a trading account with fpmarketsFX. This lack of accessible information hampers credibility and limits traders' ability to make informed decisions. Furthermore, the limited customer support option, consisting of only a phone channel, might hinder effective communication, particularly for traders seeking prompt assistance. Additionally, the absence of information about the claimed trading platform, Wave, further compounds the lack of transparency and raises questions about the company's operational reliability.

| Pros | Cons |

| Range of tradable assets | Unregulated status |

| Multiple account types | Lack of regulatory oversight |

| Leverage opportunities | Inaccessible website |

| Lacking deposit/withdrawal information | |

| Singular customer support option | |

| No information on trading platform |

FpmarketsFX's website is currently inaccessible, impeding access to crucial information and potentially affecting the company's credibility. This lack of a functional website hampers transparency and restricts potential traders from obtaining detailed insights into the company's offerings, account registration procedures, trading conditions, and platform features. As a result, interested traders are unable to create trading accounts with the company, leading to a notable disadvantage in terms of their ability to evaluate the company's services comprehensively before making an informed decision.

fpmarketsFX offers a variety of market instruments similar to its competitors, encompassing forex, stocks, commodities, indices, and cryptocurrencies.Forex: fpmarketsFX provides access to the forex market, allowing traders to engage in currency trading. This market allows participants to speculate on the exchange rate fluctuations between different currency pairs.

Stocks: fpmarketsFX facilitates trading in stocks, enabling investors to buy and sell shares in publicly-listed companies. This market offers opportunities for traders to capitalize on price movements of individual stocks.

Commodities: fpmarketsFX offers trading in commodities, which includes valuable resources like gold, oil, and agricultural products. This market allows traders to speculate on the price movements of these physical assets.

Indices: fpmarketsFX provides access to indices trading, allowing traders to invest in a collection of stocks that represent a specific market or sector. This market offers a way to speculate on the overall performance of a group of companies.

Cryptocurrencies: fpmarketsFX includes cryptocurrencies in its offering, enabling traders to speculate on the price movements of digital currencies like Bitcoin, Ethereum, and others.

The following table compares fpmarketsFX to competing brokerages in terms of available market instruments:

| Broker | Market Instruments |

| fpmarketsFX | Forex, Stocks, Commodities, Indices, Cryptocurrencies |

| FXPro | Forex, Stocks, Commodities, Indices, Cryptocurrencies |

| IC Markets | Forex, Stocks, Commodities, Indices, Cryptocurrencies |

| FBS | Forex, Stocks, Commodities, Indices, Cryptocurrencies, Precious Metals, Energies, Futures |

| Exness | Forex, Stocks, Commodities, Indices, Cryptocurrencies, Precious Metals, Energies, Options |

