User Reviews

More

User comment

2

CommentsWrite a review

2024-01-12 19:11

2024-01-12 19:11

2023-03-16 18:32

2023-03-16 18:32

Score

5-10 years

5-10 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Influence

Add brokers

Comparison

Quantity 12

Exposure

Score

Regulatory Index0.00

Business Index7.22

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

Company Name

Eddid Holdings Group

Company Abbreviation

Eddid

Platform registered country and region

Hong Kong

Company website

Company summary

Pyramid scheme complaint

Expose

Why I have to pay so many taxes when I just wanna withdraw part of my money of 600?

They will ask you to pay 20% of personal income tax, then once you paid it they will give you so many reasons not to withdraw your money like you have some violation etc. Be careful with this platform, they are scammers. below is there link : https://gu222.aide-eddidholdinos.top:6563/index/user/index/token/be361ec55a3260ca243b2507fe58b101.html

Please be careful. They will find people to enter on major social platforms, and they will lie to you and promise you will win. Start with a small recharge and make a profit. After you make a large recharge, they will find excuses to say that you will win if you recharge more. What kind of activities are you going to do? Welfare deceives you to recharge is a means of scammers. When you want to withdraw money, you will find various operations that violate the rules and ask you to pay a fine. Just not let you withdraw money. Be careful of this scammer. The contact tool is to use WhatsApp to remember the phone number at the top of the picture. Don’t be fooled (anything that can’t be downloaded normally on the Apple store is a fake platform). Beware of scams.

Please be careful. They will find people to enter on major social platforms, and they will lie to you. Planning a node to win stably. Start with a small recharge and make a profit. After you make a large recharge, they will find excuses to say that you will win if you recharge more. What kind of activities are you going to do? Welfare deceives you to recharge is a means of scammers. When you want to withdraw money, you will find various operations that violate the rules and ask you to pay a fine. Just not let you withdraw money. Be careful of this scammer. The contact tool is to use WhatsApp to remember the phone number at the top of the picture. Don’t be fooled (anything that can’t be downloaded normally on the Apple store is a fake platform). Beware of scams.

They will let you profit at first and then ask for more deposits. Please open your eyes, free from being hceated. They will contact u through whatsapp, just like the app in the picture.

Everyone can see clearly that this fake platform will start looking for someone on the major dating platforms to bring you into the market, saying what node planning is stable wins, etc. After making a profit, you will be allowed to withdraw small funds 1-2 times, and then various operation violations and activities will force you to deposit. Everyone can see clearly, this black platform is connected by whatsapp, remember this WhatsApp number (subject to the picture app), please be careful

Please be careful. They will find people to enter on major social platforms, and they will lie to you and promise you will win. Start with a small recharge and make a profit. After you make a large recharge, they will find excuses to say that you will win if you recharge more. What kind of activities are you going to do? Welfare deceives you to recharge is a means of scammers. When you want to withdraw money, you will find various operations that violate the rules and ask you to pay a fine. Just not let you withdraw money. Be careful of this scammer. The contact tool is to use WhatsApp to remember the phone number at the top of the picture. Don’t be fooled (anything that can’t be downloaded normally on the Apple store is a fake platform). Beware of scams.

Please be careful. They will find people to enter on major social platforms, and they will lie to you. Planning a node to win stably. Start with a small recharge and make a profit. After you make a large recharge, they will find excuses to say that you will win if you recharge more. What kind of activities are you going to do? Welfare deceives you to recharge is a means of scammers. When you want to withdraw money, you will find various operations that violate the rules and ask you to pay a fine. Just not let you withdraw money. Be careful of this scammer. The contact tool is to use WhatsApp to remember the phone number at the top of the picture. Don’t be fooled (anything that can’t be downloaded normally on the Apple store is a fake platform). Beware of scams.

Trick u into investing with this broker with small profit and then ask for money to upgrade. Later, you will be required to pay the individual income tax amd unfreezing fees. After the freezing time, they just closed my account. I was cheated of hundreds of thousds!!? But this platform still exists!!

