User Reviews

More

User comment

1

CommentsWrite a review

2024-01-11 20:18

2024-01-11 20:18

Score

2-5 years

2-5 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Add brokers

Comparison

Expose

Exposure

Score

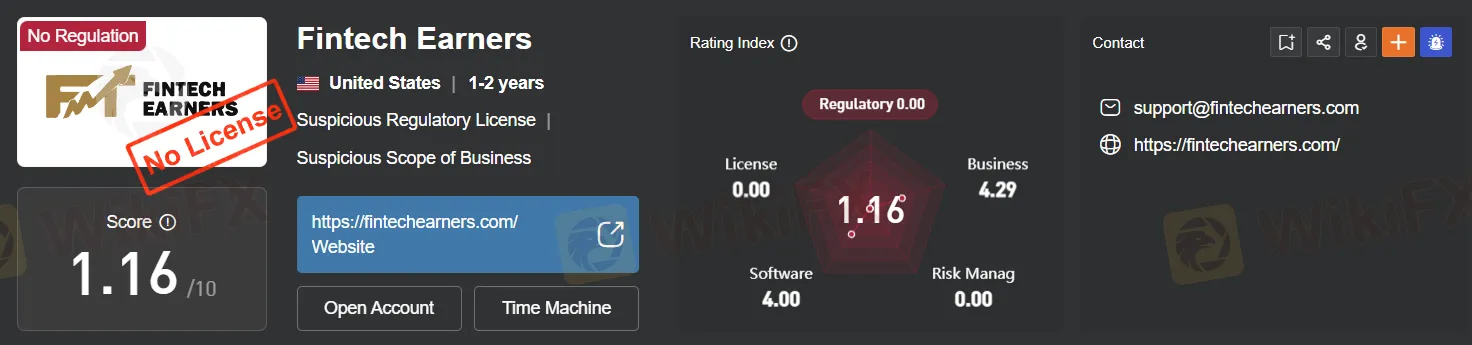

Regulatory Index0.00

Business Index5.88

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

| Company Name | Fintech Earners |

| Location | Maybachstraße 37, 51381 Leverkusen, Germany |

| Regulation | Not regulated by any financial regulatory authority |

| Investment Products | Oil & Gas, Cryptocurrencies, Forex, Agriculture Investments |

| Deposit Methods | Cryptocurrency deposits, unspecified traditional methods |

| Investment Plans | Various plans with different returns and timeframes, ranging from short-term to long-term |

| Customer Support | Contact form, email support (support@fintechearners.com), physical address in Germany |

Fintech Earners, located at Maybachstraße 37, 51381 Leverkusen, Germany, is a financial brokerage firm that offers a range of investment products, including Oil & Gas, Cryptocurrencies, Forex, and Agriculture Investments. Notably, it operates without regulation from any financial authority, which raises potential risks for investors due to limited oversight. The platform allows for deposits through cryptocurrency and unspecified traditional methods while offering customer support via a contact form, email (support@fintechearners.com), and a physical address in Germany. However, transparency is a concern as the website provides limited company information. Some investment plans offer high returns, suggesting higher risks, so investors are advised to exercise caution, conduct thorough research, and assess their risk tolerance before considering investments with Fintech Earners.

Fintech Earners is a financial brokerage firm that operates in the fintech industry. However, it is important to note that Fintech Earners is not regulated by any financial regulatory authority. This lack of regulation can pose significant risks to investors and traders, as there may be limited oversight and accountability for the company's activities. Unregulated brokers often operate in a legal gray area and may not adhere to the same strict standards and safeguards that regulated brokers do. Therefore, potential clients and investors should exercise caution when considering Fintech Earners or any similar unregulated brokerage, as their financial security and legal protections may be compromised in the absence of regulatory oversight. It is advisable to conduct thorough research and due diligence before engaging with such entities in the financial industry.

