User Reviews

More

User comment

1

CommentsWrite a review

2023-02-16 10:34

2023-02-16 10:34

Score

Influence

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index7.31

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

Company Name

Social Finance, Inc

Company Abbreviation

SOFIMONEY

Platform registered country and region

United States

Company website

X

Company summary

Pyramid scheme complaint

Expose

| SOFIMONEYReview Summary | |

| Founded | 1997-12-30 |

| Registered Country/Region | United States |

| Regulation | Unregulated |

| Services | SoFi Checking and Savings/SoFi Credit Cards/Financial InsightsSoFi Invest/Student Loan Refinancing/Personal Loans/Mortgages/Private Student Loans/SoFi Protect |

| Trading Platform | Sofi(Mobile) |

| Customer Support | Phone: (855) 456-SOFI (7634) |

| Facebook, LinkedIn, Twitter, Instagram, YouTube | |

| Email: customerservice@sofi.com/ir@sofi.com | |

SoFi is a different finance company whose goal is to help people take control of their finances and explore all the ways SoFi helps customers save, spend, earn, borrow, invest, and protect their money in one app. Professionally engaged inSoFi Checking and Savings, SoFilnvest®, Student Loan Refinancing, Private Student Loans, Personal Loans, Home Loans, and SoFi Insights和SoFi Protect.

SOFIMONEY is not regulated, making it less safe than regulated brokers.

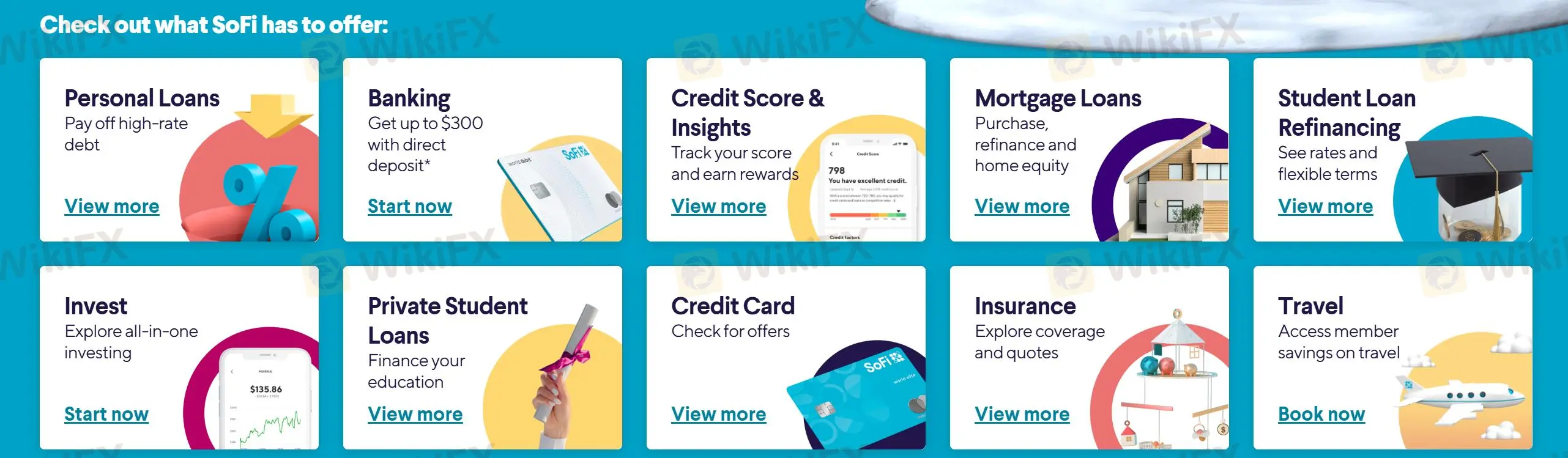

SOFIMONEY offers access to various products, including Personal Loans, Banking, Credit Score & Insights, Mortgage Loans, Student Loan Refinancing, Invest, Private Student Loans, Credit Card, Insurance, and Travel.

Personal Loans: Pay off high-interest credit card debt. These loans can also be used to pay for major life expenses or costs, such as home improvements, weddings, unexpected medical expenses, moving costs, or funerals. Amounts typically range from $5,000 to $100,000.

Credit Score & Insights: Links customers' deposit accounts (checking, savings), investment and retirement accounts as well as credit cards, student loans, mortgages, and other liabilities.

Mortgage Loans: A loan used to buy a home or other real estate without an upfront payment.

Student Loan Refinancing: Lower interest rates and/or shorter repayment terms.

Invest: Invest in stocks, ETFs, and IPOs.

Private Student Loans: Fill the gap between financial aid and family affordability.

Insurance: Includes auto, life, home, and renters insurance.

Travel: Offer customers access to their catalog of stays, flights, cars, packages, and things to do. Save 10% or more on select hotels (clearly labeled “SoFi Member Price”) in the SoFi Travel portal.

More

User comment

1

CommentsWrite a review

2023-02-16 10:34

2023-02-16 10:34