User Reviews

More

User comment

52

CommentsWrite a review

2025-09-18 02:00

2025-09-18 02:00

2024-07-08 18:31

2024-07-08 18:31

Score

10-15 years

10-15 yearsRegulated in Cyprus

Market Making License (MM)

White label MT4

South Africa Derivatives Trading License (EP) Revoked

High potential risk

Offshore Regulated

Influence

Add brokers

Comparison

Quantity 50

Exposure

Score

Regulatory Index6.72

Business Index8.00

Risk Management Index0.00

Software Index9.64

License Index0.00

Single Core

1G

40G

Danger

More

Company Name

Primus Global Ltd

Company Abbreviation

FXPRIMUS

Platform registered country and region

Cyprus

Company website

X

YouTube

Company summary

Pyramid scheme complaint

Expose

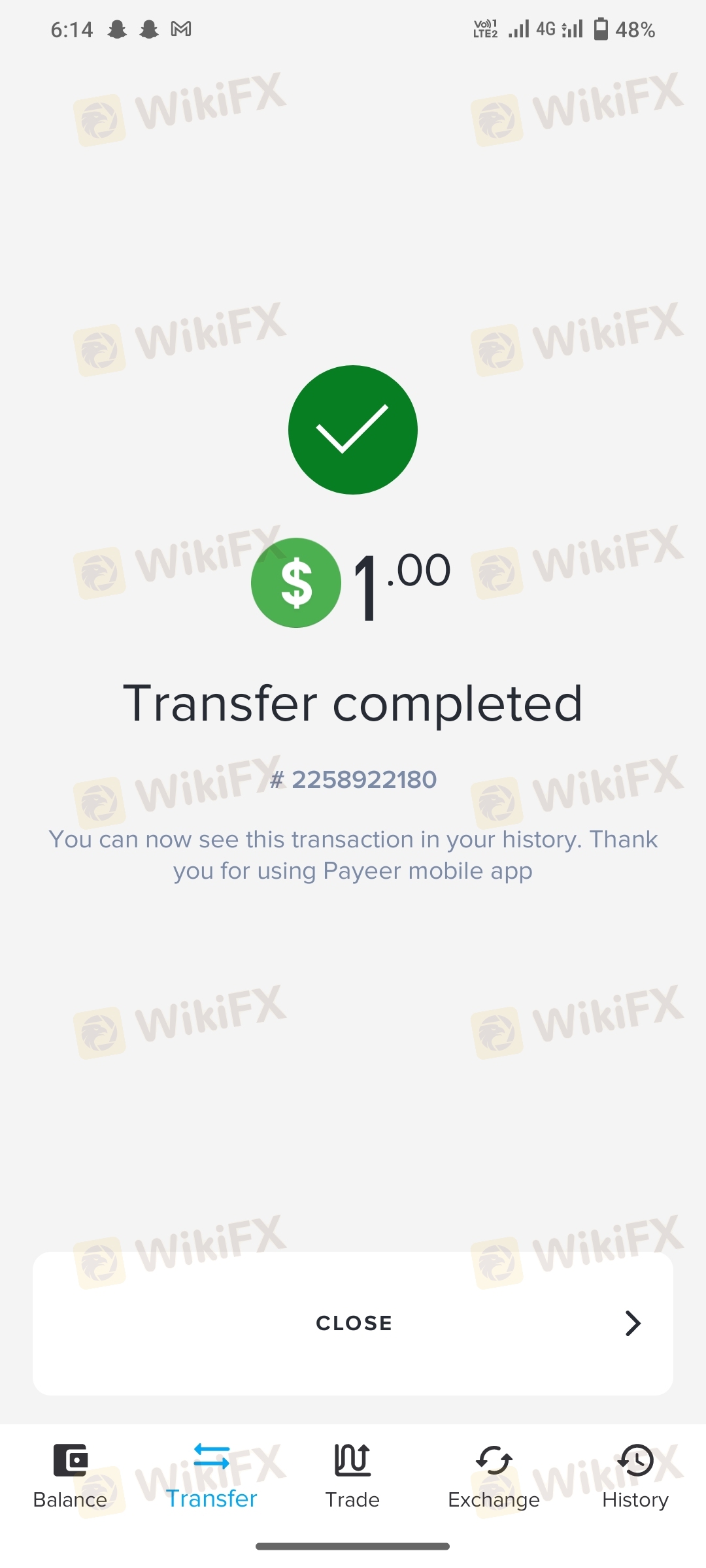

This institution does not withdraw my money and is fraudulent.

