User Reviews

More

User comment

5

CommentsWrite a review

2024-07-31 18:49

2024-07-31 18:49

2024-06-21 12:08

2024-06-21 12:08

Score

2-5 years

2-5 yearsSuspicious Regulatory License

MT5 Full License

Global Business

High potential risk

Influence

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index6.01

Risk Management Index0.00

Software Index8.31

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

Company Name

XA MARKETS LTD

Company Abbreviation

XA MARKETS

Platform registered country and region

India

Company website

X

Company summary

Pyramid scheme complaint

Expose

| XA Markets Review Summary | |

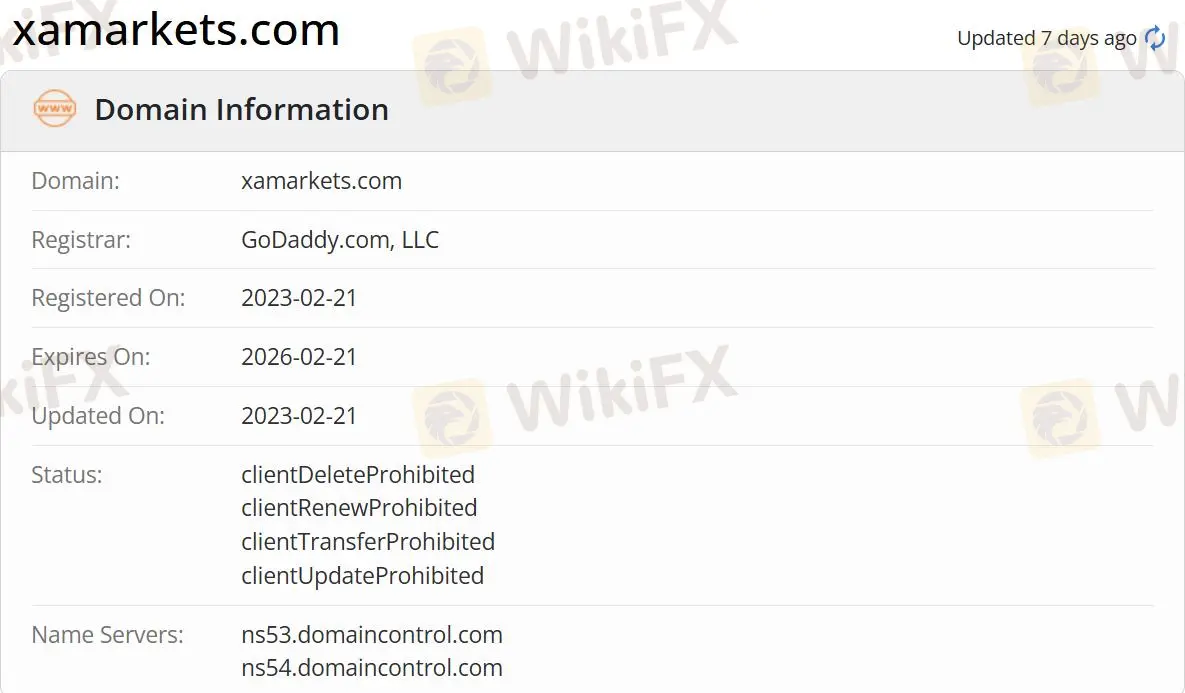

| Founded | 2023 |

| Registered Country/Region | India |

| Regulation | No regulation |

| Market Instruments | Forex, metals, shares, indices, commodities, cryptocurrencies, ETFs |

| Demo Account | ✅ |

| Leverage | Up to 1:500 |

| Spread | From 0 pips |

| Trading Platform | MT5 |

| Social Trading | ✅ |

| Min Deposit | $10 |

| Customer Support | 24/7 support |

| Tel: +914953501103 | |

| Email: info@xamarkets.com | |

| Twitter: https://twitter.com/xamarkets | |

| Facebook: https://www.facebook.com/xamarketss | |

| Instagram: https://www.instagram.com/xamarkets | |

| Office address: 1401, 2/1149-A73, 4Th Floor, Hilite Business Park, Thondayad Bypass, Kozhikode, Kerala, India | |

Founded in 2023, XA Markets is an Indian broker, offering trading in forex, metals, shares, indices, commodities, cryptocurrencies, and ETFs with leverage up to 1:500 and spread from 0.0 pips via the MT5 platform. Demo accounts are available and the minimum deposit requirement to open a live account is just 10 USD.

| Pros | Cons |

| Various trading products | New to the market |

| Demo accounts | No regulation |

| MT5 platform | |

| Social trading | |

| 24/7 support |

No, XA Markets does not have any licenses from regulatory institutions. Please be aware of the risk!

