User Reviews

More

User comment

4

CommentsWrite a review

2024-08-21 20:55

2024-08-21 20:55

2024-08-21 20:06

2024-08-21 20:06

Score

2-5 years

2-5 yearsSuspicious Regulatory License

MT5 Full License

Regional Brokers

High potential risk

Add brokers

Comparison

Quantity 1

Exposure

Score

Regulatory Index0.00

Business Index5.46

Risk Management Index0.00

Software Index7.94

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

Company Name

NextLevel Trade Ltd

Company Abbreviation

NextLevel Trade

Platform registered country and region

Comoros

Company website

Company summary

Pyramid scheme complaint

Expose

| NextLevel Trade | Basic Information |

| Company Name | NextLevel Trade |

| Headquarters | Comoros |

| Regulations | Offshore regulated by MISA |

| Tradable Assets | Forex, metals, commodities, cryptocurrencies, shares and indices |

| Time to open account | Instant |

| Trading Platforms | Mobile platforms and MT5 platform |

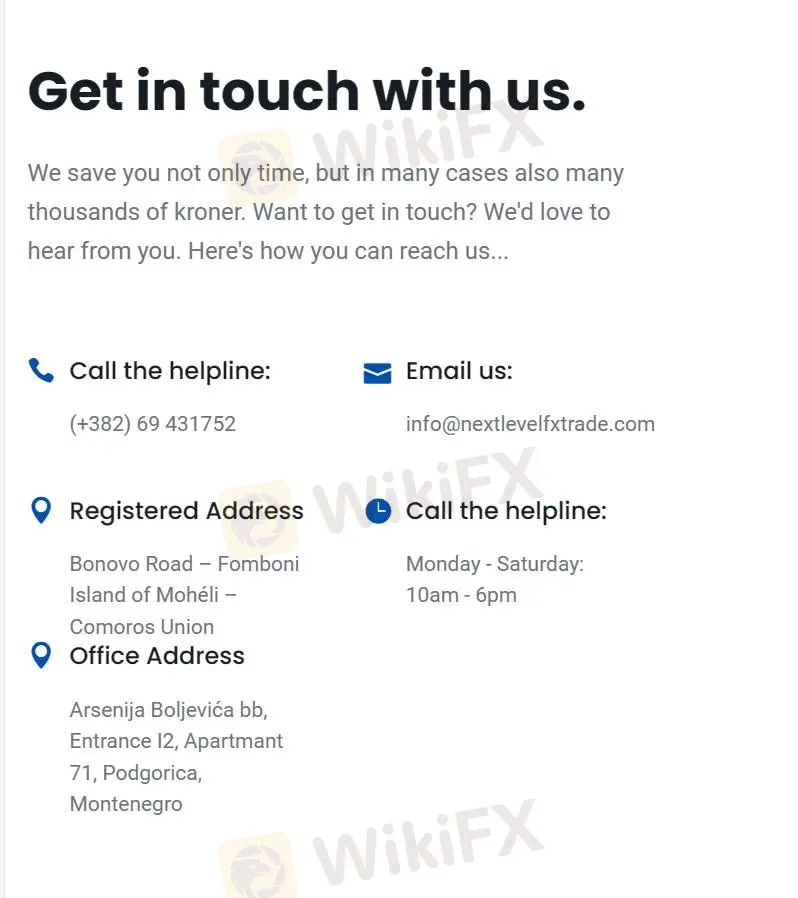

| Customer Support | info@nextlevelfxtrade.com(+382) 69 431752 |

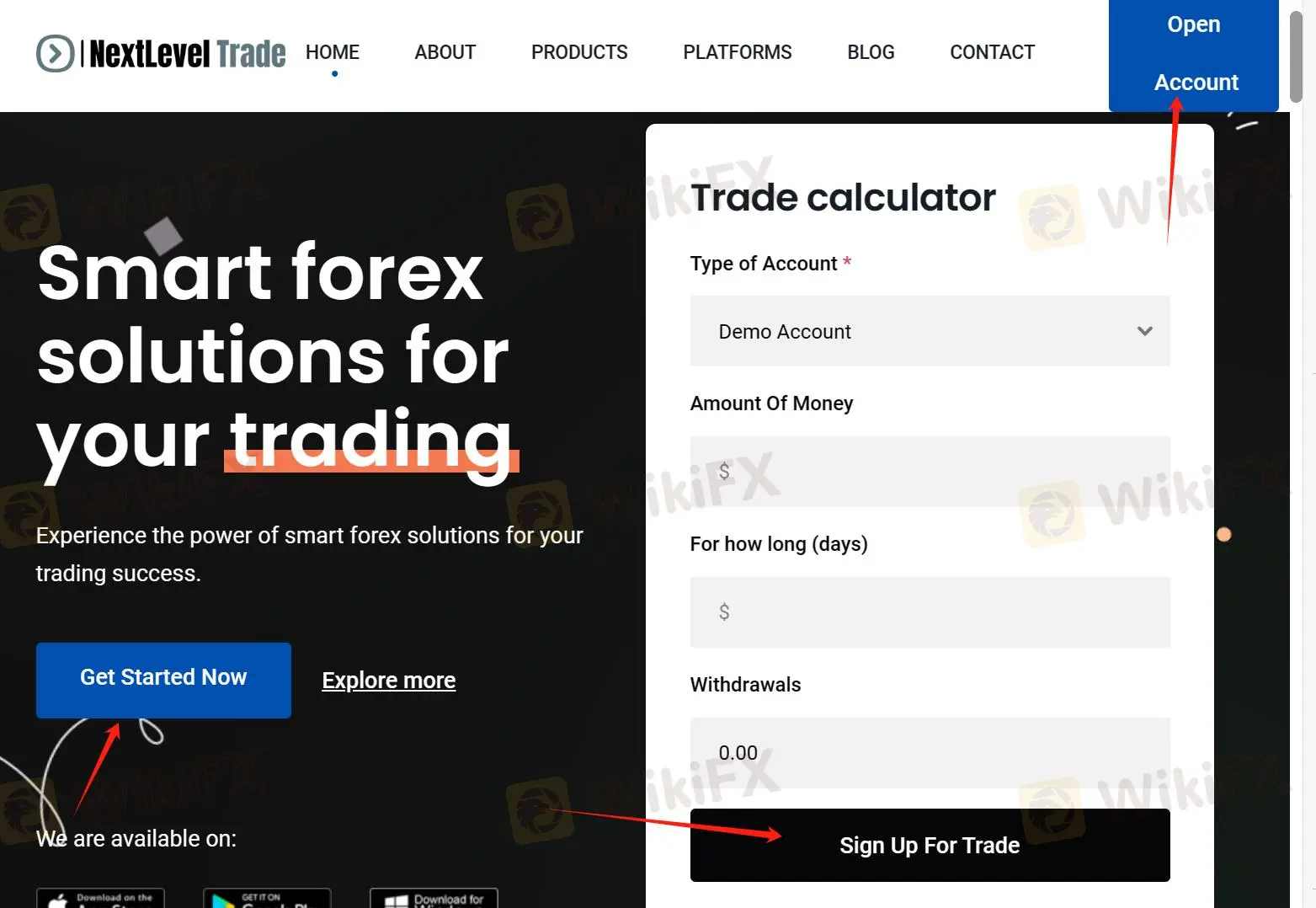

NextLevel Trade is a broker situated in Comoros, which registered in Bonovo Road – Fomboni Island of Mohéli – Comoros Union. It is an online trading platform offering various financial instruments to traders. With a range of account types, traders can access the forex, metals, commodities, cryptocurrencies, shares and indices through the MT5 platform and Mobile platforms.

NextLevel Trade is offshore regulated by the MISA with the license number of BFX2024048.

| Pros | Cons |

|

|

|

|

|

NextLevel Trade offers 6 classes of trading instruments, including forex, metals, commodities, cryptocurrencies, shares and indices.