Everyone, be careful. They will find people to enter on major social platforms, and they will lie to you. Planning a node to win stably. Start with a small recharge and make a profit. After you make a large recharge, they will find excuses to say that you will win if you recharge more What kind of activities are you going to do? Welfare cheats you to recharge is a means of scammers. When you want to withdraw money, you will find various operations that violate the rules and ask you to pay a fine again. Just not let you withdraw money. The contact tool is to use WhatsApp to remember the phone number above the picture. Don’t be fooled (the picture app shall prevail)

Please be careful. They will find people to enter on major social platforms, and they will lie to you. Planning a node to win stably. Start with a small recharge and make a profit. After you make a large recharge, they will find excuses to say that you will win if you recharge more. What kind of activities are you going to do? Welfare deceives you to recharge is a means of scammers. When you want to withdraw money, you will find various operations that violate the rules and ask you to pay a fine. Just not let you withdraw money. Be careful of this scammer. The contact tool is to use WhatsApp to remember the phone number at the top of the picture. Don’t be fooled (anything that can’t be downloaded normally on the Apple store is a fake platform). Beware of scams.

Counterfeit EDDID killing pig black platform,Beware of scams Everyone, Please be careful. They will find people to enter on major social platforms, and they will lie to you. Planning a node to win stably. Start with a small recharge and make a profit. After you make a large recharge, they will find excuses to say that you will win if you recharge more. What kind of activities are you going to do? Welfare deceives you to recharge is a means of scammers. When you want to withdraw money, you will find various operations that violate the rules and ask you to pay a fine. Just not let you withdraw money. Be careful of this scammer. The contact tool is to use WhatsApp to remember the phone number at the top of the picture. Don’t be fooled (anything that can’t be downloaded normally on the Apple store is a fake platform). Beware of scams.

| Aspect | Information |

| Registered in | Hong Kong |

| Company Name | Eddid |

| Regulation | Unregulated |

| Spreads/Fees | Commission fees for self-directed and full-service accounts, regulatory fees, service, and processing fees |

| Trading Platforms | VTrader Web |

| Tradable Assets | Equities, Options |

| Account Types | Individual, Joint (TIC, WROS), Entity (Corporate, Trust), International |

| Payment Methods | Wire Transfer, ACAT Transfer |

Eddid, an unregulated investment firm based in Hong Kong, offers a range of financial services and trading opportunities through its web-based platform, VTrader Web. Despite its lack of regulatory oversight, Eddid attracts investors with a variety of tradable assets, including equities and options, supported by diverse account types such as Individual, Joint (TIC, WROS), Entity (Corporate, Trust), and International accounts. The platform charges commission fees for both self-directed and full-service accounts, in addition to regulatory fees, service, and processing fees. Funding and managing investments with Eddid can be done through wire transfers or ACAT transfers, accommodating a wide range of investors looking for opportunities in the equities and options markets.

Eddid is known as an unregulated broker, meaning it operates outside the supervision of regulatory authorities. This lack of regulation raises concerns about the safety and security of investments made through the platform. Investors are advised to exercise caution and conduct thorough research before engaging with unregulated entities.

Eddid offers a range of investment opportunities and services catering to diverse investor needs, with a notable emphasis on equities and options trading for portfolio growth and strategic investment. However, its status as an unregulated broker necessitates caution, as it operates outside the purview of regulatory oversight, potentially increasing the risk to investments. The platform's emphasis on liquidity, risk management, and strategic advisory services underscores its commitment to providing valuable tools and advice to investors. Yet, the lack of regulatory safeguards remains a significant concern that investors must weigh against the benefits of Eddid's offerings.

| Pros | Cons |

|

|

|

|

|

|

|

|

|

|

The trading products offered by Eddid span across equities and options, each tailored to meet different investment strategies and goals.

Equities

Portfolio Growth: Eddid enables investors to build and grow their portfolios by investing in the equity market of a growing economy. This approach allows investors to put their cash to work, leveraging market growth for potential returns.

Dividend Income: Investors have the opportunity to turn their savings into a source of dividend income, offering a steady income stream from investments in dividend-paying stocks.

Risk Management: Eddid emphasizes the importance of managing market risks through asset allocation and diversification. This strategy helps in spreading out potential risks across various assets, thereby minimizing the impact of market volatility on the investment portfolio.

Liquidity: The platform highlights the importance of liquidity, which provides investors with the flexibility to quickly enter or exit positions. This liquidity also opens up more opportunities for investment, making it easier to respond to market changes.

Options

Leveraging Volatility: Eddid offers options trading as a means to turn market volatility into trading opportunities. Options allow traders to manage exposures in a flexible manner, capitalizing on market fluctuations for potential gains.

Leverage and Flexibility: Through options, investors can gain leverage, allowing them to control a larger position with a smaller amount of capital. This leverage comes with increased flexibility in executing various trading strategies.

