User Reviews

More

User comment

7

CommentsWrite a review

2025-02-25 19:37

2025-02-25 19:37

2025-02-24 21:29

2025-02-24 21:29

Score

2-5 years

2-5 yearsSuspicious Regulatory License

Suspicious Scope of Business

Australia Appointed Representative(AR) Revoked

High potential risk

Add brokers

Comparison

Quantity 1

Exposure

Score

Regulatory Index0.00

Business Index5.30

Risk Management Index0.00

Software Index4.00

License Index0.00

Single Core

1G

40G

More

Company Name

Bovei Financial Limited

Company Abbreviation

BOVEI PRO

Platform registered country and region

United Kingdom

Company website

Company summary

Pyramid scheme complaint

Expose

| Bovei | Basic Information |

| Founded | 2024 |

| Headquarters | United Kingdom |

| Regulation | FinCEN, ASIC |

| Tradable Assets | Stocks, CFDs, Forex, Commodities, Indices, Cryptocurrencies |

| Demo Account | Not mentioned |

| Minimum Deposit | $500 |

| Maximum Leverage | 1:200 |

| Spreads | Not mentioned |

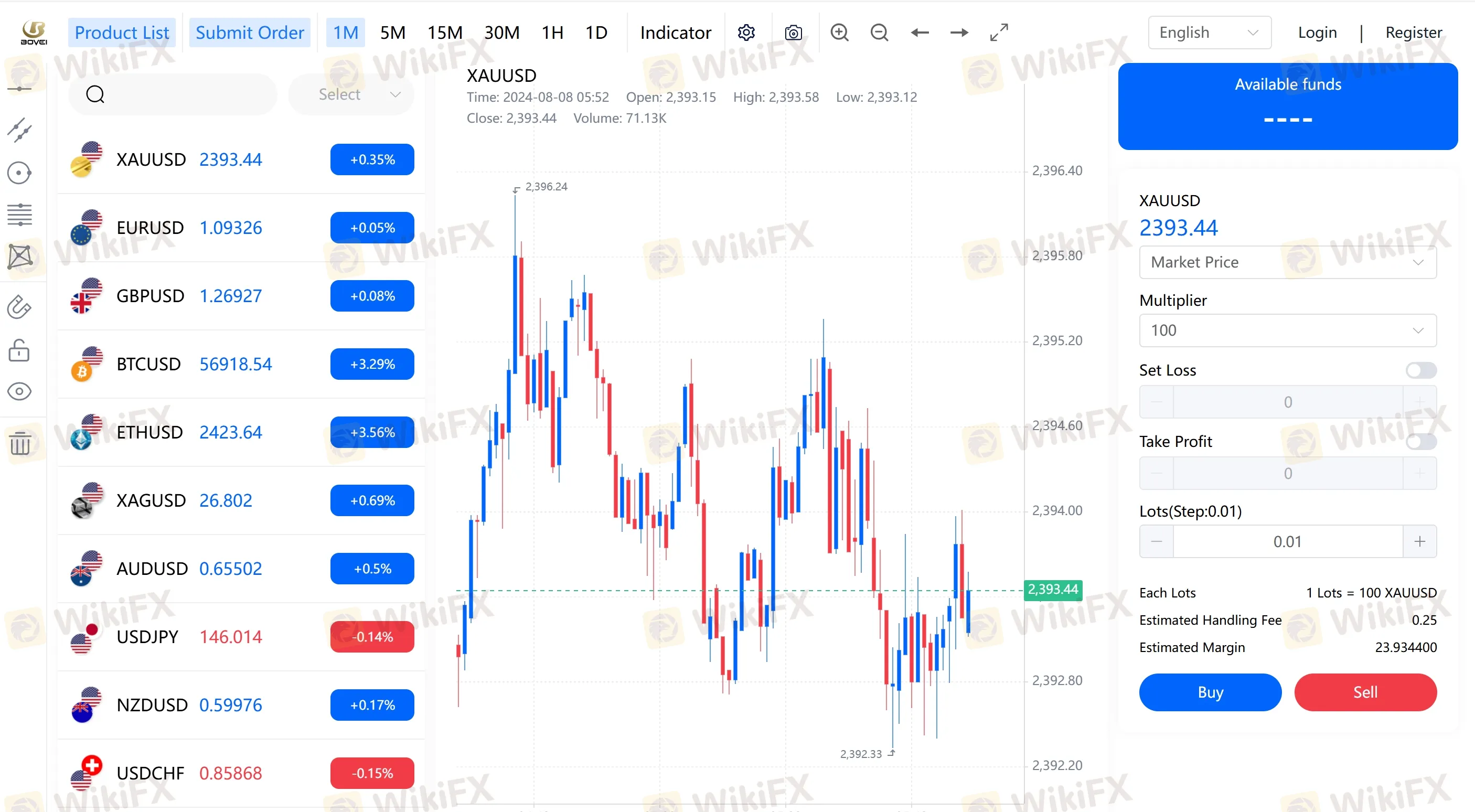

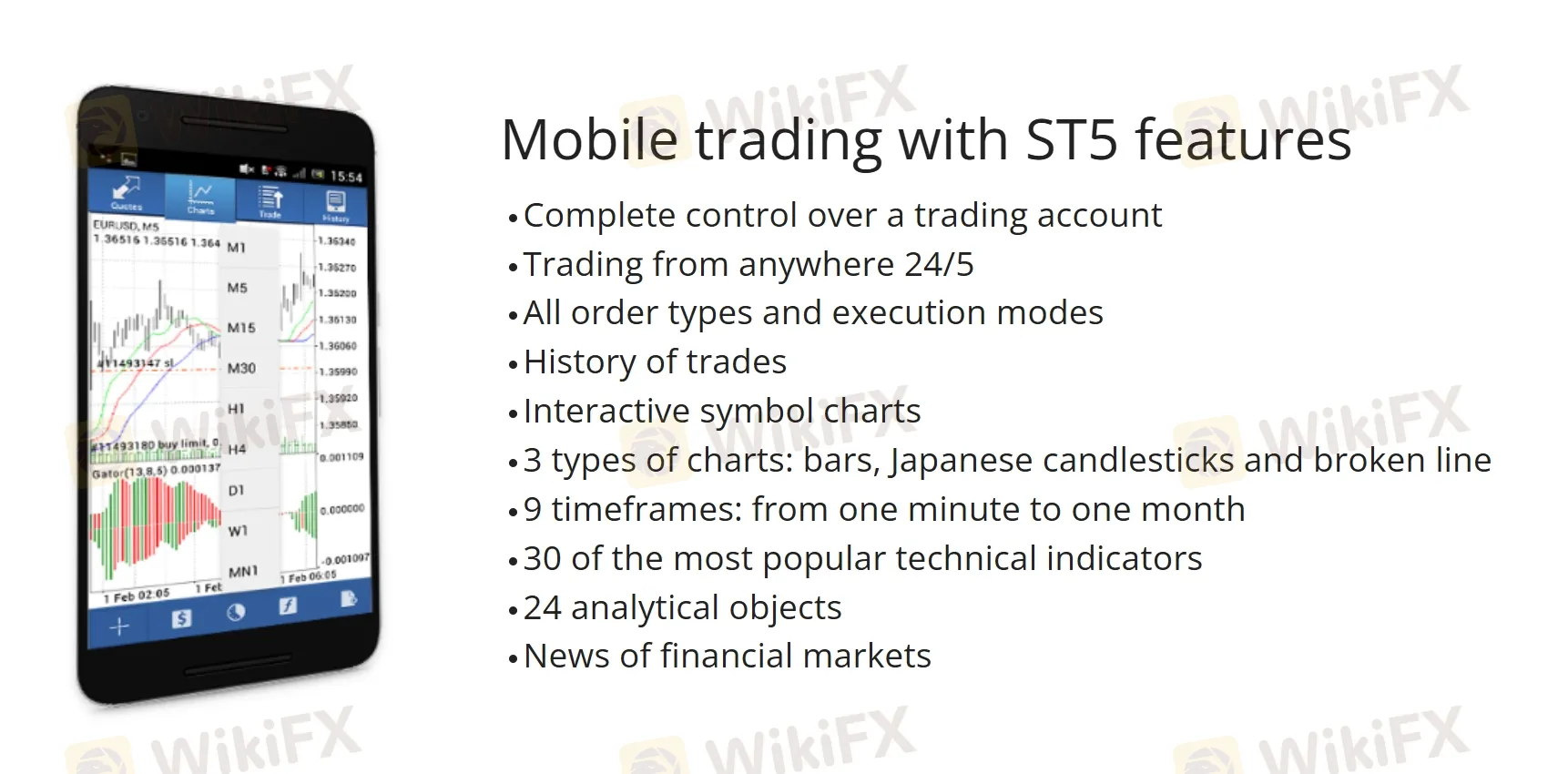

| Trading Platforms | Desktop, ST5 Mobile |

| Customer Support | Monday - Friday, 07:00 GMT - 20:00 GMT |

| Live chat | |

