Let's start here:

TMGM appears to a respected forex broker, presenting access to 12,000 tradbale instruments spanning forex, CFDs and cryptocurrencies. Traders can enjoy competitive spreads across various instruments, exemplified by the EUR/USD currency pair with an average spread of around 0.1 pips. Besides, TMGM extends a diverse set of trading platforms, notably including MetaTrader 4 and MetaTrader 5. Morever, TMGM enriches the trading journey with rich educational resources and trading tools. Lastly, 24/7 multilingual customer support stands ready. However, the question remains: Does TMGM truly live up to its claims? Let's explore more.

TMGM Information

Founded in 2013 and headquartered in Sydney, Australia, TMGM is an online ECN/STP broker. Notably, in 2016, TMGM introduced its MetaTrader 5 platform. Subsequently, the company achieved FCA membership in the UK during 2017. The year 2019 witnessed the launch of TMGM's mobile trading app, further enhancing accessibility. By 2021, TMGM's reach expanded to encompass over 200 countries worldwide.

Offering a diverse array of 12,000 trading instruments spanning forex, indices, metals, energies, shares, and cryptos, TMGM caters to traders through popular platforms including MT4 and MT5.

Pros & Cons

Is TMGM Legit?

TMGM, a regulated broker, holds authorization from the tier-one regulator ASIC. Additionally, TMGM's international operations are overseen by the VFSC in Vanuatu offshore. Now, let's quickly delve into TMGM's regulations and licenses, which will shed light on how the broker ensures compliance with industry standards and protects clients.

Under the oversight of ASIC, a prominent tier-1 regulatory authority, TMGM's Australian branch known as TRADEMAX AUSTRALIA LIMITED operates with regulatory number 436416. This entity is licensed for Market Making (MM). As per the stringent rules set by ASIC, which is globally recognized, brokers must ensure the safety of clients' funds.

Since TMGM claims to obtain the ASIC license, an investigation team from WikiFX visited the company's registered address in Australia. This visit, conducted in person, revealed that the company is operating smoothly and on a large scale. This direct observation by the investigator enhances our confidence in TMGM's legitimacy and highlights its strong and credible operations under ASIC's regulation.

TMGM's international branch, Trademax Global Limited, operates under the offshore regulation and authorization ofVFSC, holding a license for retail forex activities.

Market Instruments

TMGM goes above and beyond by offering an impressive collection of 12,000 trading instruments, setting it apart as a broker with an exceptional range of options, covering 60+ currency pairs, indices, and stocks sourced from major global exchanges. Moreover, TMGM extends its offerings to include energies, as well as sought-after precious metals like gold and silver. Adding to the mix are energies such as oil and natural gas, not to mention a selection of 10 cryptocurrencies like Bitcoin, Ethereum, and Litecoin.

