User Reviews

More

User comment

12

CommentsWrite a review

2025-09-01 00:44

2025-09-01 00:44

2025-07-20 18:29

2025-07-20 18:29

Score

10-15 years

10-15 yearsRegulated in Cyprus

Market Making License (MM)

MT5 Full License

Regional Brokers

United Arab Emirates Derivatives Trading License (MM) Revoked

High potential risk

Offshore Regulated

Influence

Add brokers

Comparison

Quantity 1

Exposure

Score

Regulatory Index7.78

Business Index8.00

Risk Management Index0.00

Software Index9.92

License Index7.64

CYSEC Regulated

Market Making License (MM)

FCA Regulated

Forex Execution License (STP)

CMA Regulated

Forex Trading License (EP)

DFSA Revoked

Derivatives Trading License (MM)

FSCA Regulated

Derivatives Trading License (EP)

VFSC Offshore Regulated

Forex Trading License (EP)

FSA Offshore Regulated

Derivatives Trading License (EP)

Single Core

1G

40G

Sanction

Sanction

More

Company Name

CFI International Ltd

Company Abbreviation

CFI

Platform registered country and region

Mauritius

Company website

X

YouTube

Company summary

Pyramid scheme complaint

Expose

| CFI GroupReview Summary | |

| Founded | 2016-03-22 |

| Registered Country/Region | Mauritius |

| Regulation | Regulated |

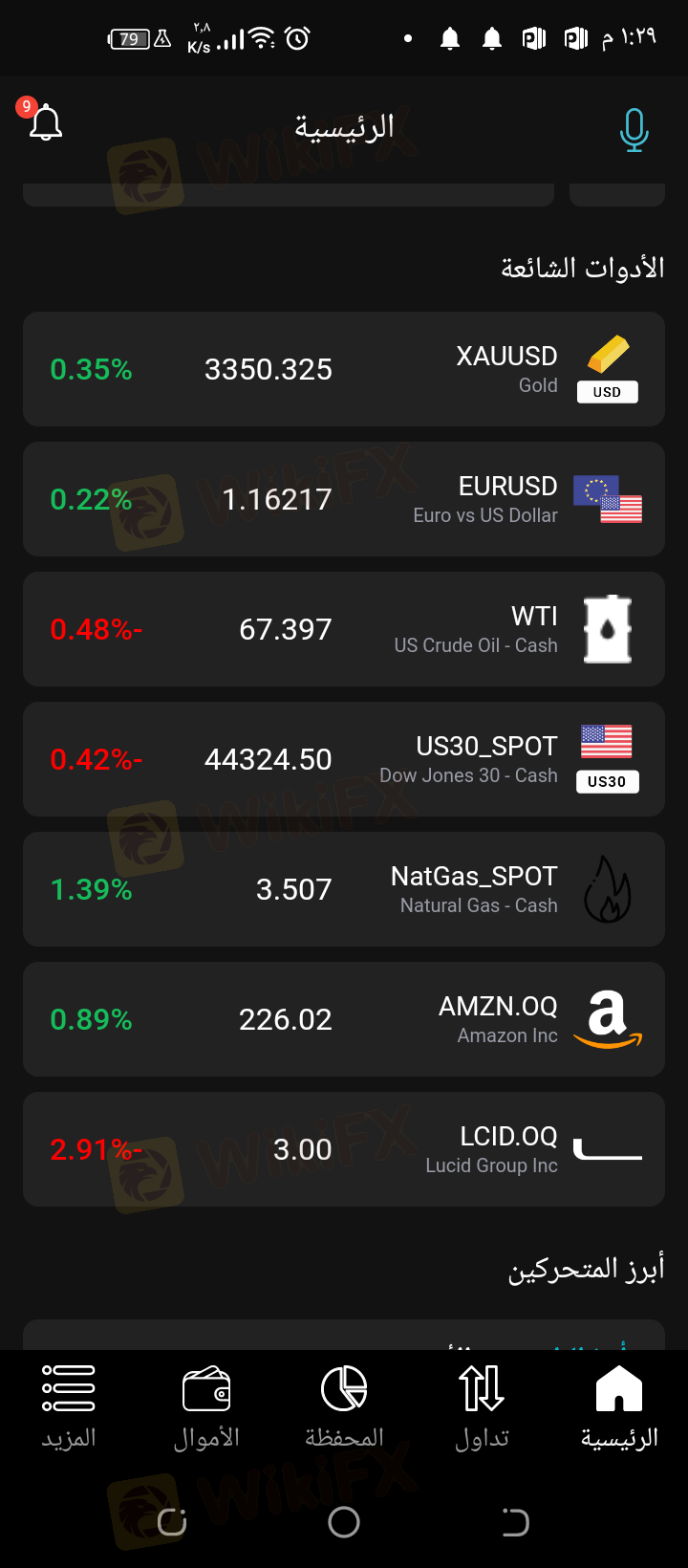

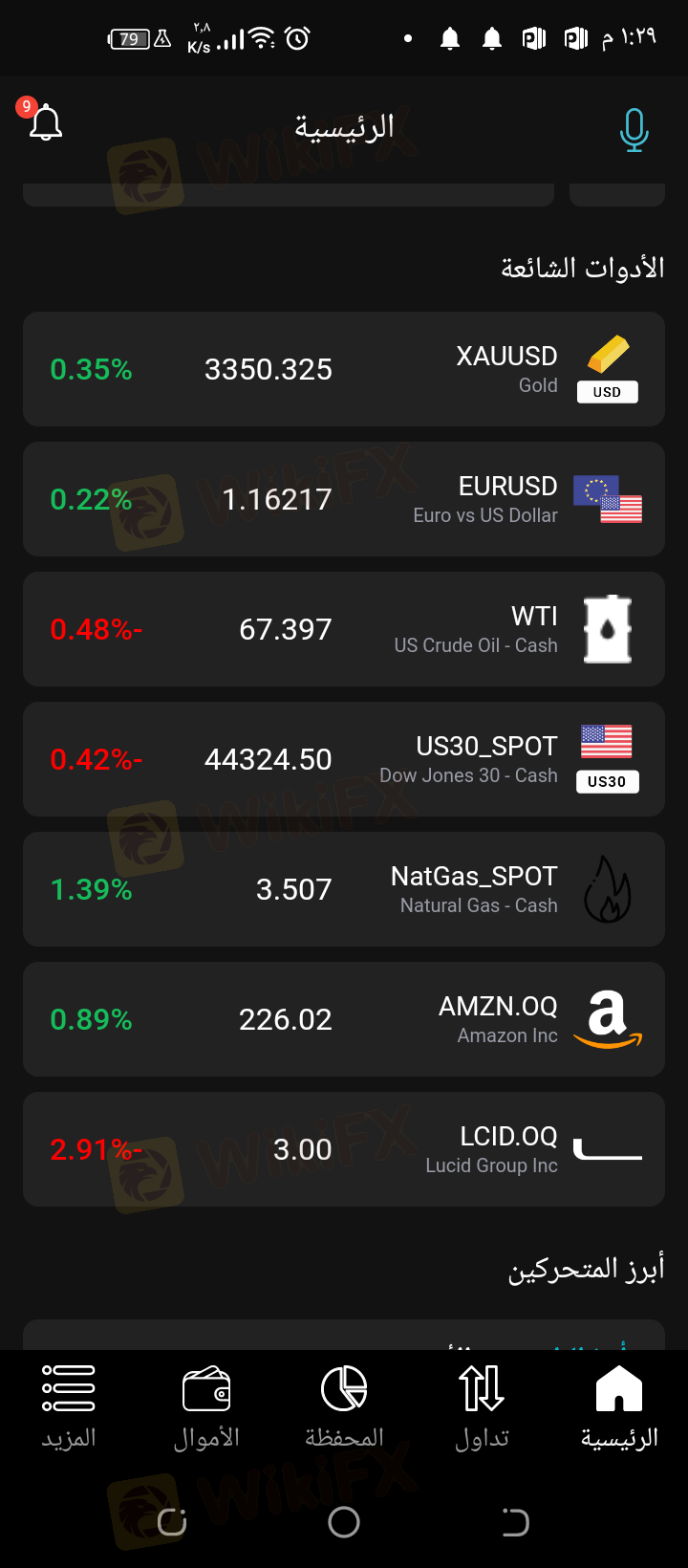

| Market Instruments | Forex/Stocks/Energies/Metals/Indices/ETFs/Crypto/Bonds/Futures |

| Demo Account | ✅ |

| Leverage | Up to 1:500 |

| Spread | From 0.0 pips |

| Trading Platform | MT4/MT5/Trading App/cTrader/Multi-Asset/TradingView(iOS/Android/Windows/Mac OS/Web) |

| Min Deposit | 0 |

| Customer Support | Phone: +2304608266 |

| Email: global@cfi.trade | |

| Facebook/Instagram/LinkedIn/Twitter/YouTube/TikTok | |

| Live chat | |

CFI Group is a brokerage company specializing in online investment and trading services. The tradable instruments include forex, stocks, energies, metals, indices, ETFs, crypto, bonds, and futures. The broker also provides two accounts with a maximum leverage of 1:500. The minimum spread is from 0.0 pips and the minimum deposit is 0. Although CFI Group is regulated by CYSEC, FCA, SCA, and BDL, and offshore regulated by SFCA and VFSA, risks cannot be completely avoided.