| Phone: +1 617 798 0330 | |

| Email: support@boveifx.com |

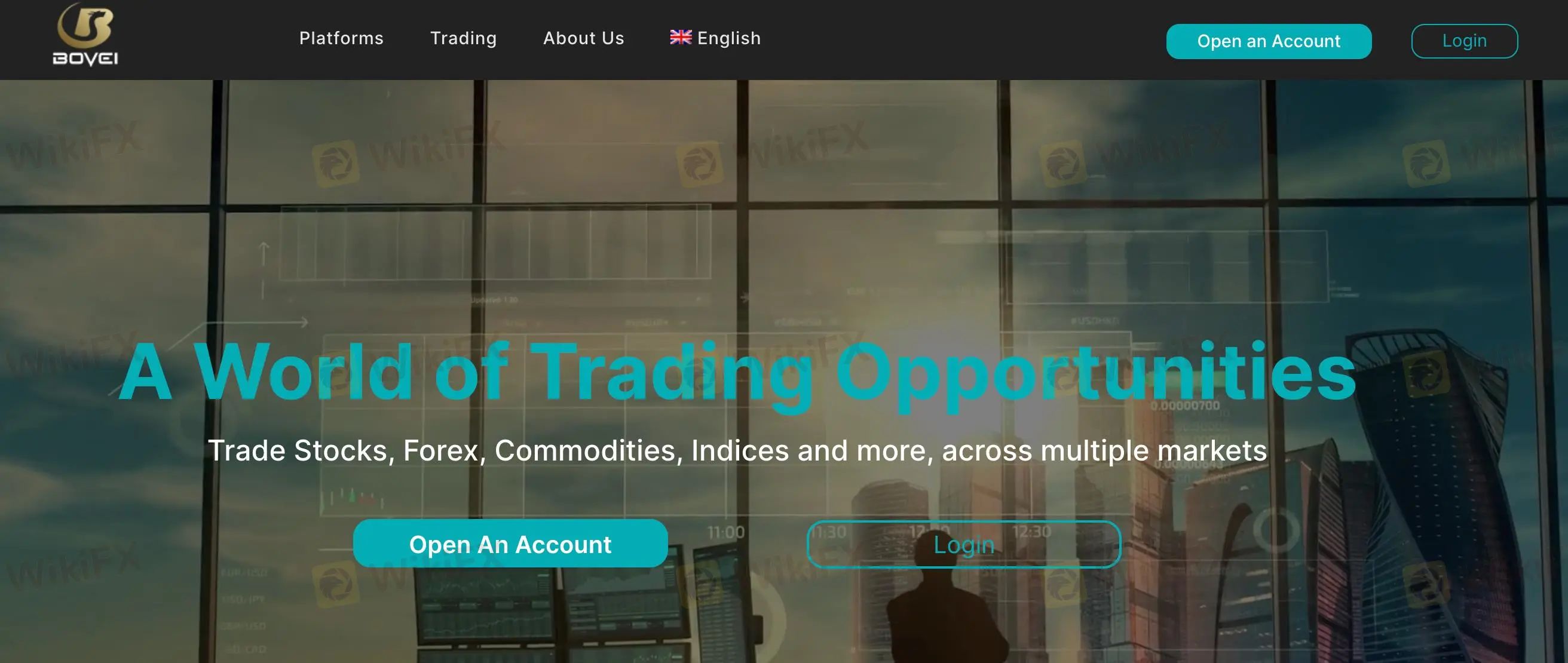

Bovei, established in 2024 and headquartered in the United Kingdom, operates as a regulated entity in both the United States and Australia, offering a wide array of trading assets including stocks, CFDs, forex, commodities, indices, and cryptocurrencies. The company caters to diverse trading preferences with its multi-asset trading account, facilitated through a versatile mobile trading application that supports both Pro and Lite views for advanced and quick trading actions respectively.