Portfolio Hedging and Income Generation: Options trading is presented as a tool for hedging against portfolio risks or for generating extra income. This can be achieved through strategies such as selling covered calls or buying protective puts.

Strategic Investment: Eddid views options as a strategic investment tool. By using options, investors can design complex trading strategies that aim for higher returns while managing risks, making options a sophisticated addition to the investment toolkit.

Eddid's trading products are designed to cater to a wide range of investment preferences, from those seeking steady income through dividends to those looking to leverage market volatility for potential gains. Through a combination of equities and options, Eddid offers a diverse set of tools for investors aiming to build and manage their investment portfolios.

Eddid's Investment Banking and Institutional Sales and Trading services cater to a broad spectrum of clients, including companies seeking financing and institutional portfolio managers. Here's a detailed look at the services provided:

Private Placement & PIPE

Strategic Advisory: Eddid offers strategic advice leveraging its team of seasoned professionals who possess extensive capital markets expertise and industry knowledge. This service is designed to guide clients through complex financial landscapes.

Intermediary Services: Acting as an intermediary in the financing process, Eddid facilitates transactions between companies and investors. This role is crucial for companies looking to secure funding without resorting to public markets.

Public Capital Market (PIPE): Eddid specializes in Private Investment in Public Equity (PIPE), arranging private investments for publicly traded companies. This approach allows public companies to raise capital more discreetly and efficiently than through public offerings.

Private Capital Market: Focused on the private sector, Eddid facilitates private placements for startups and mid- to late-stage growth companies. These private placements enable companies to raise funds directly from private investors, tailored to meet specific financial and strategic needs.

Institutional Sales and Trading

Institutional Portfolio Management: Eddid USA's team services institutional portfolio managers, including those managing mutual funds, hedge funds, and portfolios for registered investment advisors. The aim is to provide expert management that aligns with the strategic goals and risk profiles of institutional clients.

Efficient Transaction Execution: The team ensures timely and efficient execution of transactions across a variety of markets, including Listed and NASDAQ issues. This service is pivotal for managing large volumes of transactions while seeking the best possible outcomes for clients.

Trading Activities: Eddid's trading activities encompass a wide range of transactions designed to meet the diverse needs of institutional clients. These include:

Institutional Orders: Handling large orders from institutional clients that require meticulous planning and execution to minimize market impact.

Block Trades: Executing large volumes of securities transactions that typically exceed the average market volumes, necessitating specialized handling to optimize execution and pricing.

Rule 144 Transactions: Managing the sale of restricted or control securities in compliance with SEC Rule 144, ensuring legal and efficient execution.

Corporate Buybacks: Assisting corporations in the repurchase of their own shares from the marketplace, a strategy that can impact a companys stock value and earnings per share.

Retail Orders: Although primarily focused on institutional clients, Eddid also handles retail orders, providing access to their expertise and execution capabilities to a wider audience.

Eddid's comprehensive suite of services in Investment Banking and Institutional Sales and Trading demonstrates a commitment to delivering strategic advice, efficient transaction execution, and tailored financing solutions. These services are designed to support the financial and strategic objectives of a diverse client base, from startups and growth-stage companies to institutional investors and portfolio managers.

