User Reviews

More

User comment

3

CommentsWrite a review

2022-12-20 11:11

2022-12-20 11:11

2022-12-15 11:10

2022-12-15 11:10

Score

5-10 years

5-10 yearsSuspicious Regulatory License

Suspicious Scope of Business

Australia Market Maker (MM) Revoked

High potential risk

Influence

Add brokers

Comparison

Quantity 8

Exposure

Score

Regulatory Index0.00

Business Index7.43

Risk Management Index0.00

Software Index4.00

License Index0.00

Single Core

1G

40G

More

Company Name

SUPAY.com

Company Abbreviation

SUPAY

Platform registered country and region

Australia

Company website

Company summary

Pyramid scheme complaint

Expose

It was a scam. The broker said it could be operated online.

SuPAY said my bank account was wrong and asked me to pay taxes and fees. I was unable to withdraw.

This was a scam. Someone on the Internet led you to deposit and promised that you could get profits. When you planned to withdraw, it would ask you to pay the fee for the error of the platform. It required many fees such as handling fees. It was an endless scam.

It was scammer. The withdrawal took more than ten days. It said my bank account was wrong and asked for another deposit of 8,000. I paid it but it still told me to pay a personal tax of 2,000. I thought it could be deducted from the balance. Then the customer service asked me to wait for 7 working days. Finally I could not contacted with them again and the app was unavailable.

The customer service held a bad attitude. Please help report this scam.

invest and you gonna double no that wasn’t true I invest more than 10k $ and he froze my account he said pay taxes after I’m gonna release funds nope his not gonna release nothing I hope those 10k he’s gonna use for his funeral

It rejected my withdrawal for the wrong bank account so I paid the fee it required. But then it blamed to my account error. It asked me to pay $70,000 and they paid $30,000. It should be done but I was told I had to pay $30,000 further. I could not withdraw NT $6 million. Please help.

It was scammer. The withdrawal took more than ten days. It said my bank account was wrong and asked for another deposit of 8,000. I paid it but it still told me to pay a personal tax of 2,000. I thought it could be deducted from the balance. Then the customer service asked me to wait for 7 working days. Finally I could not contacted with them again and the app was unavailable.

| Key Information | Details |

| Establishment | 2005 |

| Location | Australia |

| Services | Money exchange and transfer |

| Major Traded Currencies | CNY, AUD, USD, HKD, JPY, NZD, EUR, GBP, CAD, SGD |

| Technology Used | Patented computer network, SWIFT payment system |

| Fees | No commission for cash exchanges, fees for TTs |

| Online Platform | Available, allows after-hours transactions |

| Customer Complaints | Issues with withdrawals, unresponsive customer service |

SUPAY Money Exchange is a currency exchange and remittance service provider that was established in Australia in 2005. The company is licensed under the regulation of the Australian Transaction Reports and Analysis Centre (AUSTRAC) and is subject to the obligations under the AML/ATF Act 2006.

The company uses their own patented state-of-the-art computer network as well as the SWIFT payment system, which is used by more than 10,000 financial institutions and corporations worldwide.

SUPAY doesn't charge commission fees for cash exchanges. For telegraphic transfers (TTs), if clients exchange to RMB and send to China, SUPAY charges AU$18. For other cases, SUPAY charges AU$25. If no exchange occurs, SUPAY will charge a percentage of the clients' TT amount in addition to the TT fees.

Customers can exchange and transfer money online even after hours through the online trading platform, and they can check their account balance and track their transaction history online at any time.

However, there are some reports of SUPAY being a potential scammer. Some customers reported that the withdrawal process took many days and they were asked to pay additional taxes and fees. Finally, they were unable to withdraw the money and could not get in contact with customer service. Also, the app was reported to be unavailable at times.

Here's a table summarizing the key points about SUPAY Money Exchange:

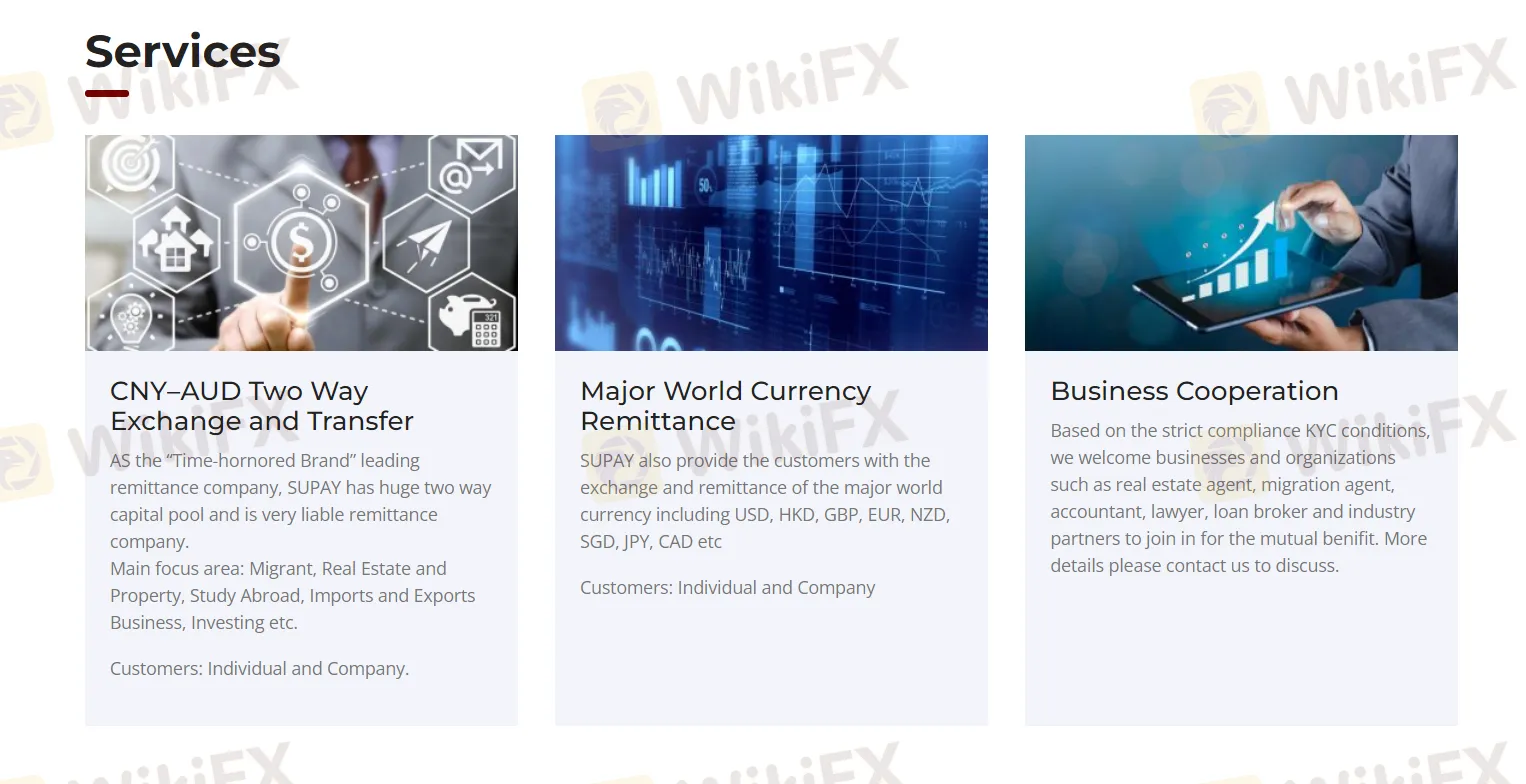

Supay provides personal customers with major foreign currency exchange and transfer services. The tradable currencies include the Chinese yuan (CNY), Australian dollar (AUD), US dollar (USD), Hong Kong dollar (HKD), Japanese yen (JPY), New Zealand dollar (NZD), Euro (EUR), Pound Sterling (GBP), Canadian dollar (CAD), and Singapore dollar (SGD). Supay also offers CNY–AUD two-way exchange and transfer services. They serve both individuals and companies, and their main focus areas include migrant, real estate and property, study abroad, imports and exports business, investing, etc.. They also invite business cooperation with organizations such as real estate agents, migration agents, accountants, lawyers, loan brokers, and industry partners, based on strict compliance KYC conditions.

