User Reviews

More

User comment

5

CommentsWrite a review

2025-10-21 19:27

2025-10-21 19:27

2024-06-14 11:15

2024-06-14 11:15

Score

5-10 years

5-10 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Influence

Add brokers

Comparison

Quantity 2

Exposure

Score

Regulatory Index0.00

Business Index7.47

Risk Management Index0.00

Software Index4.00

License Index0.00

Single Core

1G

40G

Danger

More

Company Name

DTT VAN LTD

Company Abbreviation

Global DTT

Platform registered country and region

Vanuatu

Company website

X

Company summary

Pyramid scheme complaint

Expose

| Direct TT Review Summary | |

| Founded | 2017 |

| Registered Country/Region | United Kingdom |

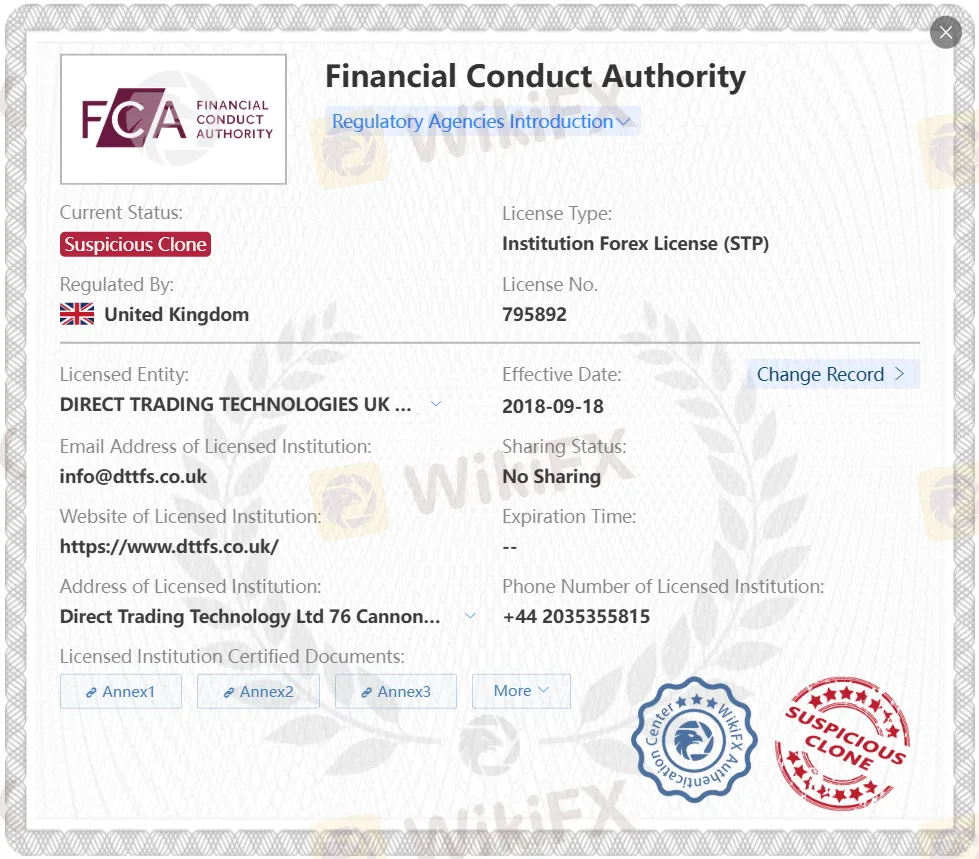

| Regulation | VFSC (Offshore regulated), FCA (Suspicious clone) |

| Market Instruments | 100,000, Forex, Indices, Energies, Cryptocurrencies, Metals, Stocks |