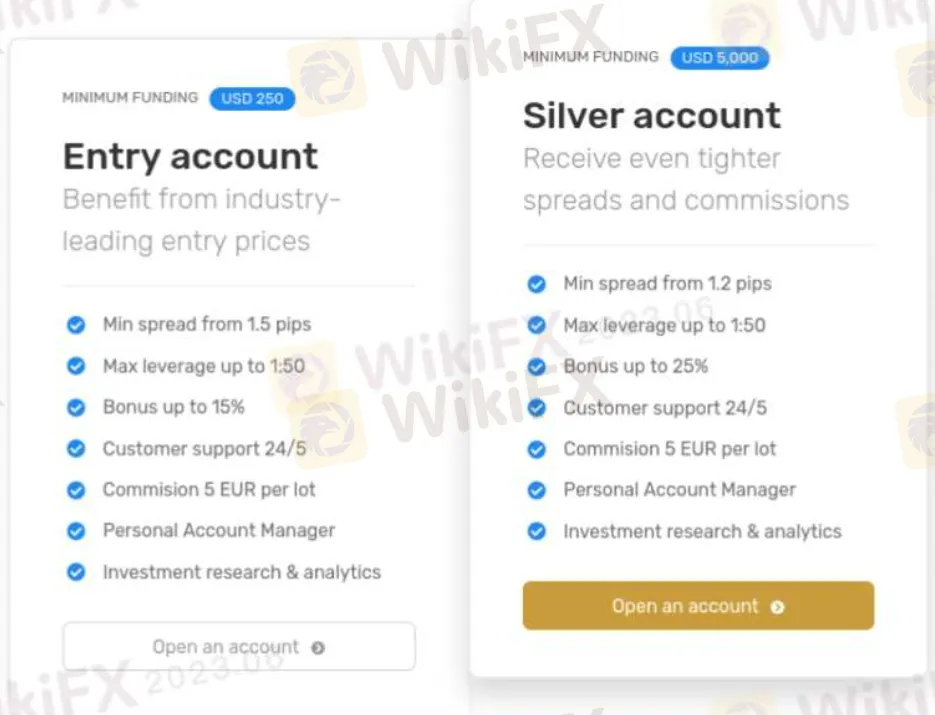

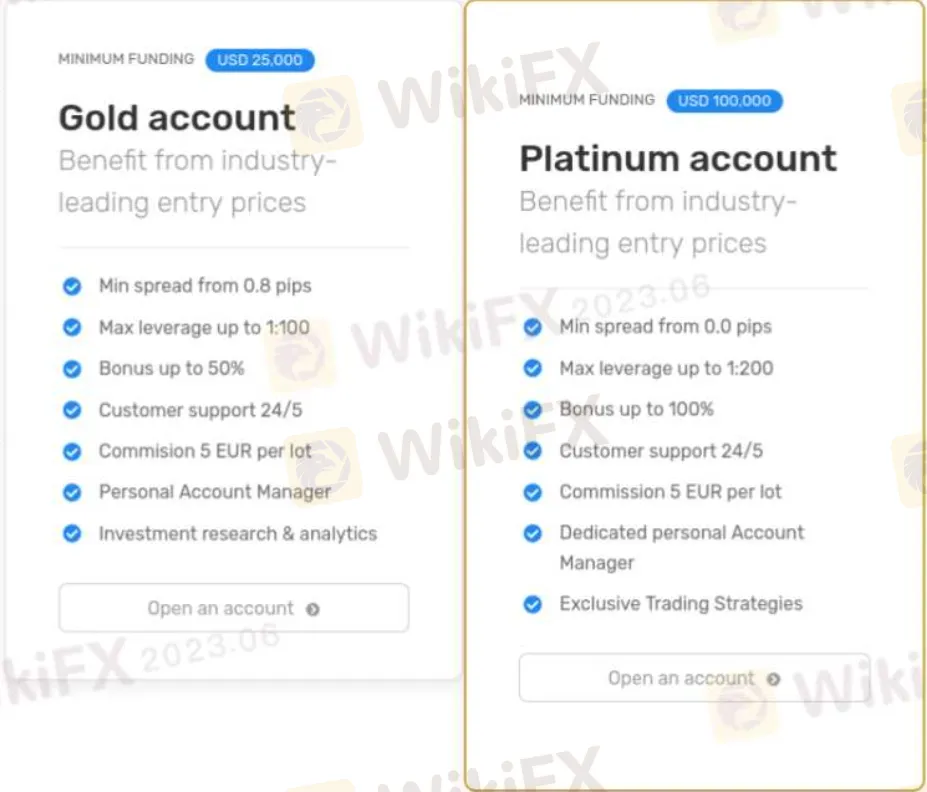

The account types offered by fpmarketsFX cater to different trading needs based on minimum deposit levels and trading conditions. Specifics are as follows:

Entry Account: The Entry account type offered by fpmarketsFX is tailored for traders looking to begin with a minimum deposit of $250. With spreads starting from 1.5 pips, traders have the opportunity to access the forex and other markets. The leverage is up to 1:50, providing a level of amplification for trading positions. It's worth noting that this account type incurs a commission of 5 EUR per lot traded.

Silver Account: The Silver account type targets traders who can afford a minimum deposit of $5,000. This account offers tighter spreads, starting from 1.2 pips, while maintaining a leverage of up to 1:50. Similarly, a commission of 5 EUR per lot traded applies to this account type. The Silver account suits traders seeking more competitive trading conditions compared to the Entry account.

Gold Account: For traders with a higher capital base, the Gold account requires a minimum deposit of $25,000. This account type offers tighter spreads starting from 0.8 pips and allows for increased leverage, up to 1:100. Like the previous accounts, the Gold account entails a commission of 5 EUR per lot traded. This account is suitable for traders looking for enhanced trading terms.

Platinum Account: The Platinum account, designed for experienced and well-capitalized traders, mandates a minimum deposit of $100,000. Traders with this account enjoy spreads starting from 0.0 pips, and they can access the highest leverage ratio offered by fpmarketsFX, which is up to 1:200. Similar to other account types, a commission of 5 EUR per lot traded applies to the Platinum account.

