User Reviews

More

User comment

10

CommentsWrite a review

2025-10-06 17:46

2025-10-06 17:46

2025-08-05 11:01

2025-08-05 11:01

Score

5-10 years

5-10 yearsSuspicious Regulatory License

MT4 Full License

Regional Brokers

Vanuatu Forex Trading License (EP) Revoked

High potential risk

Influence

Add brokers

Comparison

Quantity 10

Exposure

Score

Regulatory Index0.00

Business Index7.75

Risk Management Index0.00

Software Index8.22

License Index0.00

Single Core

1G

40G

More

Company Name

FXCL Markets Ltd

Company Abbreviation

FXCL

Platform registered country and region

Botswana

Company website

X

YouTube

Company summary

Pyramid scheme complaint

Expose

The remaining balance was gone..

My 1600 USD deposited fund almost busted with remaining 25 USD as of yesterday. Fraudulent broker partnered with READY MADE SIGNALS mostly operated by Filipino scammers. Get rid of these scammers. They will take your hard earned money into nothing... I started investing with it since August last year but nothing good happen to my account...

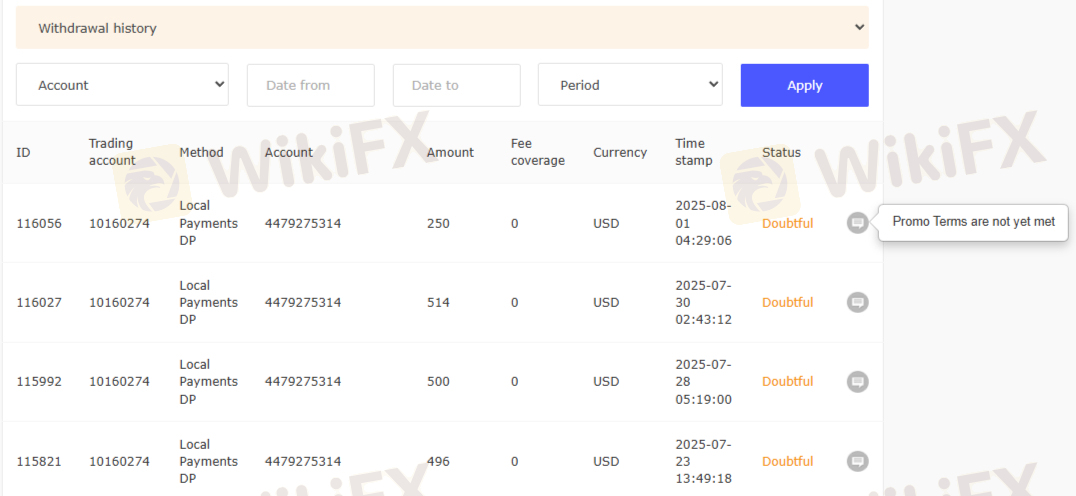

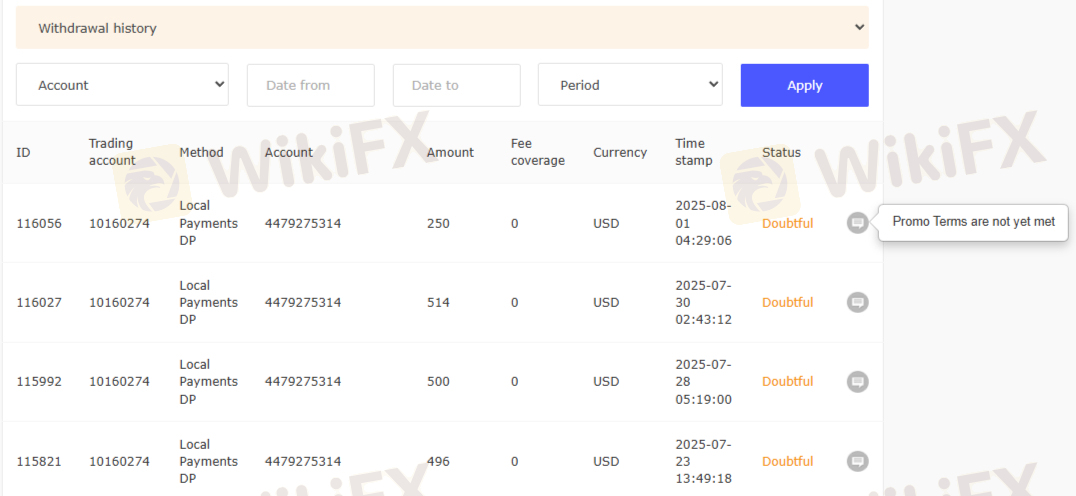

i keep on withdrawing my balance $2226/$1924 are the allowable amount but they ignoring my request they keep on trading my balance at losses, I need to withdraw this fund its an emergency suituation my Wife and son is hospitalized, please Act on my request ?

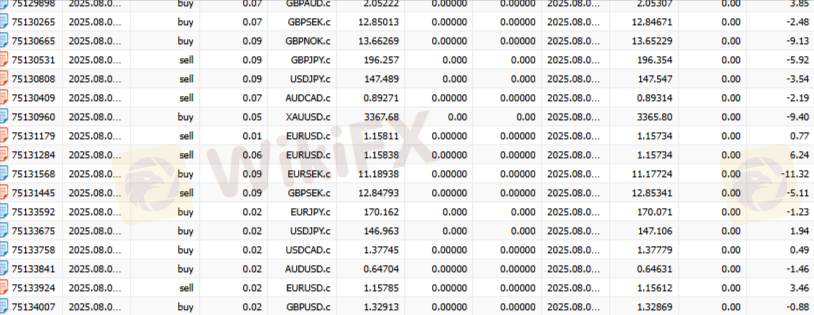

they trades my available remaining balance to losses when they notice my withdrawal for the fast month no movement but when my withdrawal request to my remaining balance thats the time trades happened why??