| Demo Account | ✅ |

| Leverage | Up to 1:200 |

| Spread | Not specified |

| Trading Platform | DTTPRO Trading Platform |

| Minimum Deposit | $50 |

| Customer Support | 24/7 support, Contact Form |

| Email: management@globaldtt.com,sales@dttuae.com | |

| Social Media: Facebook, Twitter, Instagram, LinkedIn | |

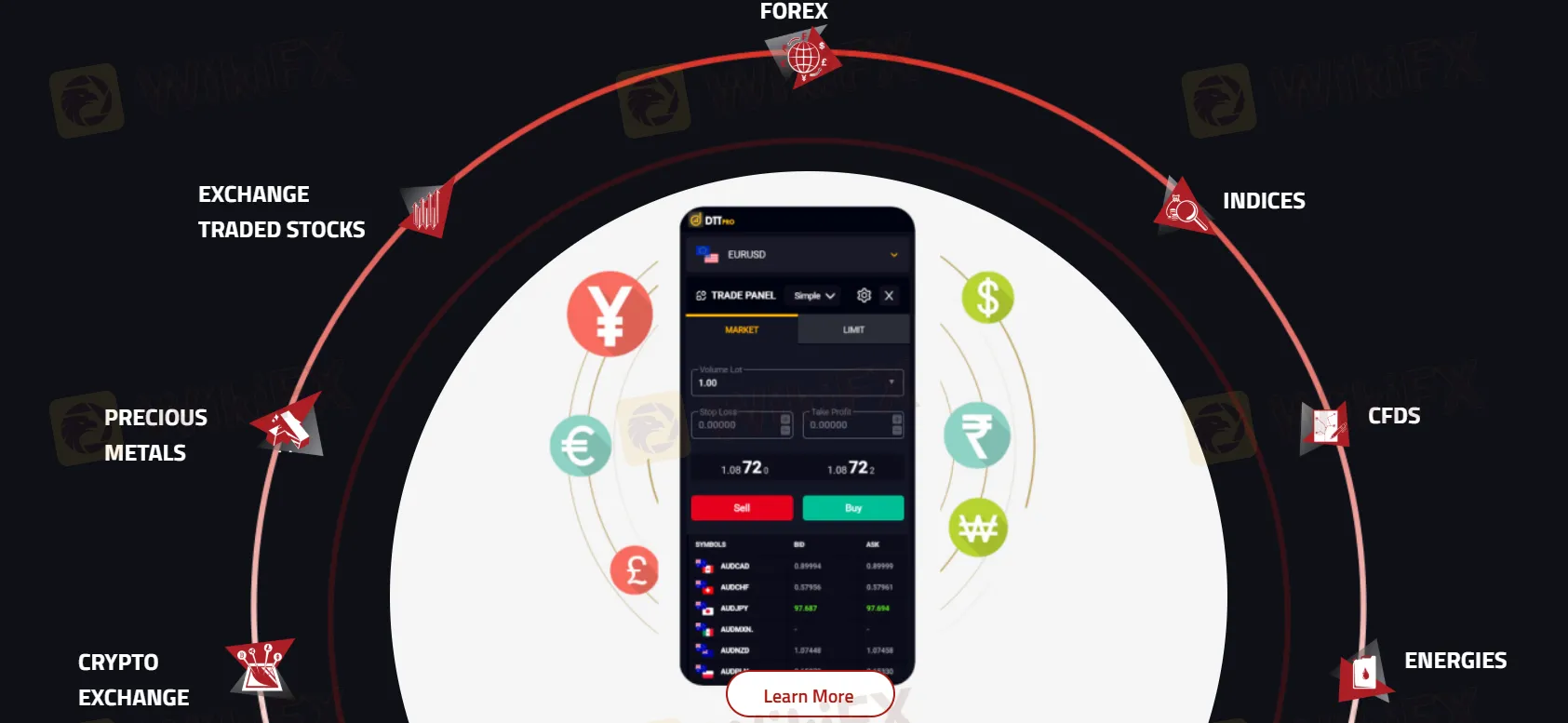

Direct TT operates as an online trading platform. It claims to offer over 100,000 tradable products such as Forex, Indices, Energies, Cryptocurrencies, Metals, and Stocks. Direct TT utilizes its DTTPRO Trading Platform to offer four types of live accounts, including Mini, Standard, VIP, and ECN. However, this company currently lacks proper regulation.