| Pros | Cons |

| Wide range of trading instruments | Lack of industry experience |

| Advanced trading platforms | High minimum deposit requirement |

| Multi-tier commission structure |

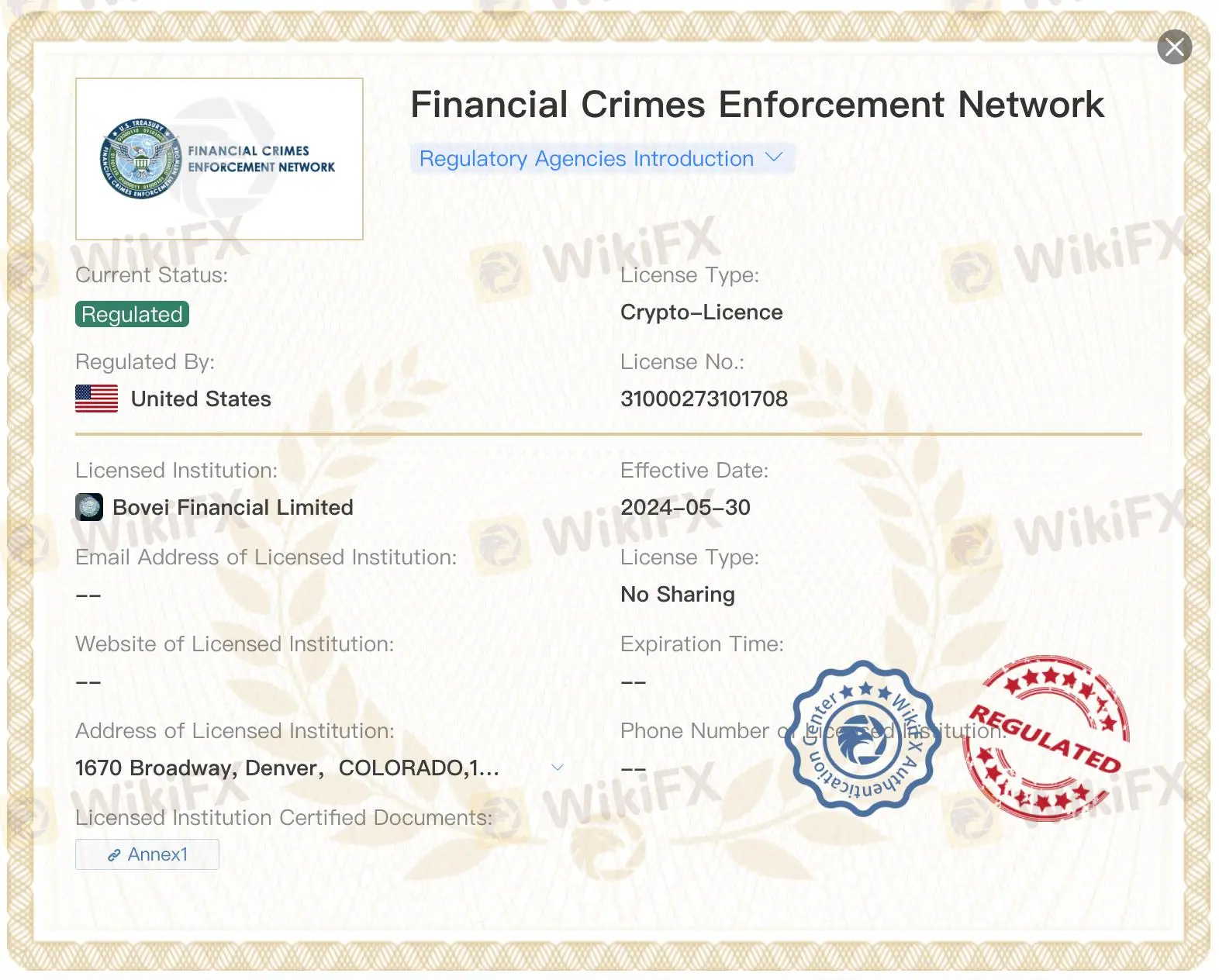

The company Bovei is regulated both in the United States and Australia. In the United States, it is regulated under a “Crypto-License,” effective from May 30, 2024, and the license number is 31000273101708. In Australia, Bovei Financial Pty Limited is an appointed representative, also regulated starting May 28, 2024, with the license number 001309549.

