User Reviews

More

User comment

7

CommentsWrite a review

2025-08-16 10:54

2025-08-16 10:54

2025-03-21 05:32

2025-03-21 05:32

Score

2-5 years

2-5 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Influence

Add brokers

Comparison

Quantity 2

Exposure

Score

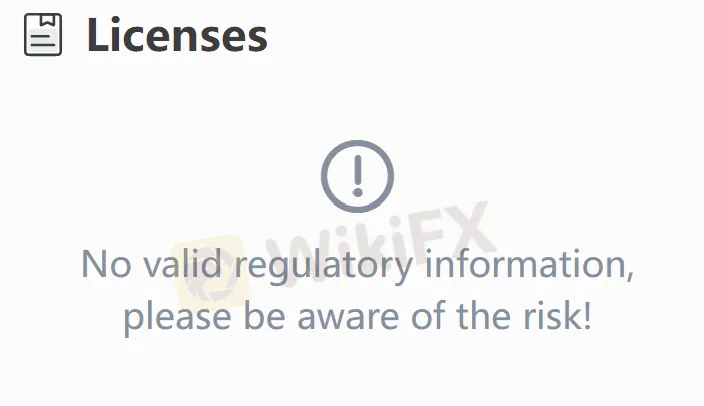

Regulatory Index0.00

Business Index5.68

Risk Management Index0.00

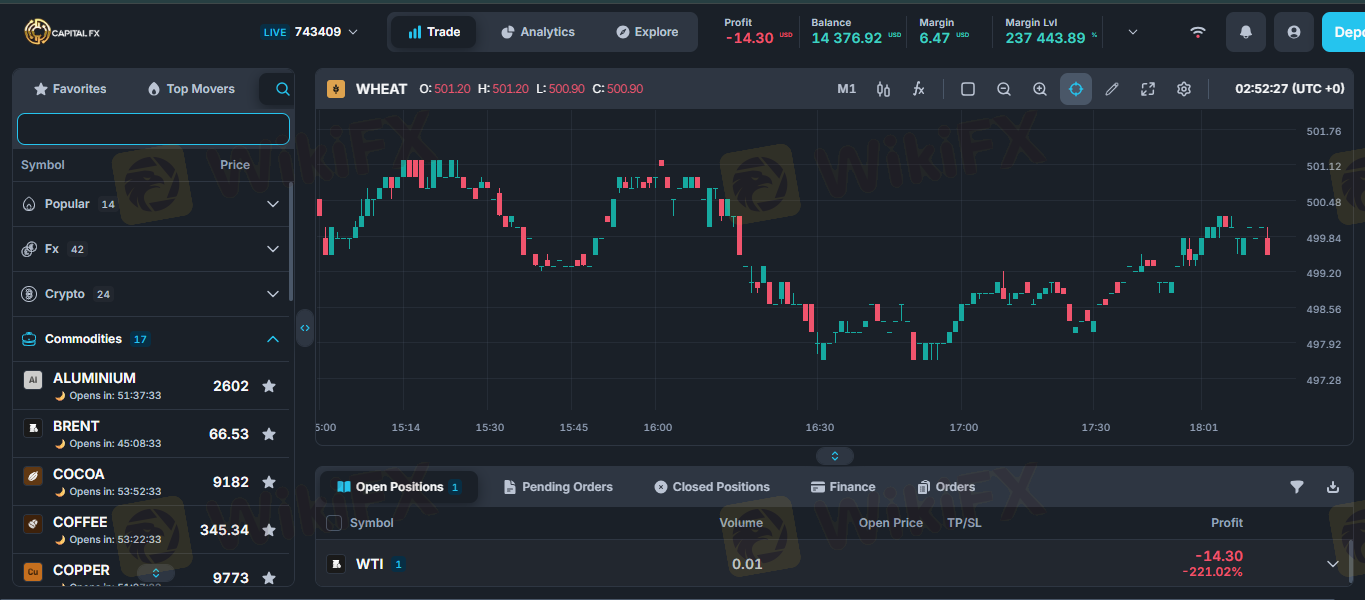

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

Company Name

Capital Fx

Company Abbreviation

Capital Fx

Platform registered country and region