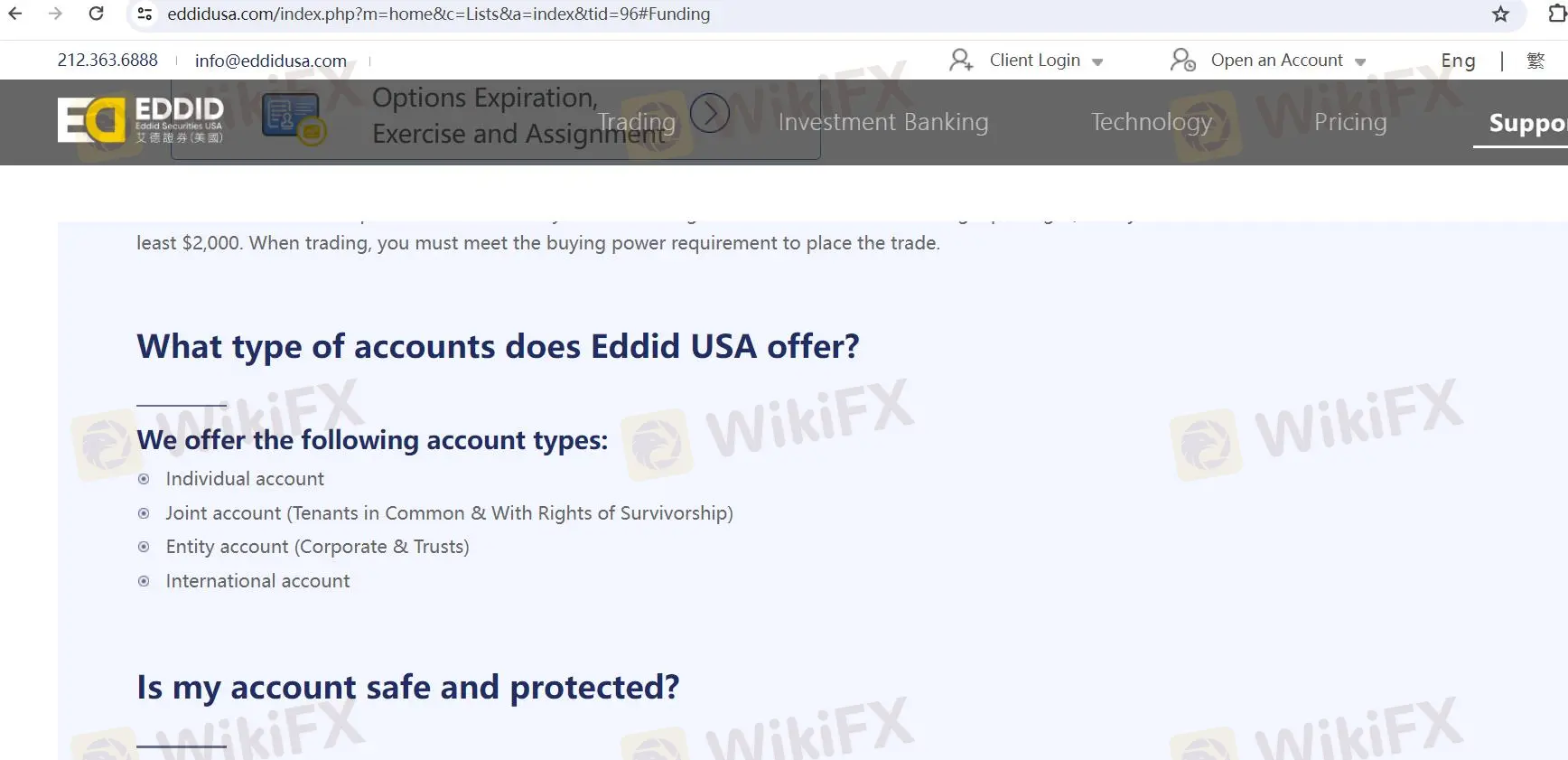

Eddid USA offers a variety of account types to cater to the diverse needs of investors, including individuals, joint account holders, entities, and international clients:

Individual Account: Designed for a single investor, this account is in the name of one person who makes all the investment decisions.

Joint Account: Available in two forms:

Tenants in Common (TIC): Allows two or more individuals to own a share of the account. Upon the death of one tenant, their share is passed to their estate.

With Rights of Survivorship (WROS): Allows two or more individuals to share equal ownership of the account, with the surviving tenant(s) automatically inheriting the deceased tenants share.

Entity Account: Tailored for legal entities, including:

Corporate Accounts: For corporations investing in the financial markets.

Trust Accounts: For trusts managing assets on behalf of beneficiaries.

International Account: Specifically for non-U.S. residents, offering them the opportunity to invest in the U.S. market.

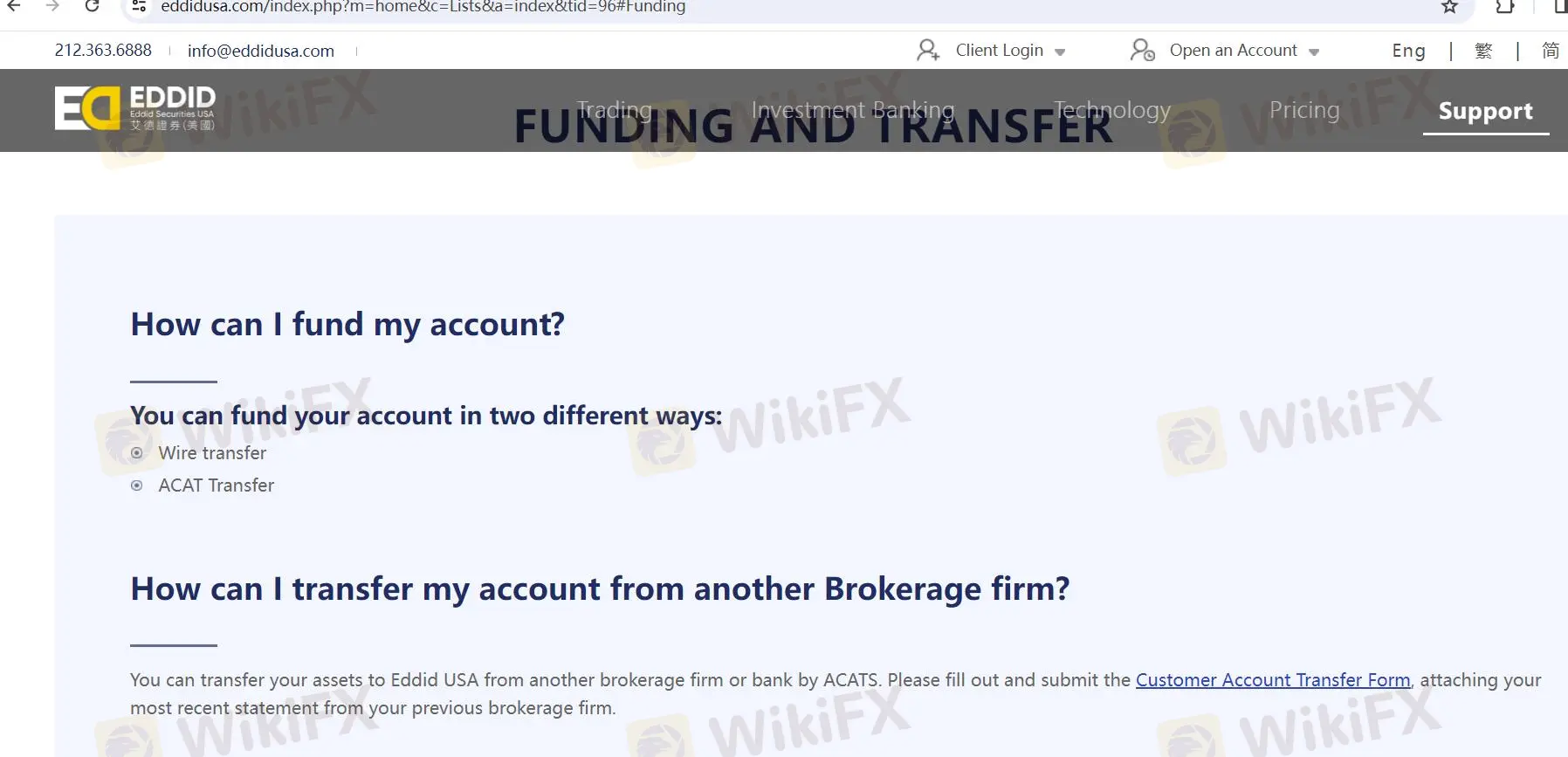

Eddid offers straightforward methods for funding your account, transferring assets from another brokerage, and withdrawing funds. Let's delve into each process:

Funding Your Account

You can add funds to your Eddid account in two ways:

Wire Transfer: Directly wire money from your bank account to your Eddid account. This method is fast and allows you to start trading as soon as the funds are received.

ACAT Transfer (Automated Customer Account Transfer Service): Transfer your assets from another brokerage firm or bank to Eddid USA using ACATS. To do this, you'll need to fill out and submit the Customer Account Transfer Form along with your most recent statement from your previous brokerage firm.

Transferring Your Account from Another Brokerage

To move your assets to Eddid USA from another brokerage or bank, utilize the ACATS process mentioned above. This is a standard procedure for transferring securities and cash between brokerage firms without the need to liquidate positions.

Withdrawing Funds from Your Account

Withdrawals can be made through the following methods:

Wire Transfer: Request a wire transfer to move funds to your domestic or international bank account. Note that there's a fee of $25 for domestic wires and $50 for international wires.

ACH (Automated Clearing House): Request an ACH transfer for a fee-free option to withdraw funds to your bank account. This method is typically slower than a wire transfer but is a cost-effective choice.