| Pros | Cons |

| Leverage up to 1:500 | No bonus information |

| 24/7 customer support | Some negative comments |

| Regulated | |

| Spread from 0.0 pips | |

| Demo account available | |

| Various tradable instruments | |

| Commission free | |

| Swap free | |

| MT4/MT5 available |

It is relatively safe for investors to conduct financial activities in regulated entities. The regulatory information of this broker is as follows:

| Regulated Country | Regulated Authority | Regulated Entity | License Type | License Number | Current Status |

| CYSEC | Credit Financier Invest (CFI) Ltd | Full License (MM) | 179/12 | Regulated |

| FCA | Credit Financier Invest Limited | Direct Passage License (STP) | 828955 | Regulated |

| SCA | CFI FINANCIAL MARKETS L.L.C | Forex Handling License | 20200000154 | Regulated |

| FSA | Credit Financier Invest International Limited | Forex Handling License | SD107 | Offshore Regulated |

| BDL | CREDIT FINANCIER INVEST S.A.L. | Financial Services | 40 | Regulated |

| VFSC | CREDIT FINANCIER INVEST LIMITED | Forex Handling License | 700479 | Offshore Regulated |

CFI Group offers access to 1500+ market instruments, including forex, stocks, energies, metals, indices, ETFs, crypto, bonds, and futures.

| Tradable Instruments | Supported |

| Forex | ✔ |

| ETFs | ✔ |

| Stocks | ✔ |

| Crypto | ✔ |

| Metals | ✔ |

| Bonds | ✔ |

| Futures | ✔ |

| Indices | ✔ |

| Energies | ✔ |

CFI Group has two account types: Zero Commission and Dynamic Trader. Traders who want low spreads can choose a dynamic trader account. Swap-free accounts are also available with conditions on certain products.

In addition, the demo account is predominantly used for familiarizing traders with the trading platform and for educational purposes only. Copy trading is also available, a way for inexperienced traders or followers who dont have the time to do extensive research or want to diversify their portfolio to copy the trades of experienced traders (also known as money managers or copy trading gurus).

| Account Type | Zero Commission | Dynamic Trader |

| Commission | $0 | Low commission, volume-based |

| Leverage | Up to 1:500 | Up to 1:500 |

| Swaps | Swap-free available | Swap-free available |

| Minimum Deposit | None | None |

| EUR/USD spread | Between 0.4-1.1 | From 0.0 pips |

The spread starts from 0.0 pips, the commission is 0% and the swap is free. The lower the spread, the faster the liquidity.

The maximum leverage is 1:500 meaning that profits and losses are magnified 500 times.

CFI Group cooperates with the authoritative MT4 and MT5 trading platforms and provides the Trading App, cTrader, Multi-Asset, and TradingView trading platforms, which are available on iOS, Android, Windows, Mac OS, or Web. Junior traders prefer MT4 over MT5. However, traders with rich experience are more suitable for using MT5. Both MT4 and MT5 offer various trading strategies and implement EA systems.

| Trading Platform | Supported | Available Devices | Suitable for |

| CFI Trading App | ✔ | iOS/Android | All traders |

| MT5 | ✔ | Windows/Mobile | Experienced traders |

| mt4 | ✔ | Windows/Mobile | Junior traders |

| CFI cTrader | ✔ | Windows/iOS/Android/Mac OS | All traders |

| CFI Multi-Asset | ✔ | iOS/Android | All traders |

| TradingView | ✔ | Web | All traders |

The first deposit amount must be none. CFI Group accepts iPay, MasterCard, Visa, and Wire Transfer for deposit and withdrawal. Generally, payments made via credit/debit cards or instant payment methods are processed instantly, while wire transfer processing times are up to 1 to 5 days. CFI Mauritius does not impose any deposit fees, any charges incurred will depend on the corresponding bank.

