User Reviews

More

User comment

0

CommentsWrite a review

No comment yet

Score

5-10 years

5-10 yearsSuspicious Regulatory License

Global Business

High potential risk

Influence

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index7.12

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

Company Name

Emirates NBD Bank PJSC

Company Abbreviation

Emirates NBD

Platform registered country and region

United Arab Emirates

Company website

X

YouTube

Company summary

Pyramid scheme complaint

Expose

| Aspect | Information |

| Registered Country/Area | UAE (United Arab Emirates) |

| Company Name | Emirates NBD |

| Regulation | Unregulated as a broker |

| Services | Comprehensive financial services including banking, foreign exchange, investment, and wealth management |

| Customer Support | Versatile support options including phone, email, WhatsApp, and postal services, with dedicated lines for different banking segments |

Emirates NBD, headquartered in the UAE (United Arab Emirates), operates as an unregulated broker offering a wide array of financial services. These services encompass banking, foreign exchange, investment, and wealth management solutions, providing customers with comprehensive financial solutions. The bank emphasizes accessibility and convenience through versatile customer support options, including phone, email, WhatsApp, and postal services, with dedicated lines tailored to different banking segments. This commitment underscores Emirates NBD's dedication to providing a seamless banking experience while upholding regulatory standards and ensuring customer satisfaction.

Emirates NBD operates as a banking institution and is not regulated as a broker. Unlike brokerage firms, Emirates NBD's regulatory oversight pertains to banking activities rather than brokerage services. Customers should take this distinction into account when utilizing financial services offered by Emirates NBD.

Emirates NBD offers a range of advantages such as comprehensive foreign exchange services, global reach, competitive rates, and convenient customer support options. However, some potential drawbacks include the need for regulatory compliance in banking activities rather than brokerage services and the importance of ensuring the security of communication channels when engaging with the bank.

| Pros | Cons |

|

|

|

|

|

|

|

Emirates NBD offers a comprehensive suite of Foreign Exchange (FX) services tailored to meet the needs of different customer segments, including Personal, Priority, Private, Business, and Corporate & Institutional clients. Here's a structured overview of their offerings:

Foreign Exchange Services Overview

Global Reach: Transfer funds to over 100 countries, ensuring global connectivity.

Convenience: Offers convenient and flexible FX services tailored to customer needs.

Security: Ensures secured transactions for peace of mind.

Competitive Rates: Provides competitive buy and sell rates for various currencies including USD, GBP, INR, PKR, CAD, and JPY.

Currency Exchange Rates

Offers real-time buy and sell rates for major currencies, facilitating efficient currency conversion and international transactions.

Currency Conversion Calculator

Features a user-friendly currency conversion calculator for accurate conversions between major currencies.

International Money Transfer Services

DirectRemit: Free and fast 60-second transfers to select countries, available 24/7 via Mobile or Online Banking.

Telegraphic Transfers: Facilitates easy international money transfers from accounts within the UAE or globally.

Western Union: Offers convenient money transfers through Online and Mobile Banking platforms.

Demand Draft: Provides guaranteed payment options with the convenience of purchasing a demand draft from home, office, or on the go.

mePay: Allows instant money transfers to anyone in the UAE using just a mobile number, without needing an account number or IBAN.

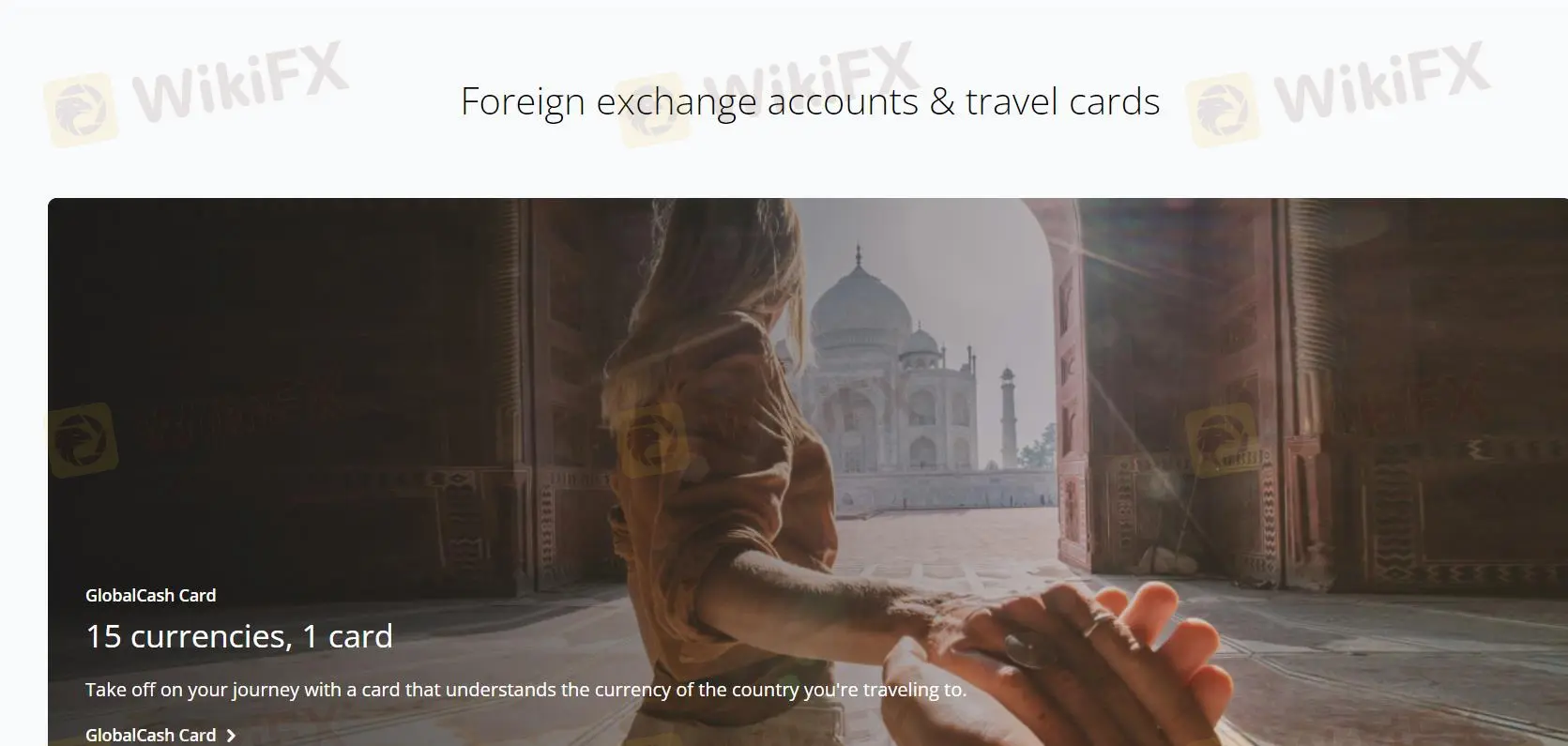

Foreign Exchange Accounts & Travel Cards

GlobalCash Card: A travel card that supports 15 currencies, designed for international travelers.

Fixed Deposits & Foreign Currency Accounts: Offers the opportunity to earn higher interest rates on foreign currencies with Fixed Deposit Accounts, accessible via Online Banking.

Foreign Currency Cash: Enables buying or selling foreign currency cash through Emirates NBD branches.

Free FX Services

Inward telegraphic transfer, account to account transfer, special rate deal booking, foreign currency cash via branches, and online FCY remittances are among the suite of free services provided to meet diverse FX needs.

Additional Information

Emirates NBD also provides guidelines and terms related to remittances and FX transactions across its services and channels, ensuring transparency and compliance.

Emirates NBD provides a comprehensive and versatile range of customer support options designed to cater to the diverse needs of its clients. These support channels ensure that clients can access assistance and manage their banking needs efficiently, through multiple platforms.

Mobile Banking Support

Access: Via the Emirates NBD Mobile Banking app.

Process: Users log in, tap at the bottom, scroll to Messaging > New Message, select a topic, send their request, and expect a response within 24 hours.

Online Banking Support

Access: Through the Emirates NBD Online Banking platform.

Process: Users log in, click on the navigation menu, go to Here to Help You > Messaging > New Message, select a topic, send their request, and anticipate a reply within 24 hours.

WhatsApp Banking

Initiation: By sending “Subscribe” to +971 600 540000 on WhatsApp.

Services: Includes account and card inquiries, with an option to chat with an agent.

Response Time: Within 30 minutes during agent chat timings (8 am to 10 pm, all week).

Phone Support

Personal Banking: Available at 600 54 0000 (local) or +971 600 54 0000 (international).

Priority Banking: Access through +971 800 100 or a dedicated relationship manager, with an international number +971 4 316 0333.

Business Banking: Call 600 54 0009 locally or +971 600 54 0009 internationally, or contact a dedicated relationship manager.

Private Banking: Reachable at 800 456 or through a relationship manager.

Corporate and Institutional Banking: Contactable at +971 4 201 2812 or via a relationship manager, available Monday to Friday, 8 am to 4 pm.

Email and Postal Support

General Queries: Through customersupport@emiratesnbd.com or by post at PO Box 777, Deira, Dubai, UAE. Response expected within 2 working days.

Corporate and Institutional Banking Queries: Via CCS@EmiratesNBD.com, with the same response time.

The bank emphasizes the security of its communication channels, advising against sharing confidential information like PIN or account details through insecure means. It encourages reporting suspicious emails to prevent fraud.

This multi-faceted approach to customer support demonstrates Emirates NBD's commitment to accessibility, convenience, and security, ensuring that clients have a seamless banking experience across all touchpoints.

Emirates NBD, operating primarily as a banking institution, offers a comprehensive suite of financial services tailored to various customer segments. While not regulated as a broker, it ensures regulatory compliance in its banking activities. With a global reach and competitive rates, its Foreign Exchange services cater to diverse needs, complemented by a range of free FX services. Through versatile customer support options, including mobile banking, online banking, WhatsApp banking, and phone and email support, Emirates NBD prioritizes accessibility, convenience, and security for its clients. This commitment underscores its dedication to providing a seamless banking experience while upholding the highest standards of service and compliance.

Q1: What services does Emirates NBD offer?

A1: Emirates NBD provides a wide range of financial services, including banking, foreign exchange, investment, and wealth management solutions.

Q2: How can I transfer money internationally with Emirates NBD?

A2: You can transfer money internationally through services like DirectRemit, telegraphic transfers, Western Union, and demand drafts, accessible via online or mobile banking platforms.

Q3: Does Emirates NBD offer travel currency cards?

A3: Yes, Emirates NBD offers the GlobalCash Card, supporting 15 currencies and designed for convenient use during international travel.

Q4: How can I contact customer support at Emirates NBD?

A4: You can reach Emirates NBD customer support through various channels, including phone, email, WhatsApp, and postal services, with dedicated lines for different banking segments.

Q5: Are Emirates NBD's communication channels secure?

A5: Yes, Emirates NBD emphasizes the security of its communication channels and advises against sharing confidential information through insecure means.

Online trading carries substantial risk, potentially leading to the total loss of invested funds. It may not be appropriate for all traders or investors. It's crucial to fully comprehend the associated risks before engaging in trading activities. Additionally, the content of this review is subject to change, reflecting updates in the company's services and policies. The review's creation date is also relevant, as information could have become outdated. Readers should confirm the latest information with the company prior to making any investment decisions. The responsibility for utilizing the information provided herein lies exclusively with the reader.

Balanced Emirates NBD review covering pros, cons, FX services, transfers, customer support, and regulation status as a bank, not a broker.

WikiFX

WikiFX

Emirates NBD has been a problem of plenty for its customers of late. They are accusing the company of foul play in every aspect of the transaction involving credit card scams, pathetic customer service over unresolved queries, and several other issues. Seemingly frustrated over these incidents, many of its customers have called out the United Arab Emirates-based financial services provider a ‘Scammer’ while sharing their reviews online. Read on to find out their reviews.

WikiFX

WikiFX

More

User comment

0

CommentsWrite a review

No comment yet

start to write first comment