| Pros | Cons |

| Demo accounts available | No valid regulation |

| Four types of live accounts | Commission charged |

| 24/7 customer support |

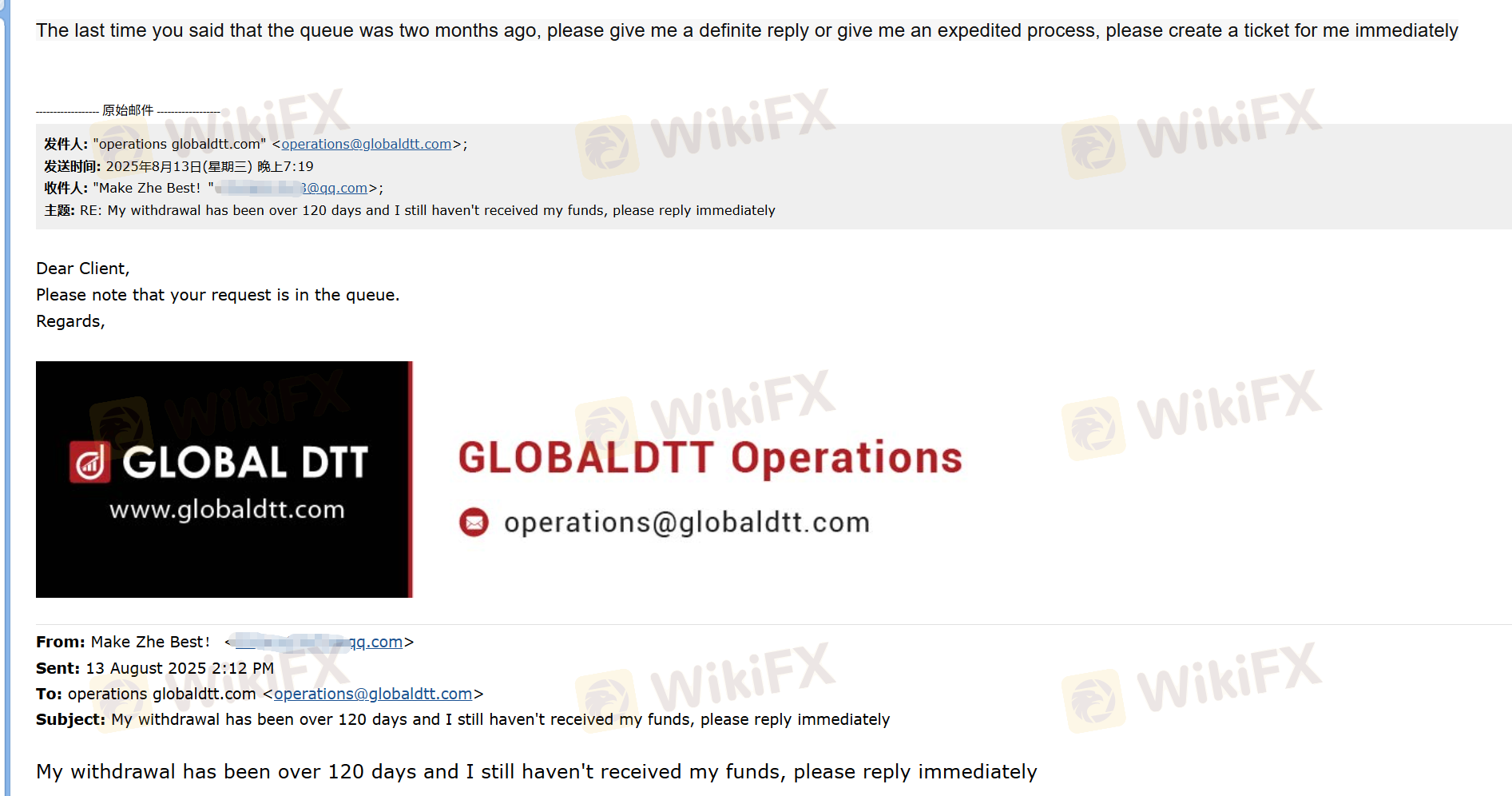

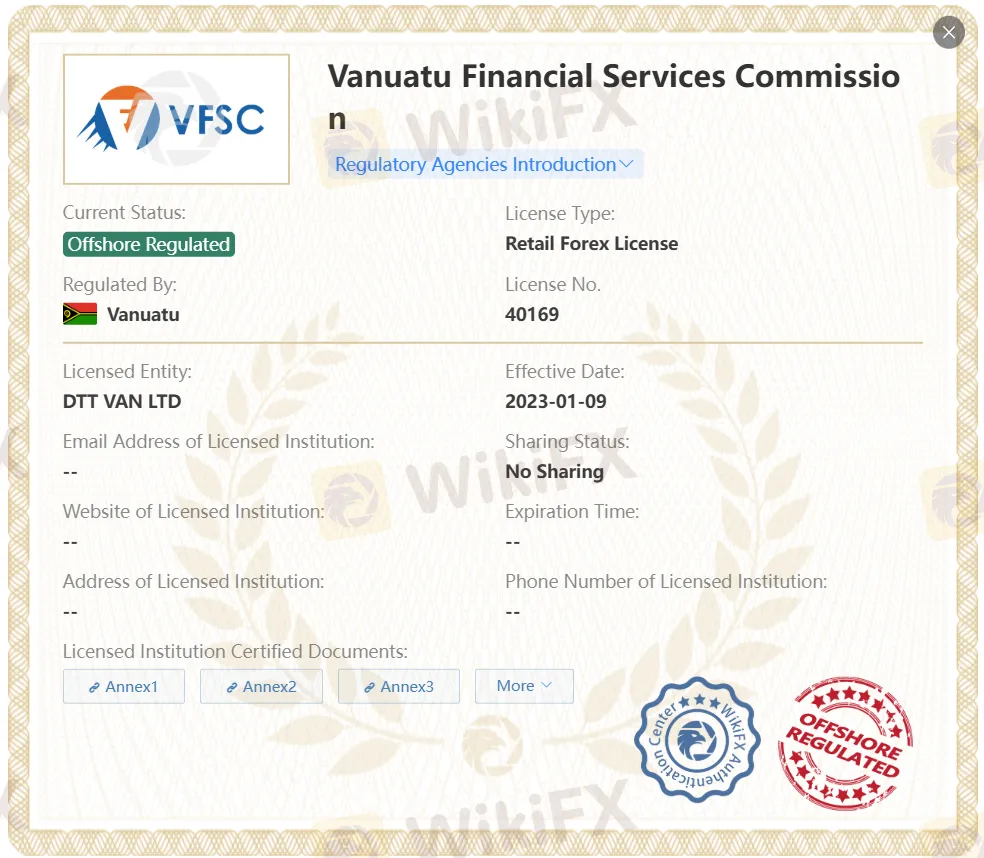

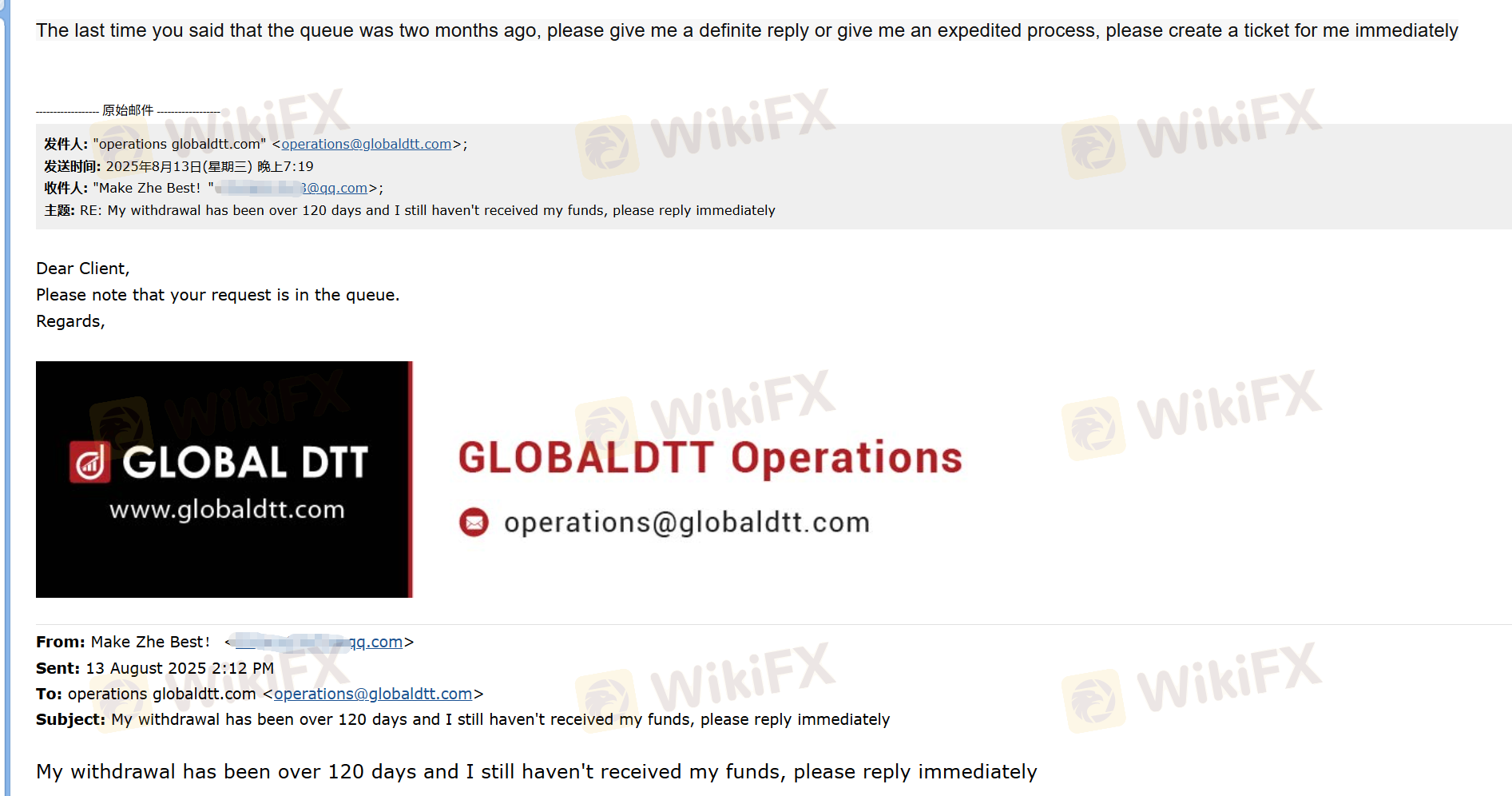

No. Direct TT's VFSC license is offshore-regulated, and its FCA license is suspected to be a fake clone, which means trading on this platform lacks the protection you are going to need.

| Regulated Country | Regulated Authority | Regulatory Status | Regulated Entity | License Type | License Number |

| Vanuatu Financial Services Commission (VFSC) | Offshore Regulated | DTT VAN LTD | Retail Forex License | 40169 |

| Financial Conduct Authority (FCA) | Suspicious Clone | DIRECT TRADING TECHNOLOGIES UK LIMITED | Institution Forex License (STP) | 795892 |

Traders on Direct TT get access to 100,000+ market instruments including Forex, Indices, Energies, Cryptocurrencies, Metals, and Stocks.

