User Reviews

More

User comment

3

CommentsWrite a review

2023-08-15 16:05

2023-08-15 16:05

2023-02-17 18:16

2023-02-17 18:16

Score

2-5 years

2-5 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index6.62

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

Company Name

NLVX LTD

Company Abbreviation

NLVX

Platform registered country and region

Saint Vincent and the Grenadines

Company website

X

Company summary

Pyramid scheme complaint

Expose

| Aspect | Information |

| Registered Country/Area | Saint Vincent and the Grenadines |

| Founded Year | 1-2 years |

| Company Name | NLVX LTD |

| Regulation | No Regulation |

| Minimum Deposit | $100 |

| Maximum Leverage | Not specified |

| Spreads | Starting from 0 pips |

| Trading Platforms | NL Trader (MT4/5 White Label) |

| Tradable Assets | Forex, Metals, Indices, Energies |

| Account Types | Key ECN, Prime ECN, Exclusive ECN, Master ECN, Dignitary ECN |

| Demo Account | Not specified |

| Islamic Account | Not specified |

| Customer Support | Telephone: +91 8424036349, +91 9616991111, +442037698861; Email: support@nlvx.com; Social media presence |

| Payment Methods | Credit Cards (Visa, MasterCard), e-wallets (Neteller, Skrill), Bank Transfer, Bitcoin, Wire Transfer |

| Educational Tools | Not specified |

NLVX is an offshore forex broker registered in Saint Vincent and the Grenadines, offering a series of forex and CFD trading services. NLVX claims that traders can trade with popular instruments through the leading MT4 trading platform, with leverage up to 1:1000 to increase profit potential.

However, NLVX is a brokerage platform operating without valid regulatory oversight. This lack of regulation raises significant concerns and poses potential risks to individuals considering engaging with NLVX. Without a governing body overseeing its operations, there is a higher probability of encountering unscrupulous practices, misleading information, and unfair trading conditions. Investors should exercise extreme caution when dealing with an unregulated broker like NLVX, as there may be limited avenues for recourse or protection if any issues arise.

Despite the absence of regulation, NLVX offers clients a range of trading instruments across various asset classes. Traders can access the Forex market, trade precious metals, engage in index trading, and explore energy commodities. These instruments provide opportunities for diversification and potential profits; however, it is essential to consider the higher risk associated with trading through an unregulated platform.

NLVX offers multiple trading account types with different minimum deposit requirements and trading conditions. Traders can choose from accounts like Key ECN, Prime ECN, Exclusive ECN, Master ECN, and Dignitary ECN. While these account types offer options for different trading needs, it's crucial to note the limitations imposed by the lack of regulatory oversight. Traders may face higher risks, limited flexibility in trading strategies, and a lack of specific information on trading conditions and features.

NLVX, a trading platform, offers several pros and cons for users to consider. On the positive side, NLVX provides higher-tier accounts with no commissions, allowing traders to potentially optimize their trading costs. Additionally, the platform offers promotional bonuses as an option, which can be enticing for some traders. NLVX also grants access to global financial markets, enabling users to trade a variety of asset classes. Moreover, NLVX boasts spreads starting from 0 pips, which can be advantageous for traders seeking competitive pricing. However, it's important to note the cons associated with NLVX. One significant concern is the lack of regulatory oversight, which may raise doubts about the platform's reliability. Additionally, the unregulated nature of NLVX increases the risk associated with trading on the platform. In case of disputes, users may have limited recourse, further emphasizing the importance of due diligence when considering NLVX as a trading option. Furthermore, there is a potential for misleading or unfair practices on the platform, and investor protection may be limited. Traders should carefully evaluate these pros and cons before making a decision about using NLVX for their trading activities.

| Pros | Cons |

| Availability of higher-tier accounts with no commissions | Lack of regulatory oversight |

| Option for promotional bonuses | Higher risk due to unregulated nature |

| Access to global financial markets | Limited recourse in case of disputes |

| Ability to trade different asset classes | Potential for misleading or unfair practices |

| Spreads starting from 0 pips | Limited investor protection |

NLVX is currently not regulated by any valid regulatory authority. This means that there is no governing body overseeing its operations or ensuring compliance with financial regulations and standards. The lack of regulation raises significant concerns and poses risks to individuals considering engaging with NLVX.

Without regulation, there is a higher probability of encountering unscrupulous practices, such as misleading information, unfair trading conditions, or even potential scams. Investors should exercise extreme caution when dealing with an unregulated broker like NLVX, as there may be limited avenues for recourse or protection if any issues arise.

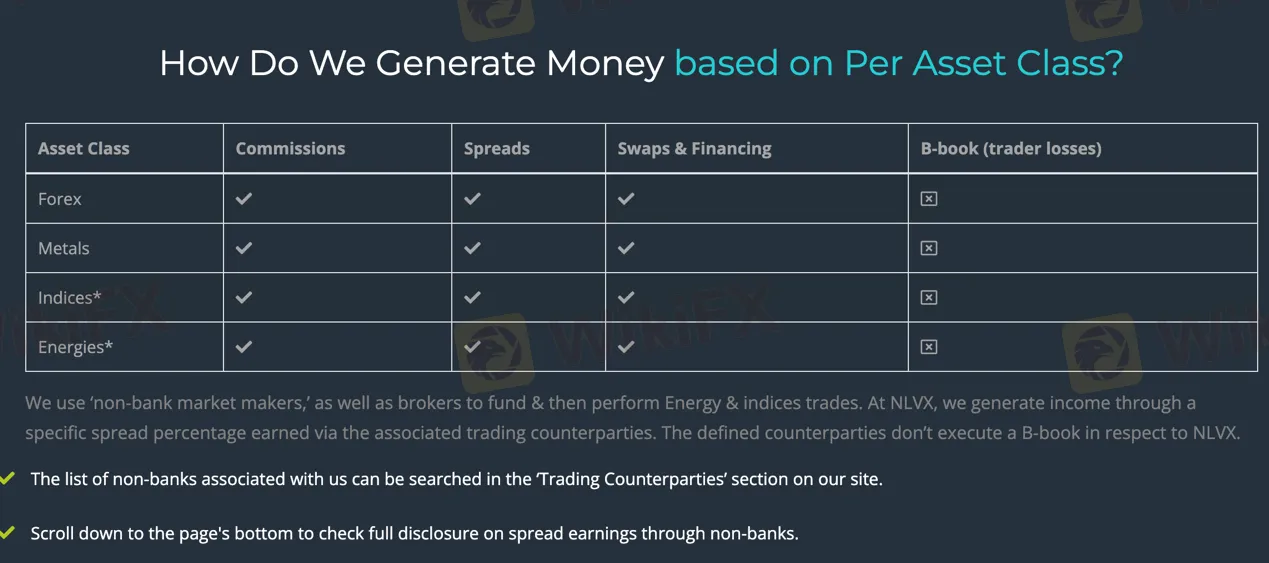

NLVX hypes that it offers clients a bulk of trading instruments. Different classes of trading assets, such as Foreign Exchange, Indices, and Precious Metals, are all available through this brokerage platform.

Forex:

NLVX provides access to the Forex market, allowing clients to trade currency pairs. The Forex market is the largest and most liquid financial market globally, offering opportunities to profit from currency fluctuations. Traders can engage in currency trading with the aim of capitalizing on exchange rate movements.

Metals:

NLVX offers trading in precious metals, such as gold, silver, platinum, and palladium. Precious metals are considered alternative investments and are often sought after for their perceived store of value and hedge against inflation. Trading in metals allows investors to diversify their portfolios and potentially benefit from price movements in these commodities.

Indices:

NLVX allows clients to trade indices, which are baskets of stocks representing a particular market or sector. Trading indices enables investors to speculate on the overall performance of a market or specific industry without having to trade individual stocks. It provides exposure to broader market trends and can be used for diversification and risk management purposes.