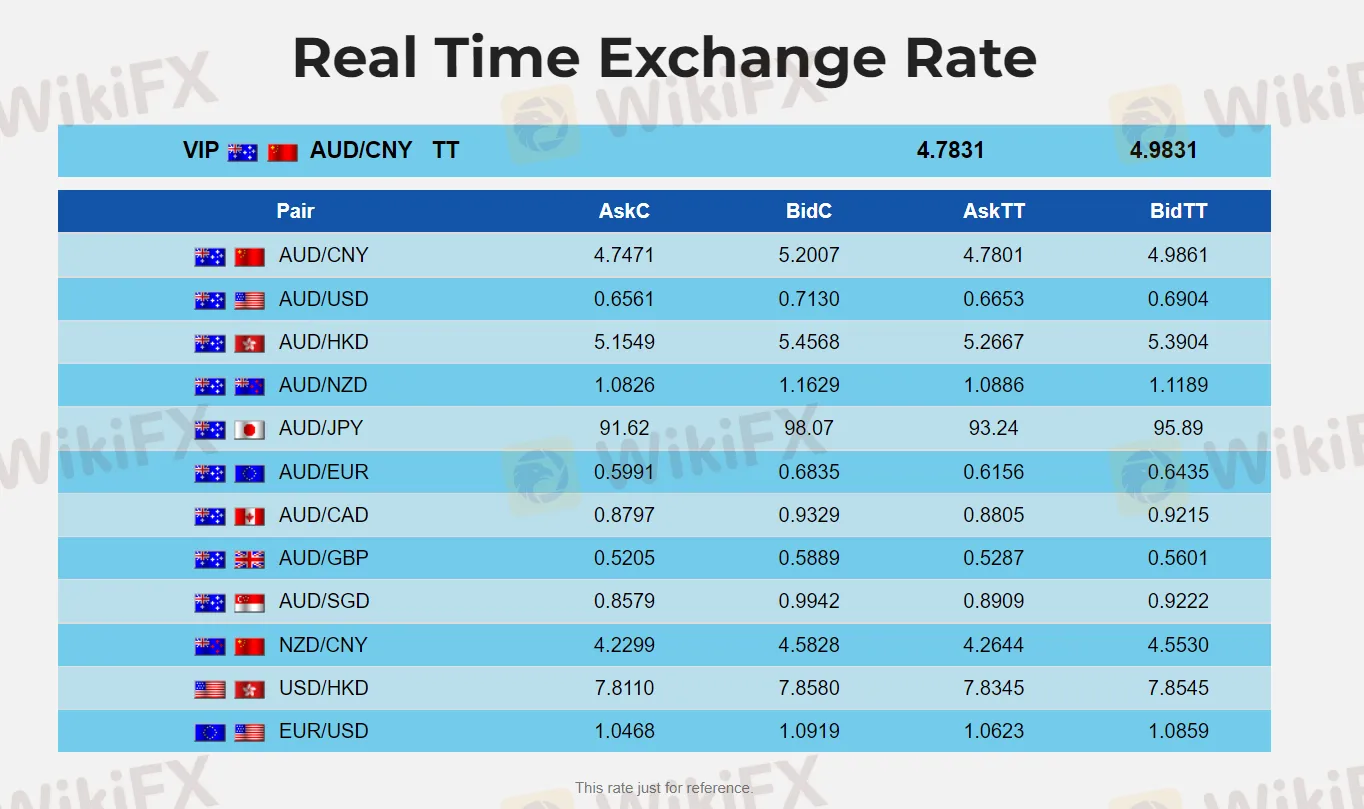

As for exchange rates, specific rates were not found on their website or in other resources. However, they allow clients to pick up the exchange rate day and night through their online trading platform, which could help minimize exchange costs.

The exchange rates below are for reference only:

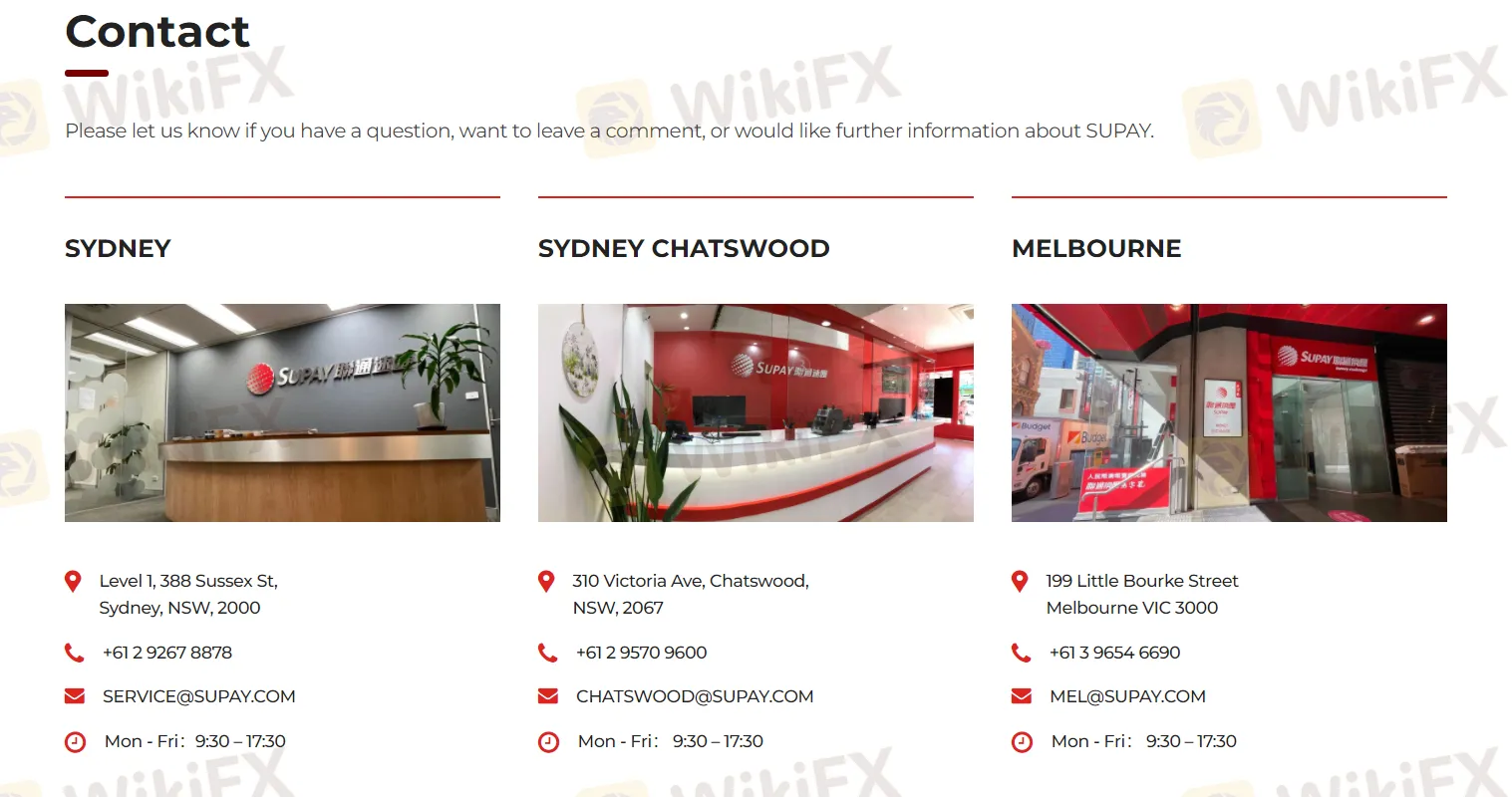

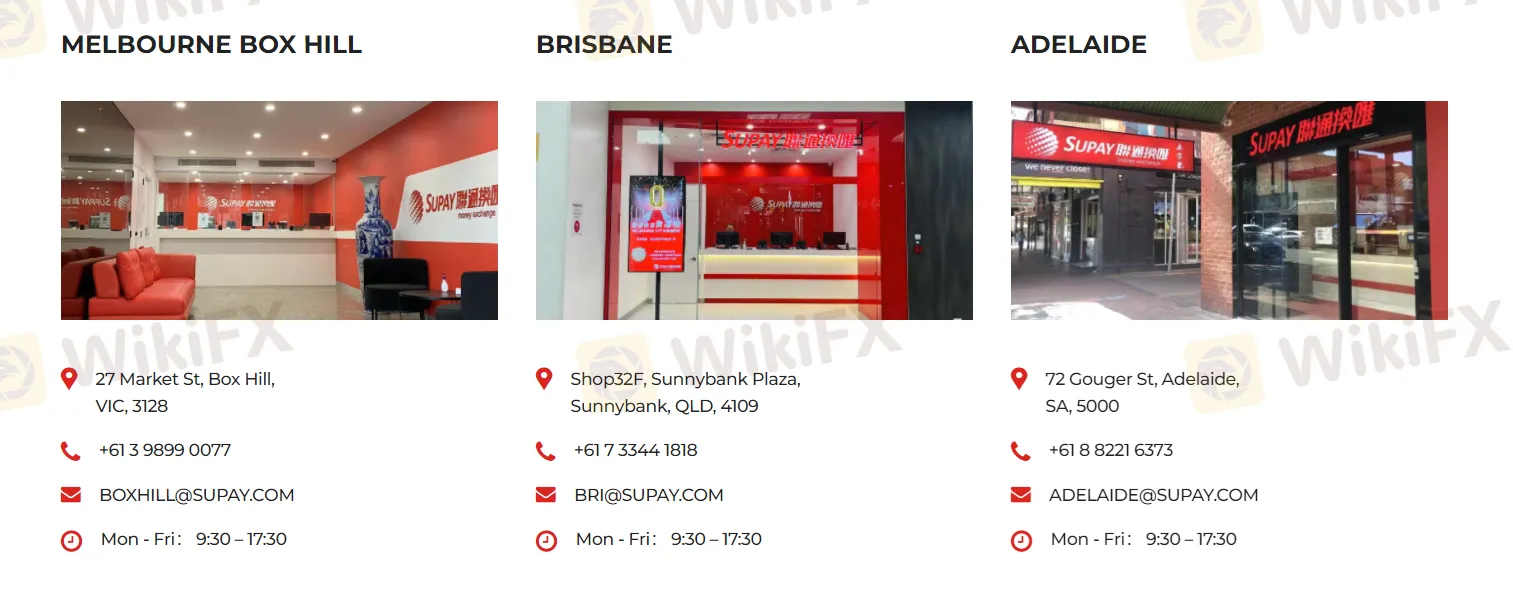

Supay has several branches in Australia, with contact information as follows:

Level 1, 388-390 Sussex Street Haymarket NSW 2000, Phone: +61 2 9267 8878, Email: service@supay.com.

310 Victoria Ave, Chatswood, NSW, 2067, Phone: +61 2 9570 9600, Email: chatswood@supay.com.

199 Little Bourke Street Melbourne VIC 3000, Phone: +61 3 9654 6690, Email: mel@supay.com.

Ground Floor 27 Market Street Box Hill VIC 3128, Phone: +61 3 9899 0077, Email: boxhill@supay.com.

Shop32F, Sunnybank Plaza, QLD, 4109, Phone: +61 7 3344 1818, Email: bri@supay.com.

72 Gouger Street Adelaide SA 5000, Phone: +61 8 8221 6373, Email: adelaide@supay.com.

Their service hours are typically Monday to Friday from 9:30 to 17:30. Some branches are also open on Saturday from 10:30 to 16:30.

Supay uses their own patent state-of-the-art computer network developed over years, as well as the SWIFT payment system used by more than 10,000 financial institutions and corporations worldwide.

They do not charge commission fees for cash exchanges. For telegraphic transfers (TTs), if the clients exchange to RMB and send to China, Supay charges AU$18. For any other cases, Supay charges AU$25. If no exchange occurs, Supay will have to charge a percentage of clients' TT amount in addition to the TT fees.

Through the online trading platform, clients of Supay can exchange and transfer money online even after hours, check their account balance, and track their transaction history online at any time.

:Some clients have reported issues with Supay. They have reported difficulties with withdrawals taking many days and problems contacting customer service. In some cases, clients were unable to withdraw their money at all. There have also been reports of the app being unavailable. It's important to note that these reports do not represent the experience of every Supay customer, but they do indicate potential risks to be aware of when considering using Supay's services.