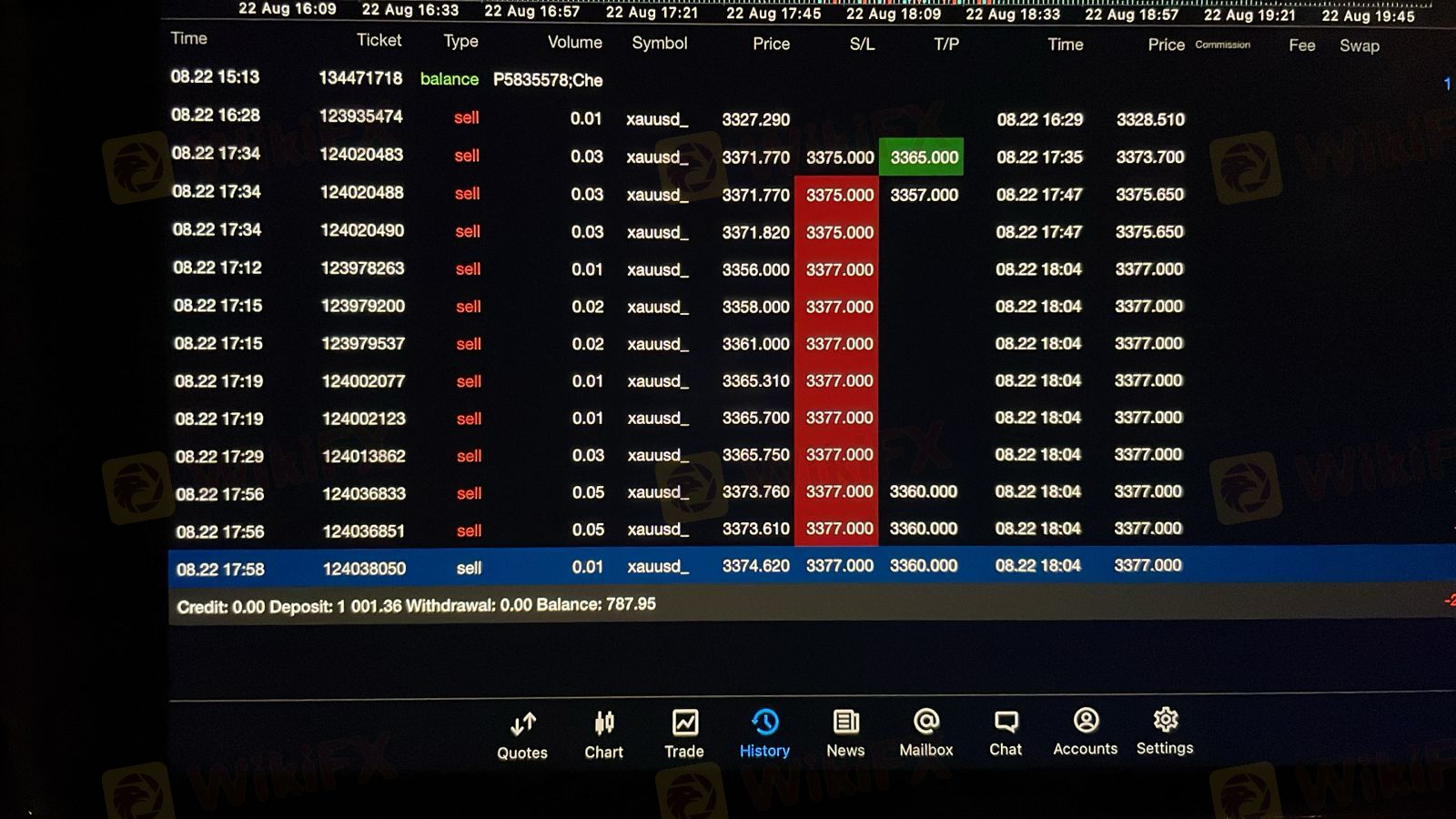

CFI (Credit Financier Invest) presents a complex profile characterized by a high-tier regulatory framework in Europe and the Middle East, juxtaposed with operational irregularities in other jurisdictions. With a WikiFX score of 7.35, the broker is positioned in the upper quadrilateral of trust, largely due to its longevity (established in 2012) and oversight by top-tier bodies like the UK FCA and Cyprus CySEC. However, distinct risk signals—specifically a revoked license in Dubai (DFSA), a "superceded" status in South Africa, and a substantial AML-related fine from CySEC—prevent this entity from receiving a flawless safety rating. This audit classifies CFI as a legitimate, high-capacity brokerage that requires traders to diligently verify which specific legal entity they are contracting with to avoid regulatory arbitrage.

WikiFX

WikiFX

CFI Financial Group earns Central Bank of Bahrain Category 2 license, marking a key milestone in its Bahrain expansion and MENA trading services rollout.