I received a withdrawal request from fxprimus company 5 days ago, they still haven't sent my money, they created different activities as I tried to communicate.

They withheld my money for 4 days, the fraudulent company intervened in my transactions and closed all transactions, interrupted mail response. They do not respond. Be careful, do not lose your money.

Hello, this institution persistently does not provide my payment. For 7 days I have not been able to withdraw my money. I have opened countless tickets but they still do not send money. I advise you not to make your investments in this institution. I have never experienced this situation in any global institution, I have been victimized, not those who read this article.

I cannot get my money in this institution. I expect you to intervene in this. I have full faith that this fraud disturbs you as well.

This company does not pay my money, it says that it cannot pay for ridiculous reasons, it has been 2 months and it has confiscated my money and now there is no response.

This fraudulent company has not paid my money in any way for 2 months. If you look at the complaints, they stole the money of many investors and finally deleted the money from the commodity, there is no ongoing investigation, they just slander and do not give any feedback.

I deposited 5000 dollars to the company and wanted to withdraw it without making any trade transactions. However, they have not paid my money for 2 days. The support team is not responding. I think I have been scammed. If the payment is not made in a few days, I will file a formal complaint to all licensing agencies. For now, no one should deposit money my acc no: 4613947

Primus did not pay my money, they deducted my money from Met4 and added it to their own safe. They do not pay my money and I cannot reach any official.

This company is a fraud. Hasn't it sent money for a week? First he deducted my money from the meta app and added it back 4 days later. He doesn't pay my money, he makes us suffer.

HelloI funded the account number 4614629 on Friday, and although I did not make any transactions, the company rejects the withdrawal request. Even though I haven't made any transactions, I haven't been able to withdraw money for a week because of the company, my e-mails are not answered, and I cannot contact anyone from the company.

Hello,Company on the subject: Primus Markets INTL LtdI first created my account on October 18, 2023.I secured funding and started trading on October 19, 2023.I tried to withdraw my money after October 20, 2023, but the company says it will not pay my money.I don't even understand what I'm accused of.They constantly send me an e-mail and say it is based on this.I am an individual trading normally.I request you to help me get my money from the company.They deleted my money from the Metatrader application. It's starting to get very annoying now.Thanks.

fxprimus does not pay my money and I cannot reach any official. They have taken the money from my account. Do not trust this institution. Do not invest at all.

This institution is not paying the money I invested, it is making me a victim. It has been a month and still no solution has been found and it does not provide any response, I need you to help me.

I have made a deposit to fx primus company 2 times And although my account is below the amount I deposited, it does not send my money, I have been scammed very badly, I cannot withdraw my money, The company has cut off communication with me And is not responding, This is a big fraud case, I hear that many investors in Turkey have been scammed by the same method.

I INVESTED 10,000 DOLLARS IN THIS COMPANY ON 10.12.2023 AND ABOUT A WEEK LATER I REQUESTED THE FIRST WITHDRAWAL AND MY MONEY DID NOT ARRIVE. THEN I WANTED TO WITHDRAW MY WHOLE BALANCE. I WAS TOLD THERE IS A TECHNICAL PROBLEM. MAKE YOUR WITHDRAWAL MANUALLY. MONEY HAS BEEN TRANSFERRED AGAIN TO META REQUIRED DOCUMENTS FOR MANUAL WITHDRAWAL REQUEST I CONDUCTED IT, AND I UNDERSTANDED IT AS IT WAS A TECHNICAL PROBLEM AND MY CHECKS DID NOT REACH ME. THE COMPANY DOES NOT RESPOND IN ANY WAY. IF YOU LOOK AT THE OTHER COMPLAINTS, YOU WILL UNDERSTAND THAT THEY FRAUD MANY INVESTORS. THE NECESSARY EVIDENCE IS ATTACHED.