My trade analyst does not respond my request.

they keep on trading my remaining balance until it become negative to avoid the withdrawal but before they freeze it without any trades for almost one month, but when they notice my withdrawal they start trading at losses until it become but I already instructed them to stop the trading so that I can withdraw because my and Wife was in the hospitalized, but they ignore my withdrawal request..beware of fund manager Jeffrey Yang who is responsible from all this losses they can edit my account at losses..he promise a withdrawal date but he is lying please resolve this matter I never stop until my withdrawal is resolve..

until now they ignore my withdrawal Im withdrawing my deposit my total deposit is 5250.$ they credited on my account $4892. because of deposit fee? im withdrawing the balance on my account not bonuses not the profit but the balance until now not resolve they just ignoring my request??

I keep trying to withdraw my remaining balance why they ignore my withdrawal request?i dont care about the bonuses i m only withdrawing what i deposited less my losses they keep ignoring my withdrawal request ?

i want to withdraw all my deposit but they ignore my withdrawal I need to recover my funds Attached below is my deposit there is fee for every deposit my total deposit 5250$

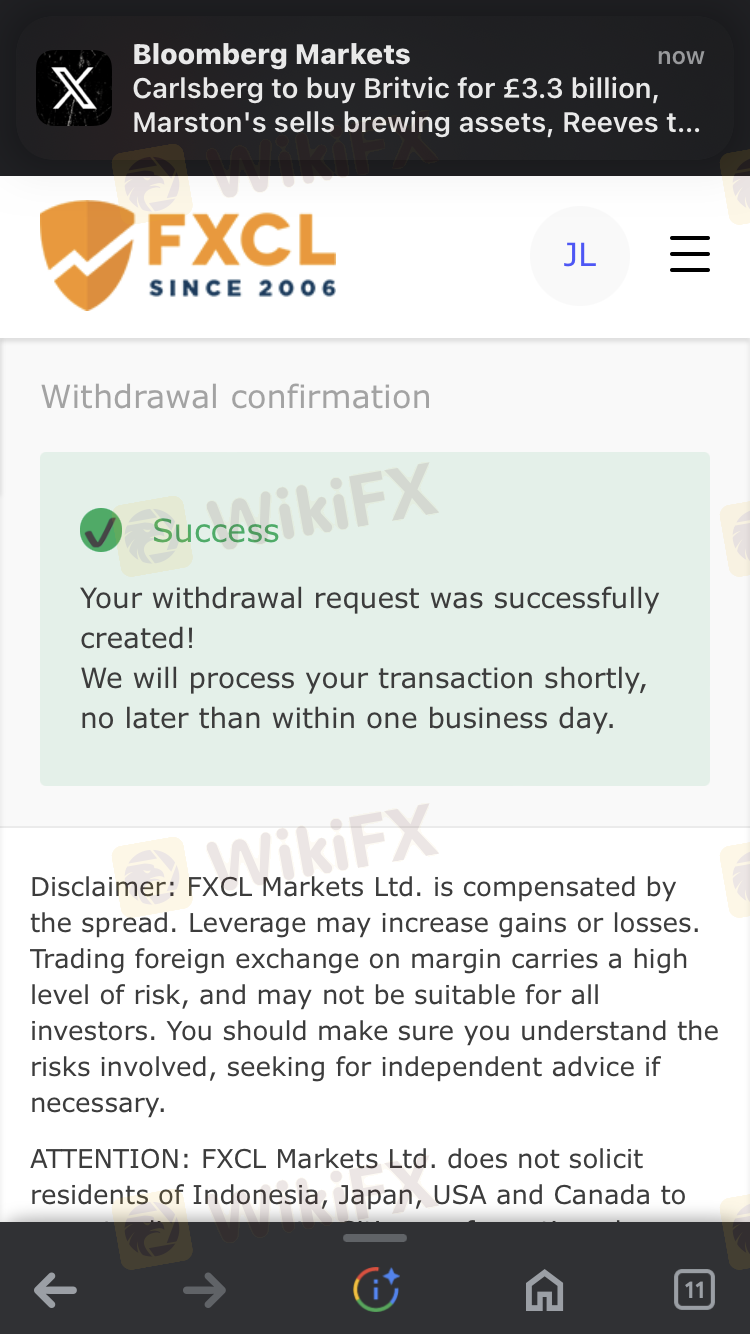

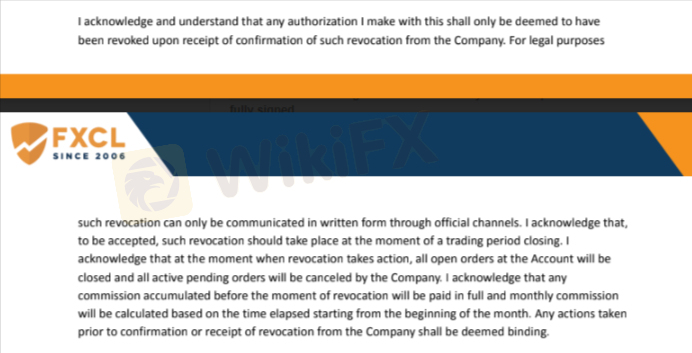

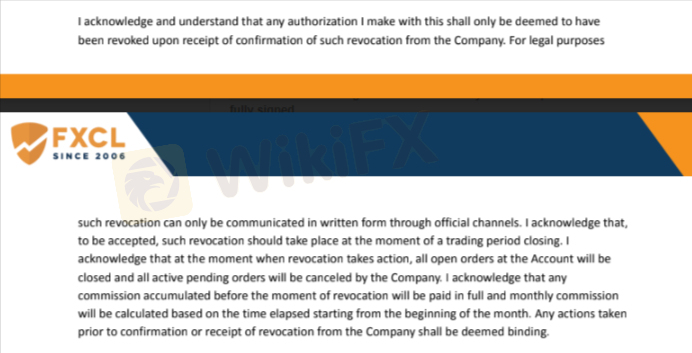

I deposited funds into FXClearing (FXCL Markets Ltd.) and was placed under a managed account handled by Tech-RMS (RMS Technologies Ltd.), acting as the MAM. After checking the reviews, background of the company, and finding that none of my emails were being answered, I submitted multiple formal revocation requests — as clearly allowed in the signed Limited Power of Attorney agreement — but FXClearing