| Tradable Instruments | Supported |

| Forex | ✔ |

| Metals | ✔ |

| Commodities | ✔ |

| Indices | ✔ |

| Shares | ✔ |

| Cryptocurrencies | ✔ |

| ETFs | ✔ |

| Bonds | ❌ |

| Options | ❌ |

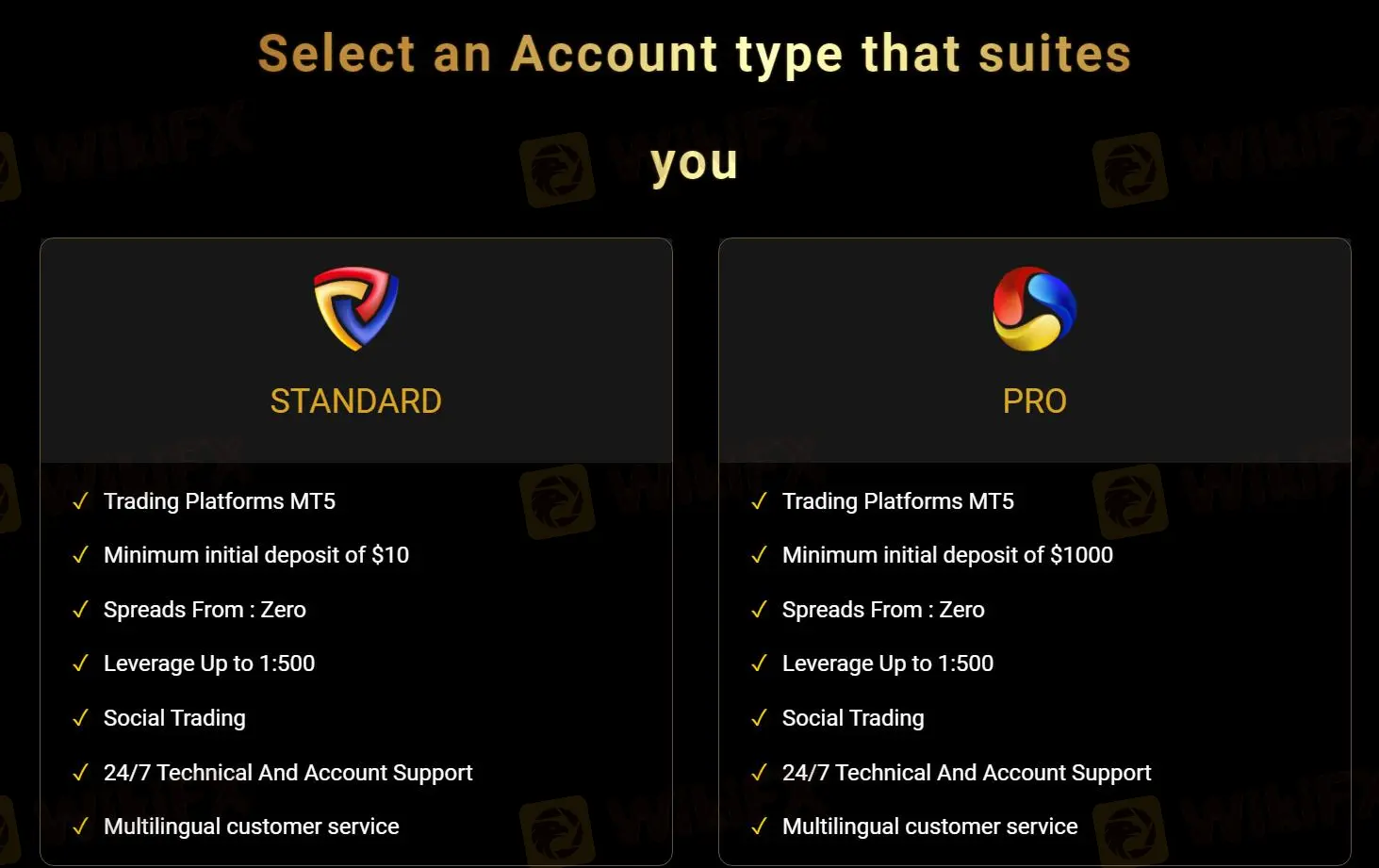

| Account Type | Min Deposit |

| Standard | $10 |

| Pro | $1,000 |

The leverage is capped at 1:500 for both account types. It is important to keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can both work in your favour and against you.

