User Reviews

More

User comment

1

CommentsWrite a review

2022-11-28 10:20

2022-11-28 10:20

Score

Influence

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index7.54

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

Company Name

Victoria Teachers Limited

Company Abbreviation

Bank First

Platform registered country and region

Australia

Company website

Company summary

Pyramid scheme complaint

Expose

| Bank FirstReview Summary | |

| Founded | 1996-04-26 |

| Registered Country/Region | Australia |

| Regulation | Exceeded |

| Services | Banking/Loans/Insurance/Financial Planning |

| Software | Mobile |

| Min Deposit | No limit |

| Customer Support | Phone: 1300 654 822/+61 3 9834 8560 |

| Email: info@bankfirst.com.au. | |

| Online Chat | |

| Social Media: Facebook, LinkedIn, YouTube, Instagram | |

Bank First provides diversified services involving all aspects of life, including banking, loans, insurance, and financial planning. However, Bank First is risky due to its exceeded status.

ASIC regulates Bank First with an exceeded status, which makes it less safe than regulated brokers.

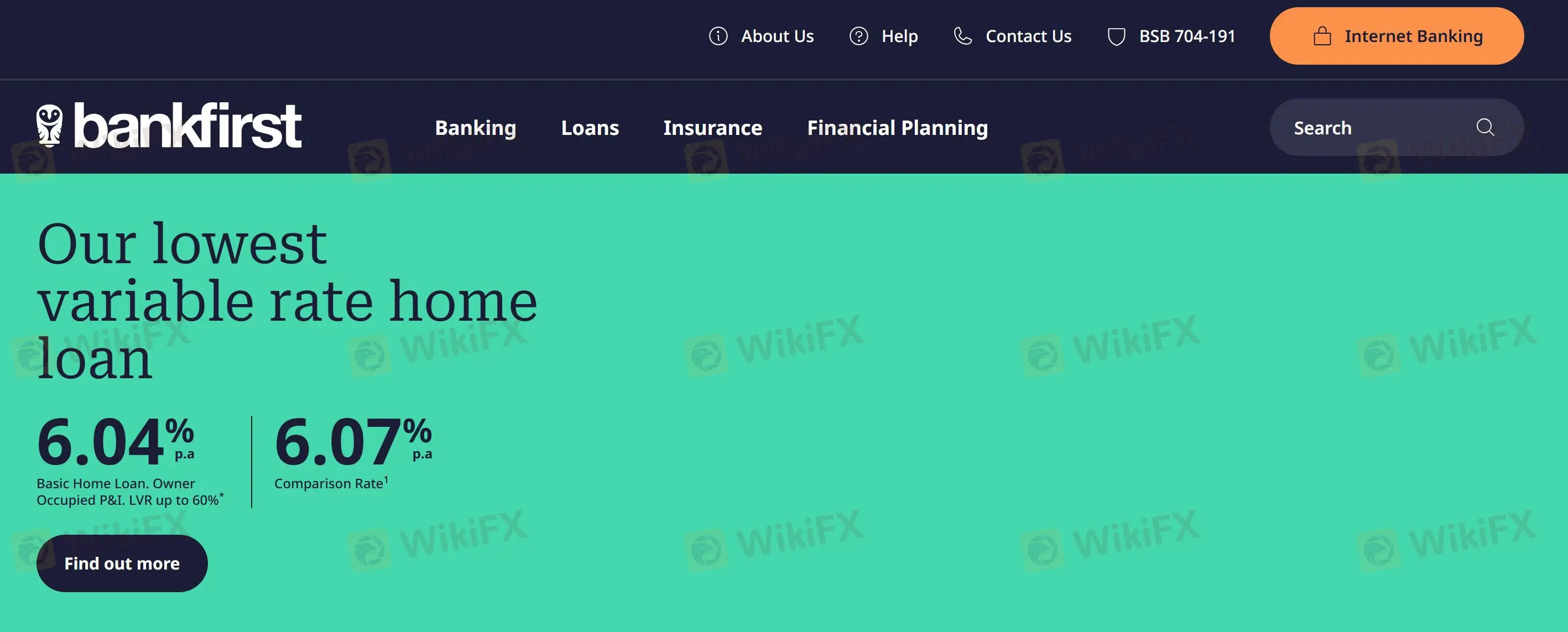

Bank First provides 4 major services, including banking, loans, insurance, and financial planning.

Banking: Businesses involved include international transfers, school accounts, preschool education accounts, interest rate banks, etc.

Loans: Including home loans, car loans, personal loans, and so on.

Insurance: Including health, travel, car, life, etc.