has never responded. They completely ignore all support channels: * Their official emails (support@fxclearing.com, info@fxclearing.com) never reply * Live chat is always offline * No hotline or working phone number * Meanwhile, Tech-RMS continues to call me using random, untraceable numbers I already submitted screenshots of the revocation clause and multiple withdrawal attempts, but they still refuse to act. It seems like a coordinated setup designed to trap client money while passing blame between the broker and a fake "agent."

| FXCLReview Summary | |

| Founded | 2006 |

| Registered Country/Region | Saint Vincent and the Grenadines |

| Regulation | VFSC |

| Market Instruments | Forex, indices, cryptocurrencies, metals |

| Demo Account | ✔ |

| Leverage | Up to 1:2000 |

| Spread | Low |

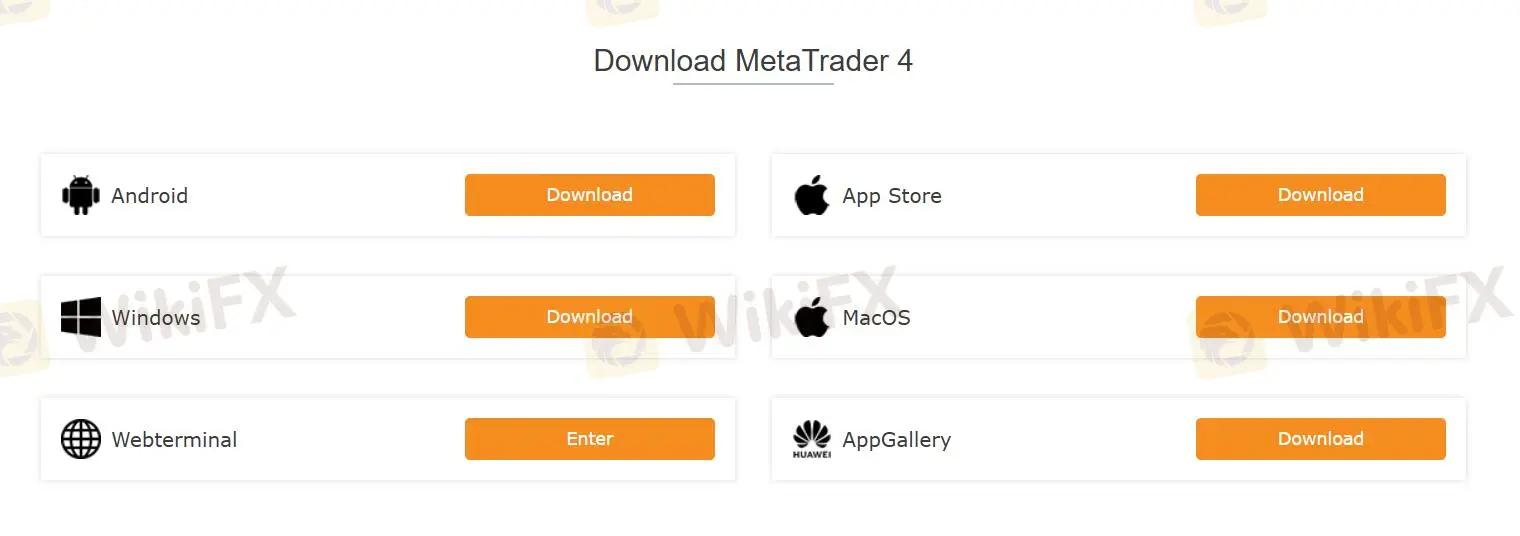

| Trading Platform | MT4 Margin WebTrader |

| Min Deposit | $1 |

| Customer Support | Email: support@fxclearing.com |

| Registered office: Plot 54368 Western Commercial Road, The Hub, Itowers, Cbd, Gaborone, Botswana. | |

FXCL, founded in 2006, is a forex brokerage registered in Saint Vincent and the Grenadines. It is regulated by VFSC. Its current status is revoked. It charges no fees or commissions. Its leverage is up to 1:2000.

| Pros | Cons |

| VFSC regulated | Limited customer support options |

| Wide range of currency pairs and trading instruments | Fixed spreads |

| Low minimum deposit of $1 | No Islamic trading account |

| Eight types of trading accounts to choose from | No MT5 supported |

| Generous leverage up to 1:2000 | No phone number information offered |

| Competitive spreads and low trading fees | |

| MT4 trading platform and webtrader supported | |

| Copy trading available | |

| Demo account available |

FXCL is regulated by VFSC in Vanuatu. Its current status is revoked.