The Virgin Islands

Company website

Company summary

Pyramid scheme complaint

Expose

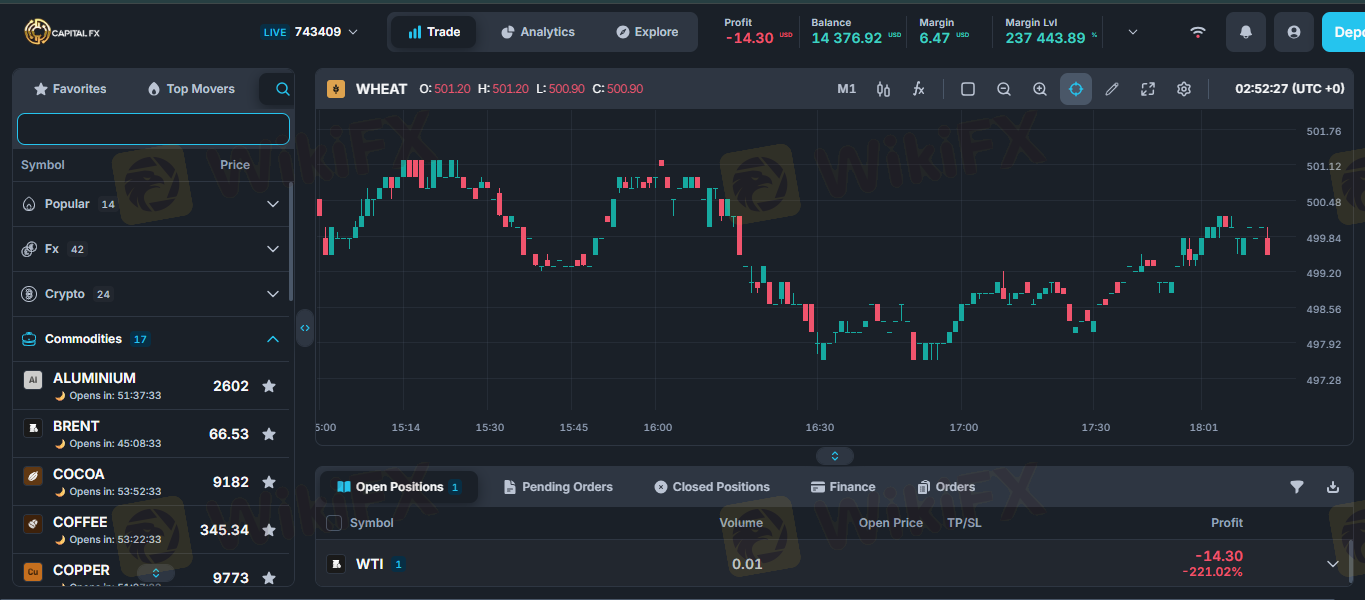

| Capital FxReview Summary | |

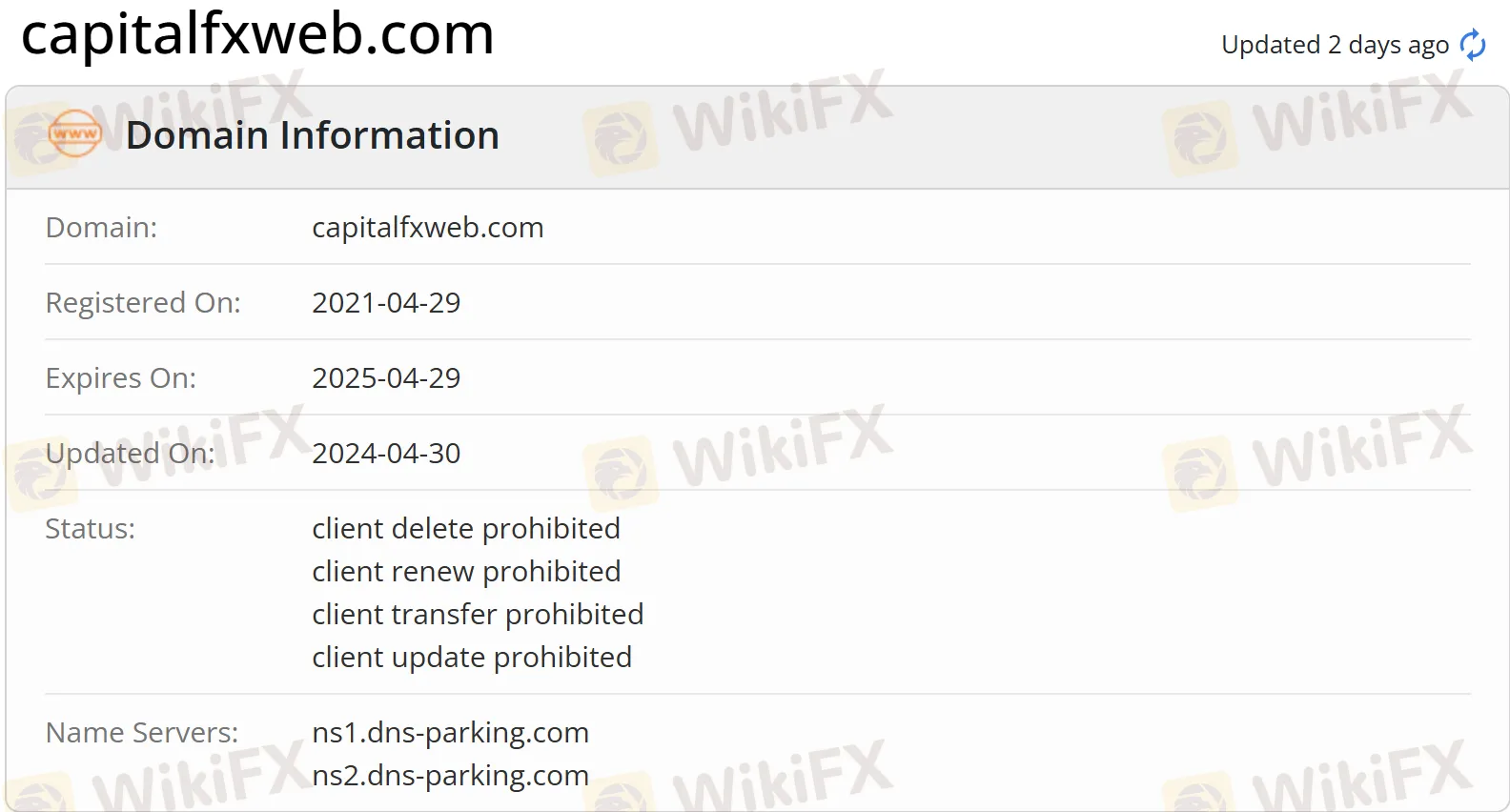

| Founded | 2021 |

| Registered Country/Region | Seychelles |

| Regulation | No Regulation |

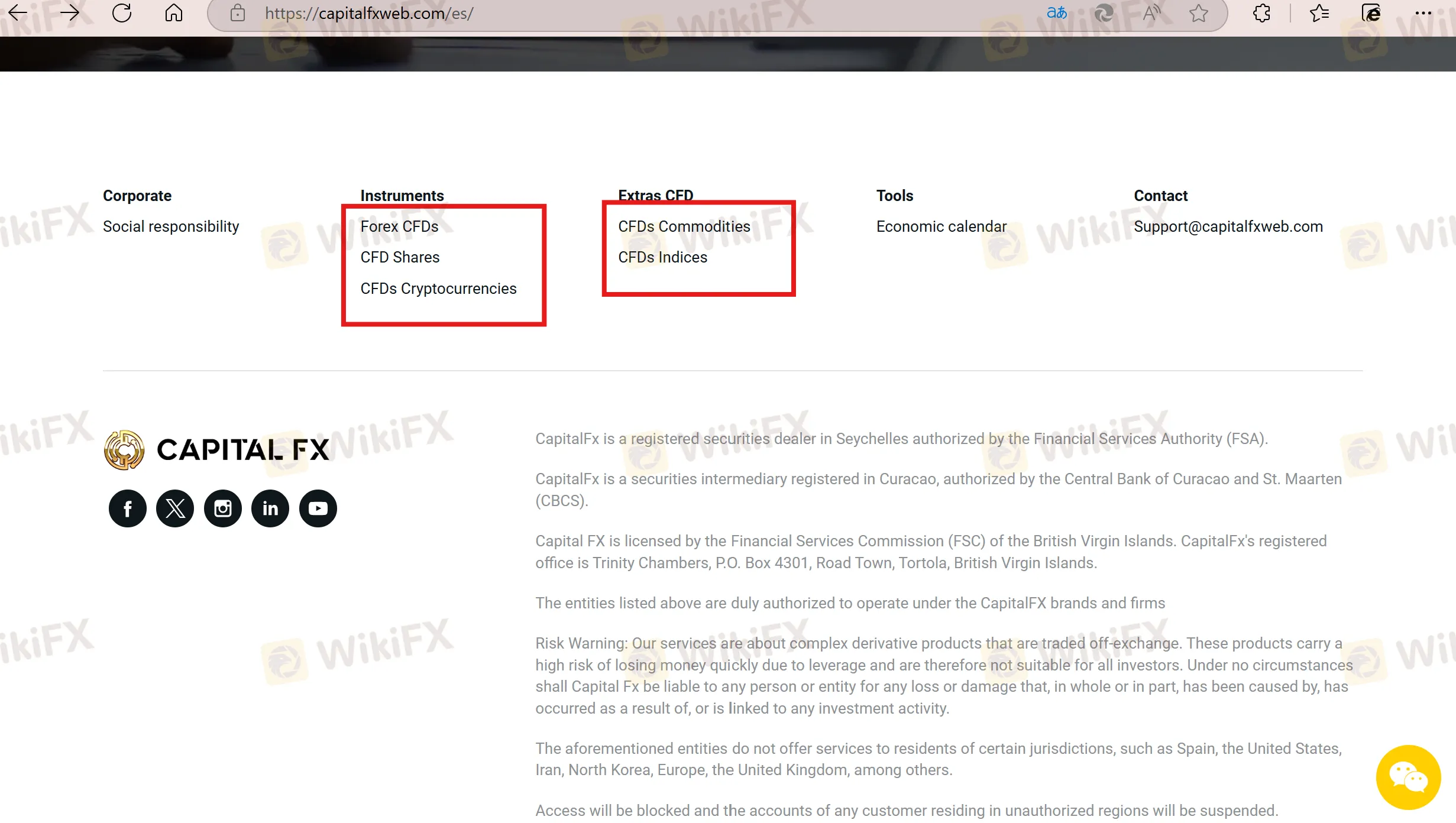

| Market Instruments | Forex, shares, cryptos, commodities, indices |

| Demo Account | ✅ |

| Leverage | / |

| Spread | / |

| Trading Platform | / |

| Minimum Deposit | / |

| Customer Support | Email: Support@capitalfxweb.com |

| Address: Trinity Chambers, P.O. Box 4301, Road Town, Tortola, British Virgin Islands | |

| Social media: Instagram, YouTube, Twitter, Facebook, LinkedIn | |

| Regional Restrictions | Spain, the United States, Iran, North Korea, Europe, the United Kingdom |

Capital Fx was registered in 2021 in Seychelles, specializing in trading services related to forex, shares, cryptos, commodities, and indices. It provides two types of accounts, with a free demo account available, but it does not reveal the details of each account. Meanwhile, it claims to be regulated, but in fact it is not, which means potential risks still exist.

| Pros | Cons |

| Demo accounts available | Lack of regulation |

| Multiple tradable assets | Regional restrictions |

| Customer support provided | Lack of transparency |

| Immediate withdrawal |

No, Capital Fx is not regulated. It claims to be authorized by the Financial Services Authority (FSA) in Seychelles, the Central Bank of Curacao and St. Maarten (CBCS), and licensed by the Financial Services Commission (FSC) of the British Virgin Islands.

However, it is in fact not regulated. Please be aware of the risks!