Here's a table comparing the features of each account type:

| Account Type | Minimum Deposit | Spreads | Leverage |

| Entry | $250 | From 1.5 pips | Up to 1:50 |

| Silver | $5,000 | From 1.2 pips | Up to 1:50 |

| Gold | $25,000 | From 0.8 pips | Up to 1:100 |

| Platinum | $100,000 | From 0.0 pips | Up to 1:200 |

The commission structure of fpmarketsFX involves a fixed charge of 5 EUR per lot traded across all account types. This fee is applicable alongside the spreads and is a consistent factor to consider when calculating trading costs. The commission can impact the overall profitability of trades, especially for high-volume traders. It's important for traders to factor in this commission when evaluating the cost-effectiveness of different account types and trading strategies.

fpmarketsFX offers a range of minimum deposit rates across its various account types to cater to different levels of traders. The minimum deposit requirement starts at $250 for the Entry account, which is designed for those looking to begin with a modest capital base. The Silver account requires a higher minimum deposit of $5,000, providing traders with slightly improved trading conditions. For more experienced and well-capitalized traders, the Gold account demands a minimum deposit of $25,000, offering tighter spreads and potentially more favorable trading terms. The highest minimum deposit of $100,000 is associated with the Platinum account, which provides access to the most competitive trading conditions and leverage ratios.

fpmarketsFX offers varying levels of leverage across different market instruments, allowing traders to potentially magnify their trading positions. The leverage ratios differ based on the type of asset being traded. The highest leverage ratio provided is up to 1:200, applicable to the Platinum account for forex trading. Similarly, leverage ratios of up to 1:50 for stocks, up to 1:100 for commodities, up to 1:50 for indices, and up to 1:20 for cryptocurrencies offer traders the ability to control larger positions with a relatively smaller amount of capital. To provide a comparative perspective, here's a table showcasing the maximum leverage ratios across different market instruments for fpmarketsFX and other mentioned brokerages:

| Broker | Forex | Stocks | Commodities | Indices | Cryptocurrencies |

| fpmarketsFX | Up to 1:200 | Up to 1:20 | Up to 1:100 | Up to 1:50 | Up to 1:20 |

| FXPro | Up to 1:500 | Up to 1:5 | Up to 1:150 | Up to 1:20 | Up to 1:2 |

| IC Markets | Up to 1:500 | Up to 1:20 | Up to 1:500 | Up to 1:20 | Up to 1:5 |

| FBS | Up to 1:3000 | Up to 1:20 | Up to 1:500 | Up to 1:100 | Up to 1:100 |

| Exness | Up to 1:2000 | Up to 1:5 | Up to 1:200 | Up to 1:200 | Up |

FpmarketsFX presents a spread structure that varies across its account types and market instruments. The spreads, or the difference between the bid and ask prices, indicate the cost of trading for traders. The Entry account offers spreads starting from 1.5 pips, while the Silver account provides slightly tighter spreads starting from 1.2 pips. The Gold account further improves the trading conditions with spreads starting from 0.8 pips. Notably, the Platinum account offers the most favorable spread conditions, with spreads starting from as low as 0.0 pips. This spread variation is intended to cater to different trader preferences and levels of experience, allowing them to choose account types that align with their trading strategies and cost considerations.

fpmarketsFX offers the Wave trading platform, as indicated by historical data of this companies website. Unfortunately, no further details are given about this platform, such as its features, functionalities, or user interface.

Here's a table that compares the trading platforms offered by the mentioned brokerages:

| Broker | Trading Platforms |

| fpmarketsFX | Wave |

| FXTM | MT4, MT5, FXTM Trader |

| Exness | MT4, MT5 |

| Pepperstone | MT4, MT5, cTrader, Smart Trader Tools |

FpmarketsFX offers customer support primarily through a single channel, which is the phone. Traders can reach out to the company's customer support team by dialing the provided phone number, +44 2037723404.

This lack of diversified customer support channels can hinder effective and timely assistance, potentially causing inconvenience for traders. It's important for brokerage firms to offer multiple communication avenues to accommodate various preferences and provide efficient solutions to trader queries.

In conclusion, fpmarketsFX is a recently established trading entity with an unregulated status. While its offering includes a spectrum of market instruments such as forex, stocks, commodities, indices, and cryptocurrencies. The company's account types cater to various trader profiles, enabling individuals to choose from different minimum deposit requirements and trading conditions.

However, the absence of a functional website obstructs access to critical information, and the single customer support channel via phone might limit the efficiency and convenience of assistance for traders. Additionally, the details regarding the offered trading platform, Wave, remain undisclosed, posing questions about the operational reliability of the platform.

Q: What types of market instruments are available for trading with fpmarketsFX?

A: Traders can access forex, stocks, commodities, indices, and cryptocurrencies.

Q: What is the minimum deposit requirement for the Silver account?

A: The Silver account requires a minimum deposit of $5,000.

Q: What is the highest leverage ratio offered by fpmarketsFX?

A: The Platinum account offers a leverage ratio of up to 1:200.

Q: How can traders reach the customer support team of fpmarketsFX?

A: Customer support can be reached through a provided phone number.

Q: What is the potential drawback of having only a phone-based customer support channel?

A: Relying solely on phone support may hinder effective and diverse assistance options.

Q: What is the unregulated status of fpmarketsFX?

A: The company operates without oversight from regulatory authorities.

More

User comment

0

CommentsWrite a review

No comment yet

start to write first comment