For both wire transfers and ACH requests, specific forms need to be filled out and submitted to initiate the process.

| Category | Product | Detail | Fee |

| Commission (Self-directed) | Equities | Per Share | $0.0299/share (min $2.99/trade) |

| Options | Per Contract | $0.65/contract (+ $1.99/trade) | |

| Commission (Full-service) | Equities | Per Share | $0.0499/share (min $30/trade) |

| Options | Per Contract | $0.99/contract (+ $30/trade) | |

| Regulatory Trading Fees and Exchanges Fee | Regulatory Fee (SEC) | Stock Sells Only | $0.000008 x no. of shares x price (min $0.01) |

| Trading Activity Fee (FINRA) | Stock Sells Only | $0.000145/share (min $0.01 – max $7.27) | |

| Regulatory Fee (SEC) | Options Sells Only | $0.000008 x no. of contracts x 100 x price (min $0.01) | |

| Trading Activity Fee (FINRA) | Options Sells Only | $0.00244/contract (min $0.01) | |

| Options Regulatory Fee (Options Exchanges) | Buys & Sells | $0.02905/contract | |

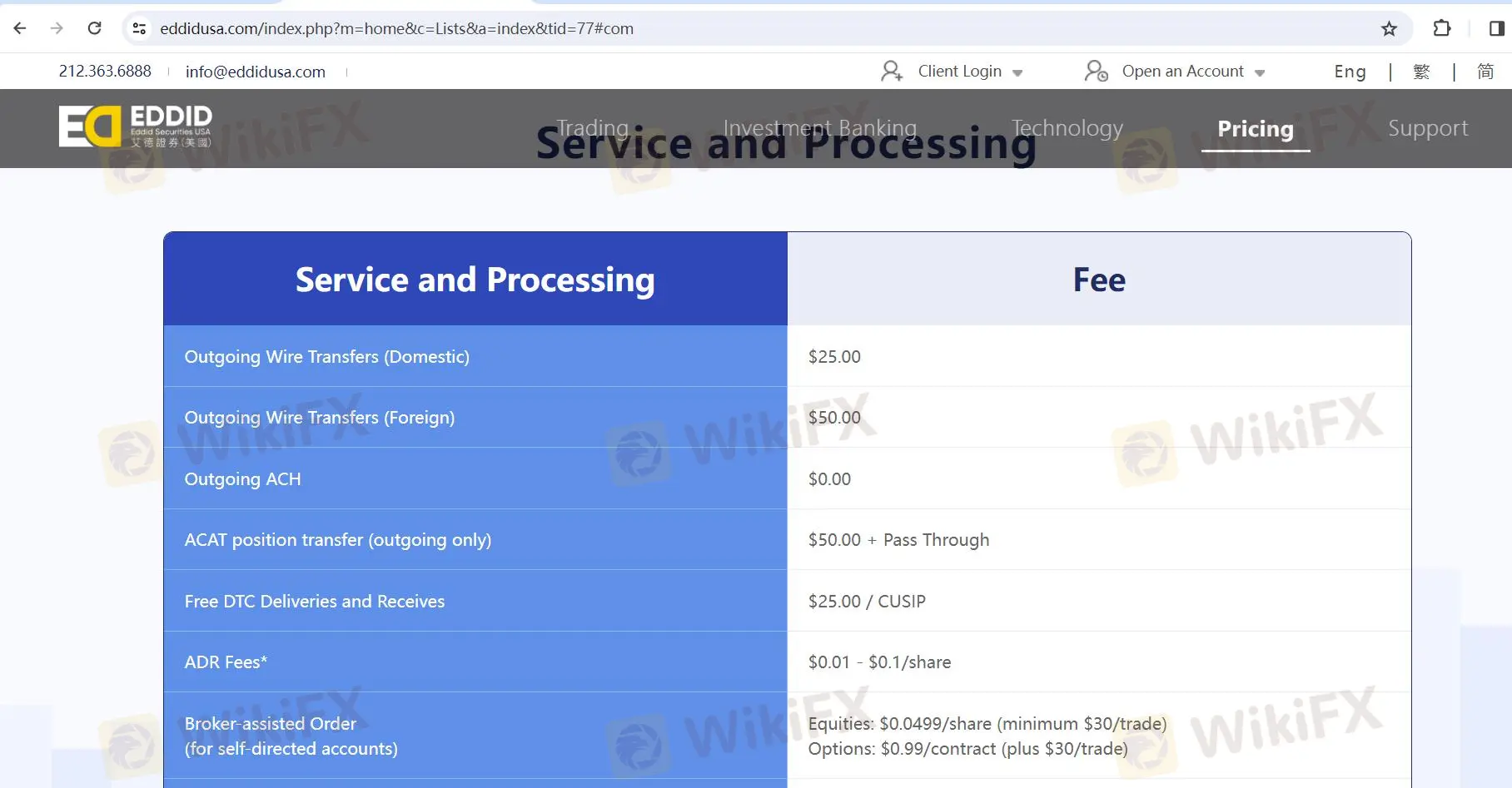

| Service and Processing | Outgoing Wire Transfers (Domestic) | - | $25.00 |

| Outgoing Wire Transfers (Foreign) | - | $50.00 | |

| Outgoing ACH | - | $0.00 | |

| ACAT Position Transfer (Outgoing Only) | - | $50.00 + Pass Through | |

| Free DTC Deliveries and Receives | - | $25.00 / CUSIP | |

| ADR Fees* | - | $0.01 - $0.10/share | |

| Broker-Assisted Order (for self-directed accounts) | Equities | - | $0.0499/share (min $30/trade) |

| Options | - | $0.99/contract (+ $30/trade) | |

| Margin Rates | $1,000,000 + | 9.75% | |

| $500,000 - $999,999 | 10.75% | ||

| $250,000 - $499,999 | 12.25% | ||

| $100,000 - $249,999 | 12.75% | ||

| $50,000 - $99,999 | 13.25% | ||

| $25,000 - $49,999 | 13.50% | ||

| $1 - $24,999 | 13.75% | ||

| Credit Interest | $1,000,000 + | 0.30% | |

| $500,000 - $999,999 | 0.30% | ||

| $250,000 - $499,999 | 0.30% | ||

| $100,000 - $249,999 | 0.30% | ||

| $50,000 - $99,999 | 0.30% | ||

| $25,000 - $49,999 | 0.30% | ||

| $1 - $24,999 | 0.30% |

This table encapsulates the commission fees for self-directed and full-service accounts, regulatory fees, service and processing fees, along with margin rates and credit interest details, providing a comprehensive overview of the costs associated with various services and transactions.