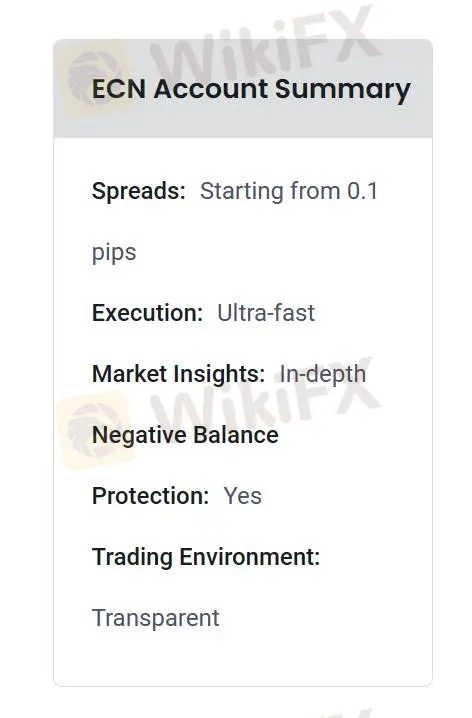

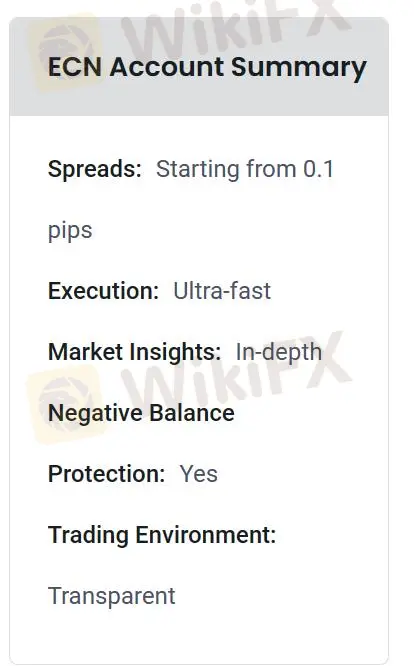

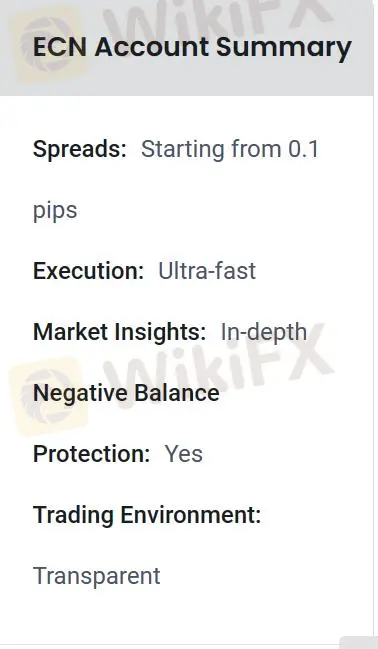

Shares: Its spreads beginning at just 0.1 pips, ensuring cost-effective trading. It offers ultra-fast execution, minimizing delays and slippage for optimal transaction efficiency. Traders benefit from in-depth market insights, providing a comprehensive understanding of market movements and trends. With negative balance protection, clients are safeguarded against losing more than their account balance, offering a secure trading experience. Additionally, the trading environment is transparent.