Traders can download the Bank First app through the App Store and Google Play.

| Software | Supported | Available Devices |

| Bank First | ✔ | Mobile |

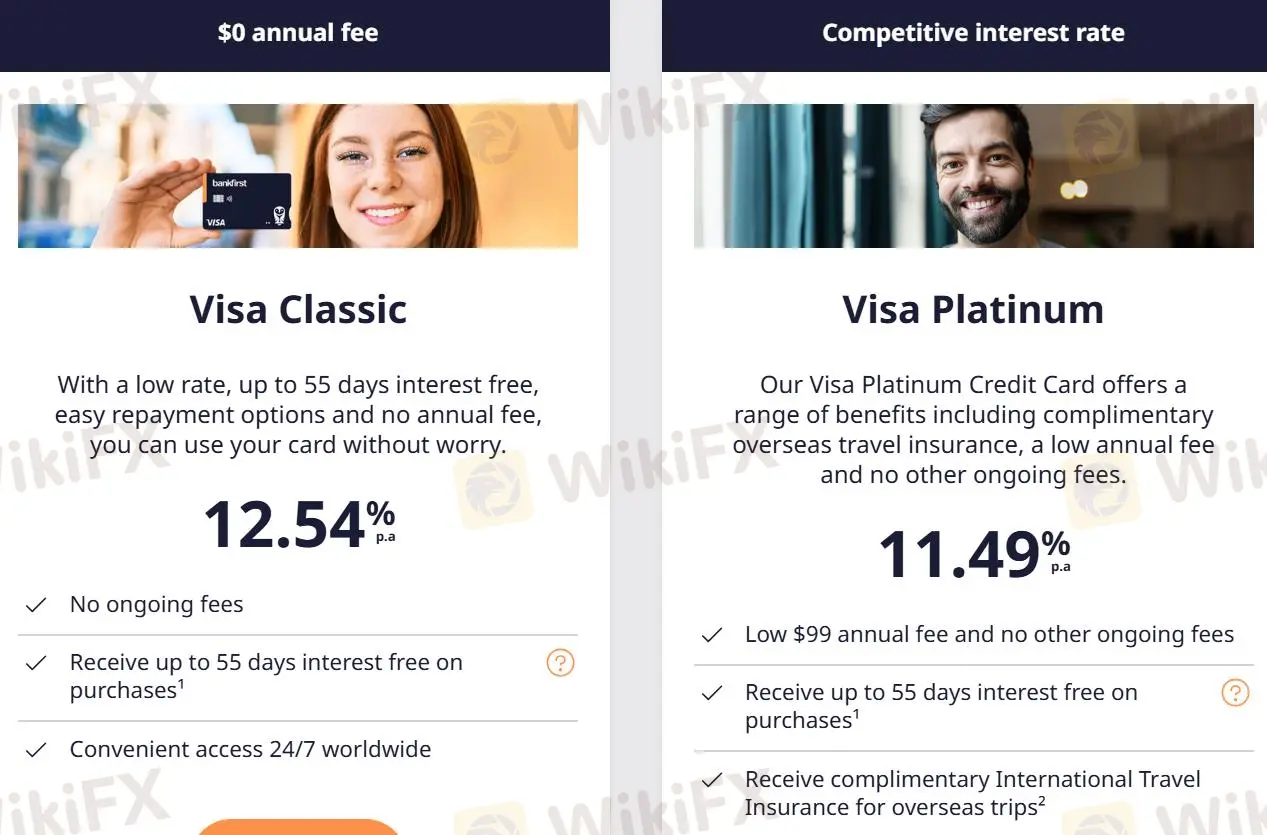

The minimum deposit is no limit. Bank First provides credit cards with annual fees starting from 0, such as Visa Classic and Visa Platinum.

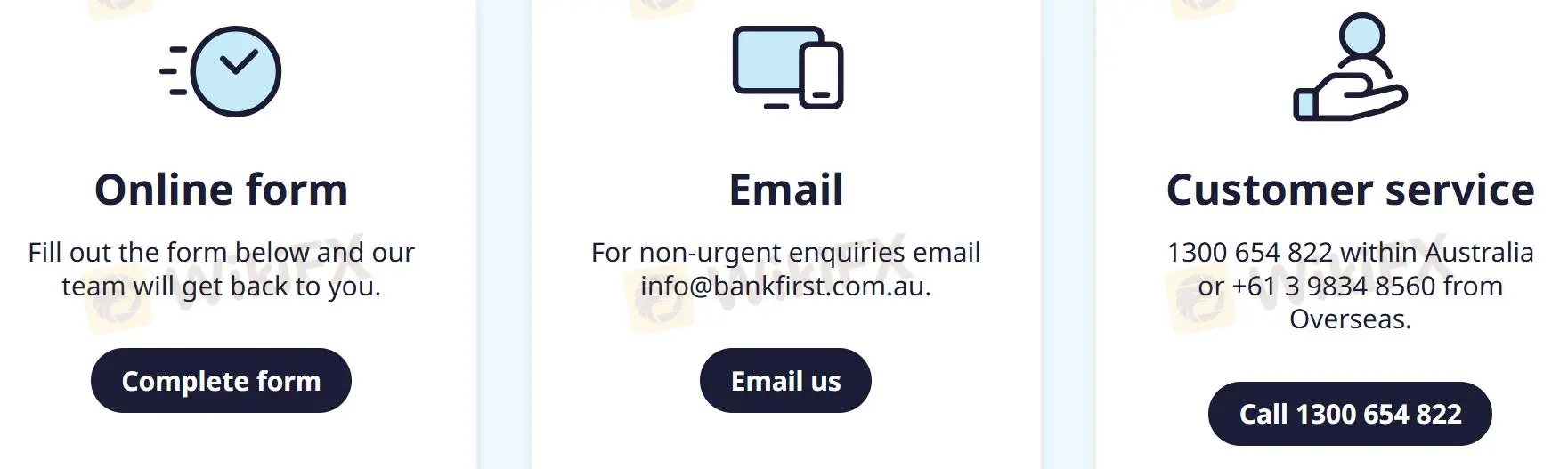

Traders can contact Bank First via phone, email, and online chat. Traders also can follow the bank through Facebook, LinkedIn, YouTube, and Instagram.