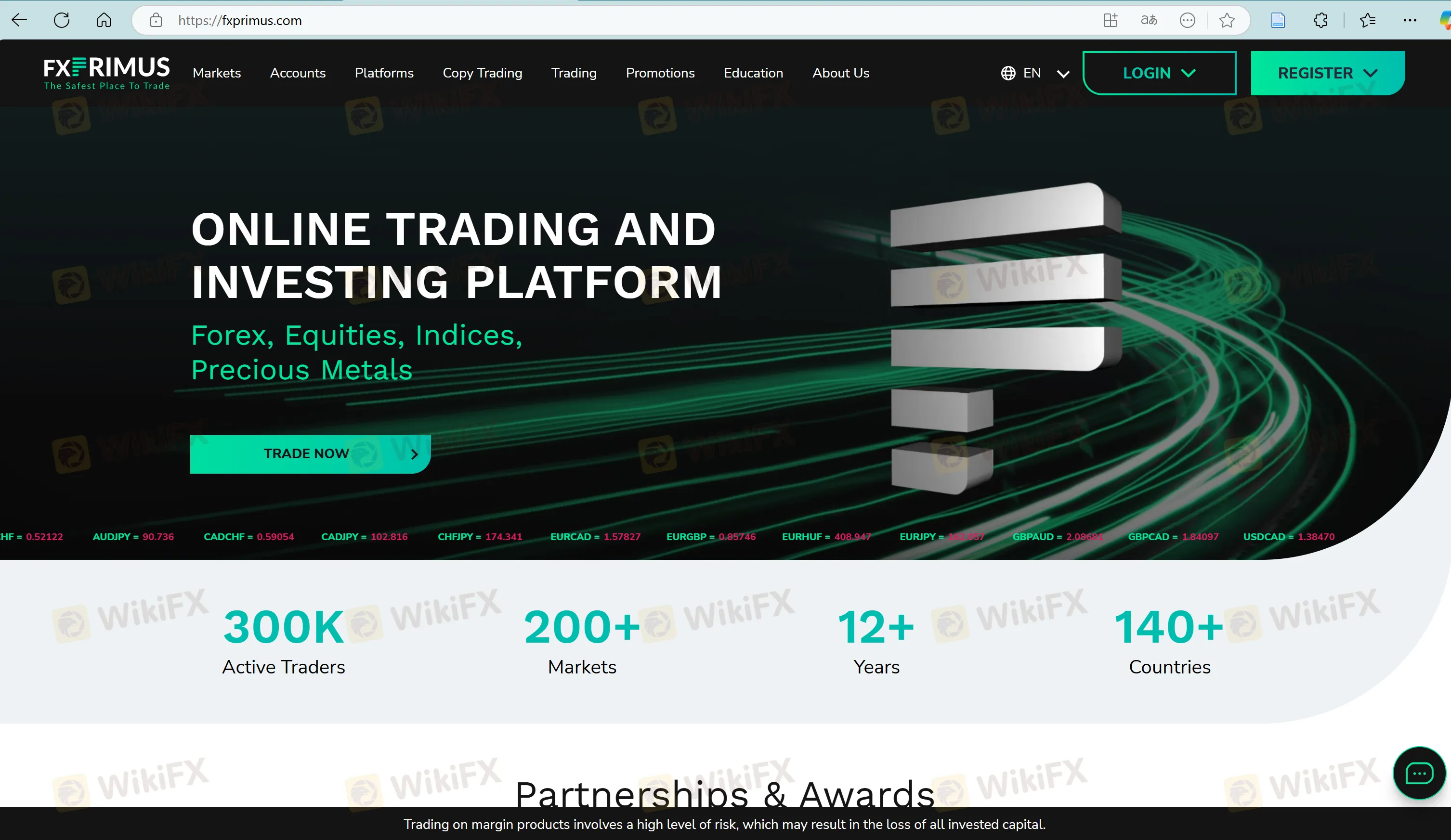

| FXPRIMUS Review Summary | |

| Founded | 2009 |

| Registered Country/Region | Cyprus |

| Regulation | CYSEC |

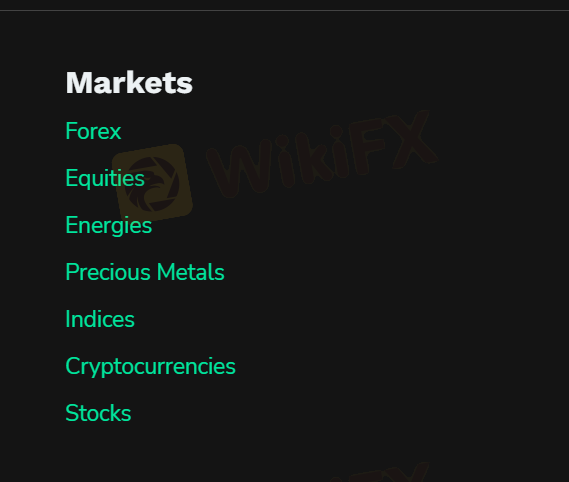

| Market Instruments | Forex, Equities, Energies, Precious Metals, Indices, Cryptocurrencies, Stocks |

