User Reviews

More

User comment

64

CommentsWrite a review

2026-02-26 01:41

2026-02-26 01:41

2026-02-04 13:08

2026-02-04 13:08

Score

5-10 years

5-10 yearsRegulated in United Kingdom

Market Making License (MM)

MT5 Full License

Global Business

High potential risk

Offshore Regulated

Benchmark

Influence

Add brokers

Comparison

Quantity 17

Exposure

Score

Regulatory Index8.19

Business Index7.56

Risk Management Index0.00

Software Index9.88

License Index8.20

Single Core

1G

40G

Danger

Danger

More

Company Name

CWG Markets Ltd

Company Abbreviation

CWG Markets

Platform registered country and region

United Kingdom

Company website

Company summary

Pyramid scheme complaint

Expose

My money was stolen and there was no response. This is a fraudulent company.

I cannot transfer the money in my wallet to my BTC Turkish account. I made a transfer, but when I check for 20 days, it always says it is under review.

Server cannot be connected. It is disconnected when you look at diagram. Unable to connect, resulting inability of closing position. Using other platforms to watch my own liquidation, I seriously suspect that it is a deliberate behavior in the background. You can connect to the server immediately after the liquidation.

I have been using this forex broker for past 1.5 years, since July 2020 and have made 2 successful partial withdrawals and 2 deposits to continue trading. There have been accumulated profits over the years. However, when I tried making a partial withdrawal during in January 2022, CWG has suddenly informed that my profits are in violation of company policies and confiscated more than 2/3 from my account. I have been trading in the same way for 1.5 years and suddenly CWG decided to take all the profits and deemed it in violation of the company policies. Till now, they wouldn't want to return the confiscated profits, and hold me hostage for not approving the withdrawal request I've made on balance funds in my account because they froze it. Really unbelievable. Beware of this company. Not sure what is happening, they were great to trade with and withdrawals were easy. But now, not so great anymore.

They defrauded us of $80,000. This is a fraudulent company. I do not recommend dealing with this company. 😞🙆

Deceive customers and claim the winning rate is 80%, resulting in liquidation. Ask the customer to deposit again after liquidation. The spread is ridiculous high

This broker scams it deducted profits from the account without justification for the action . And i have tried to reach them for restitution of my profits but there just saying still under process on live chat and on the emails there no longer reply. This broker is a scammer be alert otherwise you will lose your money!! Beware !

After depositing $100,000 on 6/21, I started trading. There was no problem with withdrawing profits until I applied for a withdrawal on 7/31. When I called the relevant personnel, they kept making excuses. It wasn't until 9/23 that the trading department of CWG sent a letter saying that I had engaged in "irregular trading" without any evidence, and then they unreasonably removed the amount of $34,579.43 from my MT4 account. I have been trading forex margin for a long time, and this is the first time I have encountered a platform that can take away your funds with just an "irregular trading" accusation. Because it takes 8 weeks for the UK to process my complaint letter, I want to remind CWG's customers here to be extra careful with this platform. Be extremely cautious. PS: The photos I provided are screenshots from my own backend. I have blurred my name and information to avoid retaliation from the platform and have deleted all my other information.

The broken server is disconnected and cannot be connected. Fortunately, the deposit is not much, so let's close it soon.

CWG Markets platform, under the pretext of swing trading, deducted the profits from the more profitable orders. It has been over half a year now, and they still haven't returned my profit of $5039.

This broker scams it deducted profits from the account without justification for the action . And i have tried to reach them for restitution of my profits but there just saying still under process on live chat and on the emails there no longer reply. This broker is a scammer be alert otherwise you will lose your money!! Beware !

CWG MARKETS Is a Complete Scam! Absolutely Shameless—Stay Away! I want to share my personal experience with CWG MARKETS, a so-called “broker” that turned out to be nothing but a scam. What they did to me was beyond outrageous, and I hope my story warns others to stay far away from this trap! It all started in June 2024, when my account was suddenly frozen out of nowhere. No explanation, no warning—nothing. I reached out to my account manager and customer support multiple times, but all I got were vague answers and endless excuses. They kept dodging my questions and delaying any real solutions. It was so frustrating and made me feel completely helpless. But the worst was yet to come. By September 2024, CWG MARKETS had randomly deducted a massive $26,652 from my account! There was no reason, no notice—just outright theft. And if that wasn’t bad enough, they actually had the audacity to tell me to withdraw the remaining balance and leave the platform. Seriously?! They trea

I submitted withdrawal request for 5 working days and still haven't arrived. this withdrawal is taking too long. the broker should do better

I've added more proof, please approve. I made a deposit to my account and I wasn't credited, after fews I contacted the customer support and I was assured I'll be credited but they still didn't credit me, here's more proof

I bought 5 lots of XAU/USD and made a profit of 5400 USD after the release of the Consumer Price Index (CPI) news at 20:30 Taiwan time on September 11, 2024. On the afternoon of September 12, the profit of 5400 USD in my CWG account on MT4 was maliciously cut off. Currently, I cannot place orders or withdraw funds from my CWG account. They said I violated the rules of rapid opening and closing trades. It's the first time I've heard of cutting off someone's profit like this. We traders can only lose money to the brokers, can't we make money? They said I violated the rules and regulations by scalping, but every trader has operated like this before. It's really despicable. Please give your opinions.

CWG MARKETS is an utterly fraudulent platform! Extremely shameless, everyone must be warned not to be deceived! Both my friend and I have had the same tragic experiences, and I am determined to fully expose the despicable actions of this fraudulent broker, CWG MARKETS, to warn everyone to stay away from this trap! The incident happened in June 2024 when my account was suddenly blocked without any explanation or warning, completely shut down unilaterally by the platform. I repeatedly contacted the account manager and customer service, but their responses were either evasive or maliciously delayed, giving no reasonable explanation at all. This attitude is simply mocking the victims, making people angry and helpless! What's even more unacceptable is that after months of waiting, instead of improving, the situation worsened dramatically! By September 2024, CWG MARKETS arbitrarily deducted 30,649 from my account—a blatant act of fraud! After taking my money, they even had the audacity to ask me to withdraw the remaining funds and leave the platform! What kind of logic is this? They are completely treating customers like sheep to be slaughtered, with no moral bottom line! I hope everyone takes this as a warning—do not be deceived again! If you have encountered similar situations, please bravely come forward and expose them. We must not allow such fraudulent platforms to continue their reckless behavior and harm more people!

| CWG Markets Review Summary | |

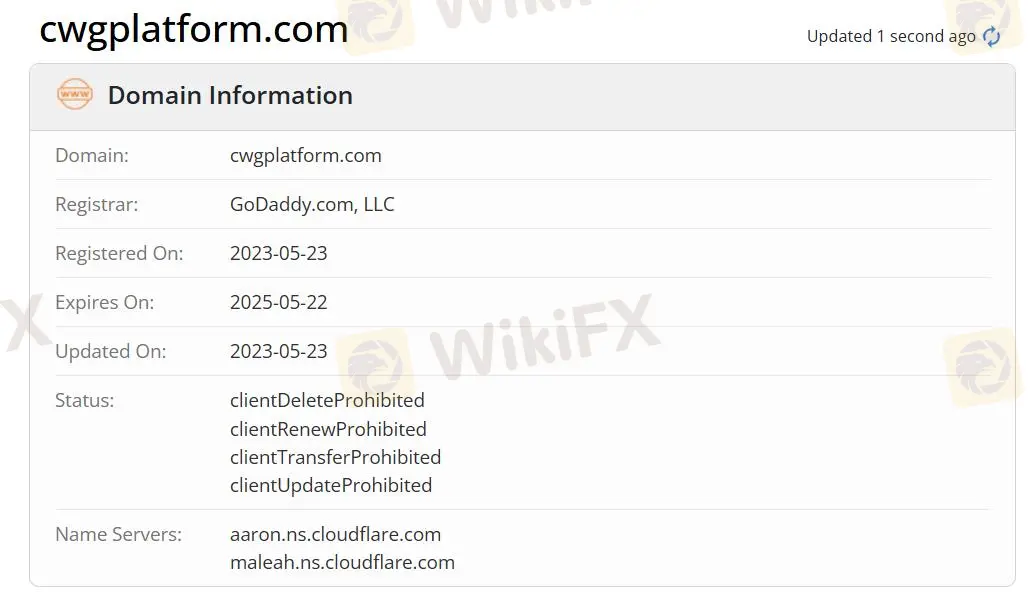

| Founded | 2023-05-23 |

| Registered Country/Region | United Kingdom |

| Regulation | Offshore Regulated(VFSC)/Regulated(FCA) |

| Market Instruments | Forex/CFD stock/Precious metals/Energy/Indices/Com. Futures |

| Demo Account | ✅ |

| Leverage | Up to 1:1000 |

| Spread | From 0.0 pips |

| Trading Platform | CWG |

| Min Deposit | $10 |

| Customer Support | Email: service@cwgmarkets.com |

| Phone: +44 2037699268, +60 1800819380 | |

| Live chat | |

| Facebook/LinkedIn/Instagram | |

CWG Markets, a registered investment firm, is the trading name of the CWG Group of companies that provides various tradable instruments including forex, CFD stock, precious metals, energy, indices, and com. futures. The broker also provides four live accounts with a maximum leverage of 1:1000. The demo and Islamic accounts are also available. The minimum spread is from 0.0 pips and the minimum deposit is $10.

| Pros | Cons |

| Various tradable instruments | High max leverage |

| Offshore Regulated(VFSC)/Regulated(FCA) | MT4/MT5 unavailable |

| Spread from 0.0 pips | Some negative comments |

| Demo account available |

| Regulated Country | Regulated Authority | Regulated Entity | License Type | License Number | Current Status |

| VFSC | CWG MARKETS LTD | Retail Forex License | 41694 | Offshore Regulated |

| FCA | CWG Markets Ltd | Market Making(MM) | 785129 | Regulated |

CWG Markets offers 500+ market instruments, including forex, CFD stock, precious metals, energy, indices, and com. futures.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Energy | ✔ |

| CFD Stock | ✔ |

| Indices | ✔ |

| Precious Metals | ✔ |

| Com. Futures | ✔ |

| Shares | ❌ |

| Commodities | ❌ |

| Cryptocurrencies | ❌ |

| ETFs | ❌ |

| Bonds | ❌ |

| Mutual Funds | ❌ |

CWG Markets has four account types: Instant, Standard, Advanced, and Institutional. Traders who want low spreads and leverage can choose an institutional account, while those with a small budget can open an instant account. In addition, the demo account is predominantly used to familiarize traders with the trading platform and for educational purposes only. Copy trading is also available, a way for inexperienced traders or followers who dont have the time to do extensive research or want to diversify their portfolio to copy the trades of experienced traders (also known as money managers or copy trading gurus). Muslims are allowed to open Islamic accounts without swaps.

| Account Type | Instant | Standard | Advanced | Institutional |

| Minimum Deposit | $10 | $50 | $200 | $30000 |

| Spreads | 2.2 pips | 1.5 pips | 0.0 pips | 0.0 pips |

| Maximum Leverage | 1:1000 | 1:500 | 1:500 | 1:100 |

| Commission | $0 Per Side | $0 Per Side | $3 Per Side | $1.5 Per Side |

| Stop Out Level | 50% | 50% | 50% | 50% |

The spread starts from 0.0 pips, the commission is from $0 per side, and the swap is as low as 0. The lower the spread, the faster the liquidity.

The maximum leverage is 1:1000 meaning that profits and losses are magnified 1000 times.

