User Reviews

More

User comment

0

CommentsWrite a review

No comment yet

Score

5-10 years

5-10 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Influence

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index7.45

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

Company Name

Castleton Commodities International LLC

Company Abbreviation

CCI

Platform registered country and region

United States

Company website

Company summary

Pyramid scheme complaint

Expose

| CCI Review Summary | |

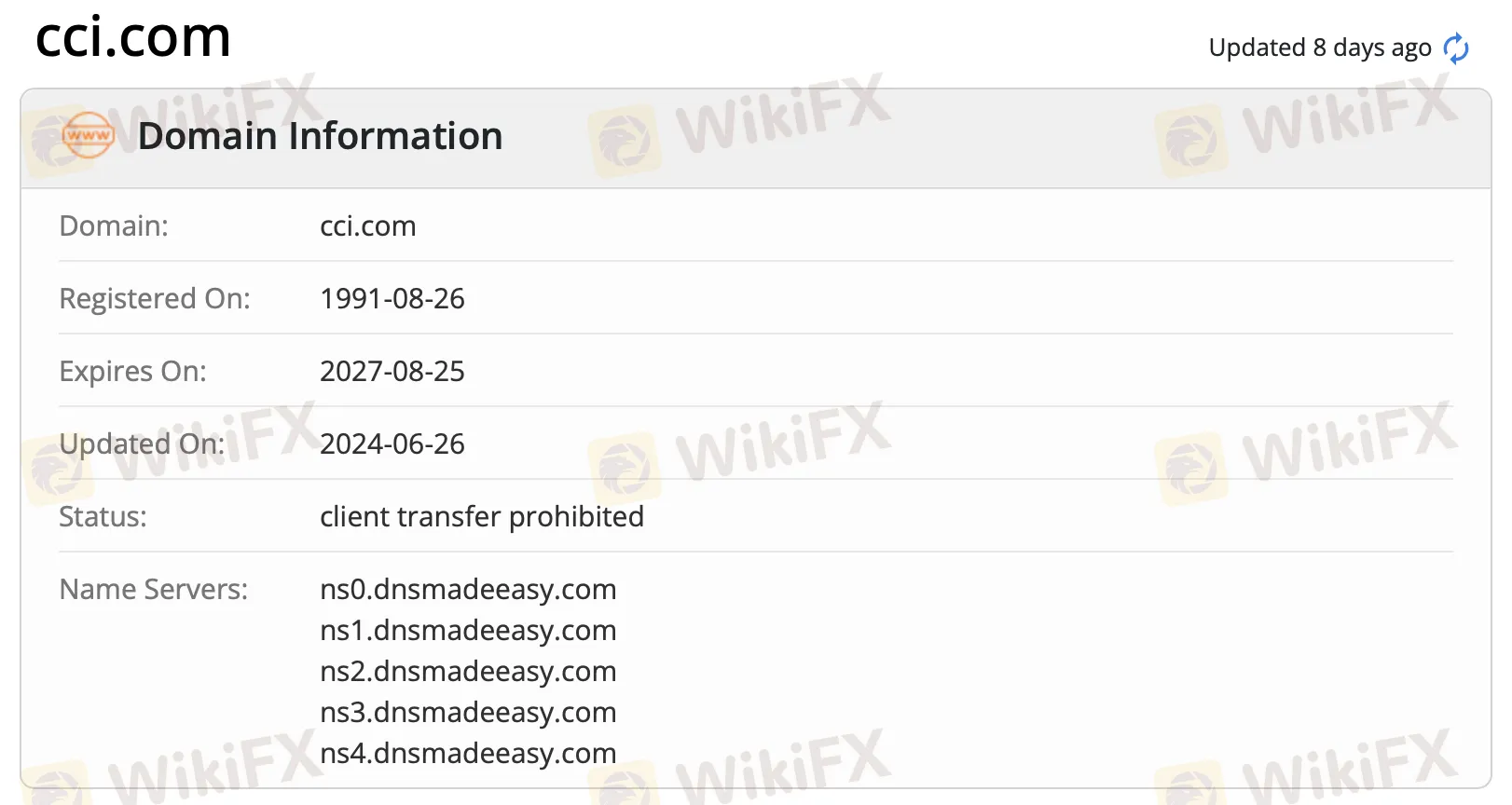

| Founded | 1991 |

| Registered Country/Region | US |

| Regulation | No regulation |

| Services | Energy commodities merchandising, infrastructure asset investment |

| Customer Support | Email: Compliance@cci.com |

| Tel: (203) 564-8100 | |

CCI was formed in 1997 as a subsidiary of the Louis Dreyfus Group and it becomes a global energy commodity trading and infrastructure asset investing company now. It offers value in energy markets through superior fundamental research, innovative logistical solutions, professional knowledge and systematic capital deployment.

| Pros | Cons |

| Long operational history | No regulation |

| Expert in asset investment |

CCI is not regulated by any financial regulatory authorities. Besides, its domain status shows that client transferring is prohibited. Please be aware of the risks!

CCI offers energy marketing and trading, and asset investing.

| Services | Supported |

| Energy commodity merchandising | ✔ |

| Asset investing | ✔ |

More

User comment

0

CommentsWrite a review

No comment yet

start to write first comment