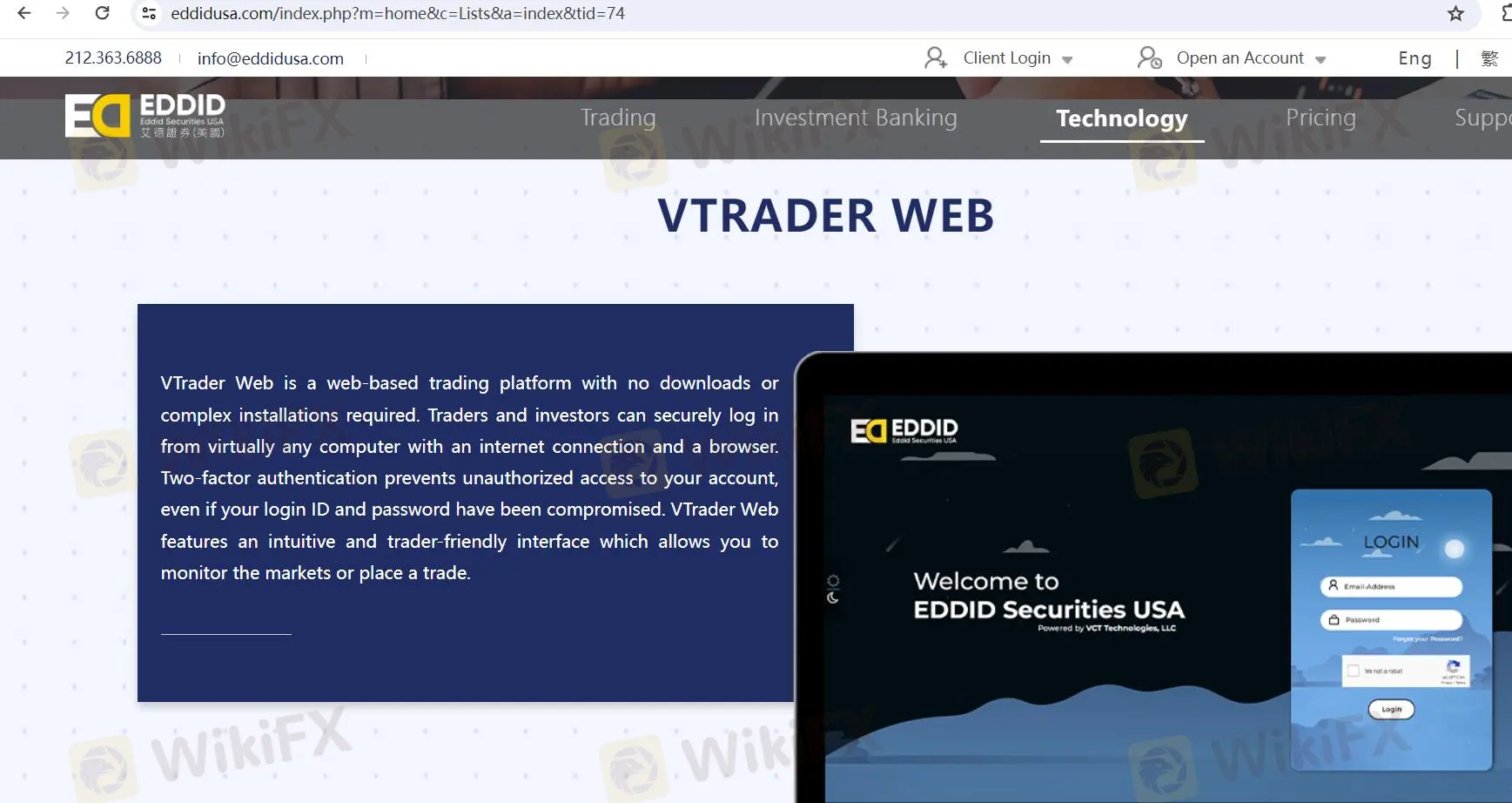

VTrader Web is a user-friendly, web-based trading platform that doesn't require any downloads or installations. You can access it from any computer with internet and a browser, ensuring convenience and mobility. To enhance security, it features two-factor authentication, adding an extra layer of protection for your account.

Eddid stands out in the financial services landscape as an unregulated broker, offering a diverse array of trading products and services tailored to different investment goals and strategies. With a focus on equities and options, Eddid aims to cater to investors looking for portfolio growth, dividend income, risk management, and the leverage of market volatility. While the lack of regulation is a point of caution, the platform's emphasis on investment banking, institutional sales, and trading services speaks to its commitment to providing strategic advice, efficient transaction execution, and tailored financing solutions. Eddid also accommodates a wide range of investors with various account types and offers straightforward methods for funding, transferring, and withdrawing funds. Despite the potential risks associated with its unregulated status, Eddid's comprehensive suite of services and user-friendly trading platforms position it as a noteworthy player for those navigating the complexities of financial markets.

Q1: What is an unregulated broker, and why does it matter for investors considering Eddid?

A1: An unregulated broker operates outside the supervision of regulatory authorities, which raises concerns about the safety and security of investments. For investors considering Eddid, this means there could be higher risks involved, and they are advised to conduct thorough research and exercise caution before engaging with the platform.

Q2: What trading products does Eddid offer?

A2: Eddid offers a range of trading products including equities and options. Equities cater to those looking for portfolio growth, dividend income, or risk management through diversified investments. Options trading offers opportunities to leverage market volatility, manage investment risks, and employ strategic investment approaches for potential gains.