Bovei offers a diverse range of trading instruments including over 29,000 U.S. stocks, more than 3,000 CFDs (Contract for Differences), and various assets such as forex, commodities, indices, and cryptocurrencies.

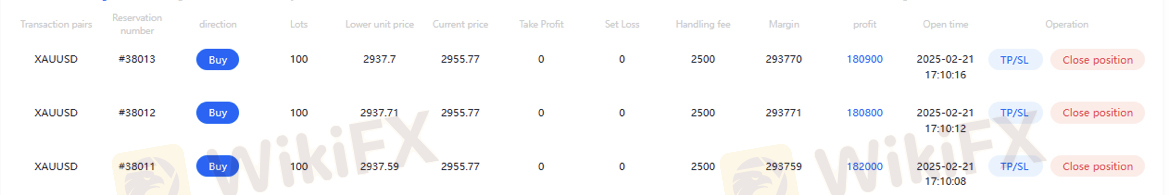

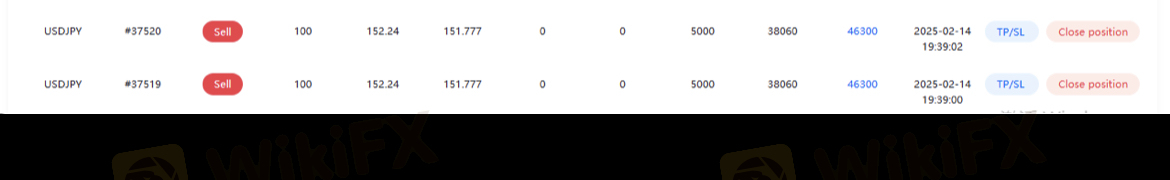

Bovei Financial Limited offers a multi-asset trading account that allows customers to trade multiple assets through a single account on the Bovei Financial Platform, with USD as the base currency. This account is subject to trading fees and commissions. Commissions for CFDs on US stocks and ETFs are charged per trade, based on the number of shares bought or sold, with a minimum order fee.

| Account Type | Minimum Deposit |

| Bronze | $500 |

| Silver | $5,000 |

| Gold | $10,000 |

| Platinum | $25,000 |

| Diamond | $50,000 |

Bovei provides different leverage rates for retail and professional traders to manage trading risk effectively.

Retail traders have access to leverage rates ranging from 1:2 for cryptocurrencies to 1:30 for major currency pairs. For non-major currency pairs, indices, and gold, the leverage is set at 1:20, while commodities and metals other than gold are at 1:10, and stocks and ETFs at 1:5.

Professional traders enjoy higher leverages, with rates up to 1:200 for currency pairs, 1:100 for metals other than silver, 1:40 for commodities, indices, and silver, 1:20 for stocks and ETFs, and 1:5 for cryptocurrencies.

Bovei Financial Limited offers tiered fees for trading across various plans:

| Account Type | Fee Per Share | Minimum Fee |

| Bronze | $0.01 | $1.5 |

| Silver | $0.008 | $1.5 |

| Gold | $0.007 | $1.5 |

| Platinum | $0.006 | $1.25 |

| Diamond | $0.005 | $1 |

These structured fees are applied specifically to CFDs on US stocks and ETFs, varying by the amount of shares traded and the account plan selected by the trader.

Bovei Financial Limited offers desktop platform and a versatile ST5 mobile trading app available on both Google Play and the App Store. The app features two distinct views for users: a Pro view, which allows for executing advanced orders and accessing market depth data, and a Lite view, designed for quick reactions to market changes. Users can easily switch between these views with a simple swipe.