WikiFX

WikiFX

CFI Financial Group is now the Official Online Trading Partner of Etihad Arena, marking a significant expansion into Abu Dhabis thriving entertainment scene.

WikiFX

WikiFX

CFI Financial Group announces Ziad Melhem as new CEO in 2025 leadership changes, driving innovation and global expansion in online brokerage services.

WikiFX

WikiFX

More

User comment

12

CommentsWrite a review

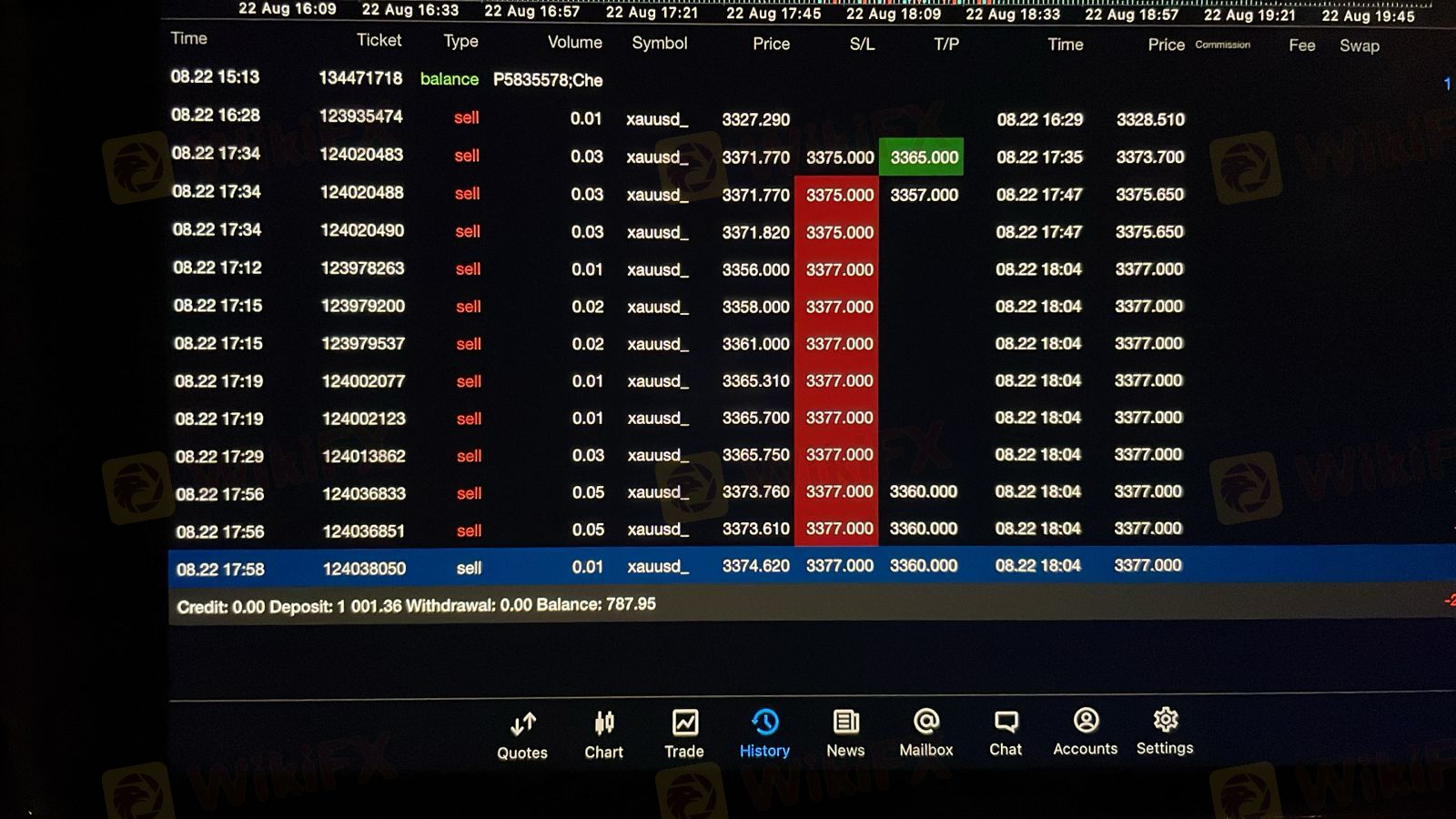

2025-09-01 00:44

2025-09-01 00:44

2025-07-20 18:29

2025-07-20 18:29