User Reviews

More

User comment

10

CommentsWrite a review

2024-05-08 17:53

2024-05-08 17:53

2024-03-08 11:50

2024-03-08 11:50

Score

Influence

Add brokers

Comparison

Quantity 1

Exposure

Score

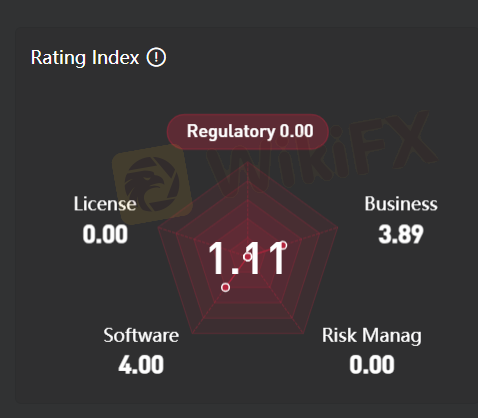

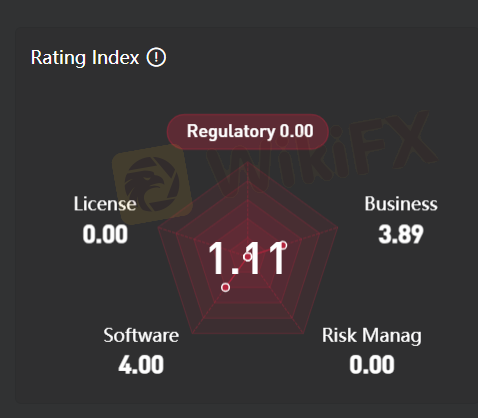

Regulatory Index0.00

Business Index5.44

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

Company Name

BitDelta

Company Abbreviation

BitDelta

Platform registered country and region

United Kingdom

Company website

X

YouTube

Company summary

Pyramid scheme complaint

Expose

| Aspect | Information |

| Company Name | BitDelta |

| Registered Country/Area | China |

| Founded Year | 2023 |

| Regulation | Unregulated |

| Tradable Assets | Cryptocurrencies, Stocks, Commodities, Indices |

| Account Types | Peer-to-peer (P2P) |

| Maximum Leverage | Not offered |

| Spreads | Variable |

| Trading Platforms | MT5, Mobile app |

| Customer Support | Email support@bitdelta.com |

| Deposit & Withdrawal | Bank transfers, Credit/Debit cards, Cryptocurrency |

| Educational Resources | Blog, Tokenomics insights, Features list |

BitDelta, a company based in China and established in 2023, operates as an unregulated platform within the financial landscape. This lack of regulation raises considerations about transparency and oversight within the exchange. Users might find concerns regarding the absence of protective oversight typically provided by regulatory authorities, potentially elevating risks associated with fraud, market manipulation, and security breaches.

The platform distinguishes itself by offering a peer-to-peer (P2P) model, allowing direct trading between users without involving the exchange as an intermediary. While this setup often translates to potentially lower fees and increased flexibility, it also poses questions about trade quality assurance and dispute resolution due to the absence of a central authority overseeing trades.

Traders on BitDelta have access to a range of tradable assets, including cryptocurrencies, stocks, commodities, and indices. This diversity caters to various investment preferences and allows for portfolio diversification across different financial markets.

BitDelta operates without regulation, prompting concerns regarding transparency and oversight within the exchange. Unregulated platforms lack the protective oversight and legal assurances provided by regulatory authorities, elevating the risk of fraud, market manipulation, and security breaches. This absence of regulation not only complicates user recourse and dispute resolution but also contributes to a less transparent trading environment. As a result, evaluating the legitimacy and reliability of the exchange becomes challenging for users due to the lack of regulatory scrutiny.

| Pros | Cons |

| Diverse asset selection | Lack of regulatory oversight |

| User-friendly interface | Limited payment methods |

| Accessible mobile app | No leverage offered |

| Comprehensive customer support |

Pros:

1.Diverse Asset Selection: BitDelta offers a wide range of assets for trading, including cryptocurrencies, stocks, commodities, and indices. This diversity allows traders to build diverse portfolios and explore various markets, catering to different investment preferences and strategies.

2. User-Friendly Interface: The platform boasts a user-friendly interface, simplifying the trading experience for both novice and experienced traders. Its intuitive design and navigation make it easy to execute trades, analyze markets, and access essential tools without a steep learning curve.

3. Accessible Mobile App: BitDelta's mobile app, available on various app stores, ensures accessibility for traders on-the-go. It allows users to monitor their trades, execute orders, and access market information conveniently from their mobile devices, enhancing flexibility and responsiveness.

4. Comprehensive Customer Support: BitDelta offers robust customer support, providing users with assistance and guidance round-the-clock. Their dedicated support team helps resolve queries, troubleshoot issues, and offer guidance, fostering a supportive trading environment.

Cons:

1.Lack of Regulatory Oversight: BitDelta operates without regulatory oversight, which might raise concerns about user protection, transparency, and adherence to industry standards. The absence of regulation could pose risks related to security, fairness, and dispute resolution.

2. Limited Payment Methods: The platform has a limited range of payment methods available for deposits and withdrawals. A restricted selection might inconvenience users who prefer alternative or specific payment options not supported by BitDelta.

3. No Leverage Offered: BitDelta does not provide leverage options to its users. While this might be seen as a risk management strategy by some, the absence of leverage limits the potential for users to amplify their trading positions and potential returns.

BitDelta's range of trading assets across forex, stocks, commodities, and indices provides traders with diverse investment opportunities across various financial markets, catering to different trading strategies and risk appetites.

1.Forex (Foreign Exchange): BitDelta offers access to a diverse range of currency pairs in the forex market. Traders can engage in the dynamic world of currency trading, speculating on the exchange rate fluctuations between various global currencies. Major, minor, and exotic currency pairs are typically available, allowing traders to capitalize on price movements in these markets.

2. Stocks: BitDelta provides opportunities for traders to invest in a selection of publicly traded stocks. These stocks often represent ownership in well-known companies listed on various global stock exchanges. Traders can speculate on price movements, dividends, and other market events related to these individual stocks.

3. Commodities: Traders using BitDelta have access to commodities trading, which includes various raw materials and primary agricultural products. This asset class can encompass goods like gold, silver, crude oil, agricultural products, and more. Trading commodities allows investors to diversify their portfolios and hedge against inflation or market volatility.

4. Indices: BitDelta offers trading options related to market indices, representing the performance of a group of stocks or assets from a particular market or sector. These indices provide exposure to broader market movements rather than individual stocks, allowing traders to speculate on the overall performance of specific markets or segments of the economy.

Bitdelta operates as a peer-to-peer (P2P) exchange, distinguishing itself by enabling direct trading between users rather than involving the exchange as an intermediary. This unique setup often translates to potentially lower fees and increased flexibility for traders. However, it's essential to note that in a P2P model, the absence of a central authority overseeing trades might raise considerations about the assurance of trade quality or the resolution of disputes.

Unlike some trading platforms that offer leverage to amplify trading positions, Bitdelta does not provide leverage options to its users. The absence of leverage might influence trading strategies and risk management techniques used by traders on the platform.

Here are the steps to open an account with BitDelta broken down into six concrete procedures:

1.Visit BitDelta's Website: Access the official BitDelta website using a web browser.

2. Locate the Sign-Up or Register Button: Look for the “Sign-Up” or “Register” button on the website's homepage or within the account creation section.

3. Complete the Registration Form: Fill out the registration form with accurate personal details. This typically includes your full name, email address, country of residence, and contact information.

4. Verification of Identity: After submitting the registration form, BitDelta may require identity verification. This often involves providing identification documents such as a passport, driver's license, or ID card to comply with regulatory requirements.

5. Account Confirmation: Once the registration and verification processes are complete, you'll receive a confirmation email or notification from BitDelta acknowledging the successful creation of your account.

6. Fund Your Account: After your account is confirmed, proceed to fund your account with the required initial deposit using the available deposit methods provided by BitDelta. Follow the instructions provided for making deposits through bank transfers, credit/debit cards, or other accepted payment methods.

By following these six steps, you can successfully register and open an account with BitDelta, enabling you to start your trading journey on their platform.

Bitdelta does not offer leverage options to its users. Unlike some other trading platforms that provide leverage to amplify trading positions, Bitdelta operates without this feature. Therefore, traders utilizing Bitdelta do not have access to leverage for magnifying their trading capital or positions. The absence of leverage on Bitdelta may influence trading strategies and risk management approaches employed by users on the platform.

Bitdelta operates with variable spreads, meaning the spread value fluctuates based on the prevailing market conditions. The spread represents the difference between the buying (ask) price and the selling (bid) price of an asset. These variable spreads can change dynamically in response to market liquidity, volatility, and demand, impacting the overall cost of trading on the platform.

Regarding commissions, Bitdelta charges a flat commission fee of 0.75% on all trades executed through its platform. This commission is calculated based on the total value of the trade. For instance, if a trade is valued at $1000, the commission charged by Bitdelta would amount to $7.50 (0.75% of $1000). This commission is a part of the overall cost structure associated with conducting trades on Bitdelta and is applied uniformly across all trades executed on the platform.