Energies:

NLVX provides trading opportunities in energy commodities like oil, natural gas, and other related products. Energy trading involves speculating on the price movements of these commodities, which are influenced by factors such as supply and demand dynamics, geopolitical events, and economic indicators.

| Pros | Cons |

| Diversification opportunities | Lack of regulatory oversight |

| Potential for profit in various markets | Higher risk due to unregulated nature |

| Access to global financial markets | Limited recourse in case of disputes |

| Ability to trade different asset classes | Potential for misleading or unfair practices |

| Limited investor protection |

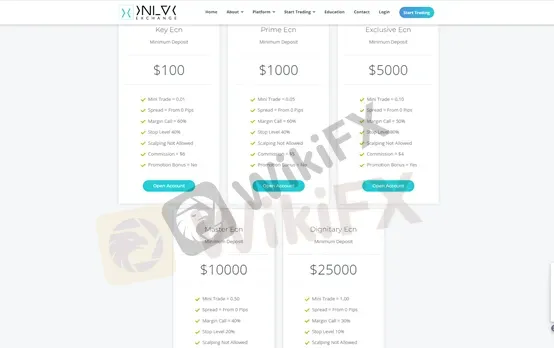

A total of five trading accounts are available on the NLVX platform, which is categorized by the minimum initial deposit requirement.

The Key ECN account is the most basic account, with an initial deposit requirement of $100. Another four trading accounts, Prime ECN, Exclusive ECN, Master ECN, and Dignitary ECN, require a minimum initial deposit of $1,000, $5,000, $10,000, and $25,000, respectively.

NLVX offers five different trading accounts to cater to various traders' needs based on their deposit size and trading preferences.

KEY ECN:

The Key ECN account is the entry-level account offered by NLVX. It requires a minimum initial deposit of $100. Traders using this account can trade with a minimum trade size of 0.01 lots and enjoy spreads starting from 0 pips. The margin call level is set at 60%, and the stop level is 40%. Scalping is not allowed in this account. Traders using the Key ECN account will incur a commission fee of $6 per trade.

PRIME ECN:

The Prime ECN account requires a minimum initial deposit of $1,000. Traders with this account can trade with a minimum trade size of 0.05 lots and benefit from spreads starting from 0 pips. The margin call and stop levels are set at 60% and 40%, respectively. Scalping is not allowed. Traders using the Prime ECN account will be charged a commission fee of $5 per trade.

EXCLUSIVE ECN:

The Exclusive ECN account is designed for more advanced traders with a minimum initial deposit requirement of $5,000. Traders can execute trades with a minimum trade size of 0.10 lots and enjoy spreads starting from 0 pips. The margin call level is set at 50%, and the stop level is 30%. Scalping is not allowed in this account. Traders using the Exclusive ECN account will be charged a commission fee of $4 per trade. Additionally, this account offers promotional bonuses.

MASTER ECN:

The Master ECN account is targeted at experienced traders and requires a minimum initial deposit of $10,000. Traders can trade with a minimum trade size of 0.50 lots and benefit from spreads starting from 0 pips. The margin call level is set at 40%, and the stop level is 20%. Scalping is not allowed in this account. Traders using the Master ECN account will be charged a commission fee of $3 per trade. This account also provides promotional bonuses.

DIGNITARY ECN:

The Dignitary ECN account is the highest-tier account offered by NLVX and caters to professional and high-net-worth traders. It requires a minimum initial deposit of $25,000. Traders using this account can trade with a minimum trade size of 1.00 lots and enjoy spreads starting from 0 pips. The margin call level is set at 30%, and the stop level is 10%. Scalping is not allowed. Traders using the Dignitary ECN account will not incur any commission fees. This account also offers promotional bonuses.

| Pros | Cons |

| Variety of account types to suit different trading needs and deposit sizes. | Limited flexibility in terms of trade sizes and allowed trading strategies (scalping not allowed in all accounts). |

| Spreads starting from 0 pips. | Minimum deposit requirements may be relatively high for some traders. |

| Option for promotional bonuses in certain account types. | Commission fees charged in some account types. |

| Gradual reduction in margin call and stop levels with higher-tier accounts. | Lack of specific information on other trading conditions and features. |

| Availability of higher-tier accounts with no commission fees. | Limited information on additional account benefits or features. |