| Regulated Country | Regulated Authority | Regulated Entity | License Type | License Number | Current Status |

| Vanuatu | VFSC | FXCL Markets Ltd | Retail Forex License | 14610 | Revoked |

FXCL offers traders forex, indices, cryptocurrencies, metals to trade.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Indices | ✔ |

| Metals | ✔ |

| Cryptocurrencies | ✔ |

| Commodities | ❌ |

| Stocks | ❌ |

| Futures | ❌ |

| Options | ❌ |

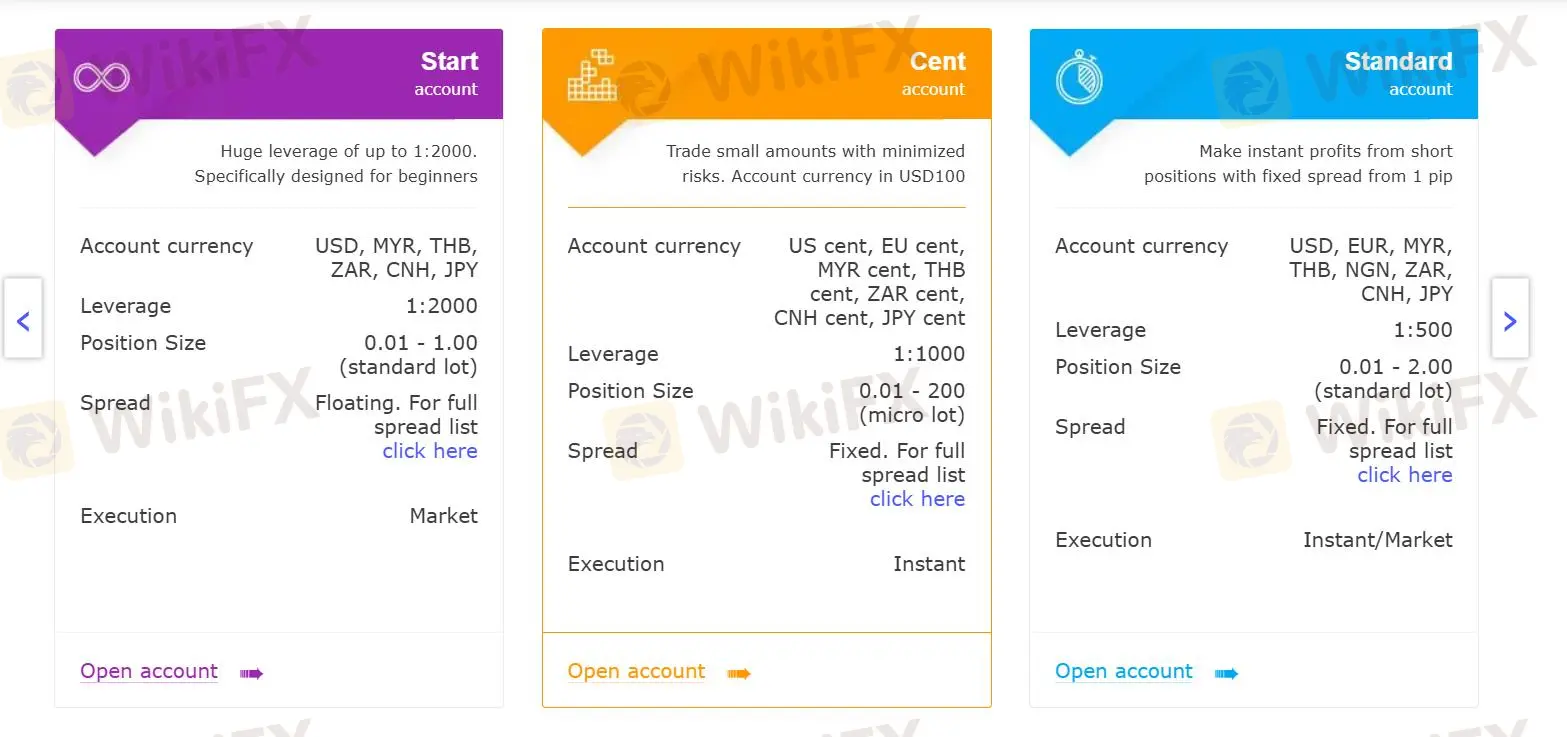

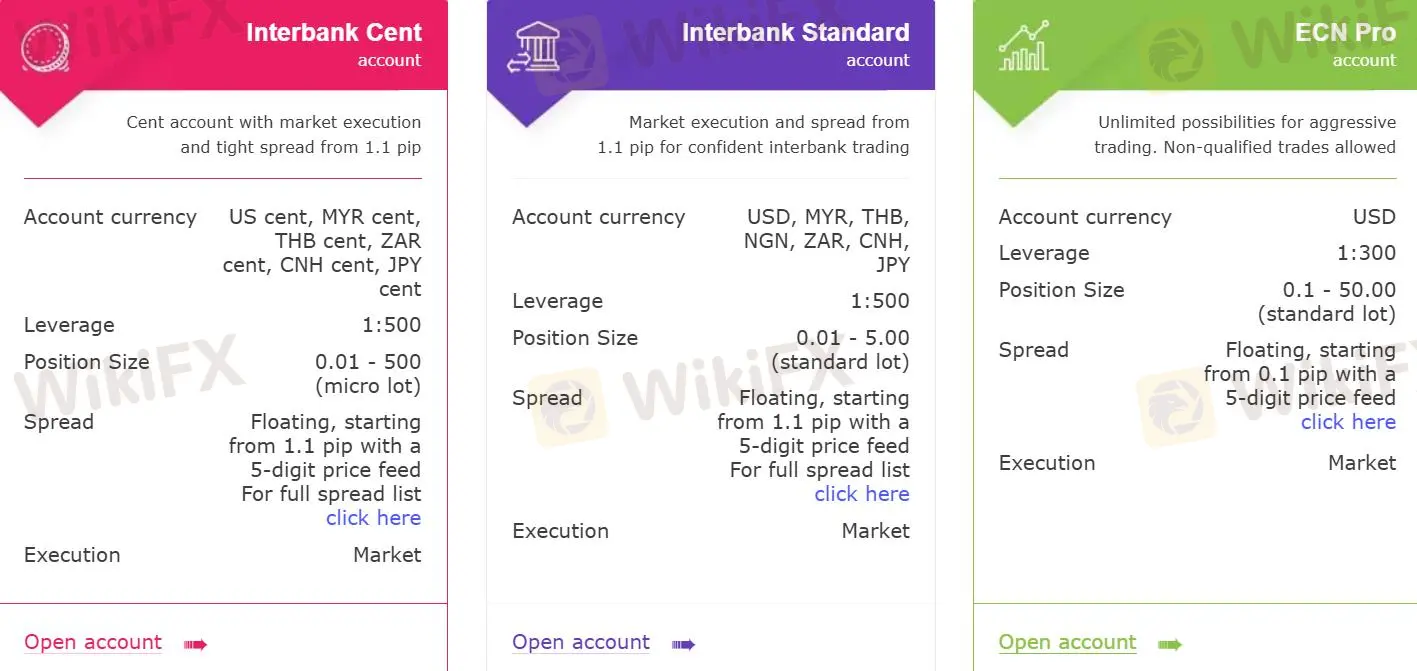

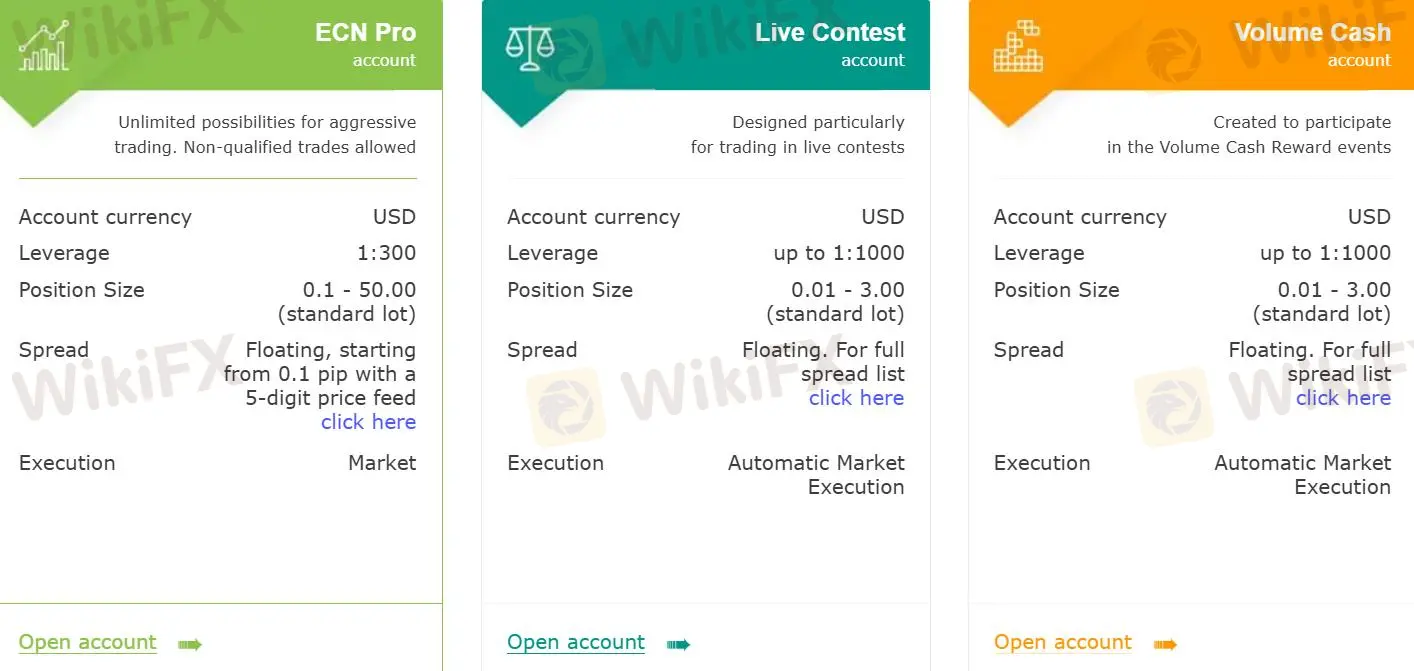

FXCL offers 4 different types of accounts to traders - Start Account, Cent Account, Standard Account, Interbank Cent Account, Interbank Standard Account, ECN Pro Account, Live Contest Account, Volume Cash Account. It also provides demo accounts.

| Account Type | Start Account | Cent Account | Standard Account | Interbank Cent Account | Interbank Standard Account | ECN Pro Account | Live Contest Account | Volume Cash Account |

| Leverage | 1:2000 | 1:1000 | 1:500 | 1:500 | 1:500 | 1:300 | 1:1000 | 1:1000 |

| Spreads | Floating for full spread list | Fixed for fufor full spread list | Fixed for fufor full spread list | Floating starting from 1.1 pip with a 5-digit price feed for full spread list | Floating,starting from 1.1 pip with a 5-digit price feed for full spread list | Floating, starting from 0.1 pip with a 5-digit price feed | Floating for full spread list | Floating for full spread list |

| Position Size | 0.01-1.00 (standard lot) | 0.01-200 (micro lot) | 0.01-2.00 (standard lot) | 0.01-500 (micro lot) | 0.01-5.00 (standard lot) | 0.01-50.00 (standard lot) | 0.01-3.00 (standard lot) | 0.01-3.00 (standard lot) |

| Execution | Market | Instant | Instant/Market | Market | Market | Market | Automatic Market Execution | Automatic Market Execution |

FXCL's spreads are as low as 0 pips. FXCL charges low commissions. It charges $3 per lot for forex, metals, indices 0.15% per lot of Crypto when transaction happens in ECN Account and $1.5 per lot for forex, metals when transaction happens in Live Contest Account and Volume Cash Account. The min deposit is $1.