| Demo Account | ✅ |

| Leverage | Up to 1:1000 |

| Spread | From 1.5 pips (PrimusCLASSIC account) |

| Trading Platforms | MT4, MT5, WebTrader |

| Minimum Deposit | $15 |

| Customer Support | Contact form, live chat 24/5 |

| Email: support@fxprimus.com | |

| Facebook, Twitter, Instagram, LinkedIn, YouTube | |

| Address: Govant Building, BP 1276, Port Vila, Vanuatu | |

| Kolonakiou 57, Linopetra, 4103, Limassol Cyprus | |

FXPRIMUS is a CySEC-regulated retail forex and CFD broker, founded in 2009 and headquartered in Cyprus. FXPRIMUS offers trading on diverse financial instruments including Forex, Equities, Energies, Precious Metals, Indices, Cryptocurrencies, and Stocks. It provides different account types with $15 minimum deposits and flexible leverages. As to trading platforms, MT4, MT5, and WebTrader are supported.

| Pros | Cons |

| Regulated by CYSEC | Expired license with the FSCA |

| Diverse customer support channels | Offshore license with the VFSC |

| Demo accounts available | High leverage risks |

| A wide range of products | |

| Diverse account types | |

| Low minimum deposit | |

| Flexible leverage ratios | |

| Multiple trading platforms |

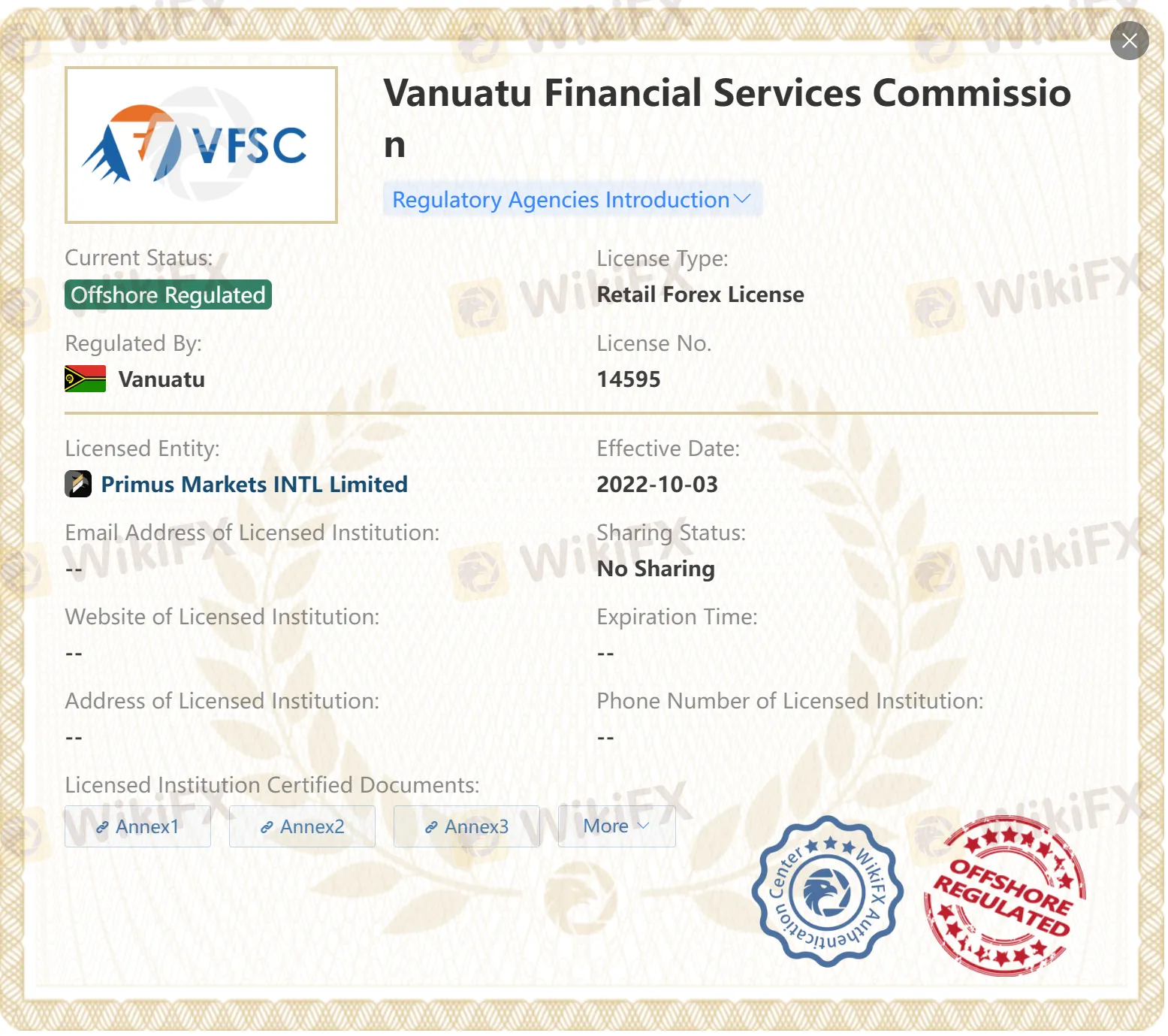

Yes, FXPRIMUS is regulated by CySEC. However, please note that it has an expired license with the FSCA and an offshore license with the VFSC.

| Regulated Country | Regulated Authority | Current Status | Regulated Entity | License Type | License Number |

| The Cyprus Securities and Exchange Commission (CySEC) | Regulated | Primus Global Ltd | Market Maker (MM) | 261/14 |

| The Financial Sector Conduct Authority (FSCA) | Expired | PRIMUS AFRICA (PTY) LTD | Financial Service Corporate | 46675 |

| The Vanuatu Financial Services Commission (VFSC) | Offshore Regulated | Primus Markets INTL Limited | Retail Forex License | 14595 |

On FXPRIMUS, you can trade with Forex, Equities, Energies, Precious Metals, Indices, Cryptocurrencies, and Stocks.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Energies | ✔ |