Q3: How does Eddid support investors in managing risks associated with trading?

A3: Eddid emphasizes the importance of risk management through strategies like asset allocation and diversification, particularly for equity investments. In options trading, it offers tools for portfolio hedging and income generation, allowing investors to mitigate risks and tailor their investment strategies to market conditions.

Q4: Can international clients open accounts with Eddid, and are there specific account types for them?

A4: Yes, international clients can open accounts with Eddid. The platform offers an International Account specifically designed for non-U.S. residents, allowing them to invest in the U.S. market. This account type is part of Eddid's range of account options that also include individual, joint, and entity accounts.

Q5: What are the methods for funding an account and withdrawing funds from Eddid?

A5: To fund an account, clients can use wire transfers for immediate funding or the ACAT process for transferring assets from another brokerage. For withdrawals, Eddid provides wire transfers and ACH transfers, with wire transfers subject to fees. ACH transfers offer a fee-free option but might be slower compared to wire transfers.

Online trading carries substantial risk, potentially leading to the total loss of invested funds. It may not be appropriate for all traders or investors. It's crucial to fully comprehend the associated risks before engaging in trading activities. Additionally, the content of this review is subject to change, reflecting updates in the company's services and policies. The review's creation date is also relevant, as information could have become outdated. Readers should confirm the latest information with the company prior to making any investment decisions. The responsibility for utilizing the information provided herein lies exclusively with the reader.

More

User comment

2

CommentsWrite a review

2024-01-12 19:11

2024-01-12 19:11

2023-03-16 18:32

2023-03-16 18:32