FXCL's trading platform is MT4 Margin WebTrader, which supports traders on PC, Mac, iPhone and Android.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT4 Margin WebTrader | ✔ | Web, Mobile | Beginner |

| MT5 | ❌ |

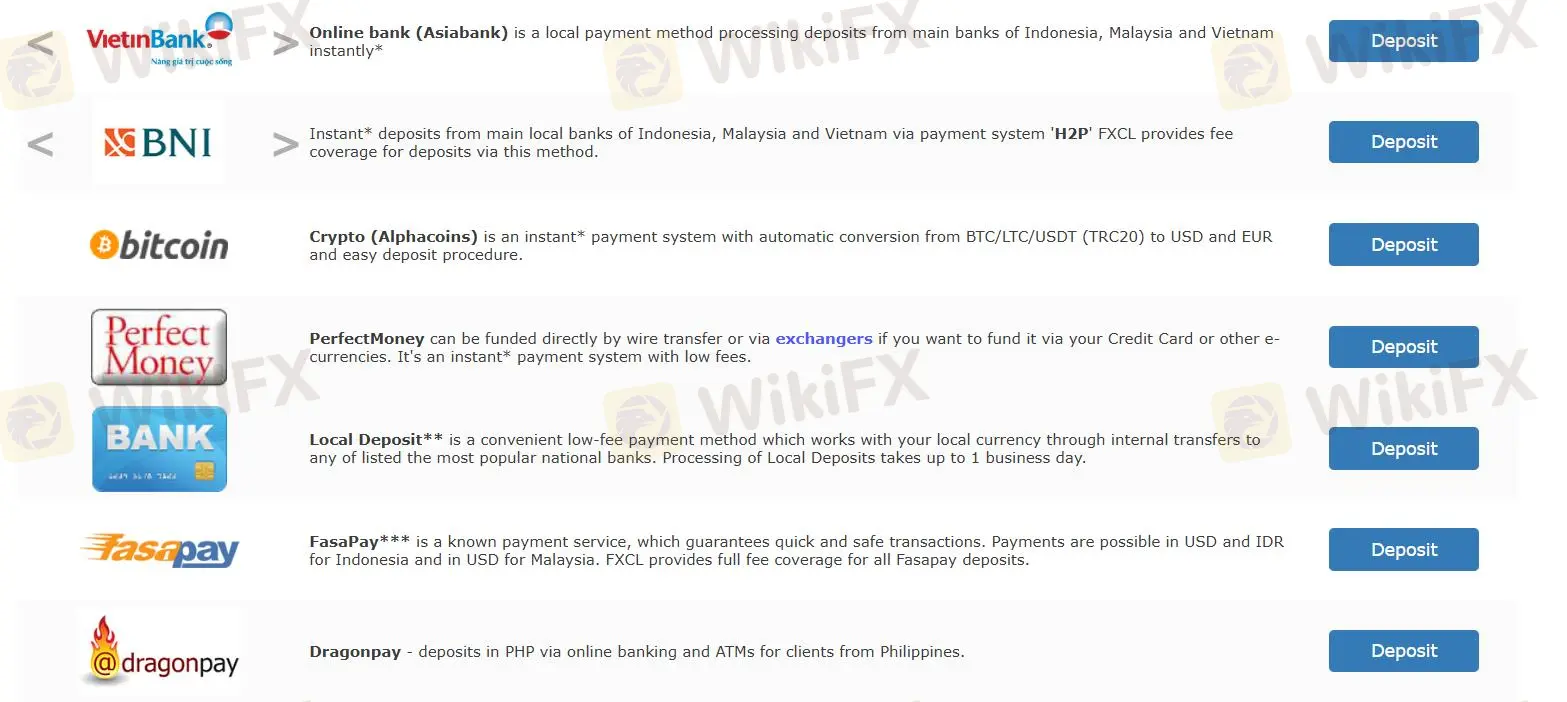

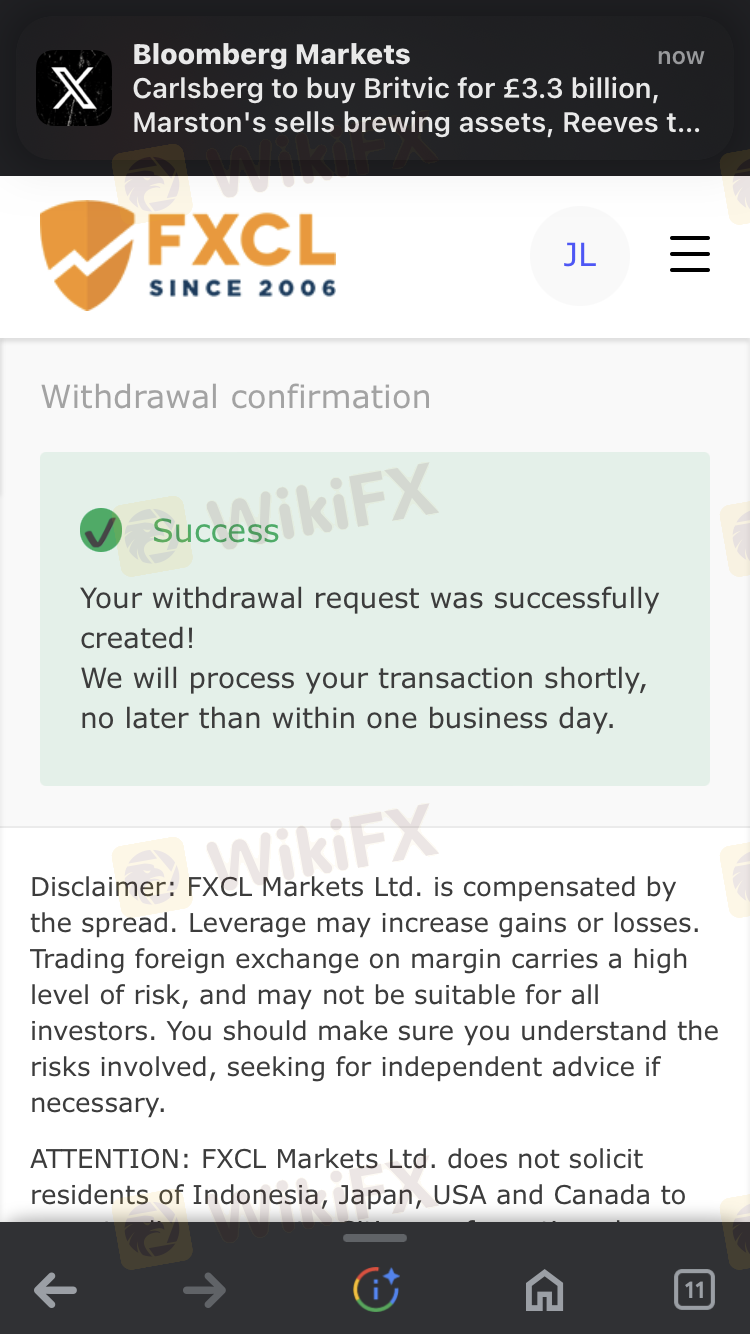

FXCL offers a lot of deposit and withdrawal methods.

