User Reviews

More

User comment

1

CommentsWrite a review

2022-11-28 10:22

2022-11-28 10:22

Score

5-10 years

5-10 yearsRegulated in Australia

Investment Advisory License

Suspicious Overrun

Medium potential risk

Influence

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index3.05

Business Index7.48

Risk Management Index0.00

Software Index4.00

License Index3.05

Single Core

1G

40G

| Credit Union SAReview Summary | |

| Founded | 2010-06-08 |

| Registered Country/Region | Australia |

| Regulation | Exceeded |

| Services | Financial Planning/Calm Wealth/Conveyancing/Wills and Estates/Seminars & Workshops/Foreign Exchange Services/Community services |

| Customer Support | Phone: 13 8777/+61883180777 |

| Social Media: Facebook, Twitter, YouTube, Instagram, LinkedIn | |

| Send a message | |

Credit Union SA is South Australia's third-largest credit union providing Savings Accounts & Term Deposits and transaction accounts. Credit Cards and Debit Cards are available. Users also choose Home Loans and Personal Loans to cope with stress. In addition, there are also various insurance products. Users can also enjoy a variety of services, such as Foreign Exchange Services and Community.

Credit Union SA is authorized andregulated by the Australia Securities & Investment Commission(ASIC), but the Exceeded status makes it less safe than regulated brokers.

Credit Union SA provides Financial Planning, Calm Wealth, Conveyancing, Wills and Estates, Seminars & Workshops, and more. The Foreign Exchange Services offer access to International Payments Service, Inward payments, Foreign cash, and Foreign Currency Fees. In addition, Community services are available.

Accounts are divided into transaction accounts and savings accounts & fixed deposits.

Transaction Accounts: The Key features & benefits of Access Account, 55+ Account, Student Banking, and Educator+ Account are No monthly fees, 24/7 banking, and a Free Visa Debit Card. 55+ transaction account is available to all members aged 55 and over. The Business+ Account charged $10/month is a convenient transaction account designed for processing payroll, purchases, supplier payments, and transfers.

Savings Accounts & Term Deposits:Term Deposit with Fixed interest rate. The Key features and benefits of Netsave Accounts, Bonus Savings Accounts, and Children's Savings Accounts are no monthly fees. Netsave rewards you with interest regardless of the user's account balance. A children's savings account is perfect for those under 8.

| Account Type | Access Account | 55+ Account | Educator+ Account | Home Loan Offset Account | Student Banking | Business+ Account |

| Interest Rate | 0.00% pa | 0.00% pa | 1.00% p.a. | 0.00% pa | - | 0.00% pa |

| Monthly Fee | $0 | $0 | $0 | $0 | $0 | $10 |

| ATM Withdrawal Fee (Australia and Overseas) | $0 | $0 | $0 | $0 | $0 | $0 |

| Account Type | Supported |

| Term Deposit | ✔ |

| Netsave Accounts | ✔ |

| Bonus Savings Accounts | ✔ |

| Children's Savings Accounts | ✔ |

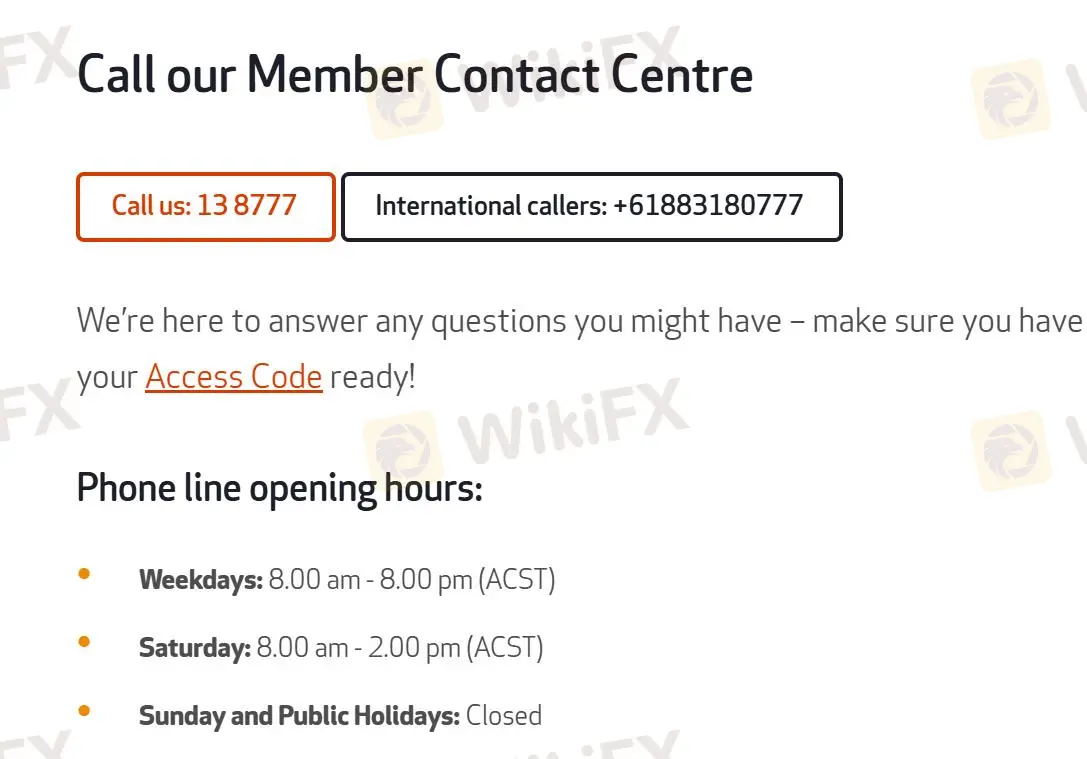

Users can get in touch with Credit Union SA through phone, international callers, and send a message. The company also provides Facebook, Twitter, YouTube, Instagram, and LinkedIn for users to learn. The telephone service is closed on Sundays and holidays. The online hours on weekdays are 8 am to 8 pm and on Saturdays are 8 am to 2 pm.

| Contact Options | Details |

| Phone | 13 8777/+61883180777 |

| Social Media | Facebook, Twitter, YouTube, Instagram, LinkedIn |

| Send a Message | ✔ |

| Supported Language | English |

| Website Language | English |

| Physical Address | / |

More

User comment

1

CommentsWrite a review

2022-11-28 10:22

2022-11-28 10:22