User Reviews

More

User comment

1

CommentsWrite a review

2023-02-24 11:01

2023-02-24 11:01

Score

5-10 years

5-10 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index7.11

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

| Aspect | Information |

| Company Name | Grupo Coril |

| Registered Country/Area | Germany |

| Founded Year | 1992 |

| Regulation | Not regulated |

| Market Instruments | Securities, Money Exchange, Financial Advisory |

| Account Types | N/A |

| Minimum Deposit | N/A |

| Maximum Leverage | N/A |

| Spreads | N/A |

| Trading Platforms | N/A |

| Customer Support | Phone at +51 955 372 706 or email at sab@grupocoril.com |

Established in Germany in 1992, Grupo Coril offers financial services, including securities intermediation, money exchange, and financial advisory.

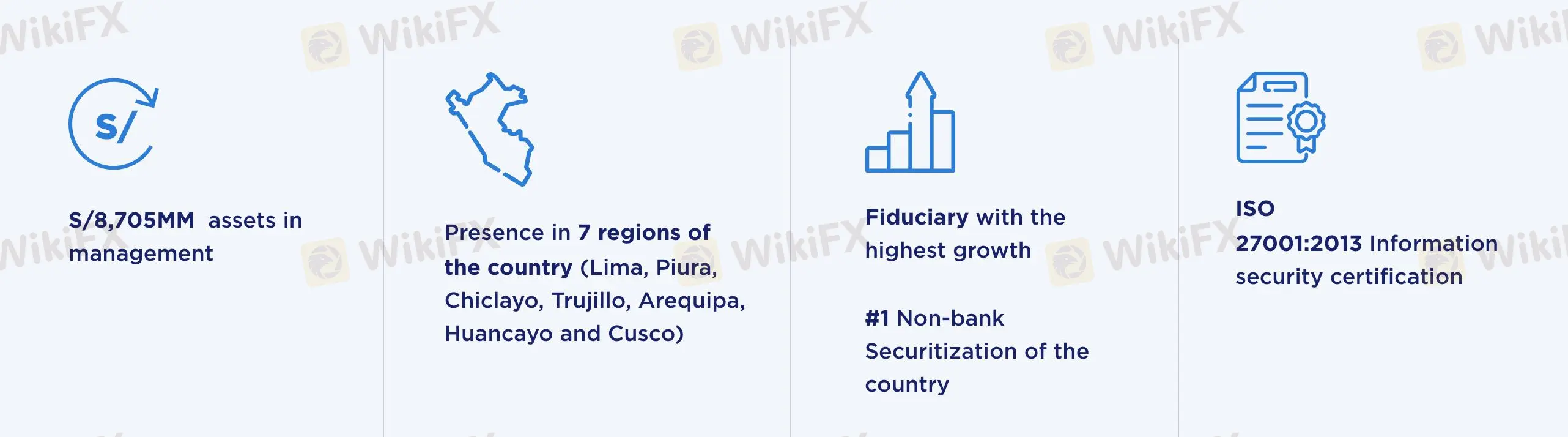

With $8,705 million assets under management and a presence in seven regions of Peru, it stands out as a leading non-bank securitization provider. Holding ISO 27001:2013 certification, it ensures information security.

Despite its growth and various trading assets, Grupo Coril operates without regulatory oversight, limiting transparency. Additionally, its limited customer support hours and absence of a trading platform may inconvenience clients.

GRUPO CORIL operates without regulation.

This absence of oversight poses risks as there are no guidelines or checks in place to ensure compliance with standards. Without regulation, GRUPO CORIL's practices, such as financial transactions and operational procedures, lack transparency and accountability.

| Pros | Cons |

| $8,705MM assets under management | Lack of regulatory oversight |

| Presence in 7 regions of the country | Lack trading platform |

| Highest growth fiduciary | |

| Leading non-bank securitization provider | |

| ISO 27001:2013 Information security certification | |

| Provides financial advisory |

Pros:

$8,705MM assets under management: Grupo Coril manages a substantial amount of assets, totaling $8,705 million. This significant figure indicates the trust and confidence clients place in Grupo Coril to manage their investments effectively. It also suggests the company's ability to handle large-scale financial operations.

Presence in 7 regions of the country: Grupo Coril has established operations in seven regions across the country, including Lima, Piura, Chiclayo, Trujillo, Arequipa, Huancayo, and Cusco.

Highest growth fiduciary: Grupo Coril is recognized as the fiduciary with the highest growth rate. This accolade reflects the company's successful performance and expansion within the financial industry.

Leading non-bank securitization provider: Grupo Coril is a prominent provider of securitization services, distinguishing itself as a leader in the non-banking sector.

ISO 27001:2013 Information security certification: Grupo Coril holds the ISO 27001:2013 certification for information security. This certification signifies that Grupo Coril adheres to international standards in managing and safeguarding sensitive information.

Cons:

Lack of regulatory oversight: Grupo Coril operates without regulatory supervision or oversight.

Lack trading platform: The absence of a trading platform may limit clients' ability to execute trades independently and access real-time market information. Clients may rely on alternative platforms or brokers, potentially resulting in additional costs or complexities in managing their investments.

Grupo Coril offers a range of trading assets through its services:

Securities Intermediation: Facilitating the purchase and sale of financial instruments in both local and international markets, utilizing stock exchanges or over-the-counter mechanisms.