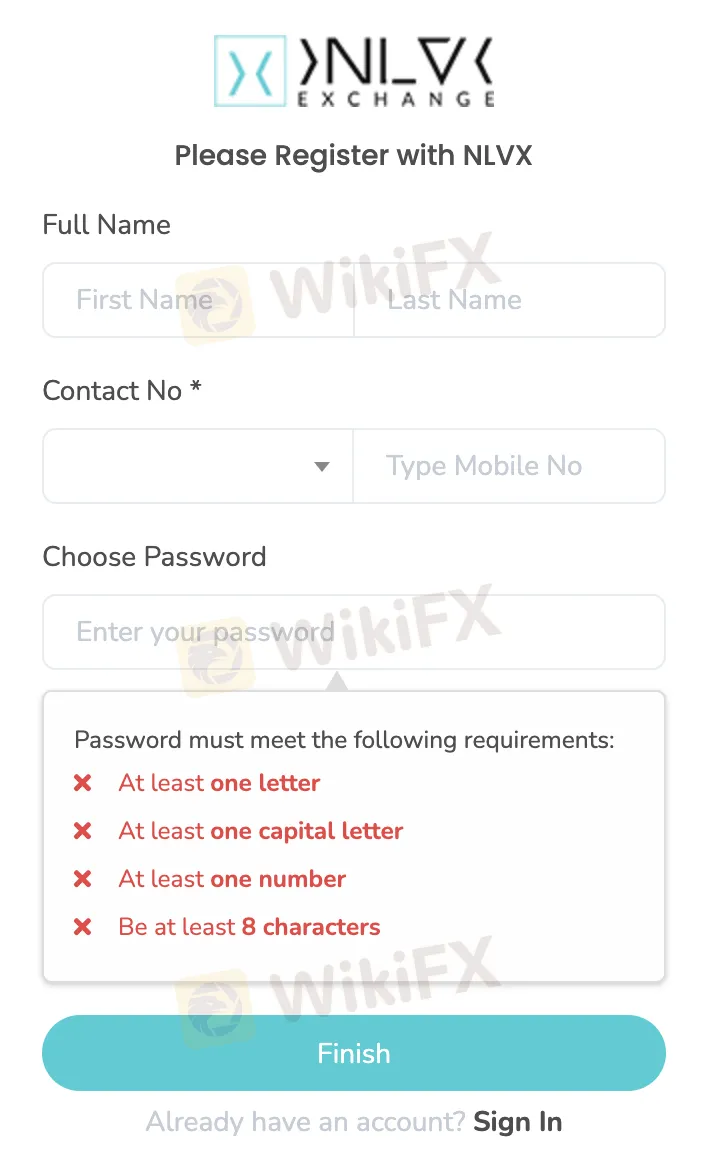

To open an account with NLVX, follow these simple steps:

1. Visit the NLVX website and click on the “Start Trading” button.

2. On the registration page, provide your email address in the designated field. If you already have an account, you can choose to sign in instead.

3. Fill in your full name, including your first name and last name.

4. Enter your contact number in the provided field. Please ensure that it is a valid mobile number.

5. Choose a secure password for your account. Your password must meet certain requirements, including having at least one letter, one capital letter, one number, and being a minimum of 8 characters in length.

6. Once you have completed all the required fields, click on the “Finish” button to finalize your registration process.

Spreads and commissions are determined by trading accounts. Four trading accounts charge a commission except for the Dignitary ECN account. The Key ECN account charges a commission of $6, spreads from 0.0 pips. Compared with the Key ECN account, the Prime ECN and Exclusive accounts charge a lower commission of $5 per trade and $4 per trade, respectively. The Master ECN account charges a commission of $3 per trade, with the spread from 0 pips.

NLVX is dedicated to providing exceptional perks and promotions to traders who are looking to make enormous profits in the Forex market. If you're seeking to earn more than your initial deposit and take advantage of incredible tradable bonuses while trading currencies, NLVX has several advantageous opportunities for you. We want to ensure that you experience financial freedom while trading with us, and that's why we offer the '30% Tradable Bonus' to eligible traders.