| Trading Asset | Available |

| forex | ✔ |

| indices | ✔ |

| energies | ✔ |

| cryptocurrencies | ✔ |

| metals | ✔ |

| stocks | ✔ |

| bonds | ❌ |

| options | ❌ |

| funds | ❌ |

| ETFs | ❌ |

On Direct TT, traders are allowed to test this platform without risking real money using a demo account.

With a minimum deposit of $50, four types of live accounts with distinct conditions are offered to traders to choose from.

| Account Type | Mini | Standard | VIP | ECN |

| Minimum Deposit | $50 | $1,000 | $10,000 | $15,000 |

| Maximum Leverage | 1:200 | |||

| Contract Size | 1 Lot = 100,000 | |||

| Spread | Normal | Professional | VIP | NO Markup |

| Commission | 0 | 5 $ PER LOT | ||

| Prepaid Card | 35 USD | FREE | ||

The leverage on Direct TT is up to 1:200. Note that high leverage can amplify not only profits but also losses.

Direct TT offers different spreads based on the account class. However, Direct TT doesn't reveal the specific spreads on its website.

As for commission, if you are an ECN account user, $5 per lot is charged. Otherwise, the commission is free.

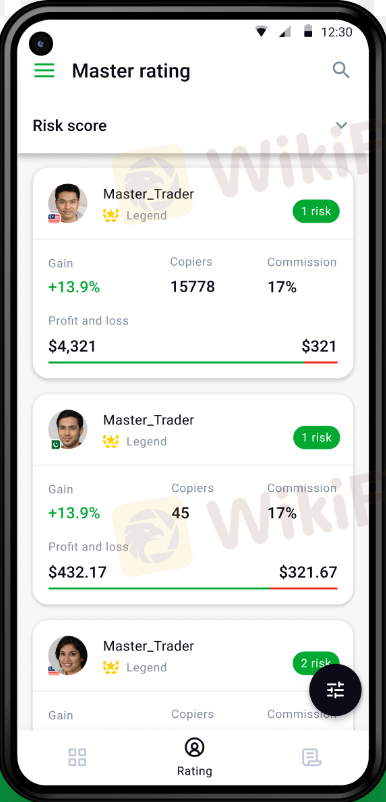

DTTPRO Trading Platform is the self-developed platform offered by Direct TT.

| Trading Platform | Supported | Available Devices | Suitable for |

| DTTPRO Trading Platform | ✔ | Desktop, Mobile, Web | / |

| MT5 | ❌ | / | Experienced traders |

| MT4 | ❌ | / | Beginners |

Here is a list of the payment methods available on this platform:

Additionally, Direct TT offers a Global DTT Debit Visa Card exclusively for traders on its platform. This card is said to have features like instant withdrawal and be available to use at any time.

More

User comment

5

CommentsWrite a review

2025-10-21 19:27

2025-10-21 19:27

2024-06-14 11:15

2024-06-14 11:15