| Metals | ✔ |

| Indices | ✔ |

| Cryptocurrencies | ✔ |

| Stocks | ✔ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

| Mutual Funds | ❌ |

| Account Type | Minimum Deposit |

| PrimusCLASSIC | $15 USD |

| PrimusPRO | $500 USD |

| PrimusZERO | $1,000 USD |

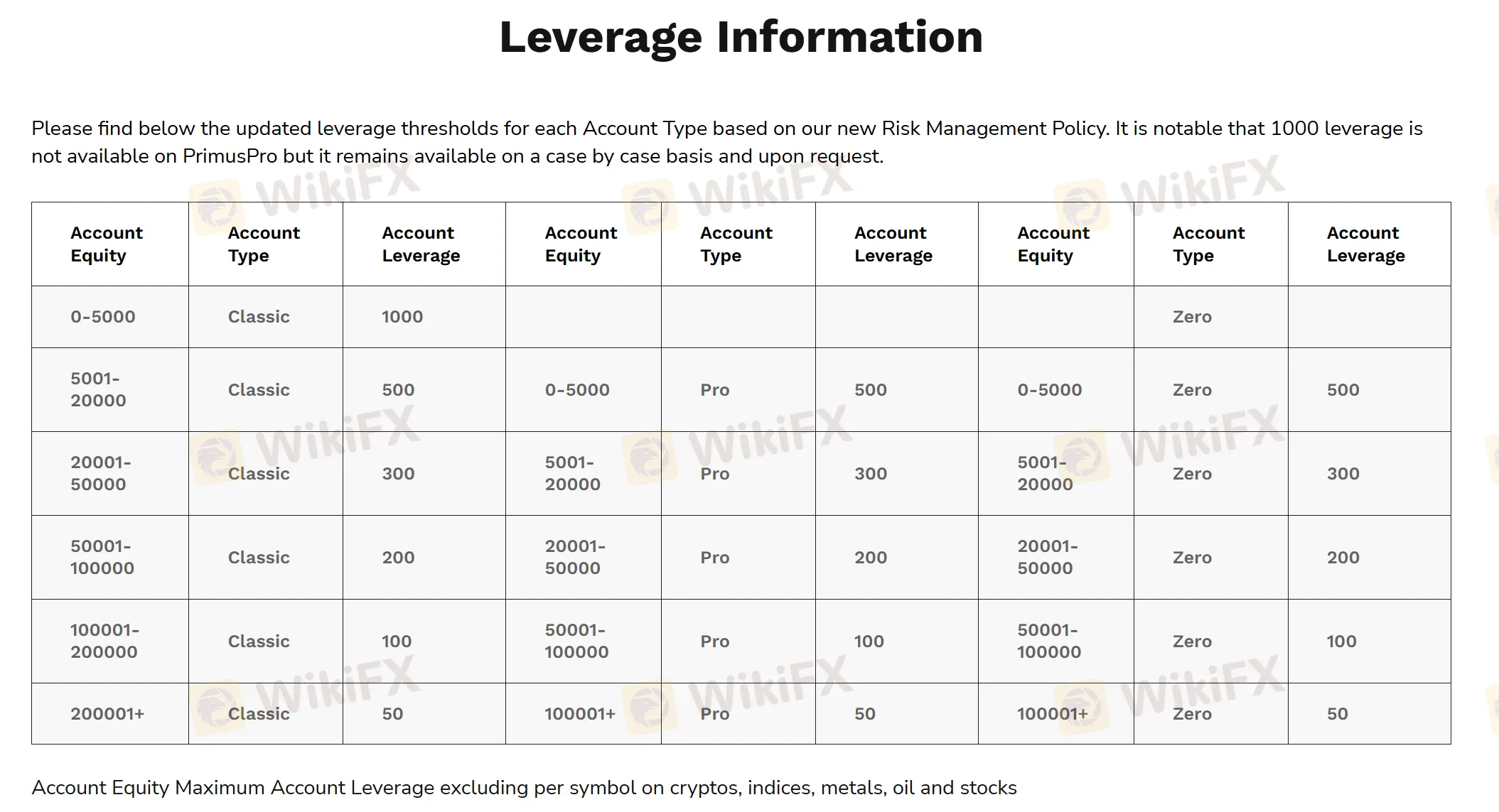

The maximum leverage is up to 1:1000 for PrimusCLASSIC account. Note that high leverage can amplify both profits and losses.

| Account Type | Maximum Leverage |

| PrimusCLASSIC | 1:1000 |

| PrimusPRO | 1:500 |

| PrimusZERO | 1:500 |

Spreads and commissions vary on the account type, detailed info are as follows:

The PrimusCLASSICaccounthas no commission fees, both starting from 1.5 pips for the average spread.

ThePrimusPRO account offers a lower spread starting from 0.3 pips, but with a commission of $8 (on MT5).

ThePrimusZERO account has the lowest spread, starting from 0 pips, and charges a commission of $5.

| Account Type | Spread | Commission |

| PrimusCLASSIC | From 1.5 pips | ❌ |

| PrimusPRO | From 0.3 pips | $8 (MT5) |

| PrimusZERO | From 0 pips | $5 |

| Trading Platform | Supported | Available Devices | Suitable for |

| MT4 | ✔ | Windows, iOS, Android | Beginners |

| MT5 | ✔ | Windows, iOS, MAC, Android | Experienced traders |

| WebTrader | ✔ | / | / |

FXPrimus is a CySEC-regulated forex broker offering MT4, MT5, and WebTrader with flexible leverage and diverse trading instruments since 2009.

WikiFX

WikiFX

At first glance, FXPrimus appears to be a reputable broker. Its website looks polished and professional, giving the impression of trustworthiness. However, behind this sleek appearance lies a concerning reality. The broker has numerous complaints registered against its name—a series of red flags that you simply can’t afford to ignore. In this article, we’ll tell you the reasons why traders are backing away from FXPrimus.

WikiFX

WikiFX

Malaysian retail traders still using FXPRIMUS should be aware that the broker has been named on the Securities Commission Malaysia (SC) Investor Alert List for carrying out unlicensed capital market activities.

WikiFX

WikiFX

Global broker FXPrimus has announced the launch of Synthetic Indices, which are engineered financial instruments that operate continuously and are designed to simulate real market conditions without being influenced by actual economic or political events. Will you try this out?

WikiFX

WikiFX

More

User comment

52

CommentsWrite a review

2025-09-18 02:00

2025-09-18 02:00

2024-07-08 18:31

2024-07-08 18:31