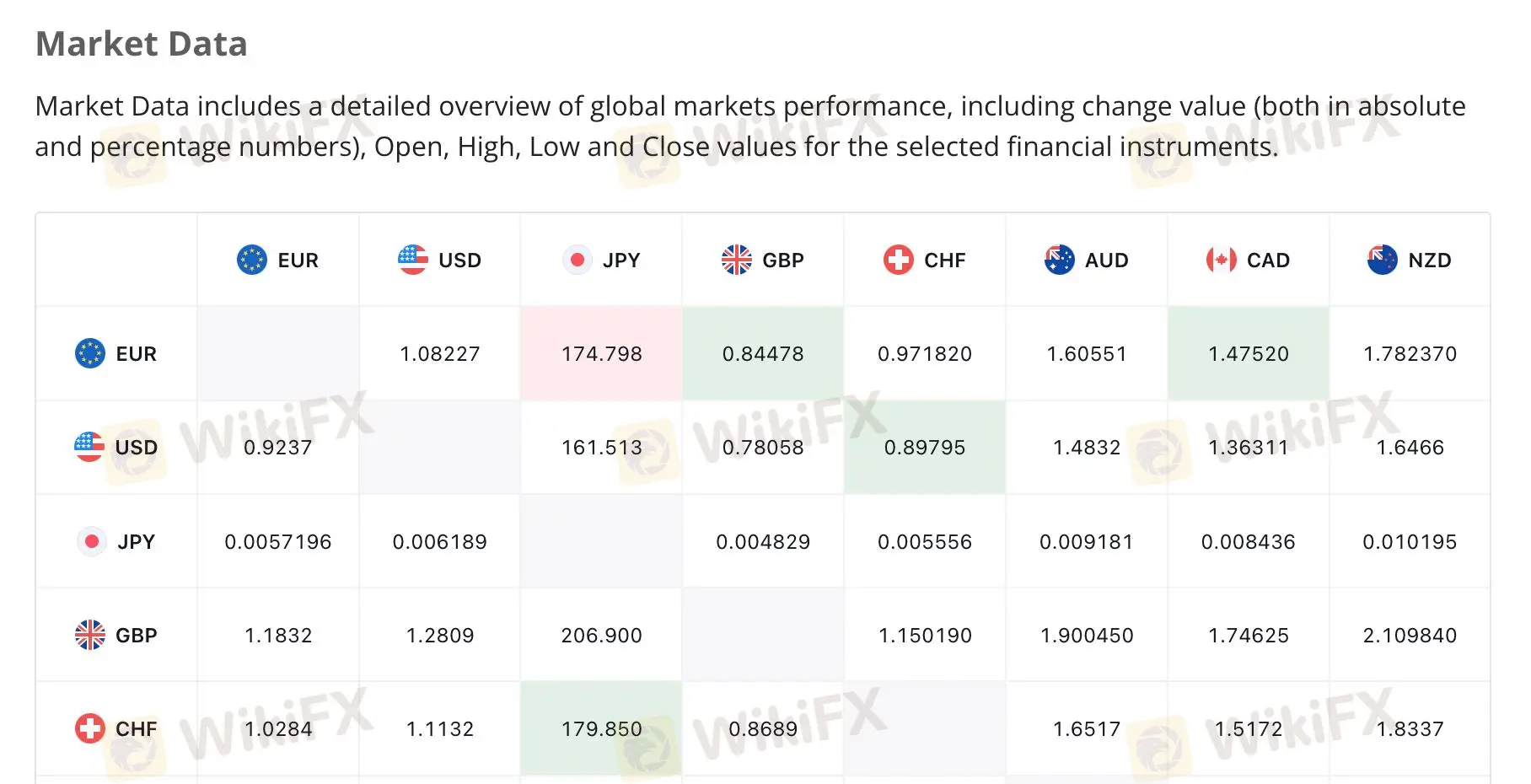

Bovei provides Market Data, which offers a detailed overview of global markets performance. This includes change values in both absolute and percentage terms, as well as Open, High, Low, and Close values for selected financial instruments.

Bovei doesn't reveal too much info on deposits and withdrawals. However, from the icons shown at the foot of their homepage, we found that it seems to accept Visa, MasterCard, Skrill, Nasdaq, Cboe, and CLOUDFLARE.