| Asset Class | Max Leverage |

| Forex | / |

| Metals | 1:500 |

| Shares | 1:10 |

| Indices | 1:100 |

| Commodities | / |

| Cryptocurrencies | 1:50 |

| Asset Class | Spread | Commission | Margin | Swap |

| Forex | Tightest | ❌ | Low | ❌ |

| Metals | Tightest on gold and silver | / | / | |

| Shares | / | ❌ | ||

| Indices | Tightest on all commodities | |||

| Commodities | Tightest | ❌ | Low | |

| Cryptocurrencies | / | |||

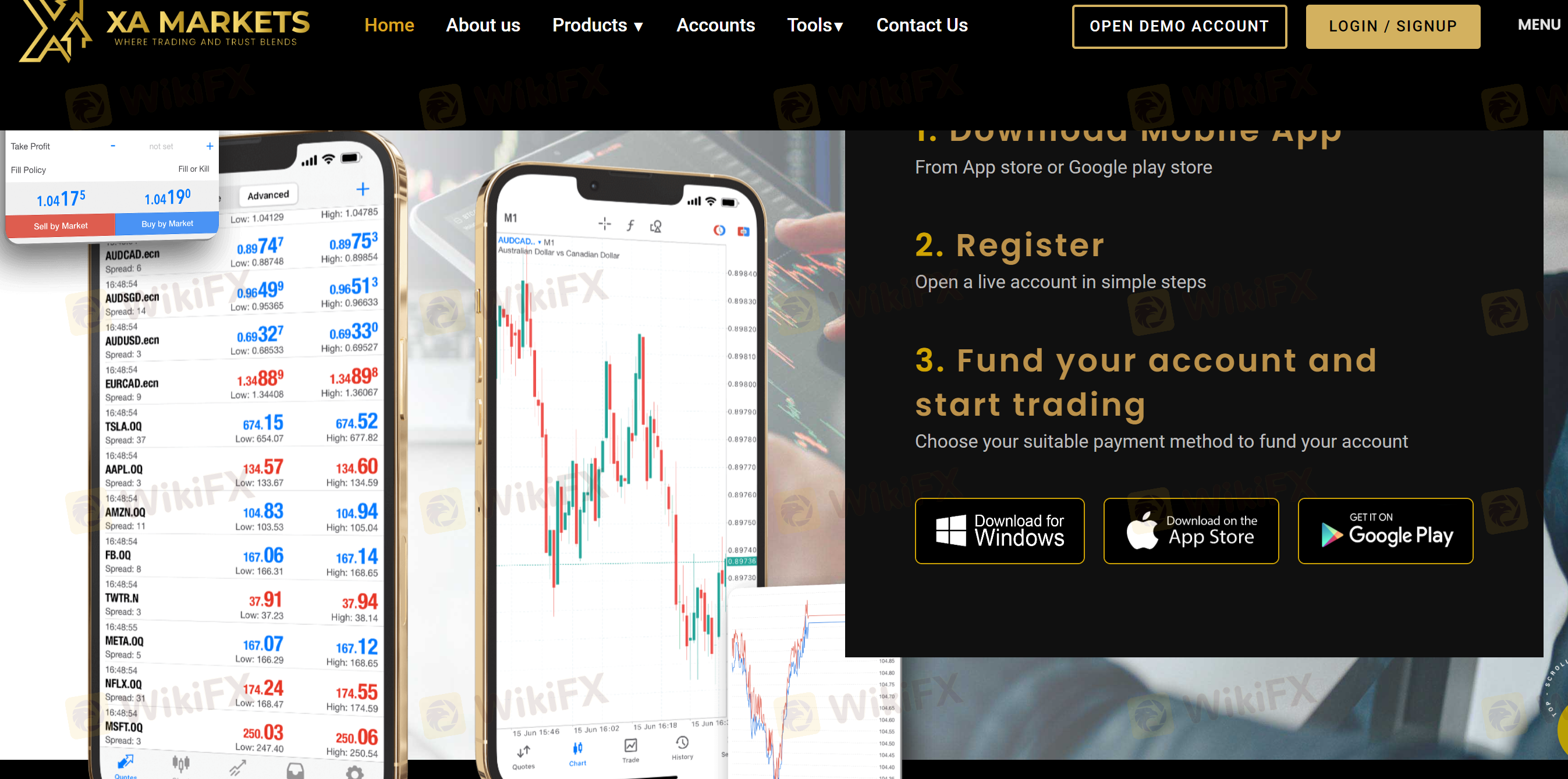

| Trading Platform | Supported | Available Devices | Suitable for |

| MT5 | ✔ | Desktop, mobile | Experienced traders |

| MT4 | ❌ | / | Beginners |

XA Markets accepts payments via VISA, Mastercard, M-PESA, and Bank Transfer.

More

User comment

5

CommentsWrite a review

2024-07-31 18:49

2024-07-31 18:49

2024-06-21 12:08

2024-06-21 12:08