| Method | Processing Time | Fees |

| Online bank (Asiabank) | Instant | N/A |

| Crypto (Alphacoins) | Instant | N/A |

| PerfectMoney | Instant | Low fees |

| Local Deposit | Up to 1 business day | Low fees |

| FasaPay | Quick | FXCL provides full fee coverage for all Fasapay deposits |

| Dragonpay | Instant | N/A |

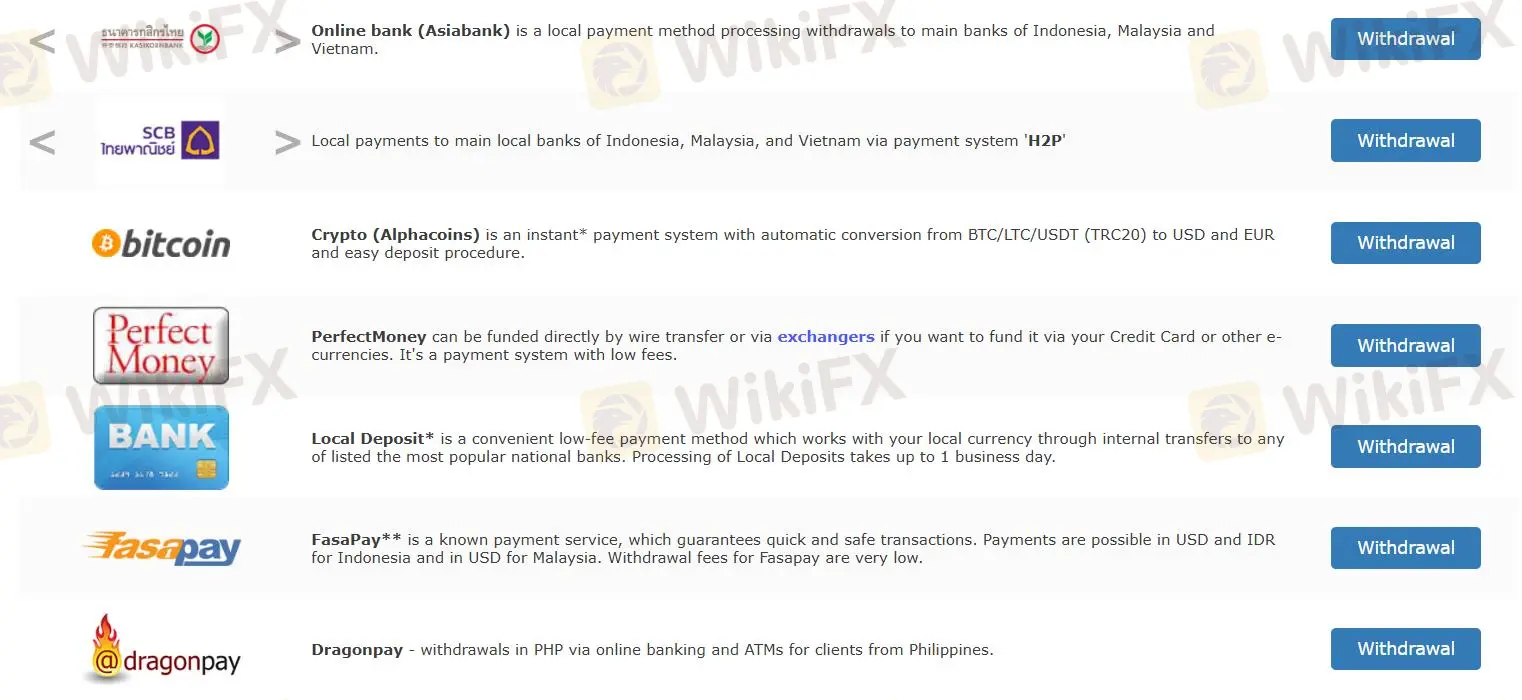

| Method | Processing Time | Fees |

| Online bank (Asiabank) | Instant | N/A |

| Crypto (Alphacoins) | Instant | N/A |

| PerfectMoney | Instant | Low fees |

| Local Deposit | Up to 1 business day | Low fees |

| FasaPay | Quick | Low fees |

| Dragonpay | Instant | N/A |

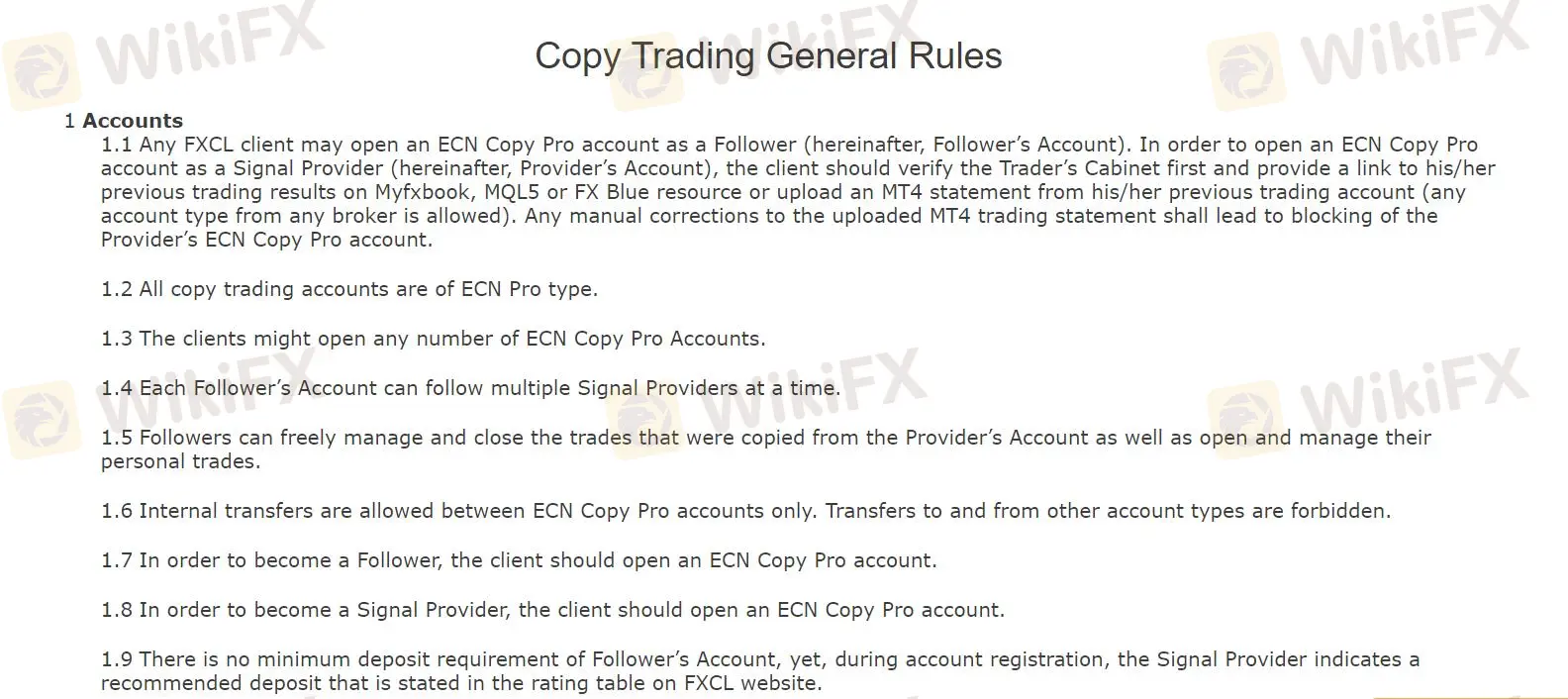

FXCL's copytrading offers an opportunity to automatically follow good traders and monitor the markets.

Any FXCL client may open an ECN Copy Pro account as a Follower (hereinafter, Follower‘s Account).In order to open an ECN Copy Pro account as a Signal Provider (hereinafter, Provider’s Account), the client should verify the Traders Cabinet first and provide a link to his/her previous trading results on Myfxbook, MQL5 or FX Blue resource or upload an MT4 statement from his/her previous trading account (any account type from any broker is allowed).

FXCL Review shows revoked VFSC license, no valid regulation, and multiple withdrawal complaints. Traders should proceed with caution.

WikiFX

WikiFX

FXClearing and Tech-RMS scammed $500 via false promises and locked withdrawals. Discover key facts to protect yourself from this forex fraud.

WikiFX

WikiFX

Are FXCL officials calling you to make you a customer by promising a magical profit number? Stop! These officials follow this route to onboard customers and make them deposit at regular intervals. However, when you wish to withdraw, the officials will deny your request. This is nothing but a strong indicator of a scam forex broker. In this article, we will expose the wrongdoings of this Botswana-based broker.

WikiFX

WikiFX

The FXCL Lucky Winter Festival has officially begun. You can be a part of this promotion. Here are all the details about this promotion.

WikiFX

WikiFX

More

User comment

10

CommentsWrite a review

2025-10-06 17:46

2025-10-06 17:46

2025-08-05 11:01

2025-08-05 11:01