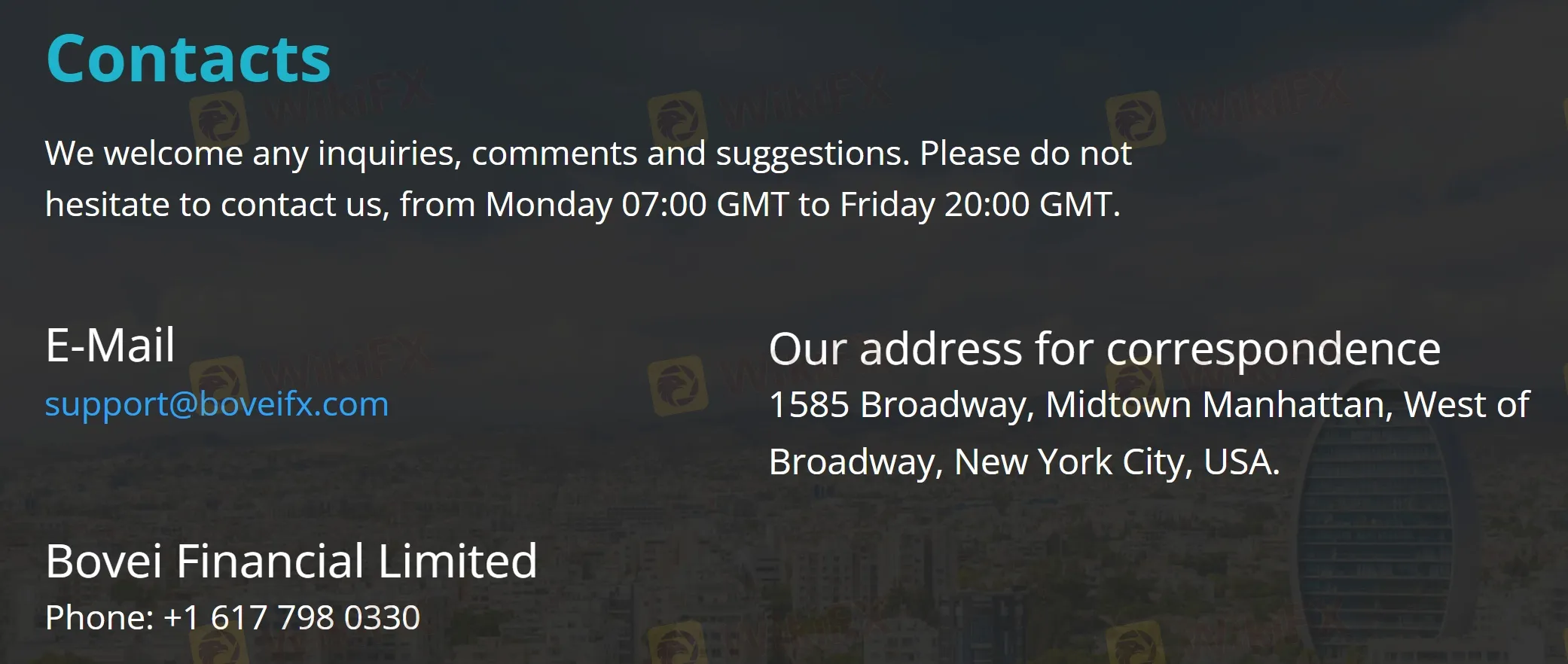

Bovei Financial Limited offers customer support via live chat, email at support@boveifx.com and by phone with the number +1 617 798 0330. Their team is available from Monday to Friday, 07:00 GMT to 20:00 GMT. For postal correspondence, their address is 1585 Broadway, Midtown Manhattan, West of Broadway, New York City, USA.

How is Bovei regulated?

Bovei is regulated by FinCEN and ASIC.

What types of assets can I trade with Bovei?

You can trade stocks, CFDs, forex, commodities, indices, and cryptocurrencies with Bovei.

DoesBovei offer demo accounts?

Not mentioned.

What's the minimum deposit requirement at Bovei?

$500.

Can I trade via MT4/5 at Bovei?

No, Bovei only provides desktop platform and a mobile trading app.

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors.

More

User comment

7

CommentsWrite a review

2025-02-25 19:37

2025-02-25 19:37

2025-02-24 21:29

2025-02-24 21:29