By opening a trade account with NLVX, you become eligible to apply for the '30% Tradable Bonus.' This bonus provides you with a significant advantage by offering 30% more favorable conditions to kick-start your journey as a trader. With this bonus, you can enhance your trading capabilities and increase your potential for higher profits. It's a great opportunity to make the most out of your trading experience with NLVX.

| Pros | Cons |

| Increased profitability | Limited to eligible traders |

| Enhanced trading capabilities | Bonus conditions may apply |

| Higher potential for profits |

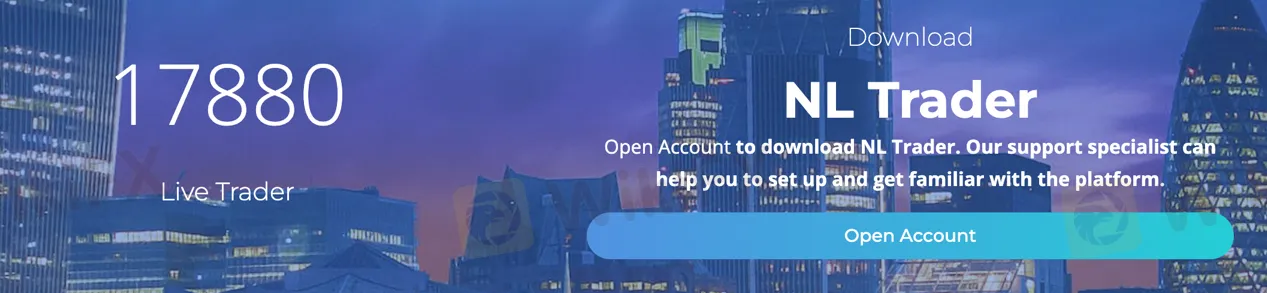

NL Trader, also known as NL, is a widely used automated electronic trading platform for online foreign currency speculative traders. With its launch over a decade ago, NL Trader is licensed for use by foreign exchange dealers and offers several advantages over other trading systems. One of its key features is the ability to automate market operations.

There are several reasons why NL Trader is popular and preferred by many traders. Firstly, it offers advanced automation capabilities, allowing traders to execute trades automatically based on predetermined strategies and parameters. This can help save time and reduce the emotional aspects of trading.

NL Trader also provides real-time market data and analysis tools, enabling traders to stay informed about market conditions and make informed decisions. The platform offers access to multiple markets and instruments, allowing traders to diversify their portfolios and explore various trading opportunities.

Risk management is another strength of NL Trader, as it offers robust features to manage and control risk exposure. Traders can set stop-loss orders, take-profit levels, and utilize other risk management tools to protect their investments.

Furthermore, NL Trader integrates with third-party trading tools and APIs, allowing traders to customize and enhance their trading experience. This can include the use of additional indicators, charting tools, and automated trading systems.

However, it's important to note that NL Trader may have some limitations. Customization options might be limited, restricting traders who prefer more tailored trading environments. Additionally, the platform may have a steep learning curve for novice traders, requiring time and effort to fully understand its features and functionalities.

| Pros | Cons |

| Advanced automation capabilities | Limited customization options |

| Integration with third-party trading tools and APIs | Steep learning curve for novice traders |

| Real-time market data and analysis tools | Reliance on internet connectivity |

| Access to multiple markets and instruments | Potential technical issues or downtime |

| Robust risk management features | Dependence on the platform provider's reliability |

Deposit

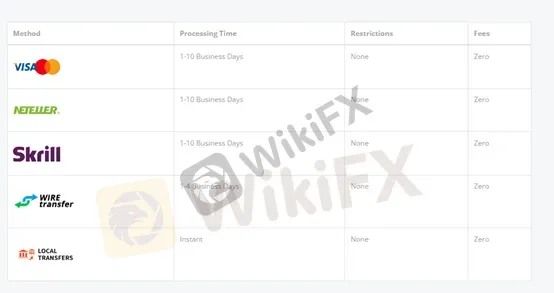

Clients can deposit funds using Visa, Mastercard, Neteller, Skrill, Bank Transfer, Bitcoin, and Wire Transfer. The deposit process can be done through the clients' portal. It is important to note that sometimes deposits may take some time to reflect in the trading account.

Withdrawal

NLVX allows clients to withdraw funds using methods such as Visa, Mastercard, Neteller, Skrill, Wire Transfer, and Local Transfers. Withdrawals can also be initiated through the clients' portal. It is worth mentioning that the withdrawal process may take a few business days to be processed. Delays can occur due to bank procedures, which are beyond NLVX's control. For bank withdrawals, the funds will be returned to the bank account registered under the same name as the NLVX trading account. Credit card withdrawals are only available for the initial deposit amount, while amounts above that will be returned via bank wire.