Capital Fx provides several types of products, including forex, shares, cryptos, commodities, and indices.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Indices | ✔ |

| Shares | ✔ |

| Commodities | ✔ |

| Cryptos | ✔ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

| Futures | ❌ |

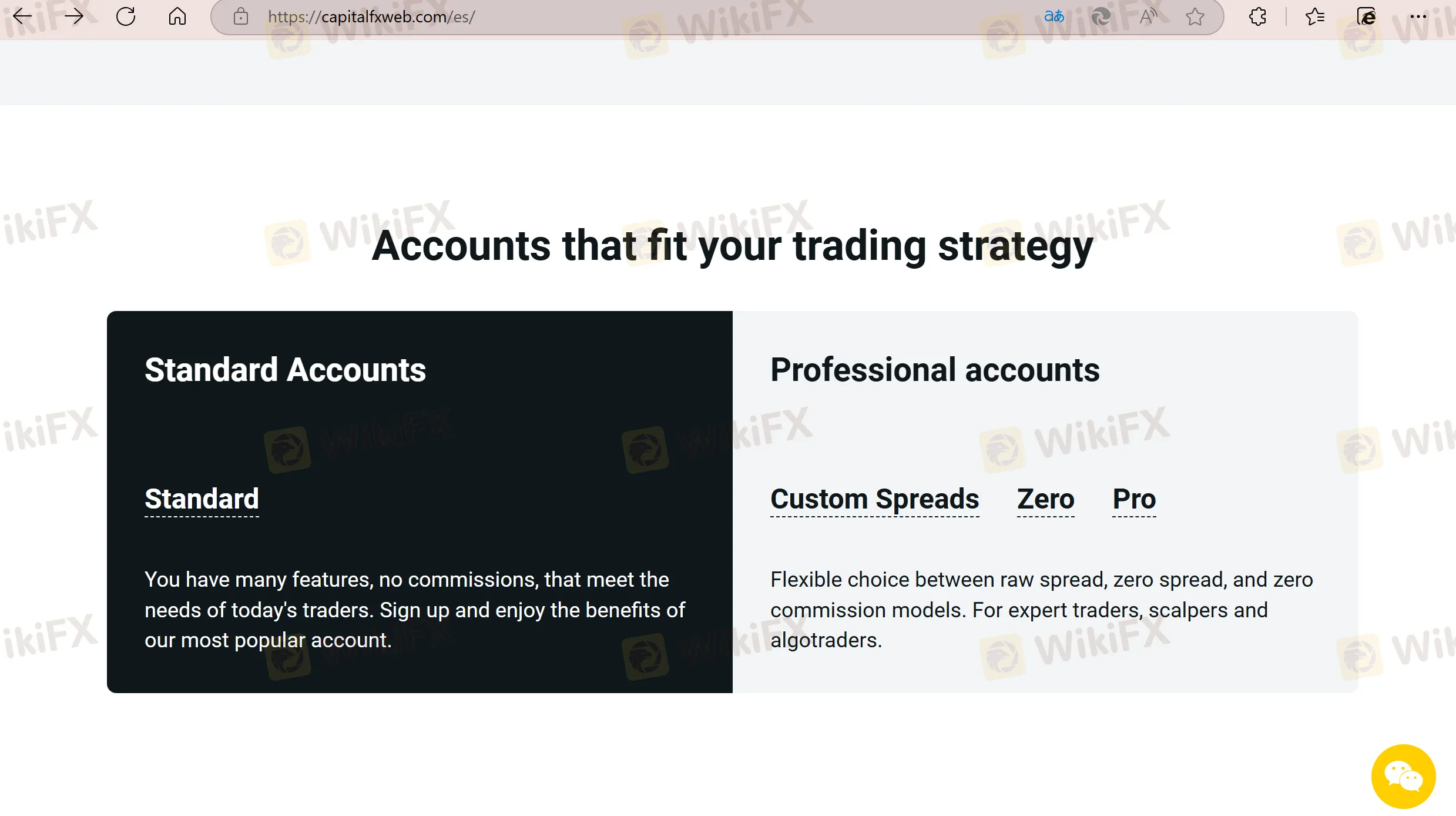

Capital Fx provides two types of accounts: Standard Account and Professional Account. Besides, a free demo account is available. Nevertheless, the details such as spreads, commissions, and leverage ratio are not revealed.