Fintech Earners offers a range of investment opportunities, but it's essential to weigh the pros and cons before considering participation. Here's a summary of the advantages and disadvantages:

| Pros | Cons |

|

|

|

|

|

|

|

|

|

|

Fintech Earners offers a range of investment options, accessible deposit methods, and multiple customer support channels, making it appealing to a diverse audience. However, its lack of regulation, high-risk plans, limited transparency, and complex markets require investors to exercise caution, conduct due diligence, and carefully consider their risk tolerance before engaging in any trading activities on the platform.

Fintech Earners offers a diverse range of trading products to cater to various investment preferences and strategies:

Oil & Gas Trading:

Fintech Earners allows individuals to participate in the oil market, offering opportunities to profit from fluctuations in oil prices. Through their online trading platform, investors can use their savings to speculate on whether oil prices will rise or fall. This type of trading typically involves trading derivatives or contracts tied to oil prices, enabling traders to take positions based on market expectations.

Cryptocurrency Trading:

Fintech Earners facilitates cryptocurrency trading, providing access to the digital currency market. Cryptocurrency investing can be done in multiple ways, including buying cryptocurrencies directly, investing in cryptocurrency funds, or supporting companies involved in the cryptocurrency space. The platform allows users to buy cryptocurrencies through crypto exchanges or certain broker-dealers, giving them exposure to this rapidly evolving asset class.

Forex (Foreign Exchange) Trading:

The platform offers access to the foreign exchange market, known as forex, which is the largest and most traded financial market globally. Fintech Earners is committed to providing its clients with the necessary education, tools, platforms, and accounts to navigate the forex market successfully. Investors can trade currencies, speculating on the relative price movements of different currency pairs.

Agricultural Investment:

Fintech Earners provides opportunities for investors interested in agriculture and farming investments. Investing in agriculture is often considered a strategic move, as the demand for food remains consistent regardless of economic conditions. Agriculture investments can include buying farmland, investing in agricultural stocks, or supporting agribusinesses. As the world's population continues to grow, agriculture's role in sustaining global societies becomes increasingly vital, making it an attractive sector for investment.

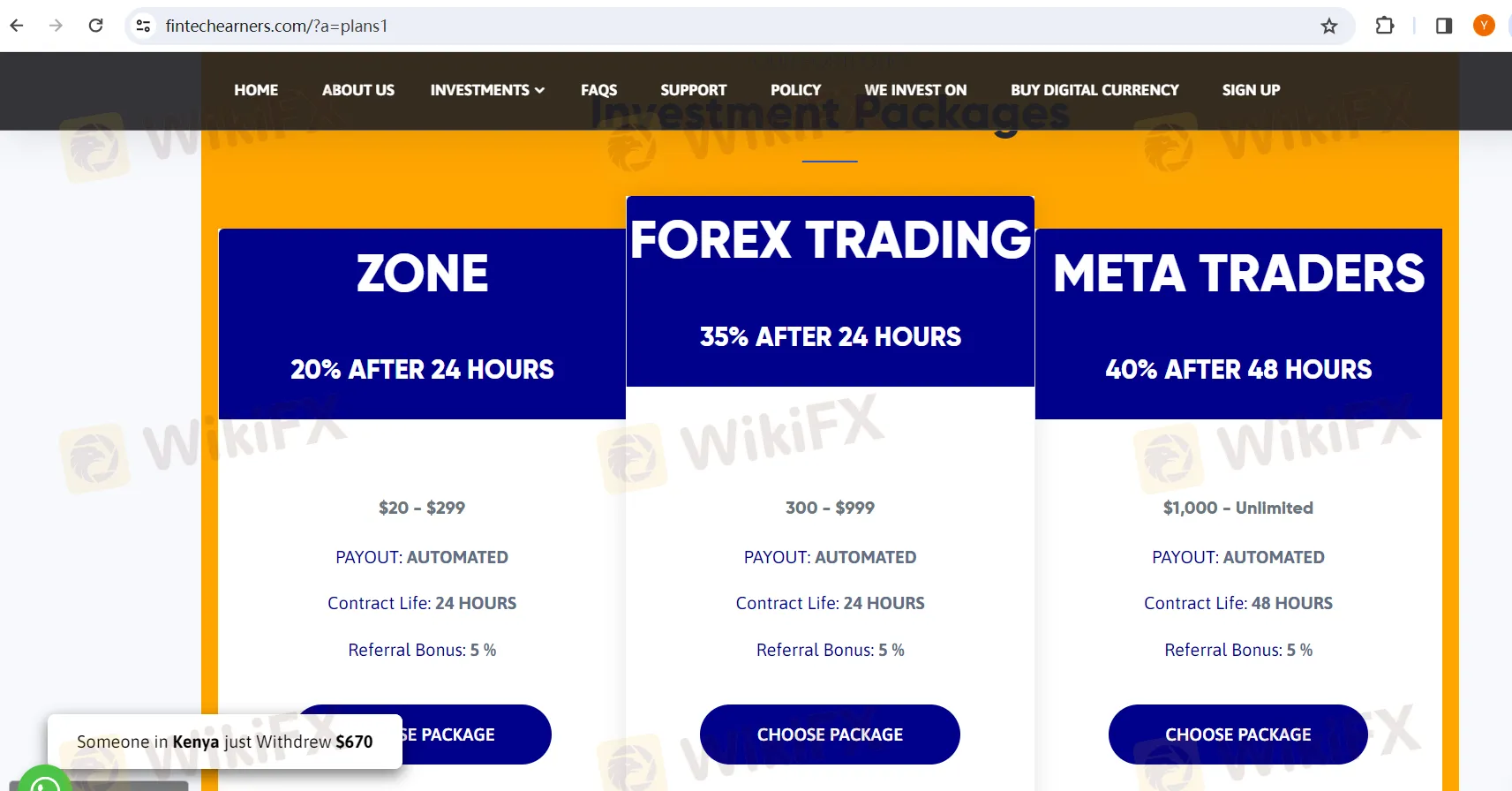

he investment plans offered by the platform are as follows:

ZONE (20% after 24 hours):

Investment Range: $20 to $299

Payout: Automated

Contract Life: 24 hours

Referral Bonus: 5%

Under the ZONE plan, investors can deposit between $20 and $299, and after 24 hours, they will receive a return of 20% on their initial investment. The process is automated, and investors can also earn a 5% referral bonus for bringing in new investors.

FOREX TRADING (35% after 24 hours):

Investment Range: $300 to $999

Payout: Automated

Contract Life: 24 hours

Referral Bonus: 5%

The FOREX TRADING plan is for investors looking to deposit between $300 and $999. After 24 hours, they will receive a return of 35% on their initial investment. Like the ZONE plan, this plan also offers a 5% referral bonus.

META TRADERS (40% after 48 hours):

Investment Range: $1,000 and above (Unlimited)

Payout: Automated

Contract Life: 48 hours

Referral Bonus: 5%

The META TRADERS plan is designed for larger investors who can deposit $1,000 or more. After 48 hours, they will receive a return of 40% on their initial investment. This plan also provides a 5% referral bonus.

STOCK MARKET (45% after 72 hours):

Investment Range: $5,000 and above (Unlimited)

Payout: Automated

Contract Life: 5 days

Referral Bonus: 5%

The STOCK MARKET plan is for investors who are comfortable with larger investments, starting at $5,000. After 72 hours, they will receive a return of 45% on their initial investment. As with the other plans, there is a 5% referral bonus available.

CONTRACT/ RETIREMENT INVESTMENT PLAN (50%):

Investment Range: $20,000 and above (Unlimited)

Payout: Automated

Contract Life: 5 days

Referral Bonus: 5%

The CONTRACT/ RETIREMENT INVESTMENT PLAN is tailored for substantial investments, starting at $20,000. Investors can earn a 50% return on their investment within 5 days, and there is a 5% referral bonus for bringing in new investors.

The platform offers a straightforward process for both depositing funds into your trading account and making withdrawals. Here's a description of how to deposit and withdraw:

Deposit Process:

Login to Your Account: Start by logging into your account on the platform.

Access the DEPOSITS Section: Once logged in, navigate to the DASHBOARD section, where you will find a button labeled “DEPOSITS.” Click on this button to initiate the deposit process.

