User Reviews

More

User comment

0

CommentsWrite a review

No comment yet

Score

5-10 years

5-10 yearsSuspicious Regulatory License

Global Business

High potential risk

Influence

Add brokers

Comparison

Expose

Exposure

Score

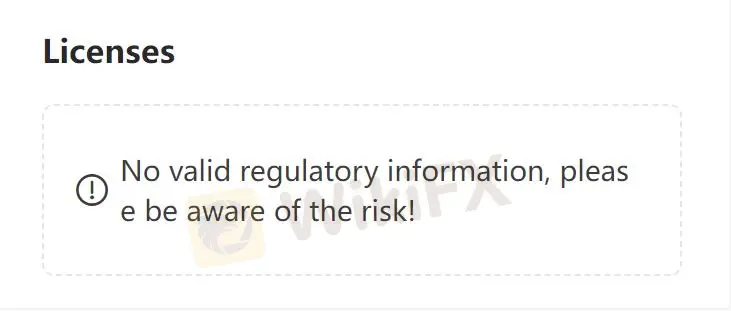

Regulatory Index0.00

Business Index7.50

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

Company Name

Kotak Securities Limited

Company Abbreviation

Kotak Securities

Platform registered country and region

India

Company website

X

YouTube

Company summary

Pyramid scheme complaint

Expose

| Kotak Securities Review Summary | |

| Founded | 1999-12-29 |

| Registered Country/Region | India |

| Regulation | Unregulated |

| Markets | Equities, Indices, Mutual Funds, and IPOs |

| Platform Product Suites | Kotak Neo App & Web, Nest Trading Terminal, and NEO Trade APls |

| Customer Support | Live Chat |

| Phone: +91 18002099191 | |

| Facebook, Instagram, YouTube, Twitter, LinkedIn | |

Kotak Securities is an unregulated Securities company registered in India that provides 4 major markets with various investment suites covering Equities, Indices, Mutual Funds, and IPOs. The broker also provides a Demat account, Kotak Neo App & Web, Nest Trading Terminal, and NEO Trade APls. Kotak Securities is still risky due to its unregulated status.

Kotak Securities is not regulated, making it less safe than regulated brokers.

Kotak Securities offers four popular markets: Equities, Indices, Mutual Funds, and IPOs. The investment suite segment includes mutual funds, futures and options, IPO, exchange-traded funds, commodities, stockcases (Stock Baskets), currency, non-convertible debentures, and sovereign gold bonds.

Kotak Securities charges the same fee which is ₹10 for per-order brokerage on all Intraday Trades and all carry-forward F&O trades and account openings fee-free. The Securities company roll outing Trade Free Pro plan with a stock delivery transaction fee of 0.1% is suited for traders who prefer lower interest rates in the Margin Trading Facility and leverage up to 4x on select stocks.

Kotak Securities supports platforms including 3 major product suites such as Kotak Neo App & Web, Nest Trading Terminal, and NEO Trade APls. API users place product types including Normal/Delivery, Cash and Carry (CNC), MIS, Intraday, and Cover Order (CO).

| Trading Platform | Supported | Available Devices |

| Kotak Neo | ✔ | App & Web |

| Nest Trading Terminal | ✔ | - |

| NEO Trade APIs | ✔ | - |

If you intend to try your hand at trading, you need to be aware. Scams are rampant in this sector. You can't escape this. Knowledge and awareness are your only weapons against this trap. Therefore, in this article, we will inform you about Forex scam brokers that you should avoid; otherwise, you will regret it later.

WikiFX

WikiFX

Kotak Securities is the leading full-service stockbroking and wealth management organization in India. It provides a comprehensive range of investment products and services to meet the needs of different investor segments.

WikiFX

WikiFX

More

User comment

0

CommentsWrite a review

No comment yet

start to write first comment