Structuring and Placement: Providing advisory services to explore financing alternatives via the capital market, including debt or equity issuance. Placement options encompass both public and private offerings.

Money Exchange: Offering currency exchange services to facilitate transactions involving different currencies, suitable for clients engaged in international trade or investment.

Financial Advisory: Providing expert guidance and recommendations on financial matters, tailored to individual or corporate clients seeking strategic financial planning or investment advice.

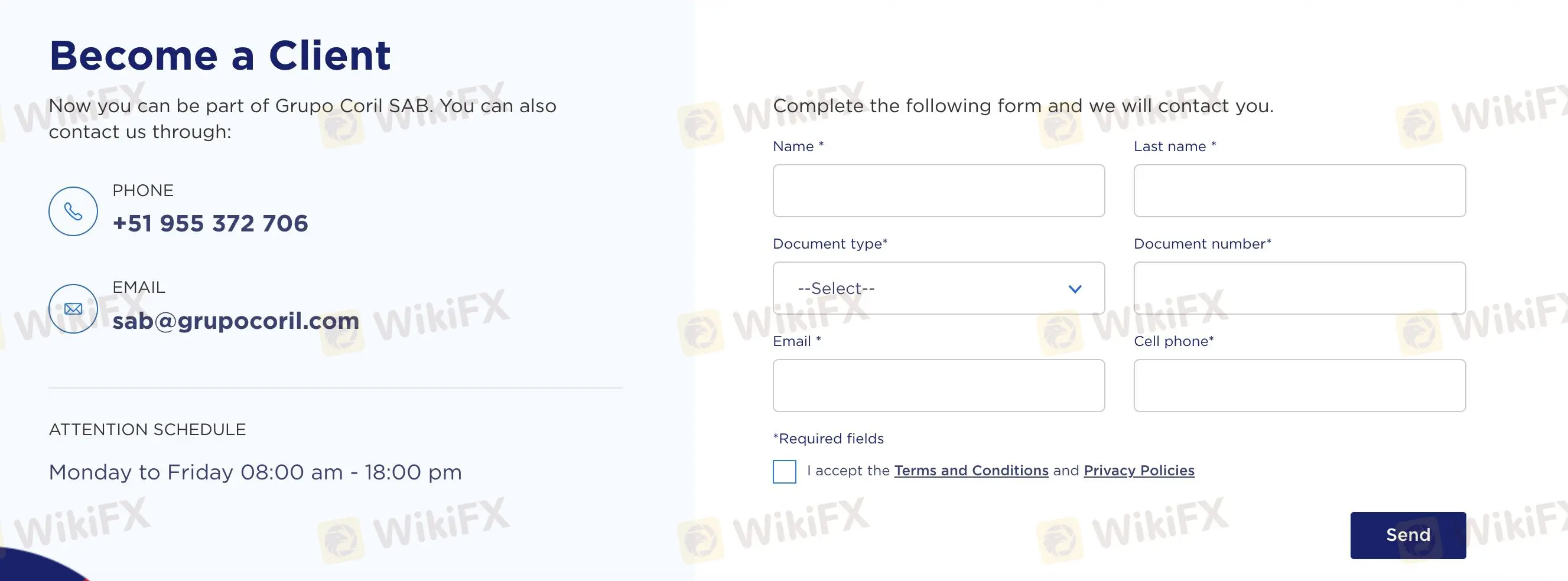

Contact Grupo Coril SAB: Reach out via phone at +51 955 372 706 during business hours. Alternatively, send an email to sab@grupocoril.com.

Verify the attention schedule: Grupo Coril SAB operates Monday to Friday from 08:00 am to 18:00 pm.

Complete the account opening form: Provide your name, last name, document type, and document number. Input your email and cell phone number.

Mandatory fields: Ensure all required fields, marked with an asterisk (*), are filled out accurately.

Accept Terms and Conditions: Acknowledge your acceptance of Grupo Coril SAB's Terms and Conditions and Privacy Policies.

Submit the form: Once the form is complete, click on the “Send” button to submit your application.

Grupo Coril SAB offers customer support to assist clients in becoming part of their services.

You can reach them via phone at +51 955 372 706 or email at sab@grupocoril.com during their attention schedule, Monday to Friday from 08:00 am to 18:00 pm.

In conclusion, Grupo Coril presents both advantages and disadvantages in its financial services provision.

The company boasts a substantial asset management portfolio, a wide regional presence, and recognition for its fiduciary growth and information security standards.

However, operating without regulatory oversight poses risks, while limited customer support hours and the absence of detailed account information may inconvenience clients.

Question: How can I contact Grupo Coril?

Answer: You can reach Grupo Coril by phone at +51 955 372 706 or via email at sab@grupocoril.com during business hours.

Question: What services does Grupo Coril offer?

Answer: Grupo Coril offers securities intermediation, money exchange, financial advisory, and structuring and placement services.

Question: Is Grupo Coril regulated by any authority?

Answer: No, Grupo Coril operates without regulatory oversight.

Question: What are the customer support hours?

Answer: Customer support is available from Monday to Friday, 08:00 am to 18:00 pm.

Question: Where is Grupo Coril headquartered?

Answer: Grupo Coril is headquartered in Germany, with operations in seven regions of Peru.

More

User comment

1

CommentsWrite a review

2023-02-24 11:01

2023-02-24 11:01