BitDelta offers a comprehensive trading experience through its platform, including the MT5 (MetaTrader 5) software. The BitDelta mobile app, available on the Play Store, enables users to trade on-the-go, providing accessibility anytime and anywhere. With over 400 assets available for trading, BitDelta offers diverse options for users, allowing for limitless potential and portfolio diversification across more than 7 financial markets. The platform boasts 15+ features designed to ensure a seamless, efficient, and dynamic trading experience for its users. Additionally, BitDelta provides dedicated 24/7 customer support, offering assistance to resolve queries and provide guidance whenever needed.

BitDelta offers a variety of payment methods for deposits and withdrawals. These methods are designed to be convenient and secure for users, and include:

Debit/Credit Cards: Visa, Mastercard, Maestro, and American Express are all accepted. This is a convenient option for most users.

Bank Transfers: This method is available for larger deposits and withdrawals. It is generally considered to be a secure option, but can be slower than other methods.

Cryptocurrencies: Bitcoin, Ethereum, Litecoin, and USDT are all accepted. This is a convenient option for users who already own cryptocurrency, or who want to avoid traditional banking systems.

Payment Fees

Trading Fees: For all pairs (BTCUSDT, BDTUSDT, ETHUSDT, and more), the minium buy&sell amount is consistently 10.5 USDT, with a fixed taker and maker fee of 0.15.

Transaction Fees: For various cryptocurrencies like BTC, ETH, LTC, BNB, XRP, BCH, USDT, UNI, USDC, and numerous others, the withdrawal fees vary significantly. Here are a few examples:

BTC has a minimum withdrawal of 0.002 and withdrawal fee of 0.001.

ETH has a minimum withdrawal of 0.02 and withdrawal fee of 0.01.

LTC has a minimum withdrawal of 0.004 and withdrawal fee of 0.002.

XRP has a minimum withdrawal of 40 and withdrawal fee of 0.5.

USDT has a minimum withdrawal of 50 and withdrawal fee 6.

Each cryptocurrency pair or token has its own specific transaction fees, ranging from fractions of the currency to much larger amounts, depending on the type of transaction conducted.

These fees play a significant role in the cost structure for traders and investors engaging in transactions within the cryptocurrency market.

BitDelta, managed by LIONHEART D.O.O., offers customer support through its dedicated email address: support@bitdelta.com. Users can reach out to address inquiries, seek assistance, or resolve issues related to the platform's functionalities, trading queries, or account-related concerns. The platform aims to provide responsive and reliable support, ensuring users receive guidance and solutions promptly. This email-based support system serves as a direct communication channel, allowing users to engage with BitDelta's support team for comprehensive assistance, contributing to a smoother and more informed trading experience for its clientele.

BitDelta offers educational resources through its blog, covering a wide array of topics related to cryptocurrency, trading insights, market trends, and platform updates. The blog serves as a valuable repository of information, providing users with articles, analysis, and news that aim to enhance their understanding of the cryptocurrency landscape and trading strategies.

Additionally, BitDelta offers educational content focusing on tokenomics, delving into the economics and mechanics behind various tokens or cryptocurrencies. This resource aims to educate users on the fundamental principles governing these digital assets, including their utility, value proposition, and underlying mechanisms.

Moreover, BitDelta provides a comprehensive features list, offering detailed information about the functionalities and tools available on the platform. This resource serves as a guide for users to navigate the platform's offerings, understand its capabilities, and leverage the available tools effectively while trading or engaging with the platform's features.

BitDelta offers a diverse range of trading assets and a user-friendly interface, enabling traders to access various markets easily. Its accessible mobile app and comprehensive customer support enhance convenience and assistance.

However, the platform faces challenges due to the lack of regulatory oversight, potentially impacting user security and transparency. The limited payment methods and absence of leverage options might restrict some users' preferences and trading strategies. Despite its advantages, users should consider the platform's drawbacks, emphasizing regulatory concerns and constraints in payment methods and leverage while navigating BitDelta's trading environment.

Q: What assets can I trade on BitDelta?

A: BitDelta offers trading opportunities across various assets, including cryptocurrencies, stocks, commodities, and indices.

Q: Does BitDelta provide leverage for trading?

A: No, BitDelta does not offer leverage options for trading on its platform.

Q: How can I contact BitDelta's customer support?

A: You can reach BitDelta's customer support team through email at support@bitdelta.com.

Q: Are there any fees for trading on BitDelta?

A: Yes, BitDelta charges a flat 0.75% commission on all trades executed on the platform.

Q: What payment methods does BitDelta support?

A: BitDelta supports various payment methods, including bank transfers, credit/debit cards, and potentially cryptocurrency transactions.

Q: Is there a minimum deposit required to start trading on BitDelta?

A: No, BitDelta does not enforce a minimum deposit requirement for users to start trading on the platform.

More

User comment

10

CommentsWrite a review

2024-05-08 17:53

2024-05-08 17:53

2024-03-08 11:50

2024-03-08 11:50