Overall, NLVX provides a variety of deposit and withdrawal options, allowing clients to choose convenient methods for their transactions. However, it's important to consider the potential delay in withdrawal processing time, which can take up to 10 business days. The table below summarizes the pros and cons of the deposit and withdrawal system:

| Pros | Cons |

| Multiple deposit options available | Potential delays in deposit reflection |

| Funds returned to registered bank account | Withdrawal processing time can take up to 10 business days |

| Variety of withdrawal options to choose from | Withdrawal delays due to bank procedures beyond NLVX's control |

| Credit card withdrawals limited to the initial deposit amount |

In conclusion, NLVX presents both advantages and disadvantages. On the positive side, NLVX offers a diverse range of trading instruments across various asset classes, providing traders with opportunities for diversification and potential profitability. The availability of multiple trading accounts caters to different traders' needs based on deposit size and trading preferences. However, the lack of regulation is a significant drawback, as it raises concerns about the absence of oversight and potential risks associated with unregulated practices. Additionally, limited investor protection and the potential for misleading or unfair practices further contribute to the risk profile of NLVX. Traders should exercise caution and carefully consider these factors before engaging with NLVX.

Q: Is NLVX regulated?

A: NLVX is currently not regulated by any valid regulatory authority. This lack of regulation raises concerns and poses risks to traders.

Q: What are the trading instruments offered by NLVX?

A: NLVX offers trading in forex, precious metals, indices, and energies. These instruments provide opportunities for diversification and profit in various markets.

Q: What are the different types of trading accounts offered by NLVX?

A: NLVX offers five trading accounts: Key ECN, Prime ECN, Exclusive ECN, Master ECN, and Dignitary ECN. Each account has different minimum deposit requirements, trade sizes, and commission fees.

Q: How can I open an account with NLVX?

A: To open an account with NLVX, visit their website, provide your email address, full name, contact number, and choose a secure password. Then, complete the registration process.

Q: What is the minimum deposit required by NLVX?

A: NLVX offers a low minimum deposit requirement of $100, allowing traders to start with a small amount of capital.

Q: What are the deposit and withdrawal options available at NLVX?

A: NLVX offers multiple options for depositing and withdrawing funds, including credit cards, e-wallets, bank transfer, Bitcoin, and wire transfer.

Q: What trading platform does NLVX use?

A: NLVX uses NL Trader, an automated electronic trading platform with advanced automation capabilities, real-time market data, and risk management features.

Q: How can I contact NLVX's customer support?

A: You can contact NLVX's customer support through telephone (+91 8424036349, +91 9616991111, +442037698861), email (support@nlvx.com), and social media platforms (Facebook, Twitter, Linkedin, Tumblr). The registered office address is 196 High Road, Wood Green, London, United Kingdom, N22 8HH.

Options trading, once exclusively associated with financial professionals, has emerged as a popular choice among individual investors in India. This article endeavors to unravel the complexities of options trading, shedding light on its basic principles, strategies, as well as the risks and rewards involved. Irrespective of your expertise level, comprehending the dynamics of options trading in India holds paramount importance in making well-informed financial choices.

WikiFX

WikiFX

The forex market, renowned for its ever-changing nature and attractive profit potential, holds immense allure for traders across the globe. Nevertheless, achieving success in navigating this global exchange market brings forth various challenges, predominantly the element of risk. In this extensive guide, we shall thoroughly explore Forex Risk Management, providing you with essential tools and knowledge to ensure prosperous trading endeavors.

WikiFX

WikiFX

Registered in Saint Vincent and the Grenadines, NLVX is an online forex broker offering various financial products. According to NLVX, it is willing to guide learners through all the processes and train them to become successful traders. Therefore, WikiFX intends to conduct a thorough review of this broker to figure out if the truth matches what it claims.

WikiFX

WikiFX

Today In this article, we’ll cover the concepts of Support and Resistance, Entry and exit levels, and Trading with leverage and a system. Hopefully, these ideas will help you make money in forex. But before we get started, let’s look at some of the basics. Remember: the basics are the foundation of any successful trading strategy.

WikiFX

WikiFX

More

User comment

3

CommentsWrite a review

2023-08-15 16:05

2023-08-15 16:05

2023-02-17 18:16

2023-02-17 18:16