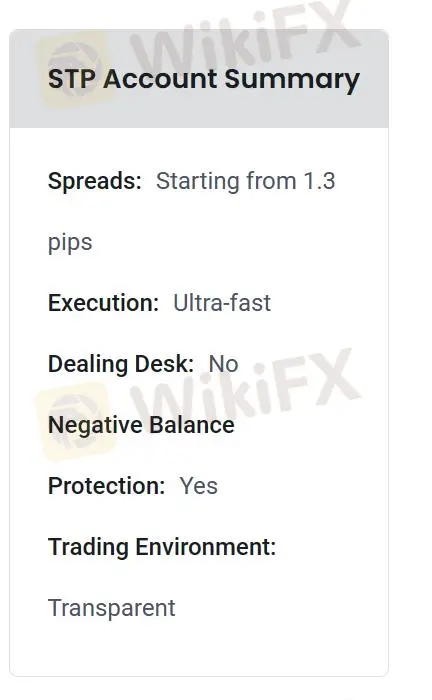

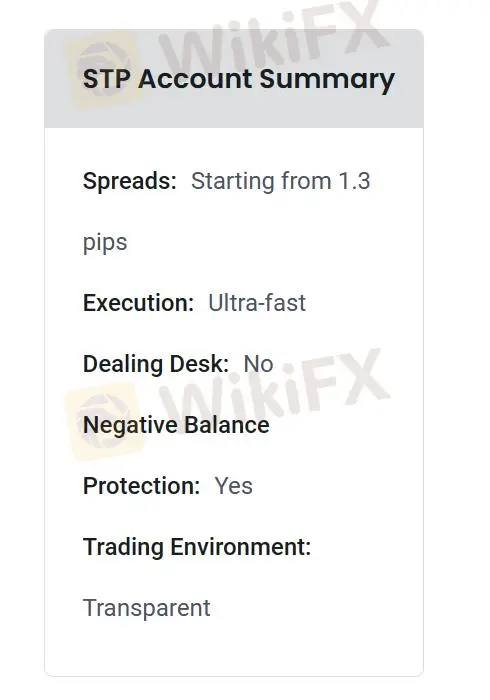

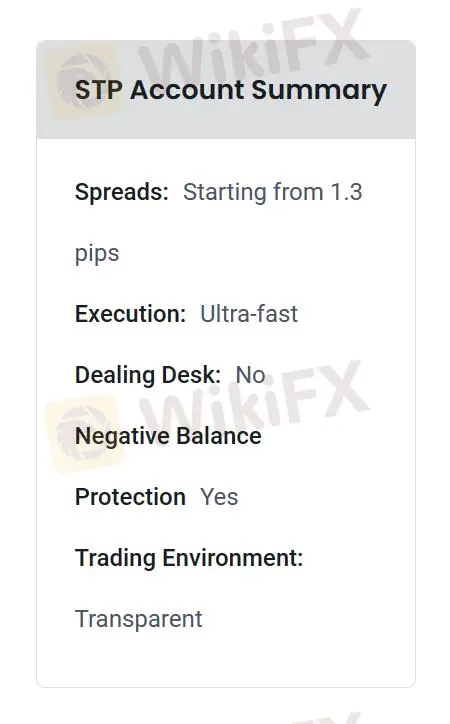

Indices: It is designed to provide traders with a competitive edge, featuring spreads that start from as low as 1.3 pips. It prides itself on ultra-fast execution, ensuring that trades are processed swiftly to capitalize on market movements. This account operates without a dealing desk, offering direct market access and eliminating any potential conflict of interest.

Commodities: It offers an advantageous trading setup with spreads commencing from a low threshold of 1.3 pips. This account type is distinguished by its ultra-fast execution, ensuring that orders are processed expeditiously, allowing traders to take full advantage of the ever-changing commodities market. Furthermore, traders are afforded a layer of financial security through negative balance protection, which guarantees that they cannot lose more money than their initial deposit, thus preventing debt to the broker.

Cryptocurrencies: The Commodities Account stands out with ultra-narrow spreads beginning at 0.1 pips, enabling cost-efficient trading. It promises ultra-fast execution, ensuring timely and accurate order placements. Traders benefit from comprehensive market insights, equipping them with essential analysis for strategic trading. The account is fortified with negative balance protection, safeguarding traders from debt by preventing losses that exceed their account funds.

Forex: It offers traders competitive spreads starting at 1.3 pips, coupled with ultra-fast execution, enabling swift and efficient market entry and exit. This no dealing desk account ensures direct market engagement, promoting fair and equitable trading. It features negative balance protection, which prevents traders from owing more than their initial investment, thus securing their financial safety.

Metals: It offers an exceptional trading experience with spreads as low as 0.1 pips, facilitating cost-effective trading strategies. It boasts ultra-fast execution speeds, ensuring that traders can act quickly on market opportunities. In-depth market insights are provided, giving traders a comprehensive understanding of commodity trends and patterns. The inclusion of negative balance protection means traders are shielded from incurring losses beyond their account balance, thus mitigating financial risk.

NextLevel Trade exclusively utilizes the mobile platforms and MT5 platform. The application of mobile is compatible with both iOS and Android smartphones. Harness the power of the mobile app to gather data, conduct detailed analyses, and execute FX transactions no matter where you are.

NextLevel Trade can be contacted at info@nextlevelfxtrade.com, (+382) 69 431752 for any inquiries or assistance.

In conclusion, NextLevel Trade presents traders with a variety of trading instruments and account types, along with the widely used the mobile platforms and MT5 platform, facilitating flexible and accessible trading opportunities. However, the lack of educational resources and unclear company policies may present challenges for traders seeking comprehensive guidance.

Where is NextLevel Trade registered?

NextLevel Trade is registered in Comoros, specifically on Bonovo Road – Fomboni Island of Mohéli – Comoros Union.

What trading platforms does NextLevel Trade offer?

NextLevel Trade offers the MetaTrader 5 (MT5) platform along with mobile platforms for both iOS and Android devices, providing a versatile trading experience.

Does NextLevel Trade have any regulatory licenses?

NextLevel Trade operates without any regulatory licenses, indicating it functions without oversight from recognized financial regulatory authorities.

What types of assets can I trade with NextLevel Trade?

You can trade a diverse range of assets including forex, metals, commodities, cryptocurrencies, shares, and indices with NextLevel Trade.

How can I get in touch with NextLevel Trade's customer support?

You can contact NextLevel Trade's customer support via email at info@nextlevelfxtrade.com or by phone at (+382) 69 431752.

All investments entail risks and may result in both profits and losses. In particular, trading leveraged derivative products such as Foreign Exchange (Forex) and Contracts for Difference (CFDs) carries a high level of risk to your capital. All these derivative products, many of which are leveraged, may not be appropriate for all investors.

More

User comment

4

CommentsWrite a review

2024-08-21 20:55

2024-08-21 20:55

2024-08-21 20:06

2024-08-21 20:06