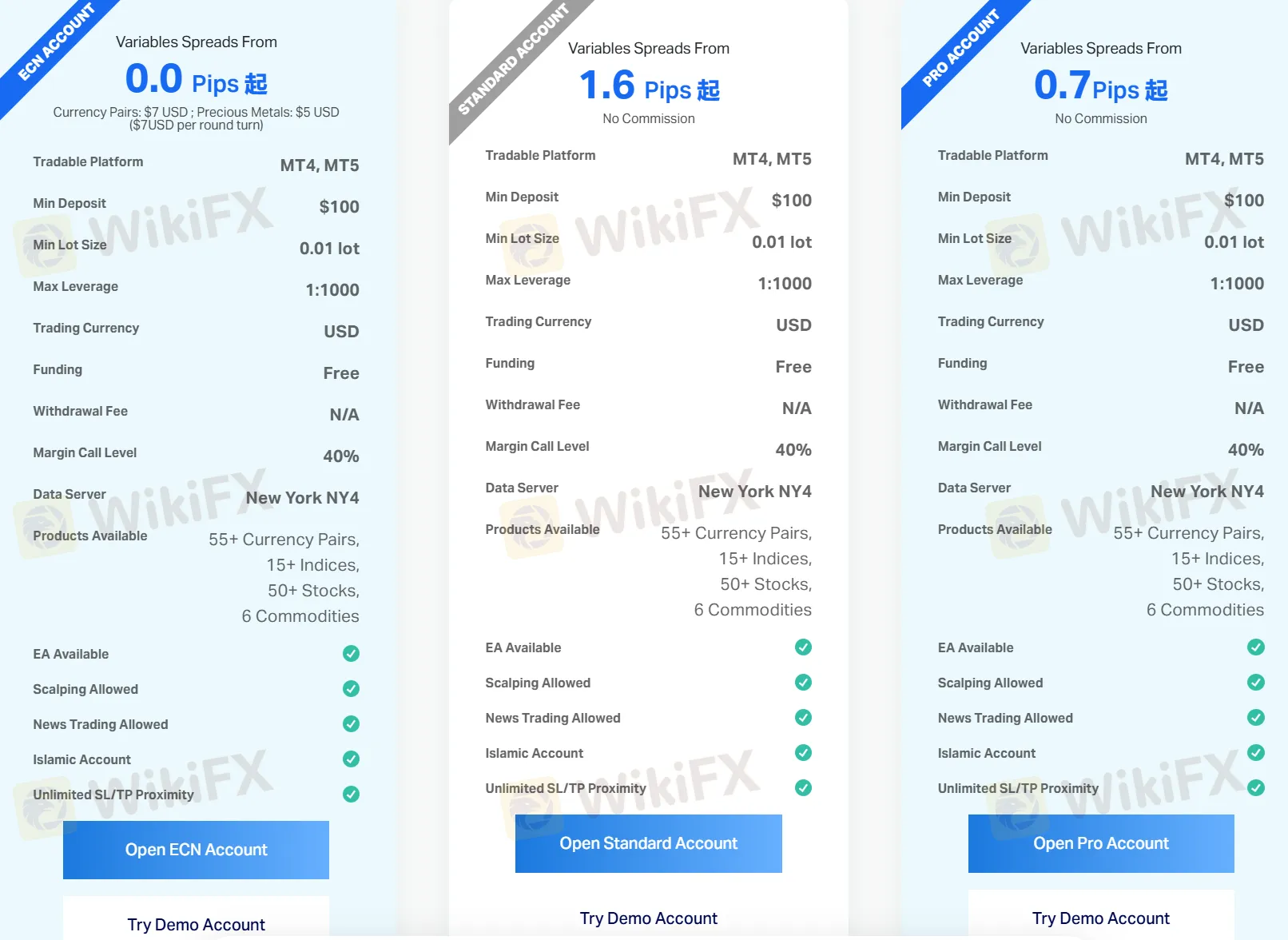

Account Type

TMGM offers three account types, including Standard, Pro, and ECN, with minimum deposit requirement of 100 USD. Islamic account and demo account are both avaiable for these three live account types.

Leverage

TMGM offers quite a high trading leverage up to 1:1000 on all account types.

Here's a table comparing leverage provided by major industry players. Notably, TMGM offers relatively higher leverage, though it appears somewhat more cautious compared to the other three competitors. However, users should remember that high leverage is a two-edged tool with potential risks.

Spreads & Commissions

TMGM offers competitive spreads and commissions on their trading instruments. The exact spreads and commissions vary depending on the account type. Found detailed info in the table below:

Generally, TMGM offers tight spreads on major forex pairs such as EUR/USD, with spreads as low as 0.0 pips. Commissions may be charged on some trading instruments, such as shares and futures. However, these commissions are generally competitive compared to other brokers in the industry.

Trading Platforms

TMGM offers popular trading platforms for their clients: MetaTrader4 (MT4), MetaTrader5 (MT5), and TMGM App.

Deposits & Withdrawals

TMGM minimum deposit vs other brokers

The minimum deposit and withdrawal amount is both $100. Depositing doesn't cost anything, but the time it takes and the currency options depend on your chosen payment method. Be aware, though, that some deposit methods like Union Pay, FasaPay, Visa, and MasterCard can't be used for withdrawals.

Customer Support

TMGM offers 24/7 customer support through multiple channels including live chat, phone, email, and social media (YouTube, Twitter, Facebook, Instagram and LinkedIn).

Frequently Asked Questions (FAQs)

Is TMGM regulated?

Yes. It is regulated by ASIC and VFSC (offshore).

At TMGM, are there any regional restrictions for traders?

Yes. Products and Services offered on their website are not intended for residents of the United States.

Does TMGM offer demo accounts?

Yes.

Does TMGM offer the industry-standard MT4 & MT5?

Yes. Both MT4 and MT5 are available.

What is the minimum deposit for TMGM?

The minimum initial deposit at TMGM to open an account is $100.

10-15 years

10-15 years

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX