User Reviews

More

User comment

0

CommentsWrite a review

No comment yet

Score

2-5 years

2-5 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index5.84

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

| InfininvestReview Summary | |

| Founded | 2023 |

| Registered Country/Region | France |

| Regulation | Uregulated |

| Market Instruments | 10,000+, Forex, Shares, Indices, Commodities, Bonds, Metals, Digital Currencies |

| Demo Account | / |

| Leverage | Up to 1:500 |

| Spread | From 0 pips |

| Trading Platform | MetaTrader 4 (MT4) & MetaTrader 5 (MT5), IRESS, WebTrader, mobile apps |

| Copy Trading | ✔ |

| Min Deposit | / |

| Customer Support | Service time: 24/7 |

| Phone: +390282958134 | |

| Email:support@infininvest.pro | |

| Facebook, Twitter, Instagram, WhatsApp, LinkedIn, YouTube | |

Infininvest was established in France in 2023, supporting seven trading asset classes and providing multilingual customer support. It claims to have 15 years of trading experience and offers low spreads. However, it is not regulated, so trading with this broker is risky.

| Pros | Cons |

| Multiple market instruments | Unregulated |

| MT4 and MT5 available | No info on minimum deposit |

| 24/7 multilingual customer support |

No, Infininvest is not regulated. Traders should carefully consider the risks it brings when choosing to trade with it.

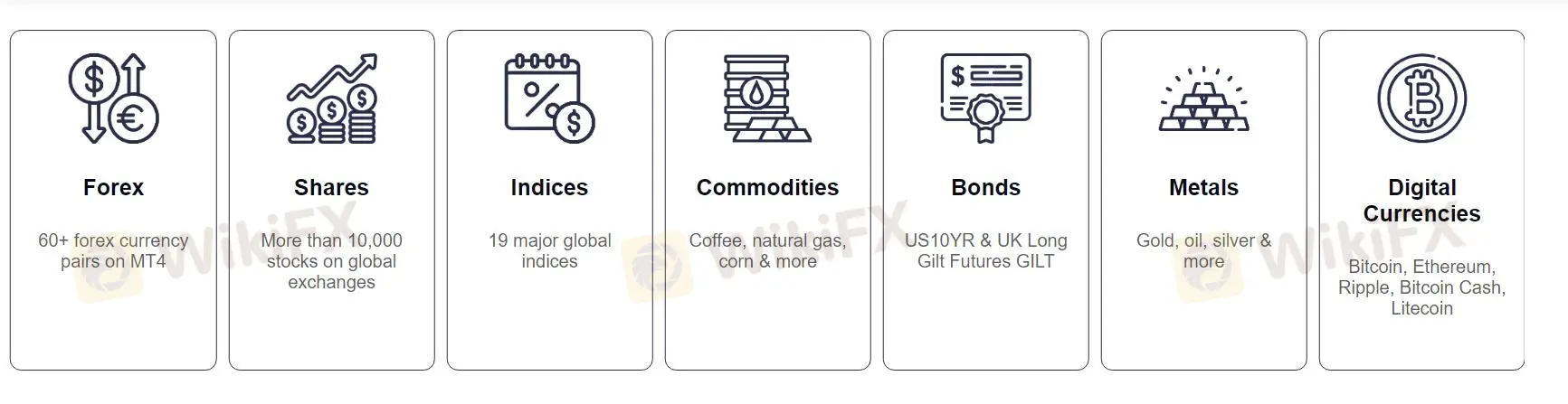

| Tradable Instruments | Supported |

| Forex | ✔ |

| Shares | ✔ |

| Indices | ✔ |

| Commodities | ✔ |

| Bonds | ✔ |

| Metals | ✔ |

| Digital Currencies | ✔ |

| Options | ❌ |

| ETFs | ❌ |

Infininvest offers leverage as high as 1:500, which can bring high returns but also high risks, so it should be approached with caution.