In summary, SUPAY Money Exchange is a company providing foreign currency exchange and transfer services. It uses advanced technology to facilitate transactions and offers an online platform for customers to manage their accounts. However, there have been reports of issues with withdrawals and customer service, leading to some negative customer reviews.

Q: When was SUPAY Money Exchange established?

A: SUPAY Money Exchange was established in 2005 in Australia.

Q: What services does SUPAY Money Exchange provide?

A: SUPAY Money Exchange provides foreign currency exchange and transfer services. They also offer an online trading platform where clients can exchange and transfer money, even after regular business hours.

Q: What currencies can be traded through SUPAY Money Exchange?

A: SUPAY Money Exchange allows for the trading of several major foreign currencies, including the Chinese yuan (CNY), Australian dollar (AUD), US dollar (USD), Hong Kong dollar (HKD), Japanese yen (JPY), New Zealand dollar (NZD), Euro (EUR), Pound Sterling (GBP), Canadian dollar (CAD), and Singapore dollar (SGD).

Q: Does SUPAY Money Exchange charge commission fees for cash exchanges?

A: SUPAY Money Exchange does not charge commission fees for cash exchanges. However, for telegraphic transfers (TTs), they charge fees based on the specifics of the transaction.

Q: Have there been any customer complaints or negative reviews about SUPAY Money Exchange?

A: Yes, there have been customer complaints and negative reviews about SUPAY Money Exchange. Some customers have reported issues with the withdrawal process, such as it taking many days and additional fees being added. Some also reported being unable to contact customer service and the app being unavailable at times.

More

User comment

3

CommentsWrite a review

2022-12-20 11:11

2022-12-20 11:11

2022-12-15 11:10

2022-12-15 11:10