| Contact Options | Details |

| Phone | 1300 654 822/+61 3 9834 8560 |

| info@bankfirst.com.au. | |

| Online Chat | ✔ |

| Social Media | Facebook, LinkedIn, YouTube, Instagram |

| Supported Language | English |

| Website Language | English |

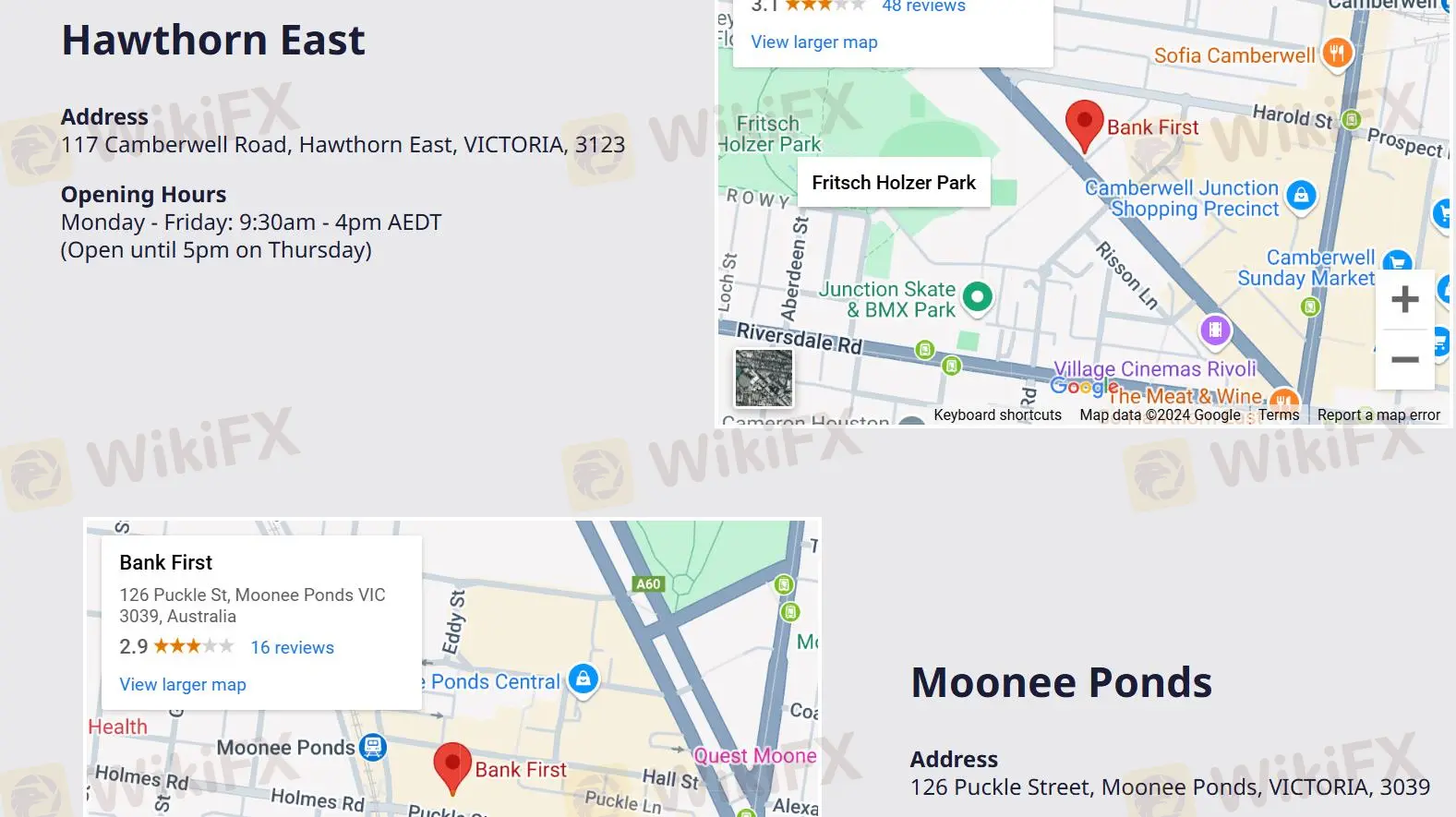

| Physical Address | 117 Camberwell Road, Hawthorn East, VICTORIA, 3123/126 Puckle Street, Moonee Ponds, VICTORIA,3039 |

More

User comment

1

CommentsWrite a review

2022-11-28 10:20

2022-11-28 10:20