| Trading Platform | Supported | Device Support | Suitable for |

| MT4 | ✔ | / | Beginners |

| MT5 | ✔ | / | Experienced traders |

| Iress | ✔ | / | / |

| WebTrader | ✔ | Web | / |

| Mobile apps | ✔ | iPhone, Android | / |

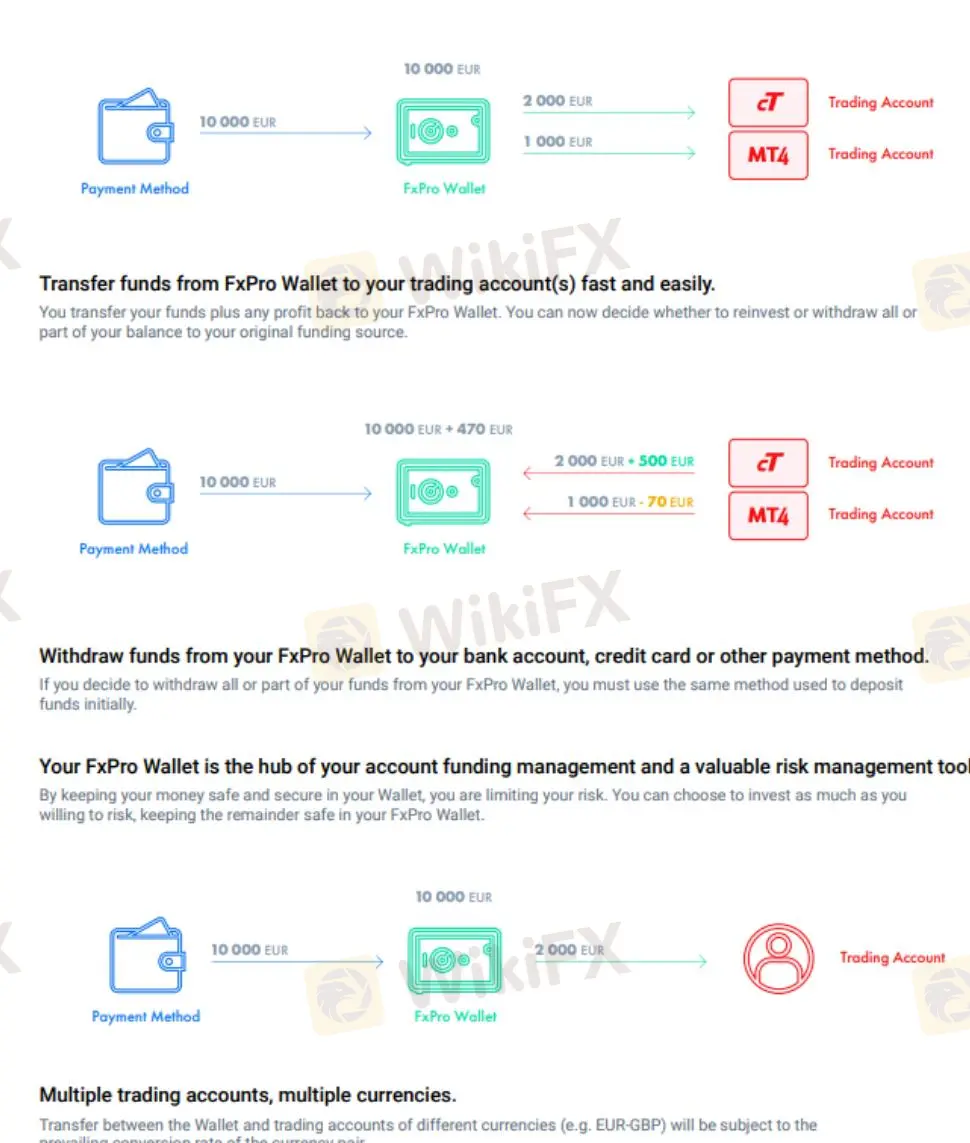

Deposit

| Deposit Option | Min. Deposit | Fee | Processing Time |

| Credit/Debit Card | €100 | ❌ | Instant |

| Bank Transfer | €500 | ❌ | 1-3 Business Days |

| FxPro Wallet | €0 | ❌ | Instant |

Withdrawal

| Withdrawal Option | Min. Withdrawal | Fee | Processing Time |

|---|---|---|---|

| Bank Transfer | 100 EUR | ❌ | Up to 3 business days |

| Credit/Debit Card | 20 EUR | Instant | |

| Skrill | 10 EUR | ||

| Neteller | |||

| PayPal | 20 EUR | ||

| FasaPay | 5 USD | ||

| Perfect Money | 1 USD | ||

| WebMoney | 1 USD | ||

| Bitcoin | 0.001 BTC | ||

| Ethereum | 0.01 ETH | ||

| Litecoin | 0.05 LTC | ||

| Dash | 0.02 DASH | ||

| Ripple | 50 XRP | ||

| Tether | 50 USDT |

More

User comment

0

CommentsWrite a review

No comment yet

start to write first comment