CWG Markets provides a propriety trading platform, instead of the authoritative MT4/MT5 with mature analysis tools and EA intelligent systems.

| Trading Platform | Supported |

| CWG | ✔ |

The first deposit amount must be $10 or above. CWG Markets accepts Visa, Mastercard, UnionPay, Poli, PayPal, Skrill, Neteller, Bank Transfer, etc. for deposit and withdrawal and commissions are free. CWG Markets does not charge any fees for withdrawals and covers the payment provider's fees for your first five withdrawals each month. For additional withdrawals beyond this limit, a $5 fee is applied to each transaction. Deposit processing times are instant and withdrawal processing times are within 72 hours.

Deposit:

| Payment Option | Currencies | Commission | Processing Time | Estimated Arrival Time |

| Skrill | USD/EUR | Free | Within 30 minutes | Instantly |

| Neteller | USD/EUR | Free | Within 30 minutes | Instantly |

| Sticpay | GBP/USD/EUR | Free | Within 30 minutes | Instantly |

| China UnionPay | CNY | Free | Within 30 minutes | Instantly |

| Bank Transfer | GBP/USD/EUR | Free | Within 72 hours | Instantly |

| Help2Pay | THB/VND/IDR | Free | Within an hour | Instantly |

| 5Pay | THB/VND/IDR | Free | Within 24 hours | Instantly |

| 5Pay | USDT-ERC20/USDT-TRC20 | Free | Within an hour | Instantly |

| 77pay | VND | Free | Within an hour | Instantly |

| Kora | NGN/ZAR/KES/GHS/USD | Free | Within an hour | Instantly |

| Pay Retailers | Support all South American countries | Free | Within an hour | Instantly |

| Asia Banks | IDR/VND/MYR | Free | Within an hour | Instantly |

| ECOM | VND | Free | Within an hour | Instantly |

Withdrawal:

| Payment Option | Currencies | Commission | Processing Time | Estimated Arrival Time |

| Skrill | USD/EUR | Free | Within an hour | Instantly |

| Neteller | USD/EUR | Free | Within an hour | Instantly |

| Sticpay | GBP/USD/EUR | Free | Within an hour | Instantly |

| China UnionPay | CNY | Free | Within an hour | 1-72 hours |

| Bank Transfer | GBP/USD/EUR | Free | Within an hour | 1-72 hours |

| Help2Pay | THB/VND/IDR | Free | Within an hour | 1-48 hours |

| 5Pay | THB/VND/IDR | Free | Within an hour | 1-24 hours |

| 5Pay | USDT-ERC20/USDT-TRC20 | Free | Within an hour | 1-48 hours |

| 77pay | VND | Free | Within an hour | 1-48 hours |

| Kora | NGN/ZAR/KES/GHS/USD | Free | Within an hour | 1-48 hours |

| Pay Retailers | Support all South American countries | Free | Within an hour | 1-48 hours |

| Asia Banks | IDR/VND/MYR | Free | Within an hour | 1-48 hours |

| ECOM | VND | Free | Within an hour | 1-48 hours |

A deposit bonus can be 100% when traders register and deposit funds. Up to $2,000 per account.

On Wednesday, as market sentiment improved, the US dollar lost its strength. The US dollar index closed down 0.01% at 97.67; With the recovery of risk appetite and the rise of stock market weakening t

WikiFX

WikiFX

With the Supreme Court abolishing old tariffs and the White House introducing new import taxes, the US dollar has fluctuated sharply. On Tuesday, the US dollar index closed down 0.026% at 97.87; The b

WikiFX

WikiFX

On Monday, after the US Supreme Court overturned Trumps tariff policy, traders re evaluated the US tariff policy, and the US dollar index closed sideways, falling 0.02% to 97.73. The benchmark 10-year

WikiFX

WikiFX

Robbed of your hard-earned funds when trading on CWG Markets? Lured into trading through the false promise of welcome bonus profits? Is trade manipulation preventing you from earning profits on this platform? Are your concerns met with silence from CWG Markets’ customer support? Act before it gets too late! Many traders have reported these experiences while sharing their reviews of CWG Markets online. In this article, we have shared their reviews. Read on to find out.

WikiFX

WikiFX

More

User comment

64

CommentsWrite a review

2026-02-26 01:41

2026-02-26 01:41

2026-02-04 13:08

2026-02-04 13:08