Choose Deposit Option: In the DEPOSITS section, you'll be presented with various deposit options. Choose the one that suits your preferences and payment method.

Follow Transaction Steps: After selecting your deposit option, you will be guided through the steps to complete your transaction. This typically involves entering the necessary payment details and confirming the deposit.

Immediate Reflection: Upon confirmation of your deposit on the blockchain network (for cryptocurrencies, such as Bitcoin), your funds will be immediately reflected in your trading account.

Withdrawal Process:

Request a Withdrawal: To initiate a withdrawal, click on the “WITHDRAW” button located at the top center of your account dashboard.

Provide Required Details: Input the required details for your withdrawal request, which typically include the amount you wish to withdraw and your Bitcoin wallet address.

Processing and Sending: Once your withdrawal request is received, the platform will process it immediately. The withdrawn funds will then be sent to your provided Bitcoin wallet address.

Withdrawal process may vary depending on the platform's policies and procedures. Additionally, while the platform mentions the use of Bitcoin for withdrawals, the specific cryptocurrency options and available withdrawal methods may differ from one platform to another.

Furthermore, the platform states that investors are allowed to make multiple deposits into their trading account, which provides flexibility for those interested in investing in various plans. However, it's crucial to exercise caution and conduct thorough research on the platform's terms, conditions, and credibility before depositing any funds. Always ensure that you fully understand the risks associated with your investment choices and comply with any applicable regulations.

Fintech Earners provides multiple avenues for customer support to ensure that users can easily reach out for assistance or inquiries:

Contact Form:

Users can access the “Contact Us” section on the platform's website, where they can enter their name, email address, and compose a message to submit their inquiries or concerns. This contact form offers a convenient way to reach the customer support team directly.

Email Support:

The platform provides an email address, “support@fintechearners.com,” for users to contact customer support via email. Email support is often a reliable and efficient way to communicate with the customer support team for more complex issues or detailed inquiries.

Physical Address:

Fintech Earners lists a physical address, located at Maybachstraße 37, 51381 Leverkusen, Germany, for users who prefer traditional mail or may want to visit the company's offices in person. However, it's essential to note that in-person visits may require prior arrangements and may not always be practical, especially for international users.

These various contact options demonstrate Fintech Earners' commitment to ensuring accessible and responsive customer support. Users have the flexibility to choose the method that best suits their needs, whether it's through an online contact form, email correspondence, or even in-person visits for those located in or near Leverkusen, Germany.

Fintech Earners is a financial brokerage firm operating in the fintech industry, offering a range of trading products including oil & gas, cryptocurrencies, forex, and agriculture investments. Notably, the platform is not regulated by any financial regulatory authority, which raises concerns regarding oversight and accountability. While it provides diverse investment plans with varying returns and timeframes, investors should exercise caution due to the associated risks, especially considering the high returns promised in some plans. Fintech Earners offers straightforward deposit and withdrawal processes, often utilizing cryptocurrencies like Bitcoin, but the specifics may vary. The platform also provides multiple customer support channels, including a contact form, email support, and a physical address in Germany, ensuring users have options for assistance. However, users should conduct thorough research and consider their risk tolerance before engaging in any trading activities.

Q1: Is Fintech Earners a regulated financial brokerage?

A1: No, Fintech Earners is not regulated by any financial regulatory authority.

Q2: What investment products are offered by Fintech Earners?

A2: Fintech Earners offers trading products in oil & gas, cryptocurrencies, forex, and agriculture investments.

Q3: Can I make multiple deposits in different investment plans?

A3: Yes, investors can make multiple deposits in any of Fintech Earners' investment plans.

Q4: How long does it take for deposits to reflect in my trading account?

A4: Deposits are typically reflected immediately once confirmed on the blockchain network for cryptocurrencies.

Q5: What customer support channels are available?

A5: Fintech Earners offers customer support through a contact form, email support, and provides a physical address in Germany for inquiries or visits.

More

User comment

1

CommentsWrite a review

2024-01-11 20:18

2024-01-11 20:18