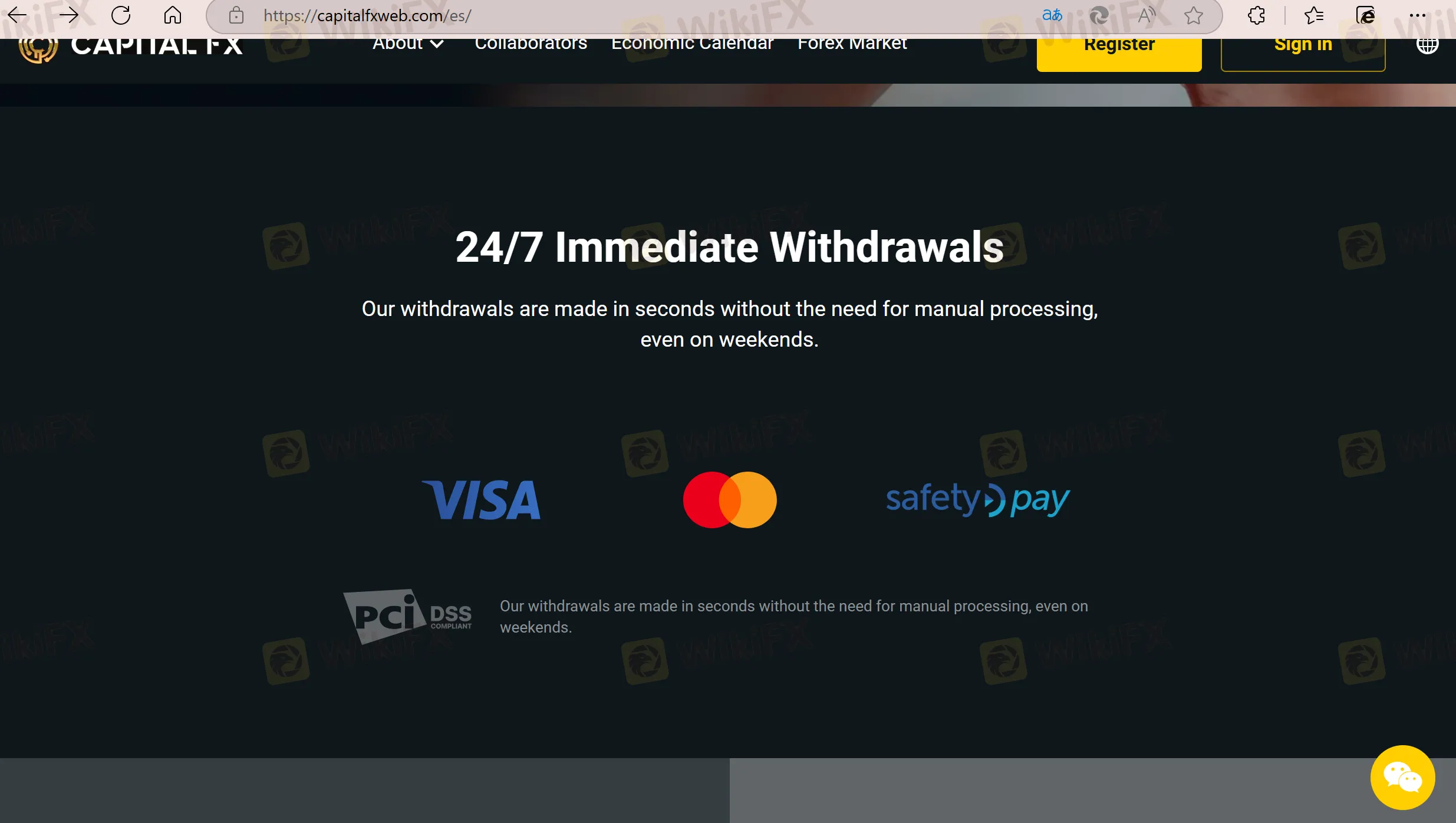

Capital Fx supports three types of payment options, including VISA, MasterCard, and safetypay. It features fast withdrawal processing. However, other details such as commission fees and base currency are not clear.

More

User comment

7

CommentsWrite a review

2025-08-16 10:54

2025-08-16 10:54

2025-03-21 05:32

2025-03-21 05:32